Can GM stock price rebound from a 5-year low?

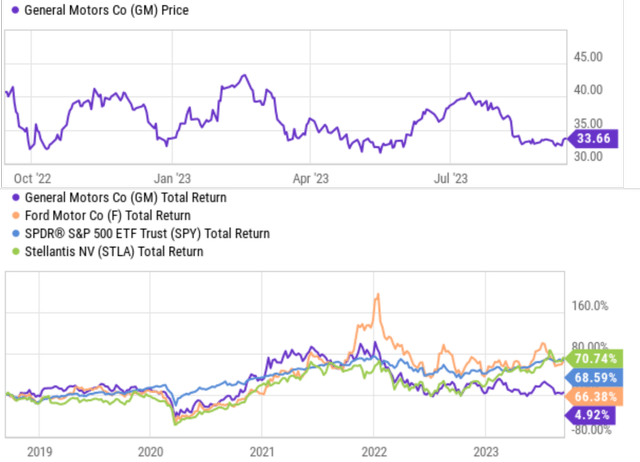

General Motors (NYSE:GM) stock has been under large selling pressure since July as you see from the plot below (top panel). Its stock price touched a peak of ~$40 in early July 2023, then plummeted to the current ~$33. Such a nosedive was caused by a series of headwinds (such as labor disputes with unionized workers). These headwinds impacted all three big Detroit automakers, and all three of them suffered large price corrections in this same period.

Against this backdrop, the goal of this article is to argue that the impact from these headwinds will be uneven among them, thus creating uneven price rebound potential. And my analysis will specifically show why I see a worse rebound potential from GM compared to Ford Motors (F) and Stellantis N.V. (STLA), especially when compared to F.

Let me broaden the horizon a bit and start with a historical perspective. The bottom panel of the plot shows the total returns of the big three in the past five years. As seen, both F and STLA’s total returns have been on par with the broader market. STLA’s performance actually outperformed the broader market a bit (70.7% vs. 68.6%). However, GM has delivered a disappointing performance amid one of the strongest bull runs in history, delivering a total return of 4.9% only. In terms of price performance, its current stock price is actually slightly lower than where it was five years ago (by about 3%).

in the remainder of this article, I will that the above underperformance is not an accident, but is caused by chronic issues. Then I will further explain why I anticipate the impacts from the UAW strike (United Auto Workers) to further exacerbate these issues.

Source: Seeking Alpha

United Auto Workers finally came

GM has been facing a series of challenges in the past few years, including negative free cash flow and rising loan rates. I will come back to these headwinds a bit later. Here, I will focus on the issue that is evolving: The UWA strike and labor disputes between the workers and GM.

In case you have not read the latest news yet, here’s a quick recap and update. As you probably already know, unionized workers and automakers have had a series of disagreements in the past. The current disputes concentrate on large pay raises (over 40%), pension plans, et al. The negotiations between the big three and UAW started in early July. GM offered a 20% raise (and the other two offered 17.5% and 20%), but the UAW rejected the offer. As a result, the UAW workers have started their UAW walkout: First ever simultaneous strike begins at Detroit Three today (Friday, Sept. 15).

The strikes and the aftermath could negatively impact GM in a number of ways as detailed in the next section.

Impact on GM

First, the strike could result in higher costs for GM (and therefore further pressure its already troublesome margins – more on this later). As just mentioned, UAW’s demands directly translate into higher operation costs (higher wages, more benefits, more training costs, et al.). As commented by a GM executive, such significant costs “would threaten our ability to maintain our manufacturing momentum.”

Second, the UAW strike will halt production at some of GM facilities. At this stage, not all UAW members are on strike yet. The UAW’s total membership is around 146K, and “only” around 13K of them were reported to have gone on strike now. However, UAW President Shawn Fain warned that more members go on strike if their members’ demands were not met. Every week of halted production could cause up to $500M of loss for each of the big three according to Deutsche Bank’s analysts. More importantly, as a second-order effect, GM could also suffer market share loss to companies that are not impacted by the UAW strike (such as Tesla (TSLA) and/or other overseas companies).

Of course, the above analysis can be applied to all three automakers. However, I see GM in a worse position to absorb the impacts, as explained next.

Why is GM in a worse position to absorb the impact?

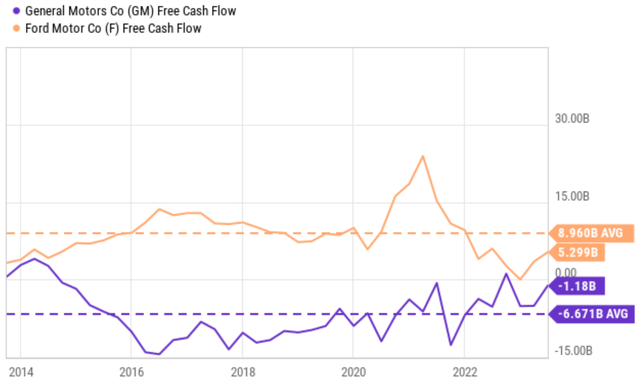

Not all cyclical stocks are the same, and GM had already been suffering negative free cash flows chronically before the strike.

The next chart compares the FCF (free cash flow) from GM to that from F in the past 10 years. As you can see, both currently and historically, GM has reported a negative FCF. To wit, it’s currently bleeding $1.18B of FCF and the 10-year average is -$6.67B per year. In comparison, F has been reporting positive FCF consistently. As seen, its current total FCF is around $5.3B and the historical average is almost $9B per year. GM is of course aware of the FCF issues and has been trying to combat these issues by cost cuts initiatives recently. However, I anticipate GM will have to meet some of the UAW’s demands eventually, which can lead to substantially higher costs. These costs can more than offset the cost cuts and in turn pressure its already stretched FCF.

Source: Seeking Alpha

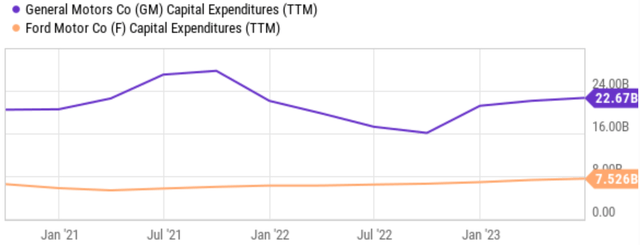

On the other hand, the company needs large capex expenditures to continue its progress toward electrification. GM has been late to the EV race and is playing catch-up, in my view. As seen from the chart below, it delivered only 7.8k electric vehicles (EVs) in H1 of 2022 and only dramatically ramped up in the past 1 year (by vastly outspending capex over F as seen in the second chart). But Ford already has a plan in motion to boost its EV output significantly. F’s Ford tripling F-150 Lightning, doubling Mach E production in 2023 involves tripling its output for F-150 Lightning and doubling its output for Mach E production in 2023. My estimate is that if this plan does materialize, it would put F to be the second EV provided in the US market, only second to Tesla. With F’s healthy FCF, I think the plan is feasible. However, in order for GM to increase its EV output, it will have to spend a considerable amount of capex to expand cell and vehicle production. I’m very concerned about the feasibility given the negative FCF and the potential for higher operation costs from the strike.

Source: carscoops.com Source: Seeking Alpha

Valuation, other risks, and final thoughts

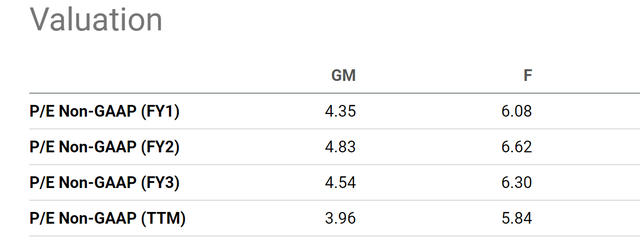

I’ve been focusing on GM’s negatives so far. There are a few positives worth mentioning. The company owns some of the most iconic models, and these models are still enjoying robust demands both in the U.S. market and overseas. For example, demand for its pickups and SUVs has been robust, and its total worldwide deliveries came in at almost 1.6 million in the most recent quarter. This translates into a 7.4% increase YOY. At the same time, the stock’s current valuation is very cheap, but in absolute and relative terms. As seen in the next chart below, its FY1 P/E is only 4.35x, almost 30% discounted from F’s 6.08x.

However, my overall conclusion is that the valuation discount is insufficient to compensate for the downside risks mentioned in this article. To recap, the top negatives to me are A) its already troublesome profitability even before the current rounds of labor disputes, and B) the high capex requirements for it to keep ramping up its EV output. I anticipate GM will have to meet some, if not all, of the UAW’s demands as the strike continues, which would lead to even higher costs for GM and worsened capital allocation options.

Source: Seeking Alpha

Read the full article here