Investment Thesis

Warner Bros. Discovery, Inc. ((NASDAQ:WBD) or the “Company”) has received much attention from financial and media analysts as it has gone through its in the spotlight transformation since the closing of its merger on April 8, 2022. Despite the general macroeconomic and media market/industry headwinds experienced, WBD has made significant progress in integrating, rationalizing and improving its businesses for the future.

Notwithstanding WBD’s successes to date and its continued strong prospects for success, WBD trades at a significantly discounted equity valuation relative to its media peers. In my opinion, a major reason for WBD’s equity valuation discount is that the company’s capital structure is generally misunderstood and often misrepresented by many media reporters and analysts. The focus of this article is to present a “deep dive” on WBD’s debt capital structure, and how its debt structure has very beneficial implications for WBD’s valuation.

Summary Overview of WBD’s Debt

WBD’s debt is often incorrectly referred to as a mountain or pile of debt that is looming over WBD as if the debt was short-term floating-rate debt with imminent significant refinancing needs that would cause the Company to take drastic actions to make its payments.

In fact, WBD has a very favorable low cost fixed-rate (4.6% average rate, with 97% of the debt being fix-rate), long-term (14+ years average life), and staggered maturity debt capital structure (extending out to 2062). As a result, the Company is insulated from future increases in interest rates and doesn’t have any refinancing risks. Furthermore, there are minimal near-term maturities – with only $42 million due before the end of this year (after payment on September 15th of $178 million) and $1.8 billion during 2024. The Company is clearly not under pressure to sell assets (e.g., CNN) to repay “looming” maturing debt.

From the inception of the merger, WBD’s management planned to rapidly pay down debt in the initial few years after closing of the transaction. The Company has delivered and has shown that its debt is very manageable given its strong and increasing Adjusted EBITDA and free cash flows.

Since the merger closed last April, WBD’s outstanding debt has already been reduced to approximately $45.4 billion, and its net debt to approximately $42.4 billion – representing an approximate $10.9 billion debt reduction (including payoffs and purchases of debts). Significantly, this debt reduction represents (1) approximately 20% of the Company’s original post-merger debt level and (2) is equivalent to about $4.50 per equity share ($10.9 billion divided by 2.44 billion shares).

With the Company’s generation of significant free cash flows during the remainder of this year and expectations for next year, the Company is well on its way to achieve its targeted gross leverage level by the end of 2024 of 2.5 to 3.0 times 2024 EBITDA. This implies gross debt of approximately $36.5 billion by the end of 2024, and net debt of approximately $34 billion. To reach this debt level would represent an additional debt reduction of $9 billion – which is likely to include some debt purchases at discounts.

Due to the significant increases in interest rates since when the merger closed (when rates were approximately 200 basis points below current levels), the fair value of WBD’s fixed-rate debt is estimated to currently be approximately $6.9 billion less than its book value. The discounts on the Company’s longer dated debt tranches are as much as 30% to 40% – creating a huge opportunity for the Company to purchase some of its debt at significant discounts.

As WBD moves towards meeting its gross leverage target for 2024, its financial flexibility will continue to grow. The Company’s remaining debt has very favorable fixed rates and has very long-term maturities – providing the Company tremendous flexibility to use its significant free cash flow (“FCF”) for additional purposes, including additional investing in its existing and new businesses, stock repurchases, additional repayment of its debt obligations (at discounts to par) and acquisitions.

Given WBD’s strengths as a diverse global media and entertainment company which has already gone through a significant transformation, WBD’s enterprise valuation, equity market capitalization, share price and EV/EBITDA ratio are extremely low relative to its media peer group.

I believe that WBD’s enterprise valuation ratio and its share price have tremendous upside as the Company continues to achieve successes in its transformation, including its improving financial performance metrics (including Adjusted EBITDA, free cash flows and debt reductions), and perhaps most significantly, the growth and profitability of its global DTC business.

Review of WBD’s Debt Structure

WBD’s debt structure was carefully planned and executed before the transaction closed in April 2022. When the merger closed on April 8, 2022, WBD had approximately $56 billion of debt, including $41.5 billion of debt assumed in connection with the transaction. There is no disputing that it’s a lot of debt, but it’s also important to recognize that WBD has significant amounts of goodwill and intangible assets – over $76.5 billion as of June 30, 2023. Having low-cost long-term fixed rate debt as a significant part of its permanent capital structure to finance a portion of these long-term intangible assets provides for an efficient and low-cost capital structure.

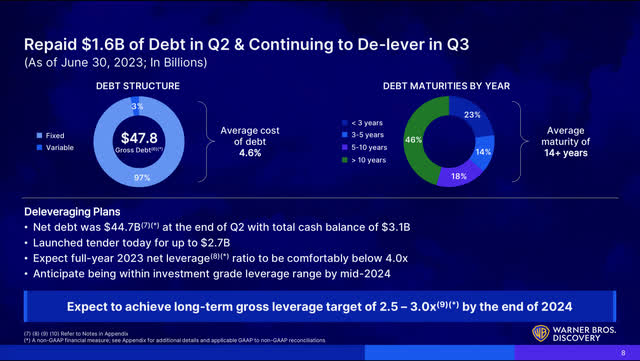

The below summary slide from the Company’s 2nd quarter 2023 earnings presentation highlights the summary characteristics of WBD’s debt (as of June 30, 2023).

WBD Summary of Debt as of June 30, 2023 (Warner Bros. Discovery)

Highlights

- WBD’s remaining debt is predominantly fixed rate (97% was fixed rate as of June 30, 2023). As a result, WBD is insulated from increases in interest rates.

- WBD’s debt has long and staggered maturities extending out to 2062 (with an average life of 14 plus years as of 6/30/23).

- As of June 30, 2023, the weighted average interest rate on WBD’s debt was 4.6%.

- It’s important to note that the long-term debt assumed through the merger was executed in a much more favorable low interest rate market environment – when the 5,10 and 30-year treasuries yielded approximately 2.42%, 2.32% and 2.44% percent, respectively (UST yields as of March 31, 2022).

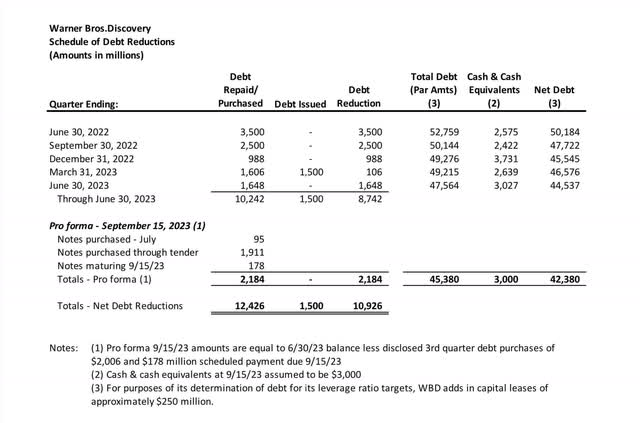

WBD’s outstanding debt has already been reduced to approximately $45.4 billion, and its net debt to approximately $42.4 billion (assuming $3.0 billion of cash and cash equivalents). As detailed in the below table, this debt reduction of $10.9 billion (including payoffs and purchases of debts) includes $8.7 billion of debt reduction through June 30, 2023, and an estimated $2.2 billion during the 3rd quarter of 2023 (the total of the Company disclosed purchases of $2 billion of debt in July and August, and its scheduled payoff on September 15, 2023 of an approximate $178 million euro-denominated borrowing).

WBD Schedule of Debt Reductions (Author based upon WBD financial disclosures)

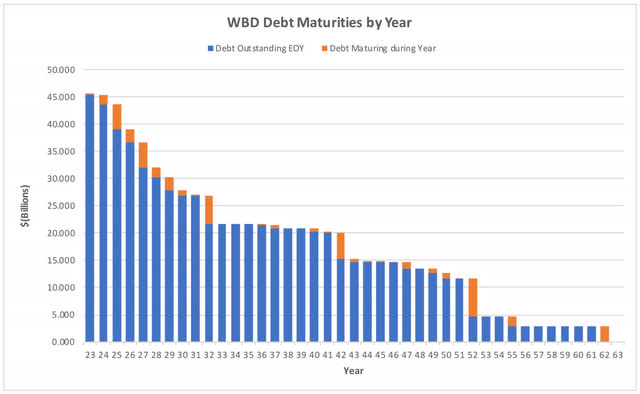

Using the detailed schedule of the Company’s outstanding debt obligations included in its quarterly earnings package, and adjusting for disclosed 3rd quarter debt reductions, the chart below shows the maturity schedule of the Company’s remaining $45.4 billion of debt. When reviewing the chart, it becomes apparent how the Company’s long-term debt consists of laddered maturities that eliminate refinancing risks in any one year.

WBD Outstanding Debt and Debt Maturities by Year (Author based upon WBD financials)

Summary of Maturing Debt

Of the Company’s $45.4 billion of remaining debt, approximately:

- $0.04 billion is due during the remainder of 2023,

- $1.8 billion is due during 2024,

- $4.5 billion is due in 2025,

- $2.3 billion is due in 2026,

- $10.0 billion is due between 2027 and 2031,

- $6.7 billion is due between 2032 and 2041, and

- $20.1 billion is due between 2042 and 2062.

WBD Guidance regarding Leverage Levels and Implied Adjusted 2024 EBITDA Guidance

Consistent with its $10.9 billion of debt reductions to date, the Company intends to continue to reduce its debt much faster than their scheduled maturities. As described below, in reaching its gross debt leverage target of 2.5 to 3 times Adjusted EBITDA for 2024, gross debt will be reduced by an additional approximate $9 billion by the end of 2024 – which is greater than all of the debt maturing between now and the end of 2026 (approximately $8.6 billion).

2023

In recognition of the continuing strikes, WBD just lowered its guidance for 2023 Adjusted EBITDA to be in the range of $10.5 billion to $11.0 billion. The Company has previously reported 1st half 2023 Adjusted EBITDA of $4.7 billion – so implied guidance for the 2nd half of 2023 is $5.8 to $6.3 billion. This guidance of $5.8 to $6.3 billion for the 2nd half of 2023 is 16% to 26% above the Company’s Adjusted EBITDA of $5.0 billion for the 2nd half of 2022 – a sign that growing synergies are being realized. When discussing synergies at Bank of America’s Media, Communication and Entertainment Conference on September 14th, Gunnar Wiedenfels(CFO) said:

“..we’ve taken the synergy target up. We’ve got $3 billion in the bag, already raised our expectation to $5 billion plus now.”

The Company just reiterated its leverage target for “net debt” to be below 4 times Adjusted EBITDA by the end of 2023 – which it appears will be easily achieved. Using the mid-point of the Company’s Adjusted EBITDA guidance – $10.75 billion – suggests “net debt” at the end of 2023 of less than $43 billion. As noted previously, after scheduled payments and disclosed 3rd quarter debt purchases to date, “net debt” is already approximately $42.4 billion – before taking into account any 4th quarter debt reductions.

The Company also just raised its guidance for 2023 FCF to be at least $5.0 billion. The Company has previously reported $0.8 billion of FCF for the 1st half of 2023, implying FCF of over $4.2 billion in the 2nd half of 2023. This guidance of over $4.2 billion is 83% above the Company reported FCF for the 2nd half of 2022 – another sign that growing synergies are being realized. As a result, it’s reasonable to expect that WBD will purchase more of its debt through the end of 2023.

2024

The Company also just affirmed its leverage target for its gross debt (not “net debt”) – now approximately $45.4 billion – to be in the range of 2.5 to 3.0 times Adjusted EBITDA by the end of 2024. Although the Company hasn’t yet provided specific guidance for 2024 Adjusted EBITDA or FCF, it has in the past suggested that Adjusted EBITDA would increase by 20% plus year-over-year, suggesting Adjusted EBITDA for 2024 of approximately $13.0 billion.

Using an Adjusted EBITDA level of $13 billion and a mid-point leverage target of 2.75 times, the targeted gross debt level would be approximately $36.5 billion. Assuming cash and cash equivalents of $2.5 billion, this would imply net debt would be approximately $34 billion. This implies an aggregate debt paydown of approximately $9 billion between now and the end of 2024.

This level of debt is consistent with what Gunnar Wiedenfels was attributed as saying in a September 4, 2023 Barron’s article: “that the optimal amount of debt for the Company was in the ballpark of $35 billion or so.”

Assuming 2024 EBITDA of $13 billion and a 50% conversion rate to FCF, 2024 FCF would be approximately $6.5 billion. When combined with the 2nd half 2023 FCF of over $4.2 billion (see above), reducing debt by approximately $9 billion of debt by the end of 2024 appears very reasonable – particularly when considering that the Company is able to purchase some of its long-term debt maturities at significant discounts to par (see below). For example, if the Company could acquire some long maturity debt at a price of 80%, then for each $1 of cash used, the Company could acquire $1.25 of debt.

Reducing outstanding debt by $9 billion would result in annualized net interest savings of approximately $414 million assuming an interest rate of 4.6% on the repaid/purchased debt – which on a go forward basis will only increase the Company’s free cash flow.

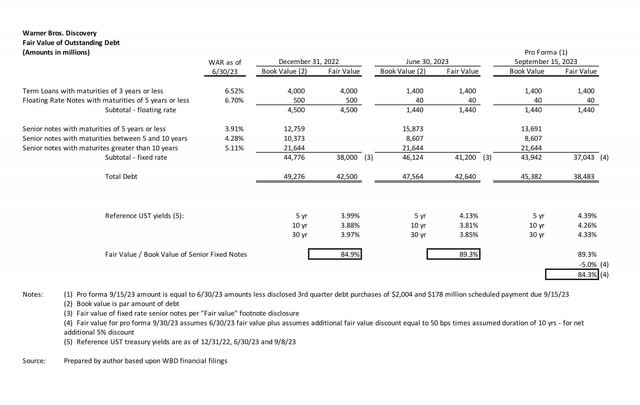

Fair Value of Debt Obligations is Significantly Less Than Book Value

WBD’s debt obligations are recorded at their historical values (close to par). However, due to the significant increases in general interest rates since the transaction closed on April 8, 2022, and the relatively low interest rates on WBD’s fixed-rate debt, the fair value of WBD’s debt obligations is significantly less than their book values.

As of June 30, 2023, the weighted average rate of WBD’s debt was 4.6%. It’s important to note that long-term debt assumed through the merger was executed in the very low interest rate market environment 17 months ago – when the 5,10 and 30-year treasuries yielded approximately 2.42%, 2.32% and 2.44% percent, respectively (yields as of March 31, 2022).

In its “Fair Value” footnote disclosure in its Financial Statements, WBD estimates the fair value of its fixed rate debt obligations was $41.2 billion (including accrued interest) as of June 30, 2023. This compares to the June 30, 2023 book value of its fixed rate debt obligations of $46.1 billion (which does not include accrued interest) – a $4.9 billion discount to book value (when ignoring accrued interest differential – which would only make the discount higher). Although the fair value discount is not disclosed for each of the debt maturities, it’s worth noting that due to the significant increases in interest rates since when the merger closed in April 2022, the discounts on some of the Company’s longer dated debt tranches are very significant – as much as 30% to 40%.

WBD Fair Value of Outstanding Debt (Author based upon WBD financial disclosure)

Since interest rates have increased by approximately 50 basis points since June 30, 2023, the current fair value of WBD’s fixed rate debt is even less. As a quick estimate, using a 50-basis point rise in rates and an assumed duration of the fixed-rate debt of 10-years (probably conservative since the debt has an average life of 14 plus years as of June 30, 2023), the incremental fair value discount would be approximately 5 percent. As shown, the pro forma fair value of the remaining fixed rate debt is estimated to be approximately $37 billion – an approximate $6.9 billion (16%) discount to its book value.

Relevance of Fair Value of Debt

Although WBD cannot “book” a gain on the fair value discount unless it actually purchases some of the debt securities at a discount, analyzing the fair value of the fixed rate debt is relevant since it highlights the attractive low-cost fixed rate and long-term debt nature of WBD’s debt. This should be a boost to WBD’s equity value since the Company has locked-in an extremely favorable permanent financing structure. When using the discounted fair value estimate of WBD’s debt obligations in the calculation of WBD’s enterprise value, it only further highlights how cheaply WBD’s equity is valued.

It is also worth noting that in the event of an acquisition of WBD, the acquiring company could assume the existing debt as long as it remains investment grade. This should be a significant benefit to WBD’s valuation since an acquirer would be able to assume WBD’s favorable low cost fixed-rate debt structure and would only need to acquire WBD’s equity.

Enterprise Valuation and Share Price

WBD has made tremendous progress in integrating, rationalizing and improving its businesses for the future. Almost since the transaction closed, the Company has faced general macroeconomic and media market/industry headwinds which it has responded to with experience, good management, hard work and creativity. The Company has made significant progress in its key three business lines and has set itself up for continued success. WBD’s management has shown its ability to identify and achieve significant synergies throughout its broad platform – most recently increasing its expectations to $5 billion plus of synergies.

WBD has revamped its studio businesses, including the realignment of the management of its DC Studios, and in a reversal of prior management’s strategy, has embraced the importance of theatrical releases. WBD management has shown its expertise in managing its extensive linear businesses, which remain very profitable and generate significant EBITDA and free cash flow despite the long-term decline in the general linear market.

Most important for its long-term future prosperity, WBD has rebuilt its DTC business through its integration of its HBO Max and Discovery streaming platforms into Max. Other than Netflix, WBD has been the leader in focusing on profitability of its DTC business rather than just adding subscribers – a strategy now embraced by all other major streamers. WBD’s efforts are showing results – with US profitability now expected for 2023, and WBD is guiding towards $1 billion plus profitability for its global DTC business in 2025. Max has the new ability to live stream programs – including CNN Max later in September, and some sports programming expected later this fall. With its enormous library of popular and diverse content, Max is well positioned to remain and improve its position as one of the premier global streaming services and is expected to have considerable success in expanding its global footprint over the next few years.

Given WBD’s strengths as a diversified global media and entertainment company which has already gone through a significant transformation, WBD’s enterprise valuation, equity market capitalization, share price and EV/EBITDA ratio are extremely low relative to its media peer group.

At its closing stock price on September 12th of $11.33, WBD’s enterprise valuation is now approximately $70 billion (equity market capitalization of $27.6 billion plus pro forma current net debt of $42.4 billion). The mid-point of the Company’s recent guidance for 2023 Adjusted EBITDA is $10.75 billion – resulting in an EV/EBITDA ratio of 6.5 times.

- If an assumed $6.9 billion discount is applied to the net debt amount due to the advantageous low fixed-rates on WBD’s debt, the EV is approximately $63 billion – resulting in an EV/EBITDA ratio of 5.86 times.

In comparison, DIS, NFLX, CMCSA and PARA have much higher EV/EBITDA ratios (based on forward EBDITDA estimates) – 12.97x, 27.90x, 7.56x and 10.74x, respectively (source – Seeking Alpha Valuation Grade and Underlying Metrics). DIS, NFLX and CMCSA also have much larger enterprise valuations: $200 billion, $208 billion and $283 billion, respectively.

As the “market” better understands the attractive investment opportunity presented by WBD, I believe that the Company should trade at a much higher valuation.

- Using the median valuation for media companies (8.40x per Seeking Alpha Valuation Grade and Underlying Metrics) would result in an Enterprise Value of approximately $90.3 billion – implying an equity capitalization of approximately $47.9 billion when using pro forma net debt of $42.4 billion, and a share price of $19.63 – approximately 73% higher than the current share price.

I believe that WBD’s enterprise value, equity market capitalization and share price have tremendous upside due to the Company’s strong and improving fundamentals, including: (1) increasing Adjusted EBITDA levels, (2) debt that is being significantly reduced and (3) a higher EV/EBITDA ratio. WBD should get a bump in its enterprise valuation ratio (and share price) as WBD continues to achieve successes in its transformation, including growing its overall EBITDA and FCF, and perhaps most significantly, the growth and profitability of its global DTC business.

Looking forward to 2024, implied guidance is for Adjusted EBITDA to increase to approximately $13 billion, and for its net debt to be reduced to approximately $35 billion by the end of 2024.

- Applying the current low EV/EBITDA ratio of 6.5 times Adjusted EBITDA of $13 billion yields an Enterprise Value of approximately $84.5 billion, and with net debt of approximately $35 billion, the implied equity capitalization would be $49.5 billion – equivalent to approximately $20.30 per share – 79% higher than WBD’s current share price of $11.33.

- Applying an EV/EBITDA ratio of 8.40 times – the current median for media companies (source – Seeking Alpha Valuation Grade and Underlying Metrics) – results in an Enterprise Value of approximately $109.2 billion, and equity capitalization of $74.2 billion – equivalent to approximately $30.40 per share – 168% higher than WBD’s current share price.

Risk Considerations

WBD currently has approximately $45.4 billion of debt (approximately of $42.4 of net debt) that over time will ultimately have to be repaid or refinanced. However, due the favorable low cost fixed-rate long-term and staggered maturity nature of its debt, the Company’s debt structure does not loom over WBD’s future.

As discussed earlier, near-term debt maturities are minimal – approximately $1.8 billion through the end of 2024, and approximately $8.6 billion through the end of 2026. To date the Company has demonstrated its ability to generate increasing amounts of Adjusted EBITDA and free cash flow to easily pay interest on its debt and reduce its debt through payoffs and debt purchases. Furthermore, the Company has been very prudent in taking care of any near-term debt maturities.

The Company’s debt leverage objective is to reduce its gross debt by the end of 2024 to 2.5 to 3.0 times its Adjusted EBITDA. Although the Company hasn’t provided specific guidance on either its 2024 Adjusted EBITDA level or a specific target debt level – as discussed herein, it implies a significant debt reduction estimated to be in the area of $9 billion. Any shortfall from meeting its objective by the end of 2024 would be only a disappointment for not meeting its leverage target objective by the targeted date.

As discussed above, the equity market current values WBD at a significant discount to its media peers. To the extent that WBD is unable to demonstrate to the market through continued successes in its business lines and improving financial metrics, there is the risk that the market continues to discount WBD’s equity valuation.

Conclusion

WBD’s debt structure is a significant balance sheet strength and provides the Company a very favorable long-term liability structure. The Company has shown that its debt is very manageable, it has already reduced its debt by $11 billion to date, and intends to continue to reduce its debt in order to meet its objective to reduce its gross debt to approximately $35 billion or so by the end of 2024. As discussed earlier, due to the long-term and staggered nature of its debt, the Company is under no pressure to repay or refinance any of its debt.

It is easy to see that WBD shares could increase to the mid $20’s over the next 12 months as: (1) its debt continues to be reduced, (2) its Adjusted EBITDA and free cash flows continue to increase (and the Company provides formal guidance for 2024), and (3) the market applies a higher EV/EBITDA valuation ratio than it currently does as result of the Company’s success in accomplishing the first two objectives.

Among the near-term catalysts that should be positives to WBD’s stock is clarification that the now resolved Disney/Charter carriage dispute will not detrimentally impact WBD. Disney’s issues in the dispute were very related to its ESPN business – fundamentally different from WBD’s sports businesses. Gunnar Wiedenfels spoke at the Bank of America’s Media, Communications and Entertainment Conference on September 14th, and among the many items discussed he presented a clear case that WBD has strong and excellent relationships with its affiliates (including Charter) and that: (1) WBD is providing excellent value to its affiliates helping driving revenues for its affiliates, (2) WBD is already provides access to Max to its affiliates premium cable customers at no additional cost, and (3) WBD has worked through many affiliate renewals in the past 17 months and has always worked out mutually beneficial solutions without fanfare or a lot of press.

The resolution of the strikes, for which the Company already ratcheted back its guidance for Adjusted EBITDA through the rest of 2023, will also serve as another near-term catalyst that should be a positive to WBD’s equity valuation.

WBD is a unique and very attractive “pure” play in global media and entertainment. With WBD currently trading at such a cheap price there is always the possibility that suitors and/or activist investors will begin to increase or take positions in WBD on or before next April (the 2-year anniversary of the merger) – when the Morris Trust restrictions with respect to corporate transactions involving the Company will end. I believe that this dynamic should bring positive momentum to the stock price later this year and into early next year.

Read the full article here