Taseko Mines Limited (NYSE:TGB) saw its stock price soar over 20 percent after the EPA issued a final underground injection control permit for its Florence Copper project in Arizona, before closing the day up almost 13% at $1.46/share. I rated Taseko a buy in an analysis near the end of June in anticipation of this catalyst. However, despite the surge I still see significant upside left, given this opens the door for the company to boost annual copper production by over 70%, to about 200Mlbs per year. That said, as great an opportunity as Florence appears to be, the current Gibraltar operating margins can limit the upside and investors should beware of the company’s debt levels, which threaten profitability and valuation.

The Door Opens For Taseko Mines

Taseko, a Vancouver-based mining company with just over 700 employees focused on copper and molybdenum, holds an 87.5% interest in the Gibraltar mine currently operating in British Columbia and nearly all of the Florence copper project but for a 2.67% cut by Mistui in a streaming agreement. The company also holds 100% interest in Yellowhead copper project, the Aley niobium project, and the New Prosperity gold and copper project located in British Columbia.

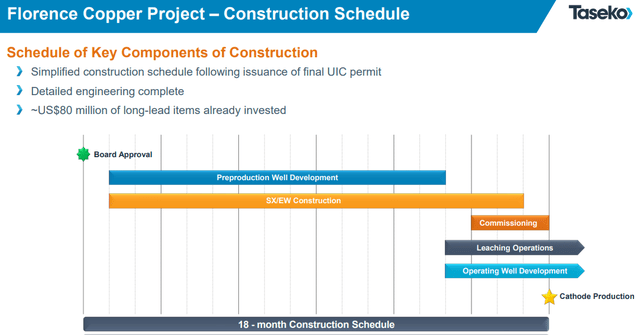

Florence will have capacity to produce up to 85Mlbs of copper annually at operating cash cost of only $1.11/lb. This will come in addition to the 115Mlbs of copper output from Taseko’s Gibraltar mine in Canada. The EPA’s move should allow Taseko to begin construction soon, which is estimated to take about 18 months.

Florence Construction Timeline (Taseko June Investor Deck)

According to the technical report, the plan proposes an In-Situ Copper Recovery (ISCR) well field supplying a solvent extraction and electrowinning (SX/EW) plant with economic copper grade of pregnant leach solution (PLS) for at least 22 years.

The approach taken was welcomed by the local community as it will create jobs while avoiding exacerbating the state’s water crisis. According to the Florence Copper FAQs: “There will be no impact on local water quality or quantity. ISCR uses significantly less water than what would be used by most types of farming or residential housing on the same area of land. The water used in the process comes from a layer of water deep underground and reused in the ISCR process over and over again for water efficiency.”

In a statement on Thursday, Taseko President and CEO Stuart McDonald said the next steps include mobilization of contractors for the wellfield and SX/EW plant construction and continuing to advance talks with potential lenders and royalty providers for the rest of project financing, which they expect to have in place prior to construction spending ramp up.

The Florence Copper Project is one of the least capital-intensive copper projects in the world and will have an environmental footprint smaller than any conventional open-pit or underground mining operation of comparable size. Low water use, low energy consumption and low carbon emissions make Florence Copper an exceptionally green project that will supply refined copper to the rapidly growing US domestic market,” McDonald said.

TGB Stock Re-Valuation

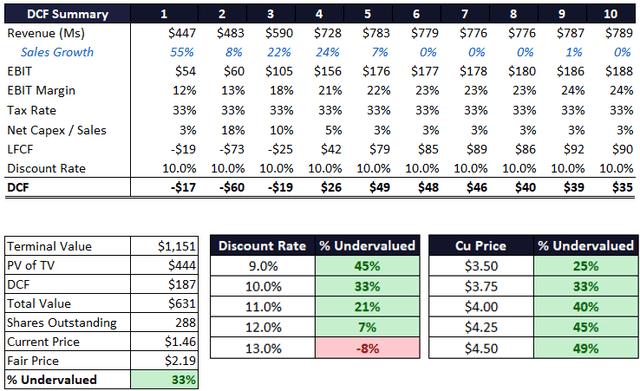

I estimated Taseko Mines stock’s fair price at $2.60/share in June, but that was before the company’s Q223 filing which revealed operating margins for the trailing twelve months dropped from 15% to 11.66%, which will be the new starting point for year 1. I make the assumption that Gibraltar operations will gradually reach 20%, roughly in the direction targeted in its technical report.

The model assumes per the technical report that Florence adds nearly 35Mlbs annually beginning in year 3 before rising to an average of 83Mlbs/year in years 5-10 net Mitsui’s cut. This comes on top of Gibraltar’s roughly 112-115Mlbs/yr, before the combined total output reaches close to 200Mlb/year. I slightly reduced Florence projections because Mitsui’s 2.67% streaming agreement cut was not fully reflected in the previous model. The Florence technical report does not incorporate this in its economic analysis. The company is also projected to produce on average of about 2.3Mlbs of molybdenum per year, which I incorporated into the DCF model.

Based on a copper price of $3.75/lb and Mo. price of $20/lb, Taseko’s annual revenue should climb to nearly $800 million by year ten in the model. Operating costs at Florence are expected to be $1.11/lb, $1.32/lb including royalties, significantly lower than the $2.66/lb Gibraltar registered in Q2. As a result, the company should see margins gradually rise. Gibraltar gradually rises to 20% while I have Florence plugged in at 35% EBIT throughout.

The aforementioned changes, especially the lower EBIT baseline, end up reducing the fair price to $2.19/share, implying that the stock is undervalued by 33%. I also provide sensitivity tables that show the value based on discount ranges of 9%-13% and copper prices of $3.50/lb to $4.50/lb.

Taseko DCF Analysis (MH Analytics)

Risks

Taseko’s rising debt levels remain a key risk for the company, eating into its operating margins and threatens its valuation. A good argument could be made for using a higher discount rate in fact if we factored in the company’s debt to market equity ratio, which is about 108% (debt / market cap). The debt to common equity ratio is at 165%, coverage ratio 1.03, and Net Debt/EBITDA ratio is 5.88. In the previous report, before the Q2 filing, we reported D/E of 169%, coverage ratio of 1.43, and Net Debt/EBITDA of 4.8. Interest expense was almost 9% of sales in Q223 and averaged about 10% of sales in the past five years – which feeds right into major risk #2.

The other concern is Gibraltar’s operating margins. The reality is Gibraltar will represent nearly 60% of production even when Florence is fully up and running. This presents opportunity as well, considering it is more likely to increase operating margins toward the industry average than to go backwards (at least one would hope). Plus, think of the possibilities if the company was able to reduce interest expenses to even 5% of sales.

Conclusion

TGB stock popped after the EPA greenlighted its Florence copper mine in Arizona, as I anticipated in a buy recommendation a couple months ago. However, I expect the stock to rise even more in the long-term, especially if investors gain confidence the company can reduce its debt load and the current operations can enhance operating margins. Hence, I maintain a buy recommendation.

Read the full article here