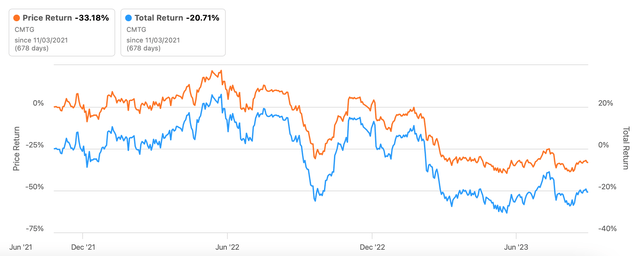

Since going public in 2021, the mortgage real estate investment trust [REIT] Claros Mortgage Trust (NYSE:CMTG) has done quite poorly in the stock markets with its price down by 34% from its opening price on listing.

With a slew of banks slashing their rating on the trust, investor confidence in it is at a low. Yet, there’s something to be said for its forward dividend yield, which is at a huge 13.2%. Its past yield hasn’t been enough to make it a worthwhile investment, though, as total returns have declined by 20.7% since listing. But it has significantly softened the blow (see chart below).

Here, the goal is then to figure out whether there’s any likelihood of the CMTG’s returns becoming positive due to price, dividends or both.

Source: Seeking Alpha

The company

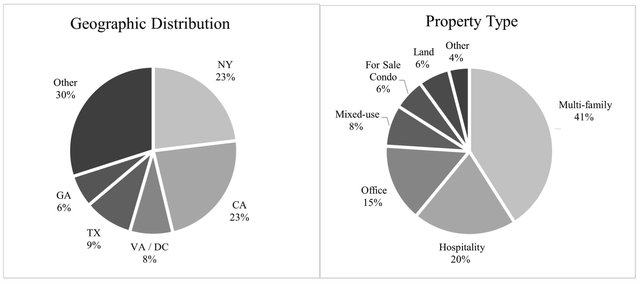

First, a quick look at the company. CMTG provides loans for commercial real estate across the US, with New York and California as its biggest markets (see chart below). Its biggest customers are multi-family, followed by hospitality and offices.

Source: CMTG

On its own, the company isn’t small, with a market capitalisation of USD 1.55 billion. But, it is tiny as far as the world of REITs goes. The biggest REIT, Prologis (PLD) has a market capitalisation [Mcap] of USD 113.8 billion is over 73x that for CMTG. Even the tenth biggest, AvalonBay Communities (AVB) is way bigger, with an MCap of USD 25.5 billion.

While different REITs can vary in terms of focus segments, it does reflect both the market potential for the company as well as what it’s up against. The picture gets clearer when we consider the revenues. Prologis had a revenue of USD 6.3 billion in 2022 and AvalonBay Communities was at USD 2.61 billion. By comparison, CMTG’s revenues were USD 287.2 million during the year.

The state of commercial real estate

The potential is further confirmed by the size of the US commercial property market at USD 1 trillion. The market is also expected to see a compounded annual growth rate [CAGR] of over 3.5% between 2023 and 2028.

Rising interest rates

However, it’s not without its challenges. The macroeconomic scenario, in particular, is bringing up issues that can affect REITS like CMTG. High interest rates are one of them, which can lower borrowing levels as well as increase the levels of delinquencies.

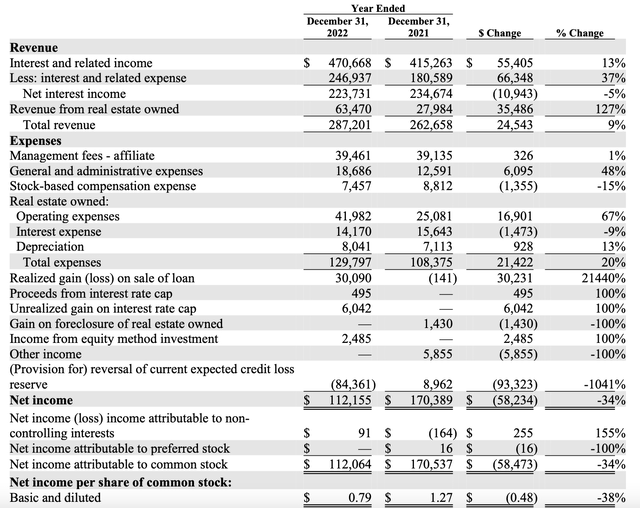

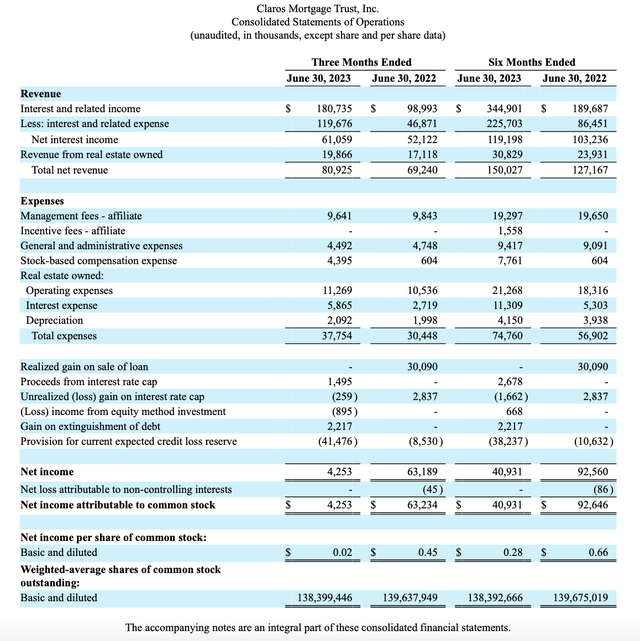

While higher interest rates can be good for a lender’s net interest income [NII], stabilising the possible loss of revenues from lower borrowings, this isn’t always the case. This is evident from CMTG’s full-year 2022 figures, when its interest expenses’ increase exceeded that for interest income, resulting in a decline in net interest income by USD 10.9 million (see table below). The situation has since reversed, which I will talk about in greater detail in the next section.

Income Statement, figures in ‘000s except per share data (Source: CMTG)

Structural changes

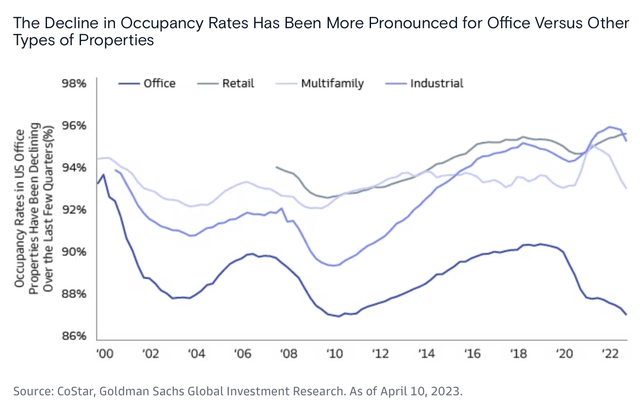

Further, a recent Goldman Sachs study points out that the office sector in particular faces headwinds. It’s the third biggest exposure for CMTG, with a 15% share in its portfolio. Besides the current macroeconomic scenario, the trend and preference for working from home is causing structural shifts in the sector that are still playing out, and not to its advantage.

It needs to be noted, that in general, occupancy rates have been declining across most real estate categories but most sharply for offices (see chart below). That’s something to watch out for going forward.

Source: Goldman Sachs

The financials

The company’s financials for the first half of 2023 (H1 2023) are a mixed bag. Based on the discussion above, here I focus on two aspects: (i) its NII and (ii) the impact of riskier lending conditions.

Net Interest Income

Reversing the trend from 2022, in H1 2023, the company’s NII increased by 15.5% year-on-year (YoY). Interest income grew by a huge 81.8%, which more than made up for an even bigger 161% rise in interest expense. The rise in NII supported total net revenue growth, which came in even higher at 18% on account of a 28.8% rise in revenues from owned real estate.

Source: CMTG

Provisions and charge offs

However, its net income still declined by 55.8% during this time, which looks glaring. But the situation isn’t as bad as it seems. Last year, the number was bumped up by gains on the sale of a loan. However, there are two points to be noted here:

- Net income would have been down by 34.5% even if CMTG didn’t have gains from sales in H1 2022. And this is because of a higher provision for credit losses, which ties in with the point on higher potential delinquencies in a high interest rate and weak economy scenario made in the last section.

- Further, on a non-GAAP basis, also called “Distributable Earnings”, it actually reported a loss in H1 2023. The loss is due to a principal charge-off, which means that the loan has been written off as a loss, that is excluded from GAAP estimates.

The number isn’t small either, at almost USD 67 million, which is over half the size of CMTG’s H1 2023 revenues. This is not a good sign, especially not when seen in conjunction with the increased provision for losses.

Assessing the stock’s merits

CMTG’s forward non-GAAP price-to-earnings (P/E) ratio at 7.6x is still a positive figure though, reflecting analysts’ optimism about its distributable earnings in H2 2023. Further, it’s actually lower than 9x for the financials sector, indicating a 19% upside to the stock and the price potential of USD 13.3.

Alternative valuations

However, it being a REIT, alternative valuations need to be considered. Its tangible book value per share is even higher at USD 17.2, which alone indicates over 50% upside to the stock.

I also calculated its price-to-funds from operation [FFO] ratio, which comes in at 22.6x. This is higher than that for Prologis and 20.1 and even for AvalonBay Communities at 17.4x. This makes the stock, which is both smaller and doesn’t have a history of sustained revenue and income growth over time less attractive. It doesn’t help that its financials have been shrinking on average over the past three years.

High dividend payout ratio

Further, its TTM dividend payout ratio of 346% is clearly unsustainable. Even if we factor in the impact of a riskier lending environment, the fact remains that even in 2021, the company’s ratio at 120% was uncomfortably high.

What next?

While there could be an upside to CMTG, the fact is that the risks right now just can’t be overlooked. The overall macroeconomic scenario might support interest income, but the challenges it comes with are far bigger than the actual or potential gains. With the risk of an economic slowdown in the US still persisting, real estate is likely to be impacted as a cyclical sector. The company has already increased provisions for losses.

Its dividend payout ratio also looks unsustainable, putting a question mark on its high forward yield. This, in turn, puts a dent on possible future returns from an investment in the stock. Still, as the current tight credit cycle eases there could be more predictability to CMTG in a massive market, which is expected to grow.

To cut a long story short, the company isn’t bad, but it’s in a sector that’s facing challenges right now and this is showing up to some extent in its numbers. I’m going with a Hold on the stock.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here