Investment action

Based on my current outlook and analysis of Clear Channel Outdoor’s (NYSE:CCO) 2Q23 results, I recommend a hold rating. I believe there is too much uncertainty in analyzing the business’s near-term performance, and I have no confidence in predicting when the macro environment will recover. On top of that, the business is handling a lot of debt and is facing a long-term headwind from online advertising. Hence, until such time as I see a visible path to CCO growth, I will be on the sidelines.

Basic Info

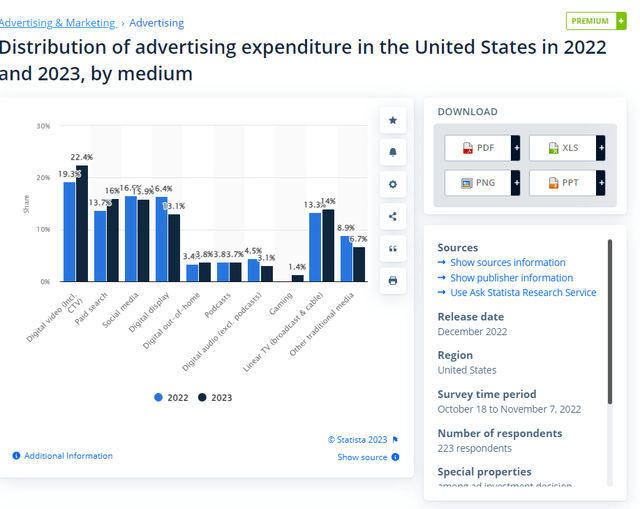

CCO provides out-of-home display advertising such as digital billboards, posters, panels, wallscapes, and mobile advertising services. Clear Channel Outdoor Holdings serves customers in the United States. CCO is a global company with a presence in the United States (55% as of FY22) and abroad (45% as of FY22). The business’ main competitor today is online advertising, where I believe a large portion of advertising dollars are being allocated to digital platforms as they have a better reach than traditional offline advertising. If we look at the data from Statista, using the US as a benchmark, around 50%+ of ads are now done through online mediums, which I believe is a key headwind that CCO is going to continue facing.

Statista

Review

While CCO 2Q23 results were better than peers (OUTFRONT Media (OUT) and Lamar Advertising (LAMR)), I am still holding back on being bullish on the stock given the lack of visibility in the near-term performance, especially with competitors highlighting a slightly weak advertising environment. When looking at CCO numbers first, the company did well in the Americas during 2Q23 and did even better in airports and Europe-North. Despite this, management has provided a cautious outlook for 3Q23, with revenues in the Americas and Europe North expected to fall sequentially at the midpoint. Management has set off a bullish tone by commenting that they are only seeing a pause by advertisers, which means campaigns are delayed but not canceled, and that they expect these campaigns to come back online in 4Q23. My focus is on the weakness in 3Q, which is consistent with what others in the industry are reporting, where cautious buyer behavior is also being observed. Given the macro conditions, I believe there is a high chance of the expected recovery being pushed out to FY24 easily.

Just as I mentioned, customers are — they just have a little hesitancy right now. And on the last call, it was — it seemed to us that it was relegated to a national and it’s become clear to us that a little of that softening is spread to the local level as well. LAMR 2Q23 earnings call

Based on our visibility as of today, we estimate the Q3 total revenues will grow slightly with billboard continuing to grow in low single digits and transit likely to decline. OUT 2Q23 earnings call

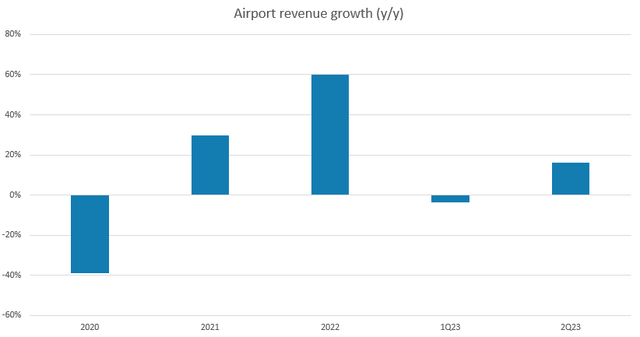

While the recent success of Airport segment may give some investors reason to be optimistic, I believe that the segment will soon face headwinds from rent abatements. Notably, the segment margin has already dropped from over 20% to the high teens. Additional supply from Newark, LaGuardia, and JFK have been major contributors to the expansion thus far. Given that CCO is unlikely to once again benefit from incremental inventory support, I expect them to face a challenging comp over the next few quarters. I do not disagree that consumer travel trends will continue to stay strong as flight capacity continues to increase and the world brings in more flight routes over time, boosting both incoming and outgoing airline passenger foot traffic. This will definitely help with incremental advertising demand. However, I don’t think the recovery will be so fast in the near term that it will sustain the current airport segment growth. Putting things into perspective, the airport segment grew 60% in FY22, which makes the 2Q23 16% growth a really strong one. Comparing to the Americas segment, the segment only grew 9% in FY22 and was flattish for 1Q and 2Q23. Given the similar nature of business, both segments growth rates should not continue to see such a big difference. Hence, I expect airport revenue to report weak y/y growth due to the tough comp, which will be bad from a headline perspective.

CCO

Overall, I think it’s extremely difficult to predict when things will bottom out in the near future. Also, CCO’s management lowered their forward guidance because of decreased visibility and vertical-specific softness in the national advertising market (which accounts for roughly a third of CCO’s Americas segment). My money is on businesses continuing to wait to launch advertising campaigns until they see a clear path to an economic recovery, given the current macro environment. This might happen in 3Q or 4Q23, or even in 1H24, but timing this is not a forte of mine as it is a macro event. So, I’m going to sit this CCO out.

The sales of Switzerland and Italy have been finalized, and the sale of Spain is expected to take place in 2024. CCO is selling its France operations and hopes to finalize the deal by the end of the fourth quarter of this year, or 4Q23. This is important as CCO is a business with a lot of debt on its balance sheet. As of 2Q23, the business had $5.6 billion in debt (ex-operating leases) and $232 million in cash, summing up to a net debt of around $5.3 billion. This is a massive multiple, around 10x FY23 EBITDA. Asset sales in Europe and the South strike me as a way to bring in much-needed cash to keep the company afloat. The positive environment for European assets is further signaled by the sale of Europe-South assets. Assets in Northern Europe have performed better than those in Southern Europe, so they are more likely to be purchased (thereby increasing liquidity and lowering the debt level).

Risk and final thoughts

There are two major risks I see in CCO. Firstly, CCO’s balance sheet is of horribly poor quality, running at high debt levels. This puts pressure on the stock’s valuation and the business’s ability to invest and also stay profitable (high interest, especially in the current rate environment). Secondly, the business is constantly facing the threat of online advertising occupying a larger portion of the total advertising market. While out-of-home advertising will not go away, the pie will get smaller, which means the growth runway is a lot shorter.

On the flipside, the upside risk could be CCO selling off its European assets faster than expected, at an appealing valuation. With that influx of cash, CCO could pay off a huge amount of debt, thereby easing the pressure on the business (on valuation and on interest payment).

Overall, CCO is a hold. Despite relatively better 2Q23 results compared to peers, uncertainties loom large in the near-term outlook, with a cautious 3Q23 forecast aligned with industry trends. The airport segment, while impressive recently, faces potential headwinds from rent abatements and tough year-over-year comparisons. The recovery timeline remains unclear in the current macroeconomic climate, making it difficult to time a favorable entry. CCO’s heavy debt load, at nearly 10x FY23 EBITDA, is a significant concern, prompting asset sales in Europe to bolster liquidity. Furthermore, the persistent rise of online advertising threatens CCO’s long-term growth potential. Given these challenges and my inability to pinpoint a clear path to recovery, I recommend a cautious “hold” rating on CCO. Investors should monitor developments closely and await more favorable conditions before considering an investment.

Read the full article here