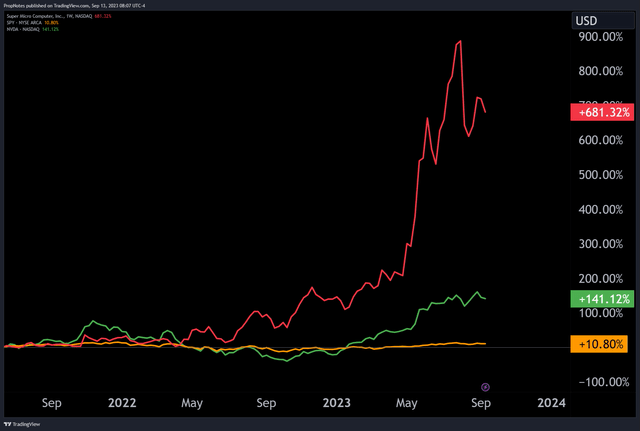

Few stocks have performed as well as Super Micro Computer (NASDAQ:SMCI) has over the last few years.

Since mid-2021, the stock has returned more than 680%, which beats Nvidia’s impressive 141% run (NVDA), and dwarfs the S&P 500’s (SPY) meager 10% total return:

TradingView

This price strength has come on the back of continued profitable execution, in addition to an Nvidia partnership that has ballooned in size as generative AI has made its debut across society.

If you haven’t heard of SMCI before, the company is in the business of selling computer hardware – mostly servers – to enterprise level clients.

Today, we’ll do a deep dive on the company in order to determine whether or not the market price represents an attractive entry point for new investors, or a poor value proposition for trend followers who have just come around to this hot stock.

As always, let’s start with the financials.

Financial Results

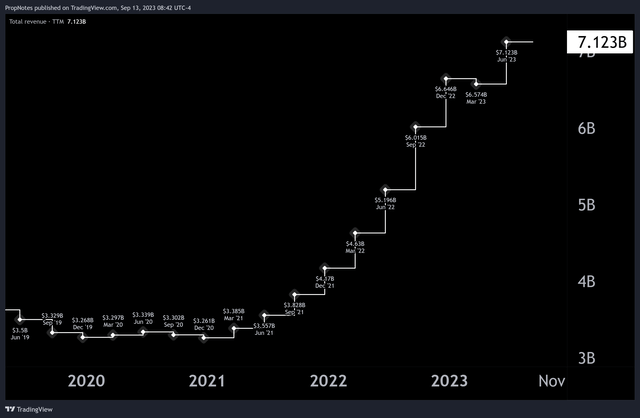

All in all, SMCI’s financials show a company that is currently experiencing hyper-growth.

While the company has existed since 1993, SMCI’s top line sales have been on fire recently, more than doubling from a base around $3 billion to just above $7 billion in the last twelve months:

TradingView

This represents a mind-blowing CAGR of ~34% over the last two and a half years.

This explosive growth has mostly been a result of the aforementioned Nvidia partnership, which has allowed for bigger deals to large enterprise and datacenter customers.

For those who don’t know, SMCI and Nvidia have a long-standing relationship. As SMCI is a leading server manufacturer and Nvidia is a leading provider of graphics processing units (GPUs), the two companies have worked together to develop and market a variety of server solutions that use Nvidia GPUs, among other things.

This has led to the most competitive products on the market today when it comes to deployable compute for AI use cases.

Management had the following to say about the massive increase in net sales:

During fiscal year 2023 we experienced increased revenue from server and storage systems, particularly from our large enterprise and datacenter customers. The year-over-year increase in net sales of server and storage systems was primarily due to the strong demands from such customers for GPU, high performance computing (“HPC”), and rack-scale solutions which are generally more complex and of higher value, resulting in an increase of average selling prices.

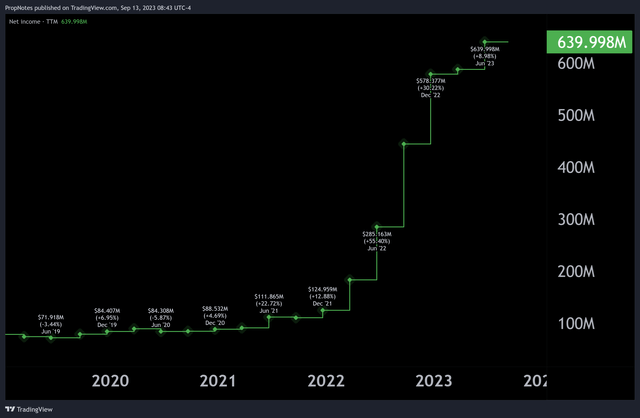

Here’s the best part. With some businesses, an increase in sales doesn’t mean an increase in profits. However, in this case, it does. Since 2021, net income has increased from a base around TTM $100 million to roughly $640 million most recently:

TradingView

This increase of more than 470% is huge; it’s largely what is behind the massive increase in SMCI’s share price over this period.

The Future

But, what about the future? Sure, the growth has been staggering, but will it continue? Is it sustainable? How does management see things moving forward?

In short, management remains bullish. On their most recent earnings call, the CEO mentioned a bit about the positive dynamics that generative AI will continue to have on their business:

With nearly half of our revenues this quarter based on AI-related designs, I expect this AI growth momentum to continue expanding our TAM across all customer types from major AI innovators, super large CSPs, Tier 1 DCs, Tier 2 cloud, and to the general enterprise market. As the performance of GPU, CPU, DPU and memory technologies increase, enhanced storage performance is also necessary to feed massive data sets to the applications without becoming a bottleneck that slows the entire system down.

In other words, the growth isn’t just about the servers SMCI builds that use Nvidia chips, but it’s also about the increased compute needs that surround that technology. This causes compounding effects in terms of demand for storage and compute servers, and SMCI hardware more generally.

In this way, SMCI should actually be viewed as an even higher leverage way of playing the demand for high performance compute / AI server systems, as opposed to Nvidia or other chip makers at that point in the value chain. SMCI has seen far more tangible growth in recent quarters, and the benefits of this trend should also spread to the company’s surrounding products.

In terms of durability, when combined with the growing log of backorders, we think that the growth SMCI has experienced is actually quite durable, especially in light of the fact that the company is the only U.S. based business that can provide deployable AI solutions at scale:

As the only U.S. -based scale AI platform designer and manufacturer, we have been shipping our winning products in volume to our partners for more than a quarter …

The demand for artificial intelligence infrastructure is perfectly addressed by our building block server architecture, and due to our building block solutions, we have the best and broadest application-optimized GPU solutions on the market. We plan to extend this leadership with the upcoming MGX platforms that we announced at Computex …

The MGX platform is a shared vision of AI computing between NVIDIA and Supermicro, designed to be open, flexible and future-proof for multiple generations of GPUs, CPUs, and DPUs.

This product differentiation and geographical situation could become important, especially given the political sensitivity around the semiconductor industry.

Overall, SMCI is in the right place, at the right time. The work that they have done so far in building the company is now paying off for investors, as the company has the best platforms available for actually deploying Nvidia (and others’) groundbreaking chip technology.

Valuation

But how much does the company cost? Given the bullish results, solid execution, and likely continued trajectory of success, one might expect that the company would be rather expensive.

However, that’s not the case.

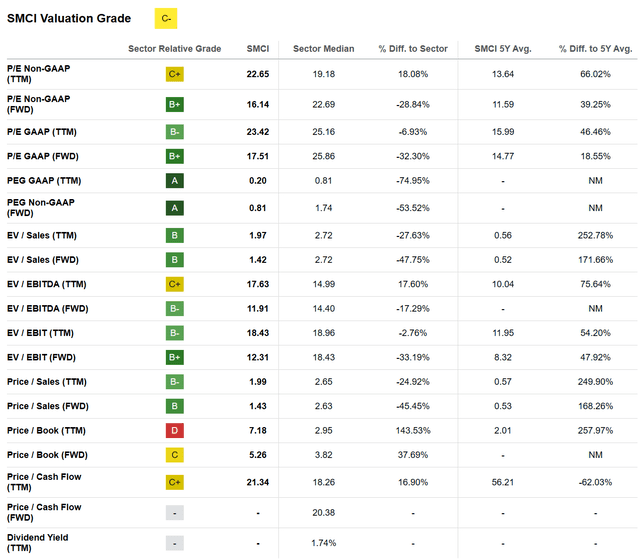

Seeking Alpha’s Quant Rating System graded SMCI’s current valuation at a “C-“.

In other words, not cheap, but not expensive:

Seeking Alpha

To us, this sounds about right, although if you exclude book value (which is basically irrelevant in a situation like this), then the valuation looks more attractive.

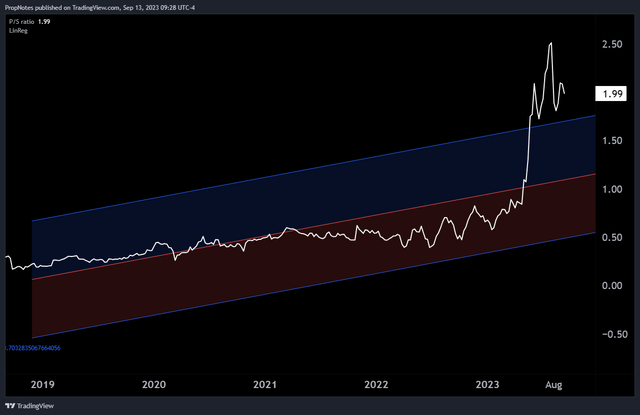

From a different perspective, the recent jump in the Price / Sales ratio may alarm some investors:

TradingView

However, often times when companies transition from stagnant periods to high growth periods, a ‘breakout’ occurs with their traditional ratios. This can often be the best time to get in.

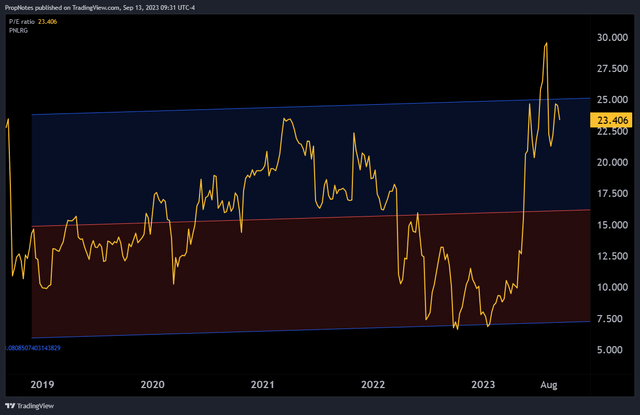

In addition, while the P/S looks “elevated”, the Price / Earnings ratio is still within its historical regression range:

TradingView

To us, this means that;

A.) SMCI isn’t historically expensive, despite the massive recent outperformance, and

B.) SMCI has a lot of potential room for multiple expansion as this story gains more attention over time.

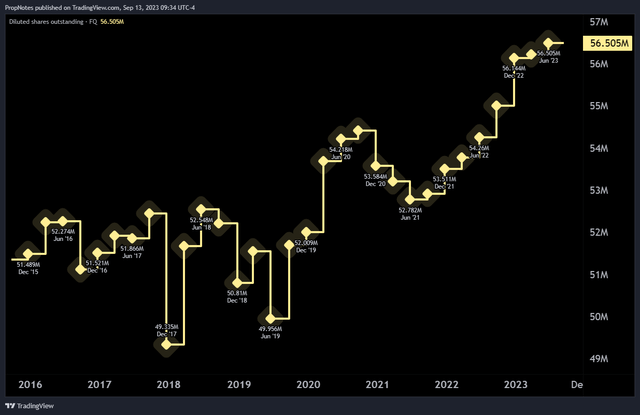

Given that the share count is small (and has been largely stable over time at around 54-55 million outstanding), we expect that a lot of future gains could accrue to a small number of shares:

TradingView

Risks

We see two big risks to buying shares in SMCI.

First, a war in Taiwan would be a massive supply headwind. Given that SMCI needs smaller components to make its server products, we expect that any disruption to this supply chain could have massive implications on the company, more so than on the market as a whole.

Second, a secular decrease in demand for AI server capacity would likely lead to a massive drop in SMCI’s share price, given the revenue and profit implications that generative AI has had so far in building up the company’s scale.

We see this as unlikely, especially given some industry estimates for how big this trend could be. However, ChatGPT has seen declining traffic since peaking in May, which could be an early sign that the hype is over.

That said, at only 23x earnings, we think there’s a significant margin of safety baked into this high-growth server play that’s leveraged itself to a massive computing trend.

Summary

All in all, we think SMCI is a “Buy”. The company has proven itself from an execution standpoint and is set to continue dominating the market for deployable server and off-the-rack systems in what amounts to a massive growth market.

SMCI’s competitive advantages include the key relationship with Nvidia – the chip industry’s leader & innovator, the geographical / political advantages of being a U.S. based company, and the exposure to a massive TAM, complete with a growing order backlog.

At 23x TTM net income, we think the company has room to run, especially over the next few years as results improve and the multiple has room to expand.

Cheers!

Read the full article here