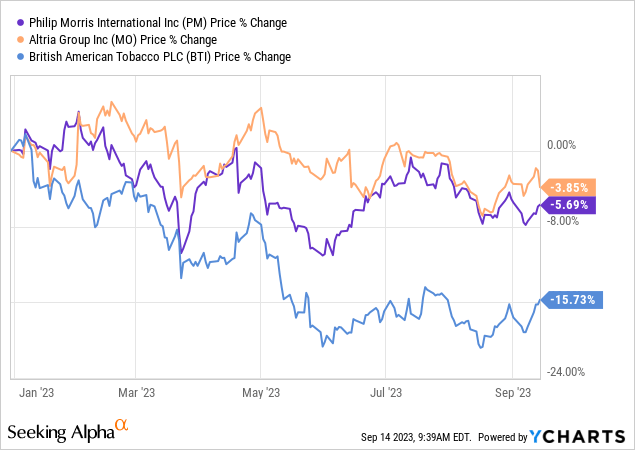

Income investors often jump at the opportunity to buy tobacco companies for their attractive dividend yields, but in the case of Philip Morris International (NYSE:PM), I believe investors are overpaying for the privilege of securing a 5.5% dividend yield. Although Philip Morris just raised its dividend by 2.4% to an annualized rate of $5.20 per-share and the tobacco firm has considerable momentum in its alternative products IQOS category, I believe the risk profile is not attractive for dividend investors. Relative to Altria Group (MO) or British American Tobacco (BTI), Philip Morris is an inferior yield choice and too expensive based on forward earnings!

Philip Morris continues to see considerable momentum in the alternative products/IQOS category

Tobacco companies including Philip Morris have invested heavily into the establishment and growth of alternative product portfolios… to generate new revenue streams and provide an offset to secular declines in the share of smokers in the traditional tobacco segment.

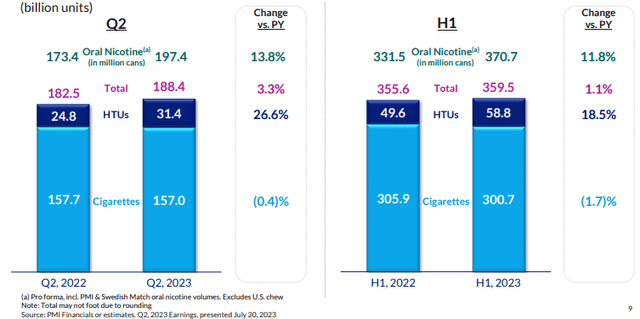

One category that is growing exceptionally strongly is Philip Morris’ IQOS brand which includes heated tobacco and electronic cigarette products. These products heat tobacco instead of burn it and the company is seeing strong demand for this product, especially from younger consumers. Philip Morris uses the abbreviation HTU, which stands for heated tobacco units, to measure its sales success with consumers, and the firm’s HTU sales have been soaring as smokers shift away from traditional tobacco products and endorse a more smoke-free future.

IQOS benefits from strong customer uptake and it is by far the fastest-growing product category in terms of volume growth in Philip Morris’ portfolio. IQOS products generated 26.6% year-over-year volume growth in the second-quarter… which was almost twice the rate as the company’s second-best performing business: oral nicotine products. This growth happens at a time when the traditional tobacco market is shrinking and shipment volumes are contracting.

Source: Philip Morris

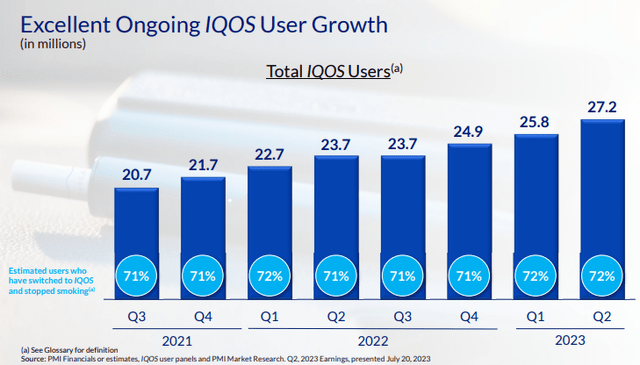

Philip Morris’ strong increase in IQOS shipment volume growth is driven by an expansion in the firm’s customer base: the number of IQOS users has soared 15% year over year in the second-quarter to 27.2M and the tobacco firm saw its third consecutive quarter of sequential growth in its IQOS user base. While Philip Morris is to be applauded for its growth in the alternative products category, this does not translate into a strong dividend value proposition for shareholders, in my opinion.

Source: Philip Morris

Inferior value proposition: dividend raise and payout ratio

Philip Morris raised its dividend 2.4% to a new annualized dividend payout of $5.20 per-share on Wednesday, which implies a new forward dividend yield of 5.5%. Altria Group recently raised its dividend by 4.3% to a new annualized dividend payout of $3.92 per-share. Altria Group’s new dividend rate implies a forward dividend yield of 8.9%. In other words, Altria is growing its dividend 79% faster than Philip Morris and offers dividend investors a 62% higher yield.

Philip Morris expects $6.13 to $6.22 in adjusted diluted EPS for FY 2023 which implies a dividend payout ratio of 84%. Altria, on the other hand, has guided for FY 2023 adjusted diluted EPS in a range of $4.89 to $5.03 which implies a projected dividend pay-out ratio of 79%. As a result, from a payout perspective, Altria’s dividend appears to me marginally safer.

Philip Morris’ 5.5% yield is too expensive

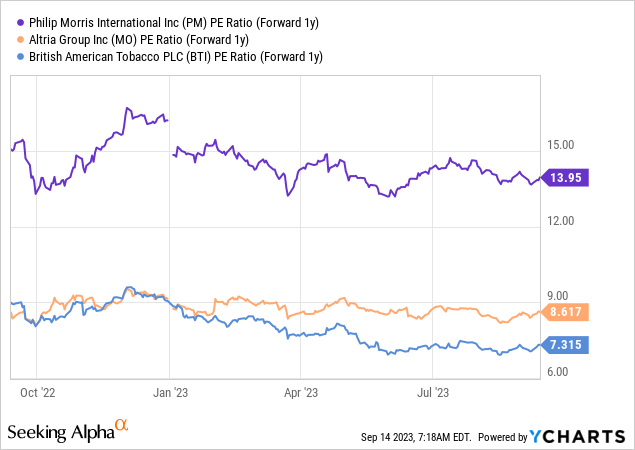

While I like Philip Morris’ commitment to raising its dividend, the company’s yield appears relatively expensive relative to its rivals. Philip Morris’ forward dividend yield is currently 5.5% (following the 2.4% dividend increase announced on Wednesday) and the tobacco firm is valued at a comparatively high P/E ratio of 14.0X. Analysts expect Philip Morris to earn $6.83 per-share in FY 2024, implying 9% year-over-year growth. Altria, on the other hand, is trading at a materially lower P/E ratio, 8.6X, in part because investors have been turned off by the company writing off its investment in e-cigarette maker JUUL Labs following regulatory headwinds.

I currently rate Altria a hold considering that the tobacco firm might see litigation regarding its e-vapor business: Altria: Dividend Raise, 9% Yield, But Risks Are Growing (Rating Downgrade). However, I consider Altria’s dividend to be cheaper and safer than Philip Morris’ at this point. British American Tobacco offers dividend investors the best value, in my opinion, with a P/E ratio of 7.3X. I continue to rate BTI as a strong buy.

Risks with Philip Morris

Philip Morris is a tobacco company and therefore constantly embroiled in litigation and lawsuits that could negatively affect its earnings potential in the short and the long term. A slowdown in growth in the non-traditional tobacco category (IQOS) would likely have an outsized impact on the company’s valuation, in my opinion, and it would likely change my opinion on the tobacco company.

Final thoughts

Altria is growing its dividend faster than Philip Morris, has a significantly higher yield and a lower projected forward dividend payout ratio which, theoretically, should make Altria’s dividend a bit less risky than Philip Morris’. At the same time, Altria’s shares are significantly cheaper than Philip Morris’, on an earnings basis, which also suggests that income investors are getting a better deal with Altria than with Philip Morris.

Philip Morris does see considerable momentum in its volume shipments, especially with regard to its IQOS and oral nicotine products, but this growth has not translated to a stronger dividend value proposition, in my opinion. Given that Philip Morris offers a much lower dividend yield to investors which costs them significantly more in terms of P/E, I would only rate the tobacco company a hold at this point!

Read the full article here