The market is in a tough spot right now, especially for tech stocks. With risk-free interest rates at 5%, it’s very difficult to justify taking on equities especially with macro conditions threatening fundamental progress. Thankfully, however, I do believe there is a “sweet spot” for investing in tech stocks, and to me that’s buying “growth at a reasonable price” stocks.

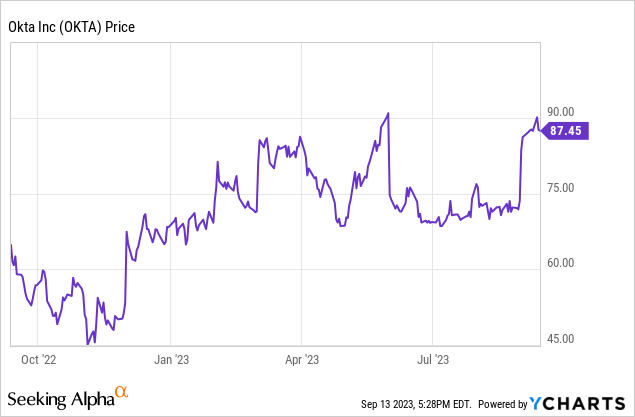

Very few tech companies are as high-quality as Okta (NASDAQ:OKTA), the leader in identity management and single sign-on technology. Okta is up nearly 30% already year to date, and unlike most other companies in the sector, momentum for Okta has picked up since the company’s recent Q2 earnings release in August.

Solid bull case underpinning $101 price target

In my view, Okta has further upside ahead. Building on my prior article on Okta, I remain bullish on this stock (with a $101 one-year price target) especially after parsing through the company’s latest quarterly results which featured a huge boost to profitability.

Okta has done a tremendous job at executing strong sales momentum in a difficult macroenvironment – demonstrating the mission-criticality of its product. Not only did the company add hundreds of new customers during the most recent quarter in spite of a soft macro landscape, but it also continued to expand existing customers’ billings – which many software companies are struggling to do at the moment in the wake of headcount reductions.

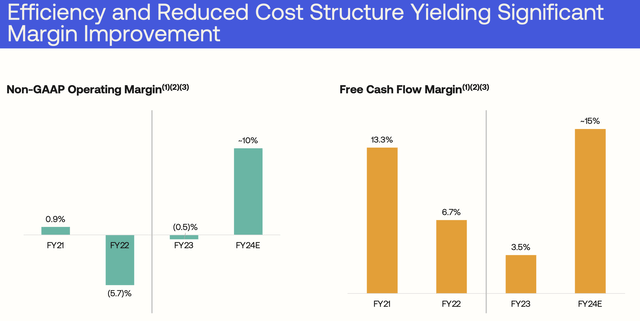

Okta itself has also made a difficult but prudent decision to lay off ~5% of its staff earlier this year, and it has done a good job since then of ensuring that headcount doesn’t creep back up – which is resulting in much richer operating margins. This is one of the primary reasons I feel good about an investment in Okta despite high risk-free interest rates: the company’s profitability is scaling at a rapid rate, helping to justify Okta’s valuation.

For investors who are newer to Okta, here is a recap of my full long-term bull case on the stock:

- Despite its massive scale, Okta is still able to grow at an incredible pace. Okta, despite having reached a massive ~$2 billion annual revenue scale, is expecting to grow roughly ~20% y/y on an organic basis in the upcoming fiscal year. This is a reflection of both the company’s strong execution plus the attractiveness of the IAM (identity access management) market.

- Huge $80 billion TAM. Okta estimates its total addressable market at $80 billion, which means its current revenue scale is only about ~2% penetrated. It’s also the clear market leader here, with competitors like OneLogin and Duo Security being smaller and lesser-known entities.

- Horizontal product. Okta is a true “horizontal” software company whose product is applicable to companies of any size in any industry.

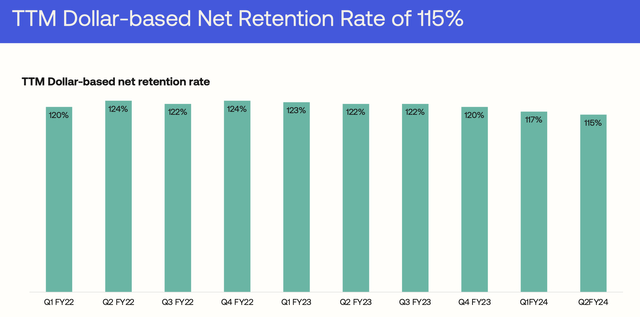

- Recurring revenue and high net retention rates. All of Okta’s business is in recurring subscriptions; in addition, the company’s seat-based pricing plus its multiple modules lend themselves nicely to its >120% net revenue retention rates. In short, Okta has a very stable subscription revenue base that is a powerful growth engine from within the current install base.

- Profitable bones. Okta has achieved above-breakeven pro forma operating margins, on top of positive free cash flow. The company’s tendency to upsell aggressively into its client base also gives it excellent operating leverage.

And in spite of a recent run-up in Okta’s stock, I still find plenty of upside room left. At current share prices near $87, Okta trades at a $13.85 billion market cap. After we net off the $2.11 billion of cash and $1.45 billion of convertible debt on Okta’s most recent balance sheet, the company’s resulting enterprise value is $13.19 billion.

Meanwhile, for the next fiscal year FY25 (the year for Okta ending in January 2025), Wall Street analysts are expecting Okta to generate $2.58 billion in revenue at a 17% y/y growth pace (data from Yahoo Finance). This puts the stock’s valuation at 5.1x EV/FY25 revenue.

In my view, given Okta’s combination of strong top-line growth plus deep bottom-line expansion, the stock has room to glide up to at least 6x FY25 revenue, implying a $101 price target and ~17% upside from current levels.

Q2 download

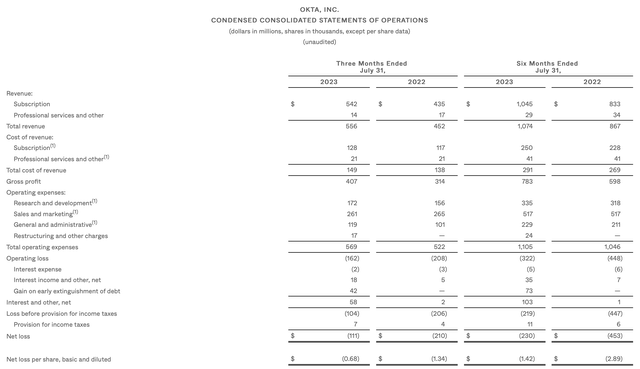

Let’s now go through Okta’s latest quarterly results in greater detail. The Q2 earnings summary is shown below:

Okta Q2 results (Okta Q2 earnings release)

Okta’s revenue grew 23% y/y to $556 million, beating Wall Street’s expectations of $524 million (+16% y/y) by a large seven-point margin. Revenue also largely kept pace with Q1’s 25% y/y growth rate, which is comforting after growth recently decelerated from the 30s.

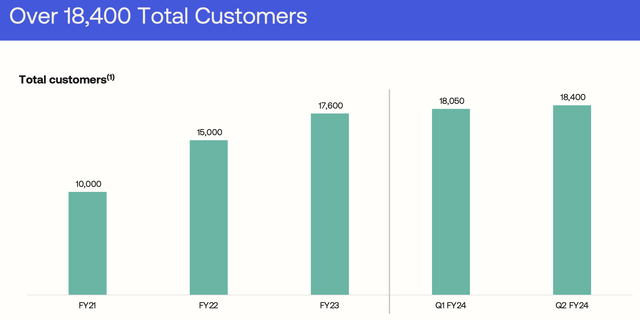

As previously mentioned, Okta managed to keep a healthy pace of customer growth, adding 350 net-new customers in the quarter to end at 18,400 total customers, up 12% y/y.

Okta customer trends (Okta Q2 earnings deck)

On top of this, the company also continued to see a healthy pace of upsells within the install base, hitting a dollar-based net retention rate of 115% (indicating 15% net upsell after churn). Many software companies have struggled to keep this figure barely above 100% in the current macro environment: as companies have slashed headcount, paid seat counts have also dwindled.

Okta net retention rates (Okta Q2 earnings deck)

Note as well that Okta management’s commentary on the Q2 earnings call was relative more sanguine than most other enterprise software companies, with CFO Brett Tighe remarking that Okta is noticing current conditions stabilize:

While macro headwinds, including a minor FX headwind to revenue, continued to impact our business, we believe the environment stabilized in Q2. Our view is based upon trends stabilizing or modest sequential improvements in contract duration, average deal size, the split between new business versus upsells, and seat expansion within upsells and renewals. Pipeline build were healthy, but new pipeline continues to be skewed towards upsells. We also experienced further improvement in metrics related to our go-to-market team, including average tenure, ramp in the number of sales reps closing Workforce Identity and Customer Identity deals. While these are all encouraging data points, we believe it’s prudent to maintain a cautious near-term outlook.”

Okta’s top-line strength also combined well with OpEx reductions, yielding an 11% pro forma operating margin in Q2, up fourteen points from the year-ago Q2 of -3%.

Okta pro forma operating margins (Okta Q2 earnings deck)

And as can be seen in the chart above, the company is expecting more than ten points of operating margin improvement from a full-year basis to ~10%, while FCF margins are also expected to expand by a similar magnitude to ~15%.

Key takeaways

With solid top-line performance and confidence in stabilizing sales momentum, plus incredible progress on profitability and cash flow, I see no reason that the Okta rally won’t keep going. Stay long here and ride the upward wave.

Read the full article here