The Netherlands will start permanently shutting down its Groningen field, the largest natural gas field in Europe, in just over two weeks on October 1, 2023. Groningen produced 6.5 billion cubic meters of gas in 2021 and its shutdown comes as Germany, the continent’s largest economy, shuttered its final three nuclear power plants in spring of this year. Down under in Australia, strikes at Chevron’s (CVX) Gorgon and Wheatstone LNG facilities, which together account for 5% of global supply, have added volatility to natural gas prices going into the traditional start of the heating period. Critically, the world entered a protracted period of heightened energy volatility last year with Russia’s invasion of Ukraine. This means LNG plants will form energy backbones for economies around the world, a macro backdrop that underlies Tellurian’s (NYSE:TELL) investment pitch.

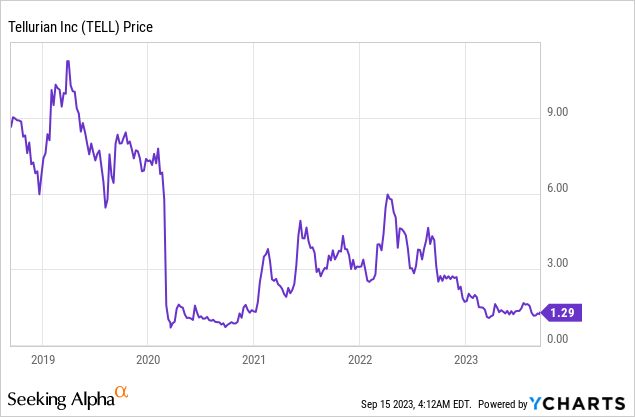

The pull of this pitch on investors has dipped over the last year with Tellurian’s common shares down nearly 70% over this time frame. This has come against a five-year chart that has seen the ticker shed significant value from its pre-pandemic level. Some of this weakness has been on the back of a Fed funds rate currently sitting at a 22-year high of 5.25% to 5.50%. But Tellurian’s failure to secure FID for its Driftwood LNG production and export terminal close to Lake Charles, Louisiana has shattered investor confidence in its management. This failure is especially jarring against the LNG boom of last year as Europe scrambled to replace piped Russian natural gas.

The Worst Case Scenario

To be clear, Tellurian currently faces a storm of headwinds. Its LNG supply deal with Gunvor was terminated last month and came on the back of last year’s exits from Vitol and Shell (SHEL). Tellurian had signed a 10-year deal with Gunvor to supply as much as 3 million metric tons per year of LNG from Driftwood, reaching similar deals with Vitol and Shell. The company’s pivot to become a domestic gas producer has stalled with natural gas drilling from Haynesville shale partially halted on the back of weak US natural gas prices. Tellurian initially stated it would keep production roughly flat at 200 million cubic feet per day in 2023.

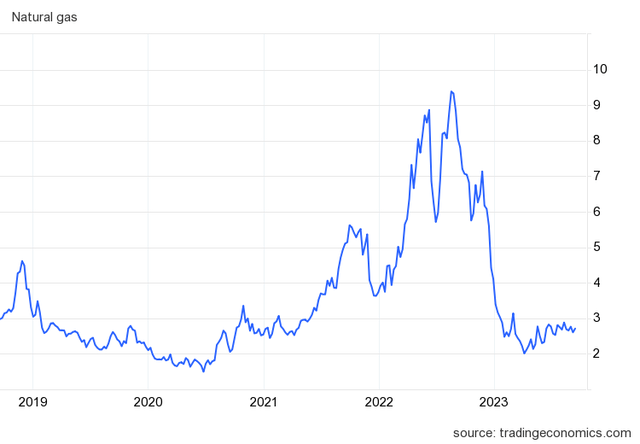

Trading Economics

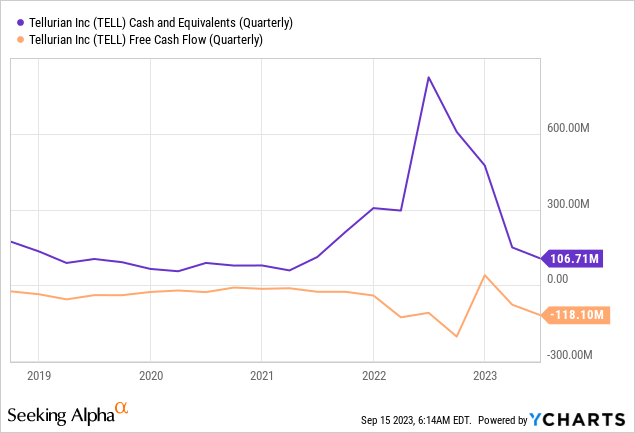

2022 was an aberration and natural gas prices have now fallen back down to be broadly in line with their historical average. US natural gas is currently trading at around $2.7/MMBtu and will likely trade close to this range for much of the rest of the year with European natural gas storage currently at 94%. This is far ahead of its average for this time of the year. Hence, the bears who constitute the 14% short interest would be right to highlight that Tellurian, at present, is a domestic gas producer that isn’t producing much gas as FID for Driftwood continues to move ever beyond the horizon. At risk is the entire company that now poses a binary return profile as free cash outflow ramps up against cash and equivalents.

Shareholders should be cognizant of the bankruptcy risk. Cash and equivalents as of the end of its last reported fiscal 2023 second quarter stood at $107 million, down from $474 million at the start of 2023. Heightening the risk profile is total borrowing which stood at $383.6 million as of the end of the second quarter. Revenue for the second quarter came in at $32 million, a 47.8% decline over its year-ago comp and a miss by $12.55 million on consensus estimates even with production at 17.2 billion cubic feet up from 9 billion cubic feet in the year-ago comp. Free cash outflow for the second quarter was high at $118.1 million.

The LNG Dream Could Live On

It’s clear that the world is moving to a global LNG-based energy system with more than 23 GW of US coal capacity to retire in 2028 alone. Further, demand for electricity is set to rise from the tripartite of GDP growth, population growth, and the insatiable rise of electric vehicles. Coal-fired power plants from Australia to the US and UK are set to close, boosting the importance of natural gas for baseload power generation in the era of renewable energy. Charif Souki, Tellurian’s founder and Chairman, is widely credited as the architect of the US LNG industry, and his headwinds with Tellurian mask his prior achievements with founding Cheniere Energy (LNG). Cheniere engineered the first US export of LNG in 2016 from its Sabine Pass terminal, helping to form an industry that has played a pivotal role in keeping the lights on for US allies responding to Russia’s brutal invasion.

The company has also entered into a binding commitment letter with asset manager Blue Owl Real Estate Capital for $1 billion in funding through the sale and leaseback of 800 acres of land underpinning Driftwood. It’s not cheap with a master lease at an 8.75% capitalization rate and with 3% annual rent escalators. Tellurian will also be required to post a letter of credit equal to 12 months of rent. The deal will not close until Tellurian secures joint and several contingent guarantors for the master lease that hold an investment grade rating of BBB or higher. This comes as Tellurian moves to sell LNG to non-equity holders, moving away from a prior equity ownership requirement. Hence, the company could keep its FID dream alive if it slows down its rate of burn and taps its equity for more liquidity to extend its cash runway. A possible rise in natural gas prices this winter could also provide a boost to earnings. However, I’ll continue to watch from the sidelines with the ticker a hold.

Read the full article here