EPR Properties (NYSE:EPR) offers passive income investors a growing FFO, a 7.5% yield, and solid dividend coverage, but the trust also has risks that passive income investors need to consider.

Following the devastating Covid-19 pandemic of 2020, the specialty REIT has seen a strong recovery in its FFO. Though the REIT continues to cover its dividend with AFFO, EPR Properties has exposure to struggling theater chain AMC Entertainment Holdings (AMC).

With recession risks rising and EPR Properties’ stock now selling for 8.5x AFFO, I think a rating classification of Hold is justified.

My Rating History

I originally covered EPR Properties in April of this year and presented my investment thesis with respect to the experiential REIT in my article EPR Properties: Strong AFFO Value Plus An 8.3% Yield.

Besides AFFO potential and a decent valuation multiple, I pointed to the trust’s solid dividend coverage as reasons to buy the stock. With tenant risks growing and EPR Properties now selling at a higher valuation multiple, my new stock classification is Hold.

EPR Properties’ Exposure To Struggling Movie Theater Chain AMC Entertainment

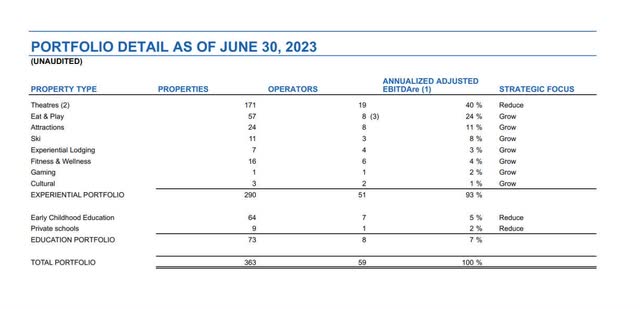

EPR Properties is heavily focused on the entertainment and leisure industries, so its revenue and FFO picture are more volatile, generally speaking than that of residential or commercial REITs. The specialty REIT primarily invests in theaters and entertainment facilities such as ski resorts, fitness and wellness centers, and a variety of other ‘experiential’ properties.

Management is shifting the portfolio away from theaters (due to the rise of streaming services) and educational institutions (which are under threat from the rise of online learning). In the second quarter, the REIT owned 363 properties in the United States worth approximately $6.7 billion. The trust is active in 44 U.S. states plus Canada.

Portfolio Overview And Strategic Focus (EPR Properties)

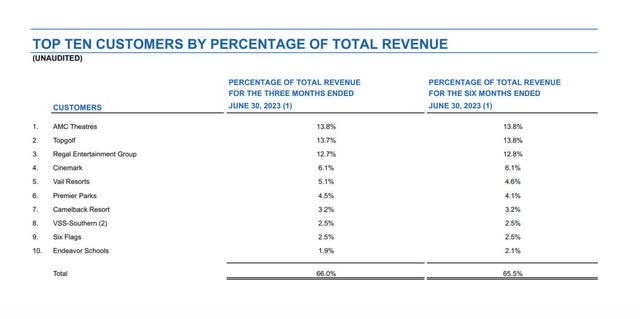

One issue that I see with EPR Properties is that the trust has considerable exposure to the movie theaters of AMC Entertainment, which is suffering from secular shifts to streaming. AMC Entertainment was recently forced to raise capital and the company’s CEO has warned of existential risks for the company if the equity raise fails.

EPR Properties owns a lot of properties that are leased to AMC Entertainment, and the movie theater chain is responsible for almost 14% of the trust’s total revenues. An AMC bankruptcy or downsizing measures would probably have dire consequences for EPR Properties. As a consequence, the trust’s dividend coverage (discussed next) might suffer and stifle the trust’s overall positive AFFO recovery.

Top 10 Customers (EPR Properties)

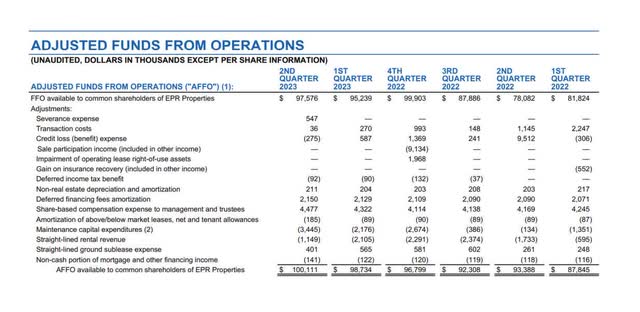

AFFO Recovery Supports Dividend Payout

EPR Properties profits as a specialty REIT when the economy is doing well and people are spending money on entertainment and leisure activities. Obviously, the REIT was severely impacted by the pandemic, which resulted in the temporary closure of entertainment facilities and theaters, resulting in a significant decrease in entertainment spending.

With that being said, however, the reopening of entertainment facilities has led to a strong recovery in the trust’s AFFO. In the second quarter, AFFO increased 14% YoY to $100.1 million, and the trust’s AFFO rose QoQ in four of the last five quarters.

Adjusted Funds From Operations (EPR Properties)

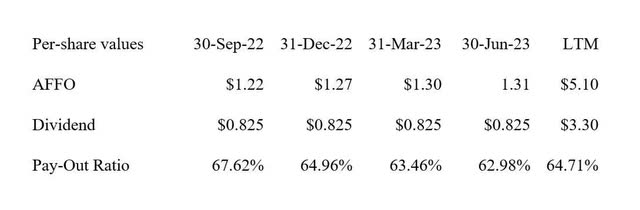

The experiential trust has a low payout ratio, which makes the 7.5% dividend appealing for passive income investors. The trust paid out 65% of its AFFO in the last year, and the payout ratio implies a high margin of safety as well.

EPR Properties suspended its dividend in 2020 (due to the pandemic) and resumed it in the second half of 2021. Since its reinstatement, the trust’s dividend has increased by 10%, but the trust has kept the payout steady at $0.275 per share monthly throughout 2023. Dividend growth, at least at the moment, is not a priority for the trust.

Dividend (Author Created Table Using Trust Information)

AFFO Multiple

In 2022, EPR Properties earned $4.89 per share in AFFO, representing a 50% YoY increase. Given the recent AFFO momentum at EPR, I expect AFFO to be around $5.15 to $5.20 per share in 2023, which implies an AFFO multiple of 8.5x.

EPR Properties traded at 7.3x in April. In a good economy and with no issues with AMC Entertainment, a 10x AFFO multiple is a possibility, in my view.

The Pandemic Has Revealed Vulnerabilities And Other Risks

The Covid-19 pandemic has revealed a significant vulnerability for leisure REITs that residential REITs do not have: The pandemic effectively shut down EPR Properties’ income-generating properties, resulting in AFFO declines and the suspension of the dividend.

People began to avoid entertainment facilities due to concerns about Covid-19 infections, resulting in a slow, multi-year recovery in the trust’s cash flow.

Experiential trusts are also more reliant on consumer spending than other REITs and consumers tend to cut back on discretionary, non-essential spending items quickly during a recession. A recent Bankrate survey put the odds of a recession in 2024 at about 59%.

Furthermore, EPR Properties has a substantial exposure to AMC Entertainment, which is struggling and poses cash flow risks to EPR Properties.

My Conclusion

EPR Properties, I believe, is a well-managed REIT in the specialty niche of experiential properties.

The trust is profiting from a recovery of consumer spending in the entertainment and leisure industries after the pandemic, which led to a robust AFFO recovery, and the dividend is well covered by AFFO.

However, there is one issue that I think is concerning. EPR Properties has outsized exposure to struggling movie theater chain AMC Entertainment, which recently announced its intention to raise more capital to keep its operations afloat.

Though the 7.5% dividend is safe for now (based on AFFO coverage), a bankruptcy of AMC Entertainment would deeply affect the trust’s revenue and cash flow potential.

A potential recession in 2024 would also hurt EPR Properties, probably more than other REITs as discretionary spending tends to disappear quickly during economic contractions. Thus, EPR is a Hold.

Read the full article here