Introduction

On April 20, I wrote an article titled XLE: Be Protected The Next Oil Bull Market Will Be Wild. In that article, I made the case to buy energy stocks to be protected from what could become a raging bull market in energy commodities.

Here’s a part of my takeaway:

Investing in the energy sector has become more challenging due to recent structural changes, which I view as a long-term positive for the industry. There is a high probability that oil prices may surge into the triple-digit territory once demand hits its bottom, thanks to the OPEC cuts and their expectations of stronger-than-anticipated long-term demand.

[…] Therefore, I strongly recommend holding energy stocks for both their potential capital gains and dividends, and I believe that having some exposure to the energy sector is critical in the current energy and inflation environment, which was not necessary before the pandemic.

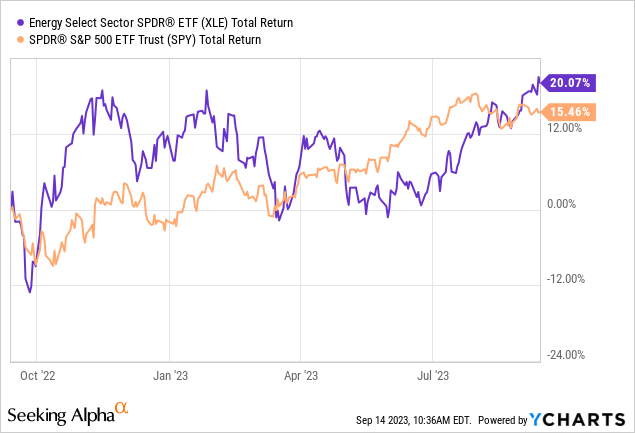

Since then, the Energy ETF (NYSEARCA:XLE) has rallied roughly 11%, beating the S&P 500 by 300 basis points.

Now, it’s time for an update. Not only have I written countless articles on various energy stocks, updating my bull case, but we’ve also seen a confirmation of my thesis.

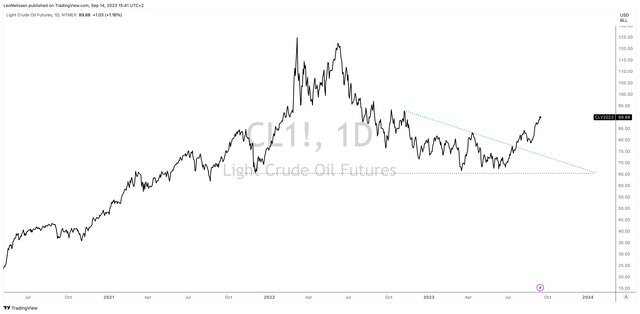

After breaking out in July, crude oil futures are back at $90. That’s despite poor consumer confidence and a general downtrend in economic growth.

TradingView (NYMEX Crude Oil)

In this article, I’ll discuss the drivers of this bull case and explain why I continue to believe that owning energy stocks is so important.

So, let’s get to it!

Supply – The Driver Of Higher Prices

Like every other commodity, oil is all about supply and demand.

The supply picture is what worries me (meaning, it could cause high inflation for many years to come) because major basins in the U.S. are running out of steam.

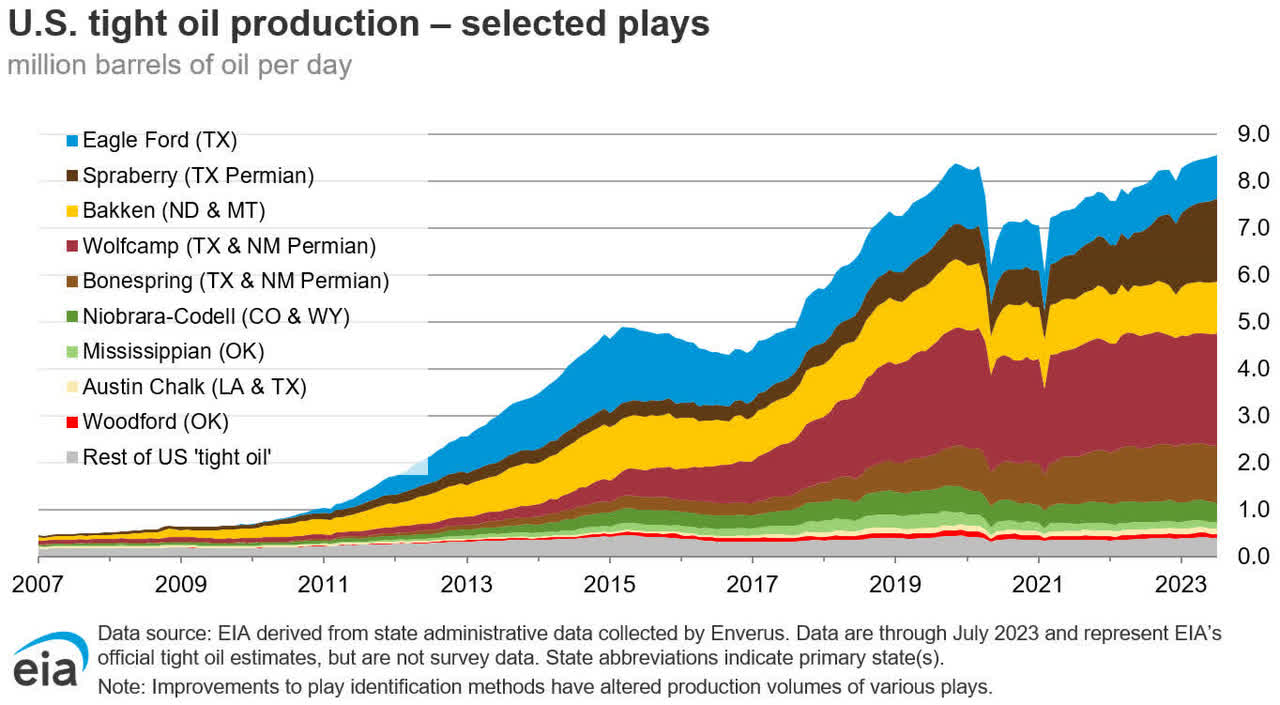

After the Great Financial Crisis, U.S. shale production was the reason why global oil prices were subdued most of the time (especially after 2014). In 2007, the U.S. produced roughly 500 thousand barrels of oil per day using unconventional measures (horizontal drilling). Now, that number is 8 million barrels per day higher!

Energy Information Administration

This annoyed OPEC a lot. It even annoyed U.S. producers, as they were producing so much that every decline in demand caused oil prices to crash.

So many smaller players went bust in the past few years.

Now, things are changing. U.S. shale is running out of stream. We’re not seeing peak oil but a significant decline in supply growth. Producers are seeing rapidly declining Tier 1 drilling reserves. They focus on free cash flow generation instead of production growth and reward investors through dividends and buybacks.

They have learned their lesson – especially in an environment where new climate movements want to put big oil out of business.

As the chart above shows, shale production is barely higher than it was prior to the pandemic. The only basin with growth left is the Permian (the big one).

Even that basin is expected to reach peak production in 4Q24.

OPEC Is Back

With the U.S. losing pricing power, OPEC is witnessing a chance to become more powerful.

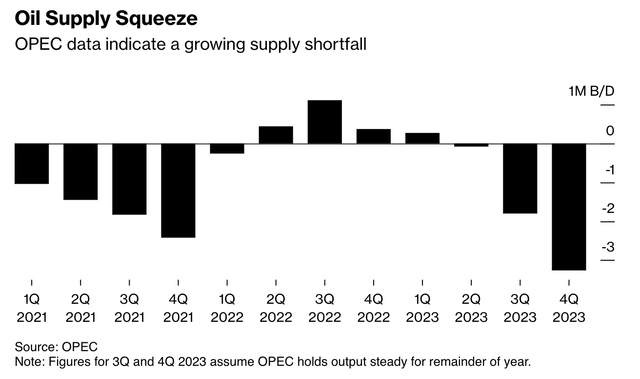

One of the reasons why oil is back at $90 is aggressive output cuts from OPEC (mainly Saudi Arabia). Saudi Arabia wants to protect $80 Brent at all costs. It also seems to be willing to defend $90 Brent, given that they announced an extension of the cuts.

Global oil markets face a deficit of 1.2 million barrels a day during the second half of 2023 following last week’s announcements by the OPEC+ leaders that they’ll extend cutbacks to the end of the year, the agency said. It’s smaller than projected last month, as a result of historical changes to demand estimates, but still poses risks for consumers. – Bloomberg

Because of the supply squeeze, we’re dealing with an increasing supply shortfall, pushing up prices.

Bloomberg

We can assume that OPEC is likely playing a political game here. While I’m obviously not a political insider who knows what, for example, the Saudis are up to, I can imagine what they are doing here.

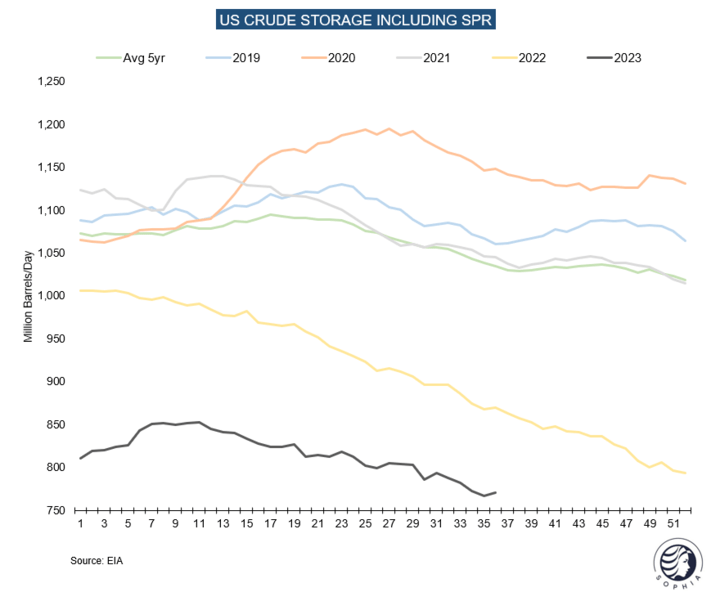

Looking at the chart below, we see that crude oil storage levels in the U.S. are way below anything we’ve seen over the past five years (and before that).

Including the strategic reserves, reserves are more than 200 million barrels below their longer-term average. Also, we’re going into a major election year. I doubt Biden – or any Democrat – wants to buy back oil in this environment.

Twitter/X (@SophiaKnowledge)

Having said that, demand developments are also favorable.

No, Demand Isn’t Peaking

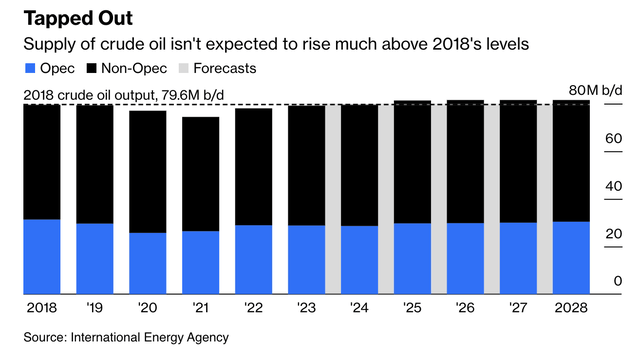

As reported by Bloomberg on September 14, forecasts from leading energy analysts suggest that global crude oil consumption is on an unstoppable ascent.

The International Energy Agency (“IEA”) projects a record-breaking 102.2 million barrels per day for this year, with a relentless climb to 105.7 mb/d by 2028.

Bloomberg

Exxon Mobil (XOM) also anticipates demand to surge by roughly 7.5 mb/d until it peaks in 2040.

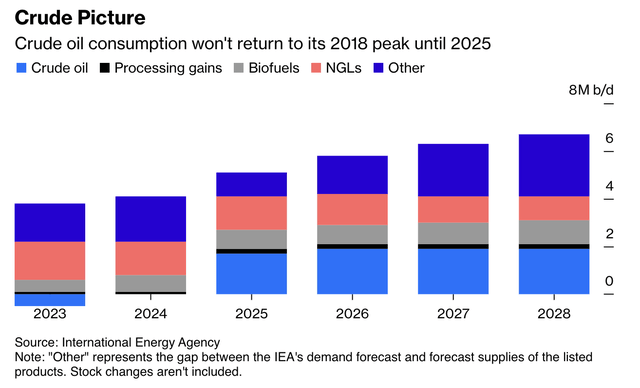

What’s interesting is that the IEA (do not confuse this with the EIA) isn’t *that* bullish. Its outlook includes barely any demand growth through 2028.

They do not expect 2018 levels to be reached before 2025, as most consumption is expected to come from natural gas liquids and biofuels.

Bloomberg

According to Bloomberg’s David Fickling, we could be looking at a peak demand scenario for crude oil – despite the overall positive demand picture of fossil fuels.

Put all that together, and the path for crude oil to rise above previous peak levels may be far narrower than you’d think from hearing bullish reports of refinery output. Last September, I predicted a global recession driven by fast-rising interest rates would prevent crude oil demand ever rising above its pre-pandemic record. The recession hasn’t materialized, but crude demand is still waiting to recover. Should biofuels and NGLs continue to outperform, we may come to look back on 2018 as the year that 150 years of crude oil demand finally peaked.

Having said that, I agree with the outlook that fossil fuel demand isn’t peaking. I do not believe that we’re anywhere close to a peak, as we’re at the start of massive growth in the middle-class population of India and various African nations.

While India will make sure to build a future with less dependency on foreign energy (learning from China’s mistakes), I do not see a scenario where oil demand turns into a headwind – ignoring cyclical recessions that happen occasionally. I’m talking about the bigger picture.

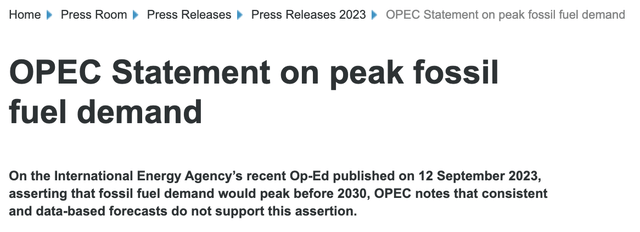

OPEC also issued a statement on September 14, reacting to the IEA’s outlook and comments.

OPEC

Allow me to share a few quotes from OPEC’s letter. I will add emphasis and my own view on things.

It is an extremely risky and impractical narrative to dismiss fossil fuels, or to suggest that they are at the beginning of their end. In past decades, there were often calls of peak supply, and in more recent ones, peak demand, but evidently neither has materialized. The difference today, and what makes such predictions so dangerous, is that they are often accompanied by calls to stop investing in new oil and gas projects.

OPEC is 100% right here. While suggesting that we could peak demand may very well be a wrong thesis, actively pushing for fewer investments in oil and gas is a serious issue. We’re currently finding out what happens when rising demand meets slower supply growth. The middle class (and everyone below) gets squeezed.

In recent years, we have seen energy issues climb back to the top of the agenda for populations as many glimpse how experimental net zero policies and targets impact their lives. They have legitimate concerns. How much will they cost in their current form? What benefits will they bring? Will they work as hyped? Are there other options to help reduce emissions? And what will happen if these forecasts, policies and targets do not materialize?

I often make the case that I am not rooting for high energy inflation. Although I have close to 20% energy exposure, my main concern is the protection of my portfolio, as elevated inflation is generally bad for the stock market.

That’s also why I’m writing this article.

Wall Street Journal

Lastly, I agree with OPEC when it comes to alternatives.

[…] OPEC does not dismiss any energy sources or technologies, and believes that all stakeholders should do the same and recognize short- and long-term energy realities,” says HE Al Ghais.

I’ve been a number of times on Dubai-based Asharq TV, where I discussed energy policies. My point has always been to use the proceeds from fossil fuels to build alternatives. We should NOT cut reliable sources before we have good alternatives.

That’s the biggest mistake we’re currently making.

My View & XLE

Putting all things together, I’m bullish on oil. While I do not rule out potential recession risks that could push oil down $20 to $70, I’m a buyer on major weakness, protecting my portfolio against what I believe will be a long-term uptrend in crude oil. I believe that triple-digit dollar prices are likely, which could come with a second wave of inflation – especially if the Fed is forced to cut rates at some point.

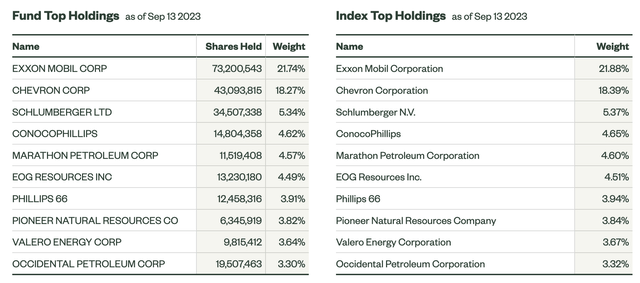

While I do not own XLE, I believe that XLE is a great way to hedge against energy inflation without having to take on elevated risks.

Incepted in 1998, XLE is one of the oldest ETFs on the market. It has a 0.10% expense ratio and a quarterly dividend. The current yield is 3.6%, which is mainly driven by Exxon Mobil and Chevron (CVX), who account for roughly 40% of this ETF.

State Street (SPDR)

Furthermore, as the overview above shows, investors get access to refiners as well. The ETF also includes providers of energy equipment and services.

This provides some diversification.

Despite not having the benefit of owning tech stocks, XLE has outperformed the S&P 500 by roughly 450 basis points over the past 12 months. This includes dividends.

Although XLE could be a bumpy ride if we enter a recession, I expect XLE to keep outperforming the S&P 500 for many more years.

Takeaway

The energy sector is experiencing a remarkable transformation, and the signs point towards a sustained bull market in oil. Recent developments, such as declining U.S. shale production growth and OPEC’s strategic output cuts, have set the stage for higher oil prices.

The supply-demand dynamics are shifting in favor of oil, with supply shortages pushing prices upward. Contrary to predictions of peak demand, global crude oil consumption continues to rise, driven by factors like India’s rising middle class.

While there are differing opinions and biases in the energy debate, one thing remains clear: energy stocks, like those in the XLE ETF, offer a solid hedge against inflation and a potentially long-term uptrend in crude oil prices.

Considering XLE’s history, low expense ratio, and diverse holdings, it presents a compelling opportunity for investors looking to benefit from the energy sector’s resurgence.

In my view, oil is poised for triple-digit prices, and XLE stands as a reliable vehicle to navigate the energy market’s opportunities and uncertainties.

Read the full article here