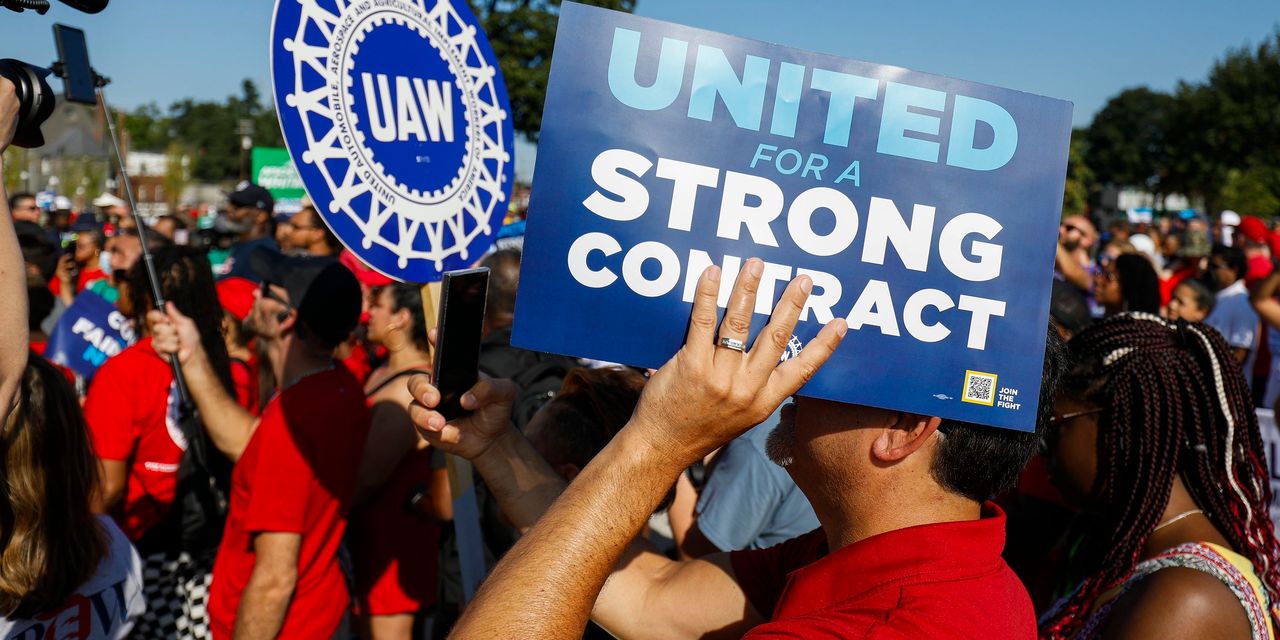

Nearly 13,000 U.S. auto workers went on strike early Friday after the Big Three and the United Auto Workers failed to reach an agreement before their national contract expired just before midnight.

UAW President Shawn Fain called the targeted strike at a Ford Motor

F,

plant in Michigan, a General Motors

GM,

plant in Missouri and a Stellantis NV

STLA,

plant in Ohio. A strike at all three U.S. car makers is a break with tradition, as the union for many years has elected to center strike efforts at one company to protect its strike fund and picket-line firepower. Fain said the union could add more plants to strike as part of its strategy to keep the automakers guessing, and urged all 150,000 UAW members to be ready if and when they’re called to strike.

“This is our generation’s defining moment,” Fain said Thursday night as he addressed UAW workers by webcast two hours before the deadline. “The money is there. The cause is righteous.”

Fain said the union is committed to a contract that reflects the “incredible sacrifices and contributions” that its members have made for years. The union has said wages for auto workers who make the top rate have risen about 6% over the past four years, while the three automakers’ North American profits have increased about 65% during that time.

A Stellantis spokesperson said the company is in contingency mode and sent the following statement: “We are extremely disappointed by the UAW leadership’s refusal to engage in a responsible manner to reach a fair agreement in the best interest of our employees, their families and our customers.”

A GM spokesperson said the company will continue to bargain with the union and that “we are disappointed by the UAW leadership’s actions, despite the unprecedented economic package GM put on the table, including historic wage increases and manufacturing commitments.”

Ford did not immediately comment after the strike began, but said in a statement earlier Thursday night that it was unhappy with the union’s counterproposal: “If implemented, the proposal would more than double Ford’s current UAW-related labor costs.”

GM’s Wentzville, Mo., plant, which the union said has about 3,600 UAW members, builds some of the car maker’s mid-size trucks and full-size vans, including the Chevy Colorado and the GMC Canyon. Ford’s plant in Wayne, Mich., makes Ford Broncos, and about 3,300 members who work in final assembly and paint would be striking. The Stellantis Toledo, Ohio, plant, which has about 5,800 UAW members, makes Jeep Gladiators and Wranglers.

UAW members join workers around the nation and across industries — such as Hollywood writers and actors, hotel staff and healthcare workers — who are on strike or are preparing to walk off their jobs. Fain reiterated to UAW members Thursday night that amid rising economic inequality, he looks at the auto workers’ strike as part of a larger battle between the haves and the have-nots.

Michelle Kaminski, associate professor in the School of HR and Labor Relations at Michigan State University, said in an interview with MarketWatch that “when the union president says this is a generational strike, I really agree with him.”

She added: “When I think about economic conditions, they are more favorable to the union now than [at any point] in the 30 years I’ve been in this field.” She said auto workers have “given up a lot” over the past couple of decades as the companies have needed both government help and worker concessions to survive.

Kaminski also cited the auto makers’ profit and financial position; the pandemic’s effect on the labor force and how workers’ commitments to their jobs have changed; and increasing inflation as factors in why she sees the timing as key. “The union’s window of opportunity is right now,” she said.

But CFRA analyst Garrett Nelson said in an interview with MarketWatch that the union “needs to be careful not to overplay their hand, as the balance sheets of the Detroit three are flush with cash and they can probably wait things out longer than the workers can.”

Automakers could weather a strike, although anything longer than about two weeks is viewed as more impactful and detrimental to the companies. GM has about $39 billion in cash and equivalents, while Ford has around $51 billion, according to a recent Moody’s Investors Service report. Stellantis’s cash and equivalent pile towers over the others, at $69 billion.

The union’s strike fund starts at $825 million, and striking workers will receive $500 a week. Fain said earlier this week that a targeted strike would help the union have flexibility and apply pressure to the companies as negotiations continue; analysts say it means the union wouldn’t deplete its strike fund so quickly.

See: Why United Auto Workers are fighting to end a two-tier system for wages and benefits

The effects of the strike could be far-reaching, both for the companies and workers who may not necessarily be on the picket lines.

Nelson said the union’s strategy of targeting specific plants could turn into a supply-chain “logistical nightmare” for the auto makers. They will have to adjust deliveries of specific parts to their assembly plants, and the average vehicle is made of more than 30,000 parts.

“The automotive supply chain is among the most complex of any industry,” Nelson said. “Not knowing which plants the UAW will target in advance could create a massive level of uncertainty and have a crippling impact on production. If the strike goes on for too long, we think auto suppliers could have to cut production and furlough workers at their plants, creating a ripple effect across the industry.”

Major suppliers’ balance sheets are not as strong, and GM, Ford and Stellantis together generally account for between 25% and 45% of their net sales, so the degradation of the supply chain is a major risk in the event of a prolonged strike.

The U.S. Chamber of Commerce this week warned about the potential widespread impact of a UAW strike. In a letter to President Joe Biden urging him to help the parties reach an agreement, the chamber said the “Detroit Three are critical to our economy.” More than 690,000 supplier jobs are tied to the auto makers, along with about 660,000 dealership jobs, the chamber said.

“A strike will quickly impact large segments of the economy, leading to layoffs and potentially even bankruptcies of U.S. businesses,” the chamber said.

See: Tesla may be the winner of Big Three-UAW labor talks

Also: Would a United Auto Workers strike push up used-car prices?

Read the full article here