Investment Thesis

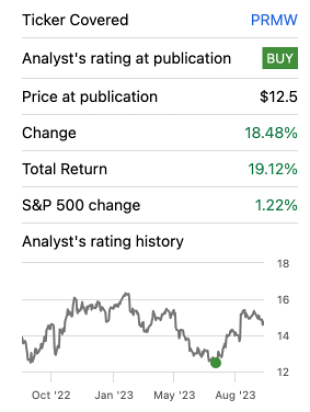

In continuation with our coverage of Primo Water (NYSE:PRMW), we rated PRMW as Buy, driven by its transformational journey over the past few years, robust and improved operational profile, and relative undervaluation. The stock has outperformed significantly, clocking over 19% gains in the last 2 months compared to a mere ~1% change in broader indices.

Seeking Alpha

It recently reported strong Q2 earnings beating estimates and raised its guidance for the full year providing better visibility on H2 2023. We continue to like the story and renewed operational profile to drive further growth. Reiterate Buy.

Beat and Raise

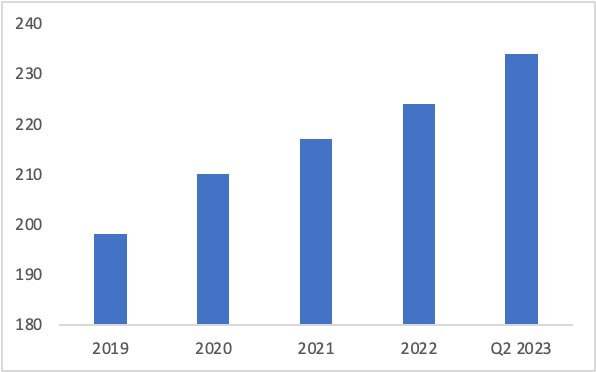

PRMW reported a consecutive beat for the year with Q2 2023 revenues jumping 4% YoY (8% normalized FX neutral growth) to $593 mn, at the top end of their guidance. The robust growth was primarily driven by pricing actions in Water/Direct Exchange (carryover pricing and normal course pricing) as well as benefits from an increase in delivery fee which led to a growth of 7% in the segment. Water Refill/Filtration segment revenues grew 18% also driven by pricing actions on outdoor machines as well as improved utilization and service levels of the stations. Europe revenues also grew a strong 12% (9% excluding FX) driven by pricing initiatives and commercial recovery with several employees returning to office. In addition, the sell-through also continued to improve (up 4% YoY in Q2 2023) and has been steadily growing demonstrating the benefits from its digital initiatives, however, it remains a low sales with limited profitability segment.

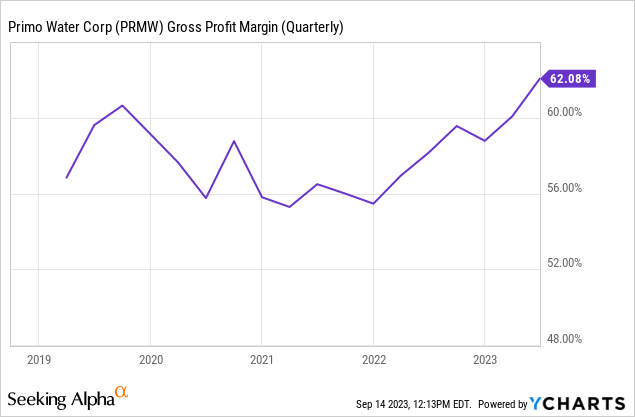

Gross Margins expanded 400 bps and have been the highest expanding about 400 bps YoY and further over 100 bps sequentially driven by pricing actions, route efficiencies (revenue per route increased 5% YoY to $157), and continued benefits from its exit of low-margin single-use retail in North America.

Improvement in No. of Units/Route/Day in Water Direct/Exchange

Company filings

Adjusted EBITDA increased 13% YoY to $122 mn at the top end of their guidance, beating consensus with margins expanding 160 bps YoY driven by strong gross margins partially offset by SG&A leverage due to higher labor costs and professional fees. In all, it reported Adj. EPS of $0.24 beating consensus expectations pegged at $0.19.

Balance sheet position continues to improve with the company ending with a cash balance of $87 mn and total debt outstanding of $1.55 bn (no maturities until 2028) with a net leverage ratio easing to 3.3x from 3.4x at the end of 2022. It repurchased $19 mn in common stock during H1 2023 and the board further authorized a share repurchase of $50 mn, which will further lend support to the stock.

PRMW updated its outlook and now expects revenue of $2.32 bn-$2.36 bn implying 4.7-6.5% growth compared to 3.8-6.1% growth it expected earlier driven by strong earnings momentum. It expects Adj. EBITDA of $470 mn at the mid-point compared to $460 mn previously, driven by continued gross margin expansion and route efficiencies. It also boosted its FCF guidance to $150 mn from $140 mn, driven by strong operational performance partially offset by higher cash taxes (expects $25 mn vs $20-$25 mn previously).

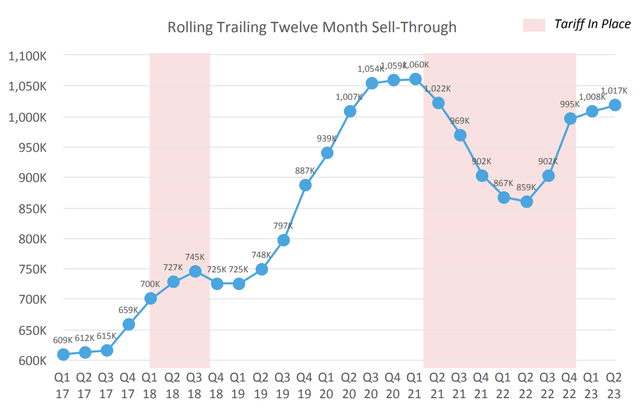

PRMW was awarded five-year exclusive partnership with Costco in H2 2022 for bottled water direct services which has been ramping up through the year leading to strong customer additions (it has added 40,000 new customers this year through the Costco booth program as well as through tuck in acquisitions). We believe the increase in number of sites as well as its initiatives through costcowater.com would continue a ramp-up in its customer additions. In addition, dispenser sell-through is likely to improve as the disposition of 25% tariffs on imported dispensers in Nov 2022 has already led to a significant improvement in sell-through in the past three quarters.

Company Presentation

The company has grown in double digits through 2022 (with above 10% growth from pricing initiatives while 3-5% volume growth). We believe that the pricing environment will remain stable particularly through normalized pricing on outdoor machines, follow-through pricing initiative on indoor machines, and increase of delivery fees would continue to bode well for the company in the near to medium term (demand has remained stable despite the pricing actions highlighting the relative inelastic demand characteristics) and expect normalized MSD pricing growth going forward. We expect EBITDA margins to continue to expand to its 21% goal driven by strong net customer additions and pricing action driving revenues along with route efficiencies and stable gross margins which will lead to SG&A leverage.

Valuation

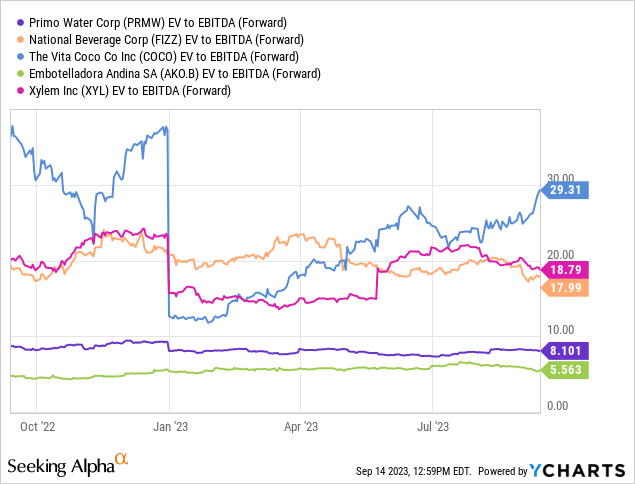

PRMW continues to trade at an EV/EBITDA of just 8.1x at a significant discount to its peers. We believe an improved operational profile and a recession-resistant stock would drive multiples expansion.

Reiterate Buy with a target price of $18.5 (at 9.3x EV/Fwd EBITDA, in line with its historical average).

| Particulars | ($ mn) |

| 2023E EBITDA | $475 mn |

| EV/EBITDA multiple | 9.3x |

| EV | $4,418 |

| (-) Net Debt | $1,464 |

| Equity Value | $2,954 |

| Shares O/S | 159.4 |

| Implied Share Price | $18.5 |

Risks to Rating

Risks to rating include:

1) Macro challenges and prolonged slowdown may lead to demand headwinds and PRMW may not be able to follow up on its pricing or may have to reduce pricing (which has been the key contributor for revenue growth past couple of quarters)

2) Adverse FX moves can be a drag on overall P&L (revenue growth impact of 4% in Q2 and 2% in Q1 due to FX)

3) European business recovery falters or stagnates due to macro pressures or competitive intensity which can cause demand headwinds and dampen sales growth along with SG&A deleverage which will further hurt operating margins

4) Execution challenges may lead to stagnating or declining revenue per route, which can lead to increased distribution and logistics costs

Conclusion

PRMW has done a spectacular job so far during the year driving topline growth through pricing initiatives as well as route efficiencies enabling gross margin expansion. We believe the company is likely to be at the top of its guidance for the year, reaping benefits from pricing actions and an increase in delivery fees in Water Direct/Exchange (which has a relatively inelastic demand), ramp up from its Costco booth program partnership along with recovery in Europe. Reiterate Buy with a target price of $18.5 (at 9.3x Fwd EV/EBITDA).

Read the full article here