Above: CEO Zaslav, an innovator and a fearless cost cutter might just be what WBD has that all entries in the sector need.

- On metrics alone, all streamers look alike for better or worse: Too much debt, no solutions that appear to show the pathway ahead to profits.

- WBD looks to us like a better bet based on management track record.

- At ~$11 a share, warts and all, it’s a buy.

“Money is only a tool. It will take you wherever you wish but will not replace you as the driver…” Ayn Rand.

There is a buffet of well thought out as well as sketchy platters on Seeking Alpha on the shares of Warner Bros. Discovery, Inc. (NASDAQ:WBD). They range from strong rationales to buy, sell or hold for a dazzling variety of reasons, some of which enter the world of accounting alchemy. There is one thesis that WBD is sitting on a gold mine of uncollected receivables, which if harvested, could bring billions to the cash line at no cost per se to put toward debt reduction. It’s a thought, among many we sift through both here on Seeking Alpha and in many other financial sites. Flawed, yes, but worth sharing without question.

Bearish takes on WBD stress, for better or worse, the futility of their effort to shovel you know what against the tide. Their conclusion, WBD is doing a decent job of disguising its reality as a dog with fleas. It has far too much sunk cost in maintaining its massive position in cable/linear TV. Add streaming woes to linear cord cutting and conclude: Stay clear of the stock.

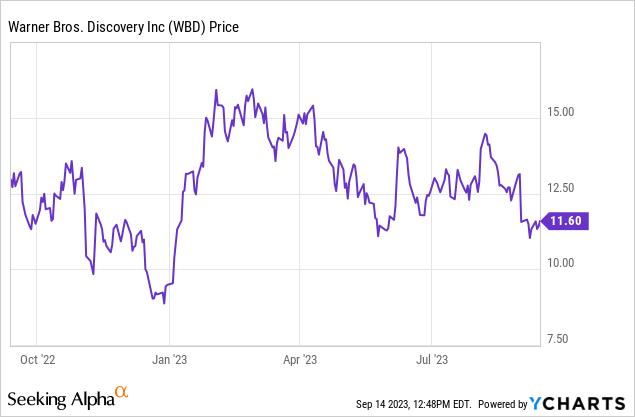

Above: If you factor in sound management execution–it’s a buy, otherwise it looks a lot like competitors in many respects.

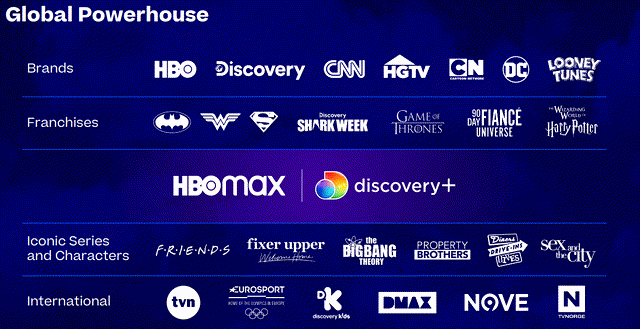

Still others cite the resiliency over time of a mass of WBD IP ahead with great odds of accelerating revenue for its streaming verticals. Scanning over a listing of WBD assets, even for skeptics, can strike more than an optimistic outlook once the company carves down its debt to the extent that Mr. Market decides to begin to make the stock interesting. But in assessing all this opinion, can investors come to a takeaway point where a definitive pathway emerges as to whether at its current price, WBD is a buy, sell, hold or pure fuggedaboutit?

Google

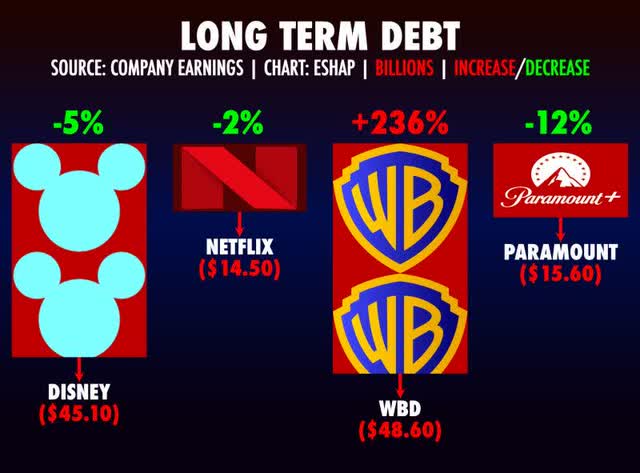

Above: Lots of red for the entire sector but it’s being chopped away steadily, perhaps needing a bit of a harder push, but headed down.

Walt Disney (DIS) and WBD sit on approximately the same excessive debt load: WBD: $47.29b (Repaid in $1.5b in 2022).

DIS: $44.5 (2020 saw debt rise 38.7% to $52.9b but pay downs since have totaled $8.4b).

Neither of these two debt numbers are very pretty. On the cash side, WBD has S $3.1b and DIS has $11.4b. But turn back the clock to the COVID horror show year of 2020, here’s how the cash boxes looked:

DIS: $23b.

WBD: $3.1b.

So DIS, a considerably larger revenue producer than WBD, is sitting on approximately the same amount of long-term debt. The debt loads and the costs of carrying them looms as one of the key factors both stocks are going nowhere per se. We have to look elsewhere to find a rationale for buying into either at this point, or for that matter, any of their key peers like Paramount Global (PARA), Netflix (NFLX) Lions Gate (LGF.A). We don’t include Amazon or Apple for the obvious reasons that streaming TV for both is essentially a petty cash drawer business.

Google

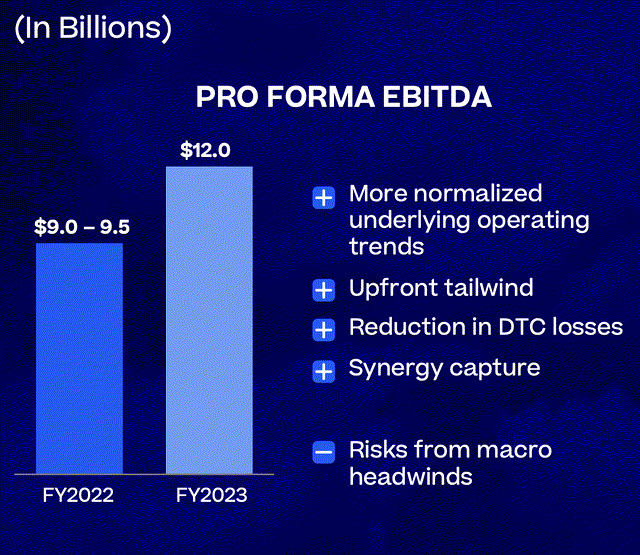

Above: Buy it or not, but the execution or not will tell the tale. We think a bet on management delivering makes good sense at $11 a share now.

Clearly, part of the decision process is to look at the entire sector here – beyond WBD and compare a move on its stock against peers. If you deep dive them all as I did, it’s hard to see how you can pluck out a stand out free of recency bias or religious belief in the golden pasts of many of these operators.

In the lemmings to the sea era when they all threw multi-billions in content at what they thought was a bottomless pit of gold in COVID-era streaming, there has been residual faith expressed. In short, these guys did it before and they can do it again. And that’s where I began to part ways with much of the masses of metrics, charts and lengthy treatises emanating like papal bulls, some from the likes of major banking analysts.

My conclusion, right or wrong was this: Which of the managements currently at the helm of the sector leaders appears to have the best handle on what’s real and what’s not? Which among them appears to be moving in a direction most likely to end up as one of the big winners. Other than the two biggies of NFLX and DIS, share prices are tempting.

Is there a four bagger hiding somewhere in the sector?

Constructing a management competence investor thesis

The single most penetrating (to me) insight drawn from thorough dives into the chaotic media/entertainment sector is this: Which group has the smartest, most resilient, most proven experience dealing with both order and chaos? My reasoning is this: the financials of one, do not present a dramatically more compelling rationale than its peers to justify opening a position on a standout vs. the field. All may have varying recipes for recovery, but as the old saw goes: everybody cooks with water. What dogs one streamer, dogs all streamers. The solution that eludes one operator, eludes them all up to this point. The nostrums dispensed by managements to date on earnings calls, give little comfort.

There is a tribal element at work here. Each key entry in the space appears to have a following that is not entirely based on measuring the competitive metrics of security analysis. Some investors have abiding faith in the depth and long-term value of a company’s IP and hold on for emotional reasons.

WBD archives

Above: All of the above may well not survive an ultimate axe or sale but the sheer mass of IP if well managed can make the difference long term.

This is the Disney tribe. They appear to buy into the premise that the massive, IP across so many genres will in the end prove ageless. Kids will always be kids, adults will always want to entertain their kids, movie goers of new generations will find the charm and delights of dated IP evergreen. This will accelerate recovery in revenue, build streaming subs, etc. Our view: Wrong. DIS IP could be overvalued because it is proving less and less resonant as its constant repurposing continues.

WBD has just proved its chops in movies with the mega blockbuster Barbie, the first we believe, of an expanding new universe of event-driven IP drawn from the Mattel world of toys and games. Colleagues close to the company tell me this: A given toy or game that has shown sustaining power among kids of sequential generations as has the Mattel stable is equal to IP fodder which may emerge whole from movies or TV shows.

Yet it remains clear that all the streamers have become to a greater or lesser extent, unwieldy contraptions of delivery systems of entertainment which do not as yet square with the emerging viewing habits of new generations. Until someone figures it all out, you have to put your ultimate faith in management and its ability to execute.

The only trenchant differentiation I see, right or wrong as noted, is in the management skill sets of the people who are running these companies now. Both by their past track records and their current responses to the streaming chaos and its collateral damage, which company appears to have their hands grasped around an approach investors can most deposit their confidence at this point?

We like the WBD team of Zaslav and Malone

I stipulate that many investors may well see the management differential piece of a recovery ramp for streamers as something of a reductio ad absurdum. But many of the arguments I’ve seen here on SA and other places utilizing well thought out applications of metrics wind up in the same place: Every management appears to be hawking the same storylines to investors: We’re cutting the costs of production, we’re laying off thousands, we’re raising prices on streaming, we’re going two tier on subscription pricing. We have great IP, we’ve got greater IP to come, we’re carving down our debt as fast as it seems financially responsible.

That said we come to the final decision: Whose skill sets bring the best chance for execution of a smart, financially viable, shareholder friendly recovery to long-term profitability and appreciation? The answer as always, is pick them. All the management of all media giants have their fans and haters – that’s a given. We reviewed the track records and execution results of many entirely from my viewpoint as an ex-member of c-suite managements of billion dollar corporations over time.

The basic lessons were these: All executive suites have top people who are: a) the real deal; b) political animals first, workers second; c) placeholders awaiting bonuses, options or contract buyouts; and d) Hale-fellow-well-met golfing or tennis buddies of the top guy or guys. These are the empty suits, Uncle Carl Icahn always rails about. And they populate boardrooms and c-suites in numbers that could scare shareholders be it known.

All this taken into account, I concluded that the blend of two people (as I have noted before on SA) seem to me to present investors with the best odds for a strong outcome after the race to survive is over. They are David Zaslav CEO of WBD and key holder John Malone. I think their blend of experience and skills, their mixture of tech brilliance (Malone) and deal making, know-how, understanding of value, and in the case of Zaslav, personal people skills far better than most, bring home a good bet on a stack now selling for ~$11. WBD shares traded at $24 when Zaslav was named CEO in the Spring of 2022).

David Zaslav is the penultimate communicator, a person who believes in constant building of personal relationships in an atmosphere rife with gigantic egotists, back-biter frauds, and agents promising him floods of magical success. But, Zaslav was a big time gambler in cable TV, working from the ground rooting instincts as to what most appealed to viewers. This brought him great success as head of Discovery.

Visionary leaders less often than not do not grasp bottom line issues very well over time. Zaslav, for all his gut instinct right guesses on content, proved himself a tough cost taskmaster. In time he has never shrunk from slashing costs mercilessly—earning him the enmity of many in the creative community he so assiduously had courted. But in time it paid off. Part of the reason was his experience as part of the team that created CNBC and the sensitivity to the financial and investment communities.

John Malone

A book published in 2022 titled: Eight Unconventional CEOs and their Radical Blueprint for Success by William Thorndike, cited Malone as one of his subjects. It tells the story of how he built TCI, his cable empire eventually sold to AT&T (T) for $50b.

Thorndike cited Malone as a CEO who was a leader who possessed the indispensable skill at the single most important job “capital allocation.” Quoting the book:

“Over a long period of time, CEOs have to do two things well: They have to manage the business to optimize the profits and after that deploy the profits. Most of what separated these guys (the 8) from their peers is in that second activity which has the unwieldy name of capital allocation.”

If you look over the very long career of Malone, you will see what I saw: this guy is a consummate allocator of capital in almost all the deals he’s ever made. We don’t know the degree of everyday contact and planning chatter that goes on between the two most important brains at WBD. We can only assume that the blend of their skill sets and experience brings into the calculation of value of the shares at the current trading range an asset that does not find its way on a balance sheet.

It comes down to a blend of making smart moves and avoiding dumb ones. On that basis, I believe Warner Bros. Discovery, Inc. shares offer investors a leadership that won’t stub a toe badly. They seem to be strongly on the job of finding a path to rebuilding a fortress company among the A list of media and entertainment. It won’t be easy or overnight, but from what I have seen thus far: a slow but steady focus on consolidation and trimming should meet the test of investor conviction.

Read the full article here