Although my own personal preference when I make investments is to buy individual stocks, a perfectly valid alternative that many investors prefer is the purchase of exchange-traded funds, or ETFs. With incredibly low fees and significant opportunities for diversification, ETFs are some of the most important investment vehicles in the world today. Finding the right ETF, however, is not always easy. The ideal scenario is to find one that can consistently outperform the broader market. But searching for something like that is akin to searching for a unicorn.

One ETF that has captured the attention of investors over the years is Schwab U.S. Dividend Equity ETF (NYSEARCA:SCHD). With a little over 100 different holdings, it truly has a diversified makeup. And, as its name suggests, it has a special emphasis on U.S.-based dividend stocks. For those seeking cash payments that could ultimately prove to be a buffer during difficult times, this kind of opportunity can make a lot of sense. But when you dig into Schwab U.S. Dividend Equity ETF specifically, you should see that the ETF is really not that great of an investment opportunity.

Assessing Schwab U.S. Dividend Equity ETF

Before we dive into my own thinking on why there are better opportunities to be had on the market than Schwab U.S. Dividend Equity ETF, it would be helpful to discuss more about the ETF and the type of investor it caters to. As I mentioned already, its focus is on U.S. based stocks that pay dividends. While this is true, it’s also important to note that it focuses on our equities that represent large capitalization companies. In fact, the weighted average market capitalization of a holding is $148 billion as of this writing. Morningstar also specifies that the ETF is value oriented. This is believable when you look at some of the metrics involving it. The price to earnings ratio for the companies it holds comes out to roughly 13.9, while the price to cash flow multiple is just under 9.

Schwab Asset Management

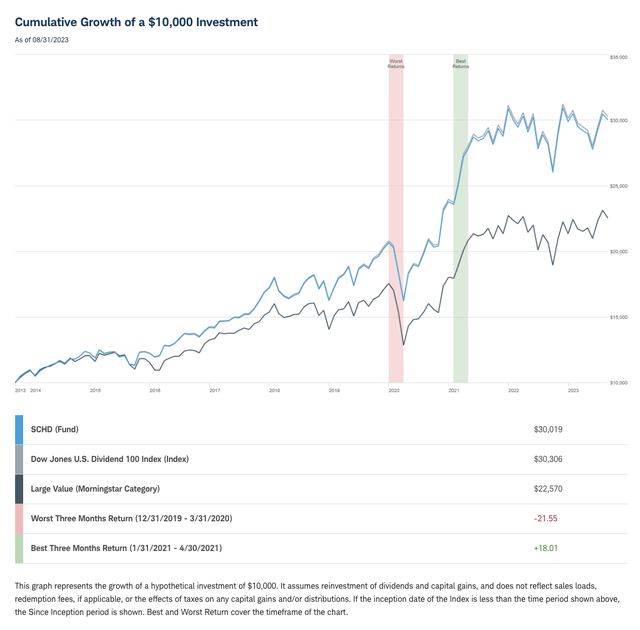

The goal behind this ETF is that it very closely mirror the returns of the Dow Jones U.S. Dividend 100 Index. And with a three-year beta coefficient of 1, it does seem to match that target. I think you could even go one step further by comparing its overall financial performance to the performance of the index that it follows. Over the past ten years, the performance of the two has been virtually identical. And to make matters even better, the ETF has achieved aggregate upside that is 33% higher than the large value category of stocks tracked by Morningstar.

Schwab Asset Management

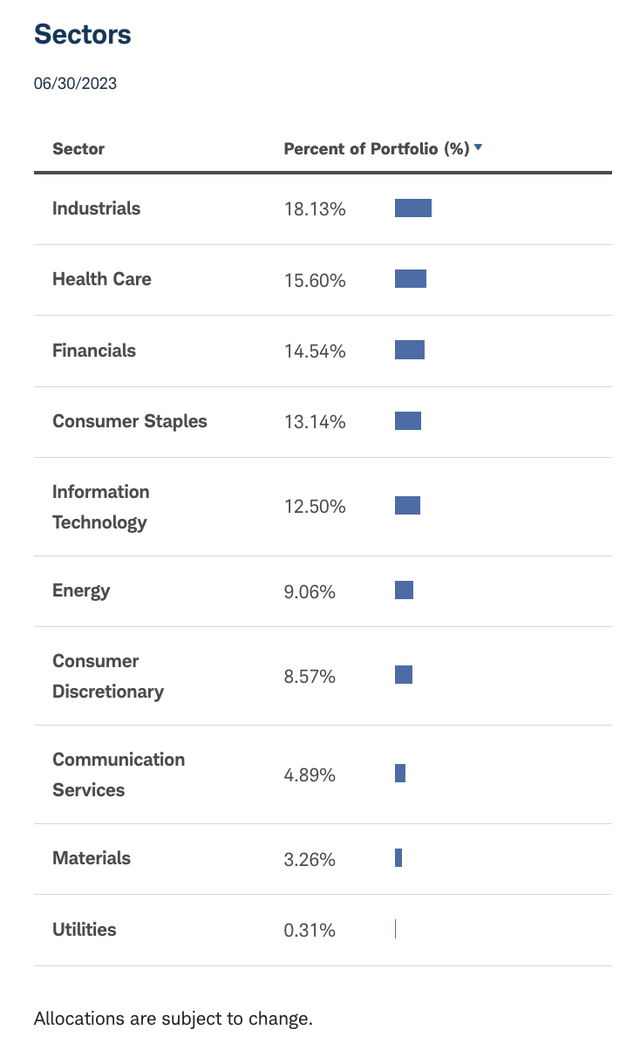

Given the index that it competes with, it should come as no surprise that the largest sector that the ETF is focused on would be industrials. 18.1% of the ETF by market capitalization falls under this category. Next in line is healthcare at 15.6%, followed by financials at 14.5%. Rounding out the top five, we have consumer staples and information technology, with readings of 13.1% and 12.5%, respectively. Other sectors include energy, consumer discretionary, communication services, materials, and utilities.

Even though there are over 100 different holdings in the ETF, it’s important to note that over 58% of the holdings, by value, are dedicated to the top 15 largest holdings. The largest of these, Amgen (AMGN), accounts for 4.45% of the weighting of the ETF. When looking at the top 15 holdings, one thing that I was surprised about were the yields of the investments in question. Only one of the top 15 largest holdings had a yield of 5% or higher. And that was Verizon Communications (VZ) with a current yield of 7.9%. In fact, the current SCHD yield stands at 3.44%.

But this is where I start taking issue with this as an attractive opportunity. While the SCHD yield is significantly higher than the 1.53% yield of the S&P 500, both pale in comparison to the 4.38% yield currently offered by 30-year treasuries. Of course, one disadvantage to going the treasury route, is that upside from appreciation is incredibly limited. When it comes to an ETF, however, upside potential is theoretically limited.

Author

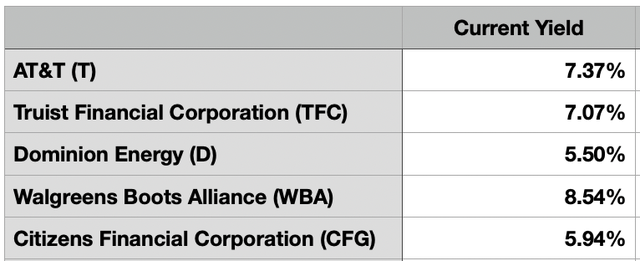

It does seem as though the ETF is prioritizing matching the index that it is tracing, because if not, there’d be no reason why it is missing out on some really great companies that would help boost that yield up. For obvious reasons, I ignored companies that were from outside of the U.S. I also decided to ignore REITs, MLPs, and BDCs since Schwab U.S. Dividend Equity ETF does not have any of those types of opportunities in it.

But that still leaves us with a variety of companies, such as the five shown in the table above. Here, we have yields ranging from 5.50% to 8.54%. And all of these companies are fairly large in size, the most significant of which is telecommunications conglomerate AT&T (T) with a $108 billion market capitalization and a hefty 7.37% yield as of this writing.

Schwab Asset Management

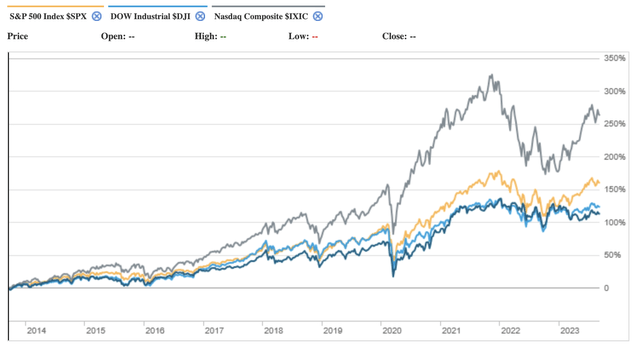

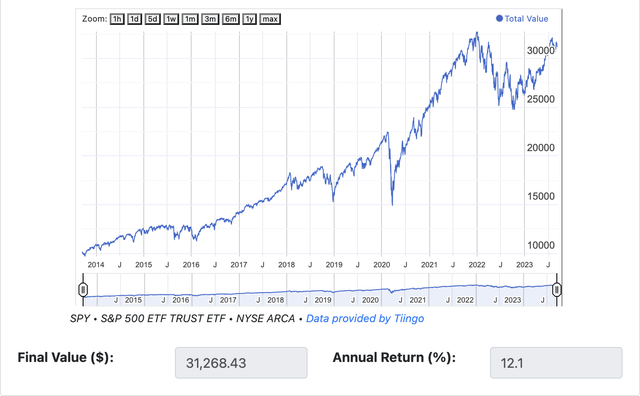

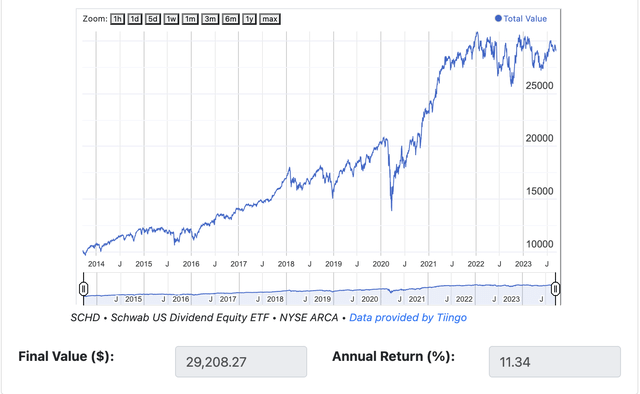

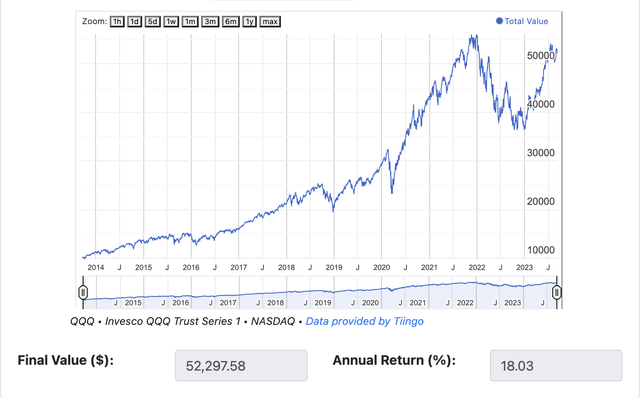

In addition to missing out on higher distributions from other large cap value stocks, the Schwab U.S. Dividend Equity ETF also has a history of underperformance compared to other major indexes. Yes, it is true that financial performance has more or less matched what the Dow Jones U.S. Dividend 100 Index has done; both the ETF and that index have a history of underperforming other major market measures. Take, as an example, the SPDR S&P 500 ETF Trust (SPY). $10,000 invested in it 10 years ago would be worth around $31,268. That assumes that dividends are reinvested into the ETF. By comparison, the same $10,000 invested in Schwab U.S. Dividend Equity ETF would be worth around $29,208. That’s a spread in favor of the SPY of 7.1%. Even over the past five years, the SPY has outperformed the Schwab U.S. Dividend Equity ETF by 3%. If we use an ETF for the NASDAQ, like the Invesco QQQ Trust (QQQ), then that same $10,000 would have turned into $52,297.58, outperforming the Dow Jones U.S. Dividend 100 Index by 79.1%.

DQYDJ DQYDJ DQYDJ

Takeaway

While Schwab U.S. Dividend Equity ETF is definitely a valid investment opportunity, particularly for those focused on distributions, I don’t believe that it is, for most investors, an optimal place to park funds. The ETF excludes multiple large cap stocks that have much higher yields than what it includes for the most part. And this ignores the opportunity to get into more exotic things like REITs, MLPs, and BDCs. For those desiring yield above all else, it might just make more sense to lock in treasuries. And for those who prefer to focus on capturing aggregate returns over the long haul, alternative ETFs like the SPY make a great deal more sense to me.

Read the full article here