I started writing about the most popular index and related ETFs – S&P 500 (SPX) (SP500) (NYSEARCA:SPY) – in late October 2022. Initially, it was a comparison with the better-quality diversified, and more stable [in my view] Cambria Shareholder Yield ETF (SYLD). Still, then I started looking at SPY as a separate investment product and chose a neutral position in late January 2023, taking into account the accumulating macroeconomic conditions at that time that suggested difficulties for the market’s prospect growth. I finally turned bearish in late March, and since then I have continued to believe that the SPY rally of recent months is nothing more than a bear market rally – the U.S. economy, strong to date, runs counter to what Powell’s Fed is trying to achieve, and the emerging collapse of non-systemic banks is driving the market to unrealistic expectations, the highly likely revision of which is set to trigger a cascade of selling, or at least limit the growth of the index. In today’s article, I will try to explain in more detail why I think so and what may provoke these revisions in the foreseeable future. Let us dive in.

The Implications Of Jerome Powell’s Press Conference on May 3, 2023

I know I am a little late to the party here, but I want to think logically about what Jerome Powell’s last public appearance a few days ago meant for the market. Speaking with various professional market participants and also having access to several sources, I got the impression that the market has misinterpreted the employment and unemployment numbers released since that conference. But let me start in order.

Here is how one of the traders describes what happened at the press conference in terms of a dialog between Powell and the journalists. Jerome Powell tried to convince us that everything would be fine, but he couldn’t say when exactly. When asked what Fed’s plans were, Powell replied that they were waiting for inflation and economic activity to decrease, which is already happening, but it takes time. A journalist from the WSJ asked whether it was necessary to raise interest rates on May 3rd, given that the momentum needed was already evident. Powell responded that the Fed was more afraid of doing too little than too much and believed there was a good balance between targets and risks.

So what was this dialog supposed to mean for the markets? Data dependency is the key driving force of the Fed, so the stronger the overall economy, the tighter Jerome Powell will be in his policy decisions. This implication should logically lead to higher bond yields, both nominal and real, and increase the value of the dollar (DXY). It also should theoretically make investors more fearful as the whole picture isn’t favorable for the high-risk segment of the market. Conversely, if the situation is reversed [weak economy], the result will be the opposite.

What was said on May 3rd was actually beneficial because it brought the long-awaited “certainty” that everyone had been waiting for – now we know that “good news” is actually “bad news” and vice versa. Now we are more likely approaching the Risk-Off mode of functioning of the stock market again, in my opinion. In situations like the present, commodity prices, gold, and high-beta stocks should theoretically fall; value stocks should dominate relative to growth stocks.

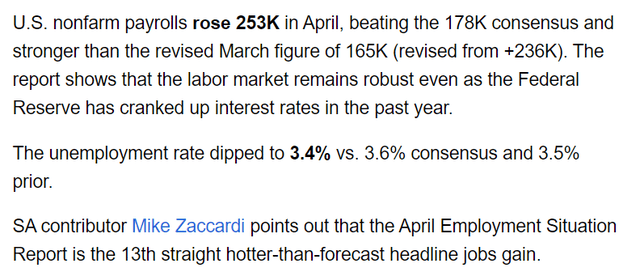

Everything above is theory. What do we see in reality? U.S. economy adds 253K [vs. the consensus of 178K] jobs in April, while the unemployment rate drops to 3.4% [vs. 3.6% consensus and 3.5% prior]. And markets rally.

SA News, 5 May 2023

SA Market data, 5 May 2023, author’s notes

Strong data from the U.S. economy triggered a market rally rather than “good-news-selling” – that contradicts Jerome Powell’s recent message, as far as I can see.

Yes, it was clear from his message that the Fed doesn’t need to raise rates as it originally wanted to – but the later data on unemployment, which continues to fall, and non-farm payroll growth, which beat consensus by >42%, left nothing to do but continue to pressure the economy until it gives up.

At the same time, the Atlanta Fed’s Market Probability Tracker, which estimates the market-implied probabilities of various ranges for the three-month average fed funds rate, now prices a higher likelihood that the Fed will cut rates very soon:

![Atlanta Fed [8 May 2023 data]](https://ifintechworld.com/wp-content/uploads/2023/05/49513514-16835180047345347.png)

Atlanta Fed [8 May 2023 data]

In my view, the market’s behavior – Friday’s stock market rally and the way forwarding feds rates are priced in today – diverges sharply from the “data dependence” I wrote about above, which Powell says the Fed itself follows in its decisions.

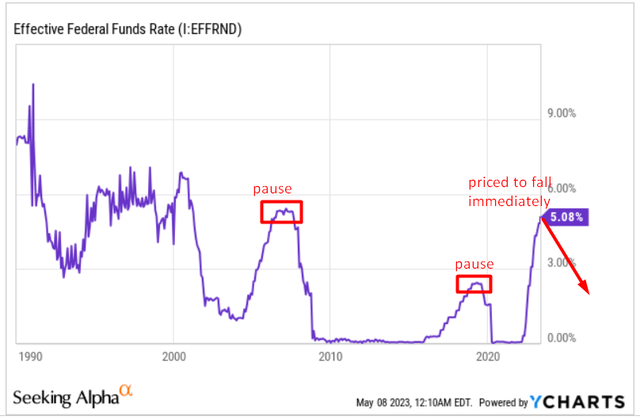

According to the CME FedWatch Tool, there is currently only a 9.6% chance of a rate hike in June and a 38.1% chance of a rate cut as early as July. For September, there is only a 23.3% chance that rates will remain at today’s levels. This is too bold a market assumption, in my opinion, because there is a lag between the rate hike and when it actually affects the economy – which is why the rate cut usually doesn’t happen immediately, but after a pause. Right now, there is no pause anticipated:

YCharts, author’s notes

So, what do we have in the bottom line here?

- Powell has made it clear that the Fed may not have to raise rates too much. It’ll be guided by the available data.

- 2 days after that speech, the latest economic data made it clear that the job is far from done – now the Fed will have to stay tight longer than Powell hinted to.

- For some reason, interest rate expectations have decided not to adjust to the recently released strong data as an obvious counter signal.

For the revealed contradiction to be resolved, a new catalyst will have to emerge that shouts to the market that the Fed isn’t done yet – that will be a real game changer for the stock market.

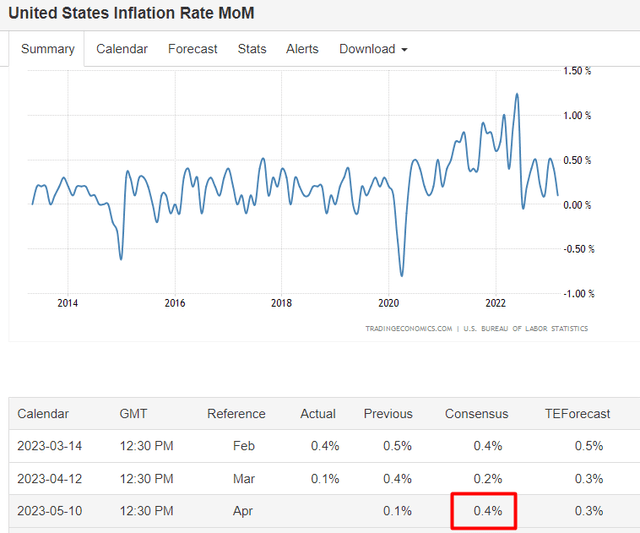

CPI May Correct The Emerged Discrepancy

The new week in the market will be truly rich in new data that can turn everything upside down. Most important, in my opinion, will be the data on inflation [CPI], which will be published on May 10. The market believes that CPI increased by 0.4% in April:

TradingEconomics, author’s notes

And this 0.4% projection seems to be too optimistic. Goldman Sachs predicts that the April headline CPI (MoM) will increase by 0.5% driven by higher food and energy prices [proprietary source], which would result in a year-on-year rate of 5.59%, remaining unchanged. Their forecast is based on a 4% surge in used car prices due to strong auction prices in Q1 and a 0.8% increase in apparel prices because of a rebound in clothing spending and favorable residual seasonality. The bank also anticipates another increase in the car insurance category as carriers continue to counteract higher repair and replacement costs. Yes, a decrease in travel categories such as airfares (-2%) and hotel lodging (-1%) due to weak webfares and unfavorable residual seasonality should pressure CPI a little. GS also believes that the March slowdown in shelter categories was genuine and reflects a decline in the boost from post-pandemic lease renewals. But overall, the analysts expect similar monthly readings in April, with an estimated 0.50% rise in rent and a 0.52% rise in owners’ equivalent rent of residence [OER]. They also estimate a 0.47% increase in core CPI – way higher than the consensus of 0.3%.

If the CPI headline for April really turns out to be what GS expects, it should greatly cool the fervor of the current market rally and return it to its well-deserved “bear market rally” status. You might ask me – the economy is so strong, why can’t this rally be called a “new bull market” no matter what the Fed does?

The fact is that the market is a forward-looking mechanism. It’s one of the fastest leading indicators in the macroeconomist’s arsenal. It prices in all the data in advance, thrives on expectations, and the adjustment to reality isn’t always immediate and not always efficient. Yes, as I write these lines, the general economy looks strong – and that’s good TODAY. But already TOMORROW it can lead to completely opposite conclusions. Take unemployment, for example. Its low level against a background of strong economic growth and low inflation is the ultimate dream. But a very low unemployment rate means that demand for labor is growing and, consequently, wages are rising – that’s bad for fighting inflation. The Fed will have to cool that growth to achieve its goal of cracking down on inflation – that’s a negative outlook for stocks. And today there are a lot of such conditions ignored by the market.

In addition to the upside risk to CPI, we also see a crisis in regional banks and the flow of capital into the technology sector, which I don’t think is logical. Yes, FANGMAN companies have largely exceeded earnings expectations, which have been revised down many times in recent months. But the absolute growth just can’t justify their stock price levels.

![Crescat Capital [May 5, 2023]](https://ifintechworld.com/wp-content/uploads/2023/05/49513514-16835231791711097.png)

Crescat Capital [May 5, 2023]

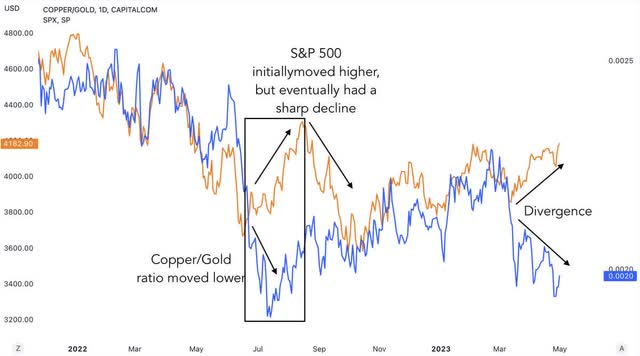

The dynamics of the energy and commodity markets also suggest that global demand is falling. Even the copper-gold ratio is increasingly diverging from the dynamics at SPY. The copper-gold ratio, traditionally used to assess the business cycle, reflects the relative strength of copper, an industrial metal associated with economic growth, versus gold, a precious metal that increases in value during periods of economic instability. During a downturn, gold tends to do better, lowering the copper-to-gold ratio – exactly what we’re seeing today. And SPY isn’t following suit.

Shared on Twitter by @GameofTrades_

This discrepancy must disappear at some point – I think it will not be in favor of SPY/SPX.

The Bottom Line

Of course, my thesis carries a number of risks that put my entire conclusion at risk. First, if CPI comes out below the expected 0.4% [MoM, headline], this would be a completely opposite signal to the market – the likelihood of an even dovish Fed would immediately become even higher and the rally is likely to continue. Second, hedge funds are too pessimistic at the moment – their short positions are leading to a covering that supports the index. Again, the more short positions, the more likely that SPY will be artificially sustained by the covering for longer than I expect.

But despite the upside risks, I still anticipate that the smart money will start to take profits somewhere in May/June. This is because the bull market has deviated significantly from its fundamentals and valuation. However, timing is not always on my side. All the fear may have already been reflected in the index’s momentum in 2022, indicating that the market has already bottomed out – another risk to my thesis to keep in mind before making any investment decisions based on the information presented in this article.

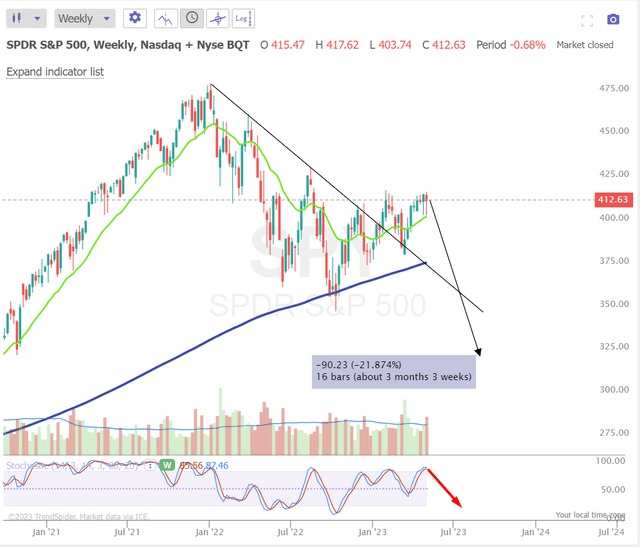

My bearish stance assumes that if the US experiences a recession, the fair P/E multiple should be approximately 15-16x. Taking into account a possible 1.5% downward EPS revision, the implied SPY price would be significantly lower than its current levels. To calculate the fair value, we multiply the FY23 P/E by the EPS adjusted for the downward revision, which results in $3222.23. This value is 21.9% lower than the current value at the time of writing, and I maintain my tactical “Sell” rating on SPY/SPX.

TrendSpider Software, author’s notes

As always, your comments are welcomed! Thanks for reading!

Read the full article here