Synovus Financial Corp. (NYSE:SNV) operates as a bank holding company with 246 branches in Georgia, Alabama, South Carolina, Florida, and Tennessee. It has 2 preferred securities Fixed-To-Floating securities that are very similar in nature, but very different in terms of price.

Preferred Securities

(NYSE:SNV.PR.D) is already a floating rate security (non-cumulative) that pays 3-month LIBOR (now transitioned to SOFR) + 3.352. It is callable anytime. It currently trades near $25. Because short-term rates are so high, it is currently giving a $.56 quarterly dividend that is yielding over 9%.

(NYSE:SNV.PR.E) is currently giving a fixed 5.875% rate (non-cumulative), but will be reset to the five-year US Treasury rate (currently 4.149) + 4.127 on 7/01/2024. Also, it will be callable on that date for $25. If it doesn’t get called, it can be called at the next dividend reset date (7/01/2029). It currently trades near $21.

Although, at the current price SNV.PR.E is only yielding ~7%, if the price stays the same and at current rates, it will yield ~10% (2.0625/25) as it transitions to a floating rate in less than a year away. As it approaches the floating rate date (7/01/2024), it should start trading closer to par or $25 just like SNV.PR.D.

Synovus Bank Safety

The prices don’t really matter if Synovus is not a safe bank and is not able to pay its dividends.

First, it has done a good job driving down uninsured, non-collateralized or uninsurable deposits to just 13% of deposits. This should prevent a bank run like what happened at First Republic in my view.

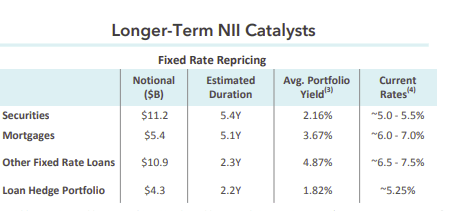

It also a nice cushion of cash and investments that are over 20% of their asset base (~$12 billion/$60 billion) and all of their investment securities ($10 billion) are marked available for sale. They have AOCI loss of $1.4 billion on the investment securities which is very manageable, since their tangible equity is still $3.7 billion. The high ratio of these investments to their asset base gives us a clear picture of their loss on these securities, and also allows them to sell securities if they lose deposits as they are highly liquid. Also, these securities are high-rated investments with a reasonable duration (5.4 years), which should give investors comfort.

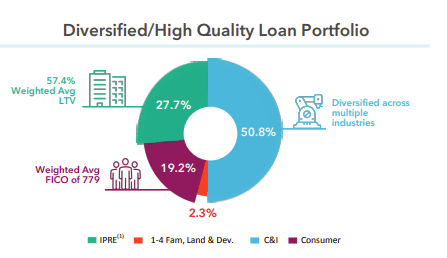

Their loans also seem to highly diversified.

Loan Portfolio (Synovus)

CRE is about 28% of their overall loan portfolio. In July, they sold $1.3 billion medical office CRE business for only a $25 million loss to give the company more flexibility and higher returns. After that, that leaves the company with only a $1.5 billion office portfolio or 2.5% of their assets. The office portfolio is still performing well and even if it doesn’t, it shouldn’t have much impact on the company from a solvency perspective.

The company is also strengthening up its balance sheet. In addition to selling its medical office loan portfolio, it has stopped buying back shares and started to retain any earnings outside dividend payments. It is a highly profitable company and even with reduced 2023 earnings, it should make over $600 million in net income.

Also, over time there are NII catalysts for the company as ~63% of its loans are floating rate, which should help profitability if interest rates stay high.

NII catalysts (Synovus)

Given the bank looks very safe, I believe the SNV.PR.E security currently looks mispriced.

Read the full article here