Singular Research

Special Situations Report: A Compelling Investment Opportunity Emerges

Modine Manufacturing Company (NYSE:MOD) has reported robust Q1 FY:24 financial results. The Company achieved revenue totaling $622.4 million, which represents 15% growth YoY, along with a non-GAAP EBITDA of $80.4 million, showcasing a notable year-over-year growth of 91%. This impressive performance is primarily attributed to Modine’s strategic expansion into burgeoning sectors, including electric vehicles (EVs), data centers, and indoor air quality solutions.

As Modine’s transformation gains increased visibility within the market, it presents a promising opportunity for potential investors. Considering these factors, Modine emerges as an enticing investment prospect, leading us to uphold our BUY rating.

Investment Thesis

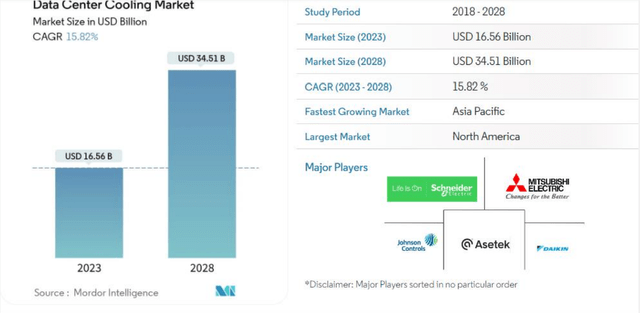

The surging demand for data centers, driven by the rapid expansion of generative AI technologies, presents a significant opportunity for Modine’s data center cooling solutions. These centers are crucial for handling large data volumes, especially for AI and machine learning applications.

In this evolving landscape, several key points come to the forefront. First, the surge in data center demand is predominantly propelled by AI, although its influence extends beyond to encompass digital entertainment, online services, healthcare, and finance, all contributing to the escalating need for robust data infrastructure. Second, the increasing complexity of AI applications, including cutting-edge generative AI, necessitates highly specialized data centers equipped with tailored hardware and software solutions. Third, the advent of AI is fostering efficiency and innovation within data centers, with innovations such as robotic monitoring and energy optimization reshaping operational paradigms. Lastly, the global data center industry, particularly in emerging markets, is experiencing rapid growth, buoyed by a substantial portion of the projected $1 trillion tech investment in AI over the next five years, further fortifying data center infrastructure.

As AI usage rises, data centers generate more heat. Specialized AI chips emit significant heat, requiring innovative cooling systems. AI-oriented servers demand enhanced cooling and power usage. Modine excels in providing sustainable, energy-efficient cooling systems tailored for AI applications. Their product range includes precision air conditioning, hybrid fan coils, chillers, and advanced control solutions.

With the data center sector set to expand, especially in AI-centric regions like North America, Modine is strategically positioned to meet the cooling challenges of generative AI. Their alignment with the growing market for digital infrastructure and AI-driven demand makes them an attractive choice for investors in the data center cooling solutions sector.

Mordor Intelligence

Modine’s EV Systems business is poised to be another key driver of the Company’s near-term growth. Despite some supply chain constraints causing delays in certain launches, there is strong demand for their EV offerings. With 25 program wins, including two for their fuel cell product, Modine has secured awarded revenue at peak annual production exceeding $150 million. The Company anticipates a significant ramp-up in this business, projecting a compound growth rate of 40% to 50%. This robust growth trajectory positions Modine well to capitalize on the expanding EV market and underscores its potential for near-term growth in this segment, building upon the foundation of approximately $50 million in revenue generated in FY:23.

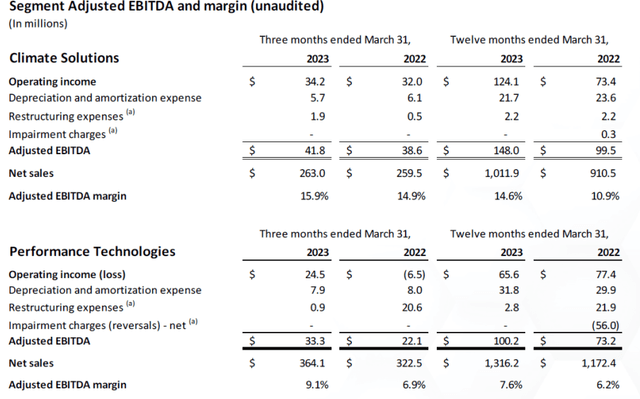

Modine’s recent financial performance has been strong, reflecting revenue growth and margin expansion. The Company’s ability to generate healthy cash flow and invest strategically in research and development bolsters our confidence in its long-term prospects. We believe there is still significant margin improvement potential based on the statements of management and the ongoing transformation efforts. The progress update provided by management indicates that they have made substantial headway in the Climate Solutions segment, demonstrating that the transformation process is delivering positive results.

Furthermore, with the transformation in the Performance Technologies segment still in its early stages, there is room for further improvements as this segment evolves. Management’s strategic organization, market selection, and clear objectives position the Company for continued margin enhancements. Given that the Climate Solutions segment is on track with its financial targets, and with the Performance Technologies segment is poised for transformation, we anticipate that Modine will continue to realize margin improvements in the foreseeable future.

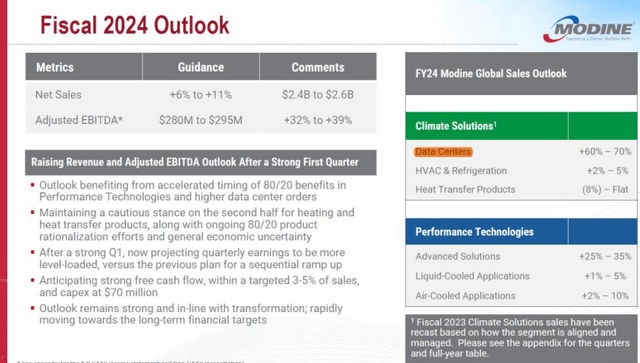

Modine Investor Presentation

Catalyst

Modine’s persistent upward trajectory in earnings, underpinned by its strategic emphasis on lucrative sectors such as electric vehicles and data centers, holds the potential to serve as a significant driver for stock value appreciation. Favorable quarterly earnings results that outperform analyst projections have the capacity to instill confidence among investors. Furthermore, heightened analyst coverage and favorable upgrades have the capacity to enhance investor sentiment and draw fresh investments into the stock, further bolstering its growth prospects.

Q1:24 Highlights

- Modine had an exciting quarter with a record 15% top-line growth and 91% increase in adjusted EBITDA compared to the previous year.

- The Company acquired Napps Technology and the Jetson brand, adding a chiller range to their indoor air quality business, targeting schools.

- The Climate Solutions segment achieved 11% revenue growth and an 18.3% adjusted EBITDA margin, with data centers leading revenue and margin growth.

- Data center sales doubled YoY, and the outlook for data center revenue growth this year is raised to 60%- 70%, reflecting higher-than-expected orders.

- The Company is exploring next-generation technology for data centers, including cooling technologies for high-performance computing and AI applications.

- Despite weak market conditions, heating sales were down nearly 40%, but margins improved due to operational improvements.

- Performance Technologies segment saw 18% revenue growth and an 11.2% adjusted EBITDA margin, doubling from the prior year.

- Focus on improving commercial terms and long-term contracts helped recapture margin loss due to inflation.

- Simplification and improvement efforts led to eliminating non-strategic product lines and negotiating favorable exits.

- Focus on growth opportunities in businesses like genset (expected 30% CAGR) and EV Systems (projected revenue over $150 million).

- Emphasis on the 80/20 strategy for the Performance Technologies segment, with investments in growth drivers and addressing low-margin businesses.

Modine Investor Presentation

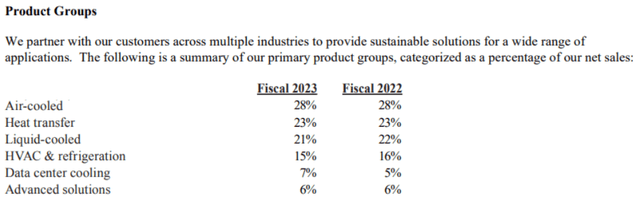

For the size of each business line relative to net sales, see below.

Modine Company Filings

Risk to Our Thesis

- Limited Growth in HVAC&R Submarkets: Heat transfer segment faces challenges in certain HVAC&R submarkets, requiring strategic navigation for sustained growth.

- Heat Pump Adoption: Adoption of heat pump technology in Europe is an opportunity, but Modine must adapt its products and strategies to align with changing regulations.

- Transformation Execution Risk: The ongoing transformation poses execution risks.

- Data Center Market Shift: A shift towards liquid cooling versus chillers in data centers could lead to potential market share loss.

- Lack of Brand Recognition: Modine lacks brand equity and recognition in key growth markets like data center cooling, which may impact its market positioning.

Valuation

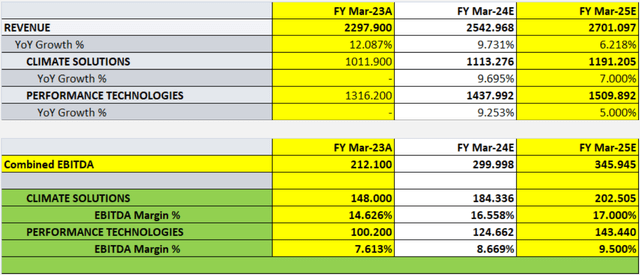

We employed two distinct valuation methods to assess the Company’s value. First, we utilized the Sum Of The Parts (SOTP) approach, and second, we implemented a Discounted Cash Flow (DCF) model. Our choice to use the SOTP method stemmed from the significant disparity in earnings multiples observed between MOD’s building equipment and auto parts divisions.

For the SOTP valuation, we assigned an Enterprise Value (EV) to MOD’s Climate Solutions business, leveraging valuation metrics consistent with those used in the building equipment sector. Simultaneously, we evaluated Performance Technologies using metrics typically applied to auto parts companies. Subsequently, we applied the DCF approach to establish assumptions for segments aligning with the low to mid-point of guidance until FY:28.

To derive our target price, we relied on the Discounted Cash Flow model, which accounted for 50% of our target valuation. This model projected distributable cash flow for the next five years and assumed a terminal growth rate of 5% beyond 2029. In determining the valuation, we considered a cost of equity of approximately 13%. Applying this methodology, our DCF model generated a value of $57 per share.

Concurrently, our Sum of the Parts (SOTP) valuation yielded a value of $56 per share. To arrive at our ultimate target price, we combined these two values using a weighted average calculation. Consequently, we arrived at a weighted average price target of $56 per share.

Modine Company Filings and Singular Research

Read the full article here