Moelis & Company (NYSE:MC) is one of the most elite advisory boutiques in the world. They are investing in talent, as they always do, when their markets are weak. We think things are coming back online in a meaningful way, and there should be decent sequential performance. Not back to 2021 levels, but decent performance. We are seeing IPO activity in tech, we are seeing a return to capital markets, and we are also seeing exits come back for public market investors from the private market world.

Q2 Breakdown

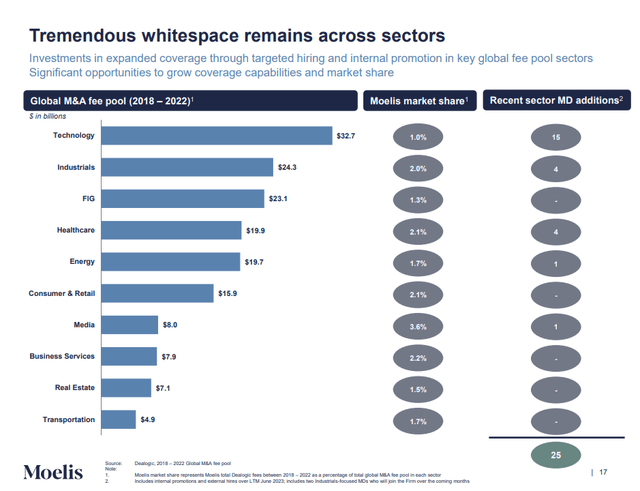

Since the Q2, there’s been a lot of life in the markets. Outside of the rally in AI related names, there’s now been finally a successful IPO with Arm (ARM), a really big one. Tech is where Moelis has been hiring MDs most aggressively. MD headcount grew a lot, a signature move during a recession in M&A markets, and tech is where the additions have been to move their market share needle.

Deal Pools (Q2 2023 Pres)

Sequential performance has been decent but not great, with declines in the Q2 being less than declines in the H1 but still with sequential declines in revenues, but MC outperformed the broader M&A market by a decent margin. But still, we cover the advisory sector extensively and others have managed to eke out sequential growth, such as Lazard (LAZ).

Retainer revenue related to restructuring has been up massively, almost 100%, being a leading indicator for some restructuring business, primarily liability management, which isn’t that dramatic. We’d been hearing news that some restructuring action is beginning to happen, stuff that resident CFOs can’t handle, and that’s finally going to start paying off for the advisors.

Other good news is credit markets, where financing even in the LevFin markets is becoming more available. Moreover, lost activity in private equity is beginning to come back as activity in private credit. Also, stabilizing cost of capital situations are also beginning to drive some activity in capital markets businesses as well, and we’ve seen that with peers like Piper Sandler (PIPR), and MC should start seeing benefits as well.

In all, MC performance looked decent. They are pretty high-ticket focused, unlike some of the mid-market companies we cover, which is why there’s been a more pronounced drought, but we think the wave of higher ticket deals is going to come back next, even if we like mid-market better.

Bottom Line

There are some other dynamics, too. Strategic deals tend to turn over a lot faster. While Moelis & Company is busy, and they are responding to top of the funnel activity, it will take several quarters before there is a pickup in revenues from these engagements. Revenue events are far off unless sponsors come back in force, who move a lot faster than strategics and bring revenue events sooner.

The cost of capital situation is still a little uncertain. The CPI data could have been better, and people were disappointed with the bearing energy had. This could mean more rate hikes are to come. We thought another one would be likely, with the last leg of inflation being the toughest. This could derail activity, and is a real risk. At the least, further rate hikes will keep sponsors sidelined and mean revenues are deferred.

The company already plans on rebalancing talent, so comp ratios are inflated right now. This is essential because incoming bonus seasons next year will start to weigh on the financial position – not in terms of solvency, but just in terms of the dividend, which is much loved by investors.

For now, we are seeing even in our own coverage universe more private market exits after years of a drought. This is great news, and it is a good sign for M&A markets altogether. The rebound will be drawn out, we think, with an uptick in restructuring to help, and while there are risks, we are pretty confident in what the sequential evolutions will look like.

We’re not sure about Moelis & Company’s current price, looks a little high historically considering the broader environment, but we aren’t averse to the fundamentals in the sector. Maybe Moelis isn’t our pick, but we are keeping an eye on this sector as more inflections should be coming.

Read the full article here