Investment Overview – BMY’s Middling Position Within Big Pharma Industry

Bristol Myers Squibb (NYSE:BMY) is the US’ seventh largest pharmaceutical company by market cap, which stands at $123bn at the time of writing, with shares priced at ~$59 – down 27% from their all-time high price of $81, reached in November last year.

The company generated the fifth highest revenue of the “Big 8” US Pharmas in 2022 – $46.2bn, behind Pfizer (PFE) – $100bn, Johnson & Johnson (JNJ), $95bn, Merck & Co (MRK), $58bn, and AbbVie (ABBV), $58bn. In terms of net income, BMY was ranked sixth, with $6.3bn after the above-mentioned 5 companies plus Amgen (AMGN). BMY’s price to earnings ratio was ~16x, and its price to sales ratio of 3x, the second lowest in the sector, Eli Lilly’s (LLY) being the highest.

BMY’s dividend payout is presently $0.57 per quarter, which translates to a yield of ~3.7%, the fourth highest in the US Big Pharma sector (Pfizer’s 4.8% yield is the highest). The company’s share price gain of just 3% over the past 3 years is the second worst in the sector – Lilly is way ahead, having driven a ~300% gain, and BMY’s share price loss of 16% across the past year is the second worst in the sector, ahead of Pfizer’s 28% loss. BMY’s debt to equity ratio of ~123% is the 4th highest in the sector – total long term debt currently stands at $35bn.

In short, BMY is a solid Pharma company that offers a solid dividend, but little in the way of dynamic growth – shares trade at a lower value today than they did 5 years ago, despite the company’s best efforts to inspire growth, including the $74bn acquisition of Celgene in 2019, which drove a revenue increase from $26.1bn in 2019, to $42.5bn in 2020.

The Celgene acquisition brought several blockbuster drugs under BMY’s control – including >$12bn per annum selling multiple myeloma therapy Revlimid, and >$3bn per annum Pomalyst, plus a portfolio of late stage pipeline assets which the company has gone on to successfully commercialise – cancer therapies abecma, breyanzi, and inrebic, autoimmune drug zeposia and anemia therapy reblozyl.

In my last post on BMY for Seeking Alpha I discussed how these recently approved drugs, and several others developed in-house (e.g. leukemia therapy onureg, melanoma drug opdualog and anti-inflammatory Sotyktu) can drive BMY’s business forward even as long-term stalwarts – the anti-coagulant Eliquis, immunotherapy Opdivo (for solid tumor cancers) and Revlimid and Pomalyst – lose their patent protections in the coming years.

I fed all the available data into a product-by-product forecasting table (available to view in my previous post) and used it to create a forward income statement, and then used that to complete a discounted cash flow analysis suggesting the present day value of BMY stock ought to be as high as $90.

I concluded however that BMY may struggle to obtain such a high price per share, as, despite being a solid performer developing numerous valuable drugs with Blockbuster (<$1bn per annum), the lack of any standout product with genuinely compelling peak revenue potential (by Big Pharma standards) – say in the double digit billions – may imply that several more years of share price stagnancy is all shareholders have to look forward to.

In the remainder of this post, however, I will focus on something that is weighing down BMY’s share price in the here and now – the control that the government is attempting to wrestle away from Pharma companies over drug pricing decisions, and the targeting of 2 (at least) of BMY’s most valuable assets – the anti-coagulant Eliquis, and the immune checkpoint inhibitor (“ICI”) Opdivo.

What Is The Inflation Reduction Act – & How Does It Affect Big Pharma

According to a McKinsey article discussing the Inflation Reduction Act (“IRA”), signed into law in August 2022, it “contains $500 billion in new spending and tax breaks that aim to boost clean energy, reduce healthcare costs, and increase tax revenues”. Specifically, in relation to the Pharma industry:

The IRA seeks to lower prescription drug costs by allowing Medicare to negotiate prices with drug companies, put an inflation cap on drug prices, and lower out-of-pocket expenses for Medicare recipients. It also extends Affordable Care Act (“ACA”) subsidies for three years. Together, the CBO estimates these measures will save the federal government $173 billion through 2031. (Source: McKinsey).

Drug pricing is currently controlled through negotiations between 3 entities – the drug’s developer and manufacturer e.g. BMY, Pfizer et al, health insurers, and a type of middle man known as a Pharmacy Benefit Manager (“PBM”). The system – prior to the introduction of IRA – was a more or less unregulated, closed shop, in which a Pharma will offer rebates to insurers in exchange for a place on their formulary lists i.e. the drugs it will reimburse patients for. The rebates tend to be administered by the PBM.

Within the government sponsored Medicare program, prices are often based on the average selling price (“ASP”) of the drug across numerous health plans, with Medicare usually receiving a further discount of ~23%. In essence, the negotiations involve plenty of under the table horse-trading which is conducted in-house, and behind closed doors, and although the Pharma industry insists it’s a fair system, some of the hiking of drug prices across the past 2 decades make for grim reading. For example, according to a Time magazine article:

From 2007 to 2016, Mylan raised the list price of its EpiPen about 500%, from just under $100 to more than $600. From 2002 to 2013, insulin prices more than tripled.

From 2012 to 2019, the average price of AbbVie’s rheumatoid-arthritis drug Humira climbed from $19,000 a year to $60,000 a year—and that’s after rebates. These are dramatic examples of a systemwide problem: prices for brand-name drugs are rising at a rate that far outstrips inflation.

The government has wanted to make sure it actively participates in drug price negotiations for a long time, and finally, thanks to the passing of IRA – it has that right – at least for now. The IRA was probably initially best known for limiting the rate of drug price increases to the rate of inflation, but in a statement released in January, the Centers for Medicaid and Medicare Services (“CMS”) stated that:

The IRA authorizes Medicare to directly negotiate drug prices for certain high expenditure, single source Medicare Part B or Part D drugs. For the first year of the Negotiation Program, the Secretary will select 10 Part D high expenditure, single source drugs for negotiation.

The maximum fair prices that are negotiated for these drugs will apply beginning in initial price applicability year 2026. The Secretary will select an additional 15 Part D drugs for negotiation for initial price applicability year 2027, 15 Part B or Part D drugs for initial price applicability year 2028, and 20 Part B or Part D drugs for initial price applicability year 2029 and subsequent initial price applicability years.

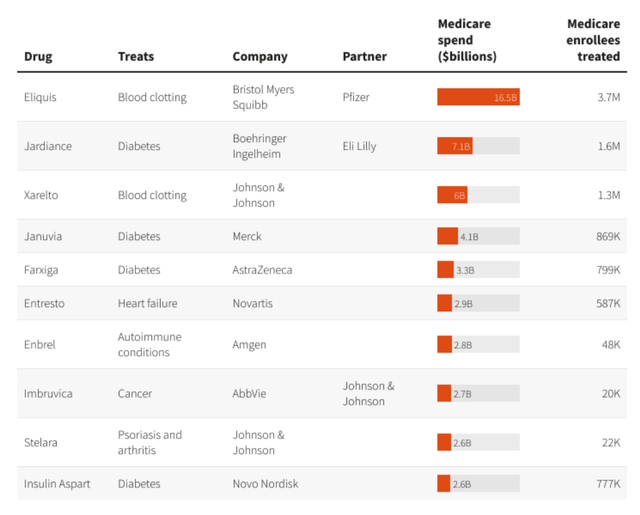

At the end of August, the CMS announced the first 10 drugs that will be subject to negotiation in year one, as below:

CMS selects 10 drugs for Part D price negotiation (Reuters)

As we can see above, the best-selling drug on this list is BMY’s Eliquis (it should be noted that revenues from sales of Eliquis are split 50/50 with Pfizer).

According to the regulations, the new prices that will be agreed for these drugs will be at least 25% lower than the original list prices. Another goal of the IRA is to ensure that no Medicare patient pays no more than $2,000 per annum on out-of-pocket spending on prescription drugs – beginning in 2025.

Price negotiations involving Medicare will begin this year, but no price changes will come into effect until 2026. According to the US Department of Health and Human Services (“HHS”):

In future years, CMS will select for negotiation up to 15 more drugs covered under Part D for 2027, up to 15 more drugs for 2028 (including drugs covered under Part B and Part D), and up to 20 more drugs for each year after that, as outlined in the Inflation Reduction Act.

This is obviously a momentous change for the likes of BMY and Pfizer, Johnson & Johnson, Merck, Amgen, who find their drugs on the first list of 10 drugs, which, according to the HHS, accounted for:

$50.5 billion in total Part D gross covered prescription drug costs, or about 20%, of total Part D gross covered prescription drug costs between June 1, 2022 and May 31, 2023

Understanding The Impact On BMY – And The Action BMY Is Taking In Response

In fact, because Eliquis is due to lose its patent protection sometime around 2026, the impact of the new rules on BMY may be quite minimal at first, but the company has said that >$8bn per annum selling Opdivo – itself likely to lose patent protection around 2028 – will likely to be on the next list issued, and needless to say, BMY’s interpretation of the changes differs radically from the CMS and HHS.

Since the list was announced, BMY’s stock price has lost ~6% of its value – Opdivo and Eliquis – which earned ~$12bn of revenues in 2022 – made up ~43% of BMY’s total revenues in 2022. BMY CEO Giovanni Caforio – who will step down at the beginning of November, to be replaced by Christopher Boerner, PhD, formerly Chief Commercialization Officer, has suggested that insurance companies may opt to no longer make Eliquis and Opdivo available to patients as a result of the changes, although the CMS has disputed this claim.

Back in June, BMY announced that it had “filed a lawsuit challenging the constitutionality” of the new laws, joining Merck, which launched its own lawsuit against IRA a few weeks earlier.

BMY is contesting that the IRA “violates the Fifth Amendment, which requires the government to pay a reasonable amount if it takes property for public use”, and that the IRA:

violates the rights of free speech that are guaranteed by the First Amendment. The IRA makes manufacturers of innovative medicines state publicly that the government’s price setting is a true negotiation that resulted in a fair price, even if it was not.

BMY says that it has “long supported efforts to meaningfully enhance patient access and lower out-of-pocket costs”, and says that the restrictions on pricing imposed by the new laws will directly impact its R&D budget, stating that they have:

already changed the way we look at our development programs in oncology and beyond, whether it’s a decision to advance a new medicine or pursue additional indications for an existing one

In short, BMY, Merck – and it would not be surprising if more Big Pharma companies join them – are trying to establish the moral high ground, arguing that the system ain’t broke, so why should the government attempt to fix it?

The Likely Outcome Of What Promises To Be A Lengthy Dispute On BMY’s Share Price

Despite its protestations, arguably, BMY has emerged as the Pharma that will be most impacted by the changes brought about by the introduction of IRA and its changes to the drug pricing landscape, giving governments a long sought after seat at the negotiating table, and a highly significant one at that.

It is probably no coincidence that BMY’s share price has sunk from its all-time high price of >$80 in November last year, to a >2-year low price of $59 at the time of writing.

BMY and Merck hope that the courts will take their side and declare the new changes unconstitutional, and the Pharma industry has powerful lobbies that will support both companies, but the government has been determined to introduce curbs on price hikes for the best part of 2 decades.

Although the government and the pharma industry formed an uneasy truce during the pandemic, with drug pricing concerns set aside, the truce was never likely to last, and the Biden administration has moved quickly and decisively to take its seat at the table alongside the drug companies, health insurers and PBMs. It’s hard to see it taking a backward step at this juncture.

Ultimately, as well as being a drain on BMY’s resources at a time when BMY is attempting to phase out older drugs and establish new ones in new markets – no easy task – the changes, and the well publicised dispute with the government is likely to weigh fairly heavily on BMY’s share price for the foreseeable future.

BMY is forecasting for a low-single-digit year-on-year decline in revenues in 2023, and downgraded its forecast for Revlimid sales from $6.5bn, to $5.5bn, whilst estimating FY23 non-GAAP EPS to be $7.35 – $7.65, and GAAP EPS of $3.72 – $4.02. That in itself is not ideal, but in fairness to the company, new drug sales are expected to come in at $862m – up 79% year-on-year, and none of these drugs are likely to be impacted by the IRA for many years to come.

As such, there are several different ways of interpreting the current state of play. A BMY bull might argue that the market is overreacting to the new drug-pricing laws, and the court cases that will follow, and that given Eliquis and Opdivo represent BMY’s past, and its more recently marketed drugs the future – management believes that Reblozyl, Sotyktu, heart failure drug Camzyos and the rest of its “new product portfolio” can generate $25bn per annum in peak sales – the current depressed share price represents a strong buying opportunity.

On the other hand, a bearish take could be that the tough challenges BMY already faced, with the impending patent expiries of Eliquis, Opdivo, and Pomalyst, just became a good deal harder, as these drugs revenues could sink harder and faster than expected, thanks to IRA. The risk and uncertainty may imply very limited upside potential, with the risk of further losses very real.

My take is that the truth lies somewhere in the middle. Although the market often values Pharma companies based on “jam tomorrow” i.e. what revenues newly launched and soon-to-be launched drugs can generate 5 years from now (Eli Lilly’s astonishing gains based on the promise of its Alzheimer’s therapy donanemab, and weight loss drug tirzepatide are an example of this), it is also extremely sensitive to drug pricing issues and indeed anything it perceives may impact Pharma’s bottom lines.

There’s no question Big Pharma drives exceptional profit margins, although BMY’s are at the lower end, <15% as mentioned previously (the company is introducing a $4bn share repurchase plan as a fillip to investors). As a BMY shareholder myself, I intend to ride out the storm, as I do think the market may be overreacting to the new rules, and on this occasion, the fact that none of BMY’s new drug portfolio threatens to make “obscene” profits, with peak revenues limited to ~$5bn at most, means they may avoid featuring on the CMS / HHS’s lists going forward.

I would even consider buying on the uncertainty, but since I believe these disputes will take a long time to resolve, I don’t feel under any pressure to start increasing my position today. I am resigning myself to yet more years of share price stagnation as nothing is going to get resolved in a hurry, with some light potentially at the end of the drug-pricing tunnel. After all, both the government and the Pharma industry say they are working toward the same goal – better drugs and healthcare for patients. The two sides may have more in common than they believe.

Read the full article here