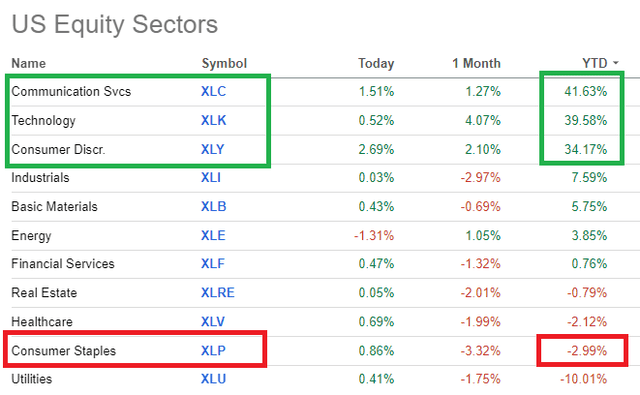

As high growth and momentum stocks continue to make new highs among the recent hype around generative artificial intelligence, investors are once again exuberant about the potential of certain areas of the market.

Consequently, low-risk consumer staples are once again among the worst performers, but this time around with a very wide margin to the more cyclical and tech-oriented sectors.

Seeking Alpha

For anyone not interested in playing the bigger fool game by chasing the latest hot names as they trade at double-digit price multiples, consumer staples offer an attractive playing field for high quality businesses at reasonable prices.

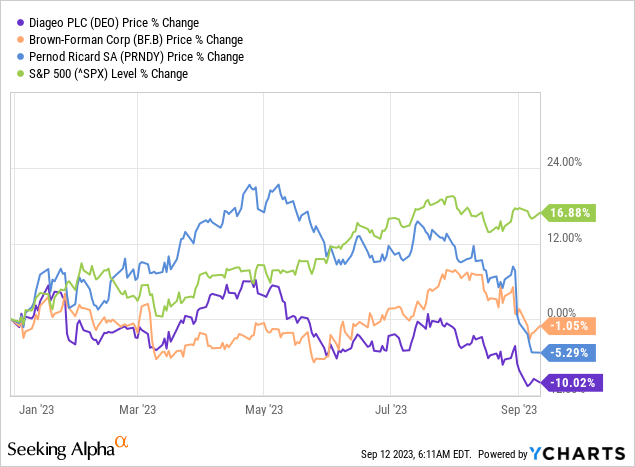

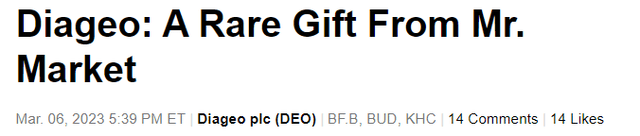

One very good example is Diageo (NYSE:DEO), which a couple of months ago I called ‘a rare gift from Mr. Market’. In light of everything said above, however, it is not surprising that DEO is now in a negative territory for the year.

What is more interesting, however, is that Diageo has fallen by more than 10% so far in 2023 which makes it the worst performer from its peer group in the large-cap spirits.

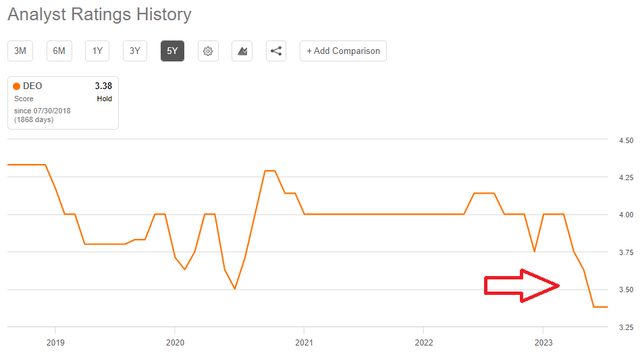

As profitability took a slight hit this year, analysts have come rushing to downgrade the stock and thus creating a narrative around the stock. We could see on the graph below that Wall Street Analysts haven’t been that bearish on the stock in more than 5 years.

Seeking Alpha

The extract below provides a good summary on what the analysts are looking for and why they are so sceptical on Diageo’s prospects. Volume growth normalizing after a period of excess demand at a time when commodity prices remain elevated seems to be the main narrative behind the recent downgrades.

Analyst Sarah Simon said that while industry spirits sales volume grew materially faster during the COVID-19 period, growth has now normalized and growth in the key U.S. market has converged with beer. The view from Simon is that dynamic means a potential period of underperformance for Diageo (DEO). (…)

Looking ahead, Simon and team think it will take at least 12 months for the spirits business to normalize. “While the company could in theory cut marketing in order to limit earnings downgrades, this would likely result in slower run-down of the excess inventories that have built up,” she warned.

Source: Seeking Alpha

Although this is likely true, it hardly matters for long-term shareholders and in my view, none of that is a reason to sell the stock or to stay away from it in the first place.

When I wrote about Diageo back in March of this year, I focused predominantly on the company’s growth strategy and why its strong global brand portfolio is a major competitive advantage that is nearly impossible to replicate.

Seeking Alpha

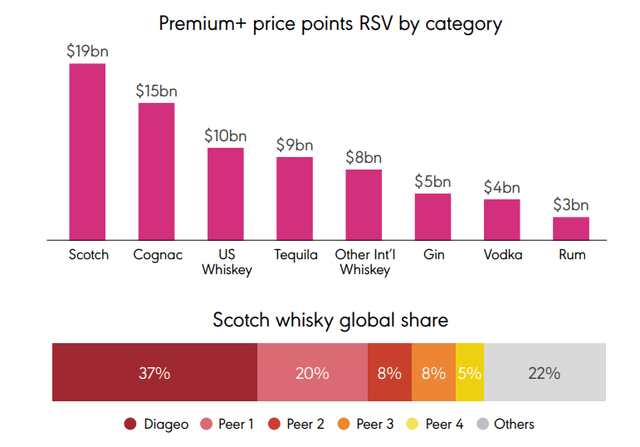

By owning the premium global brands in one of the most attractive spirits category – Scotch whisky, Diageo is able to sustain above industry-average profitability and very high return on invested capital.

Diageo Investor Presentation

As I showed back in March and will reiterate again, topline growth is not the most important characteristic for a company like Diageo. Instead, it is margins and ultimately return on capital that is driving the company’s premium valuation.

Even More Attractively Priced

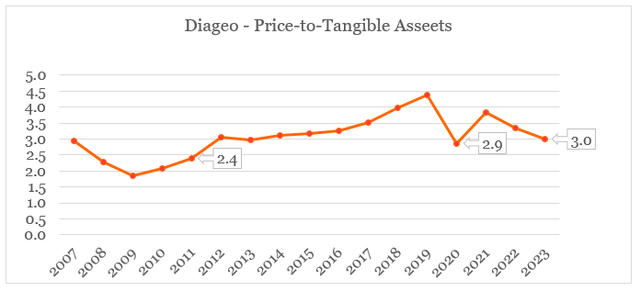

As a company that has been very aggressive on the M&A front, Diageo’s financials have significant amounts of goodwill and other intangible assets booked within the company’s total assets.

Since intangible assets are carried at historical cost and amortized annually, while goodwill is simply a balancing figure for the amount paid when acquisition occurs, it is useful to look at how the company is trading relative to its tangible assets only.

As of today, Diageo is once again close to trading below 3 times its tangible assets (see below). This has not occurred since 2011, with the exception of 2020 when the pandemic hit.

prepared by the author, using data from Annual Reports and Seeking Alpha

While the company’s tangible assets could be bought at their lowest price since 2011 (excluding the pandemic period), Diageo’s intangible assets are now worth significantly more than they used to in 2011.

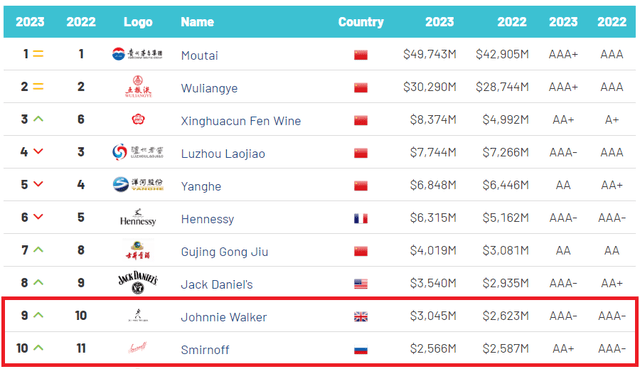

Its iconic global brands are now among the strongest in their respective categories and as we can also see below, according to Brand Finance, Diageo has two brands within the world’s Top 10 most valuable spirits brands.

Diageo Brand Portfolio (Diageo Website)

Brand Finance Spirits 50 2023 Ranking

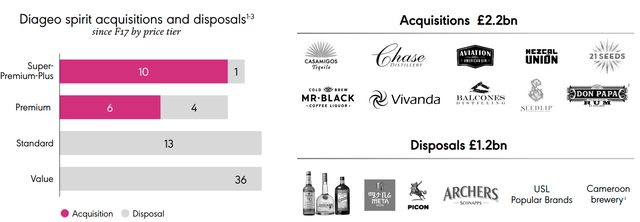

Also in recent years, the company has strengthened its portfolio by focusing on premium categories and disposing of less known value brands.

Diageo Investor Presentation

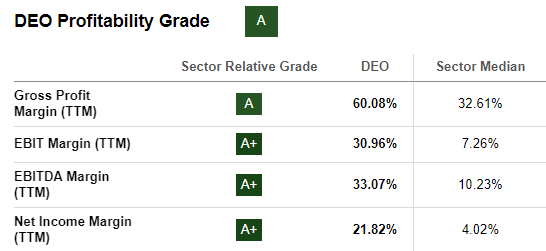

This has resulted in the company having one of the highest margins in the sector with its gross margin being nearly twice than the sector median.

Seeking Alpha

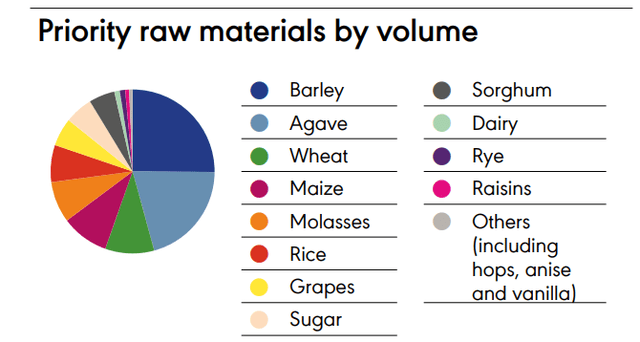

Although there could be difficulties in the short run, Diageo appears to be already lapping the most challenging period from raw material price increases point of view. As we can see down below, barley is one of the key raw materials for DEO.

Diageo Annual Report 2023

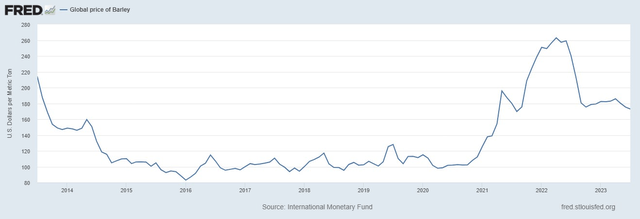

The global price of barley is already back to its late 2021 levels which would provide a tailwind for Diageo’s gross margins going forward even after considering the company’s strong pricing power.

FRED

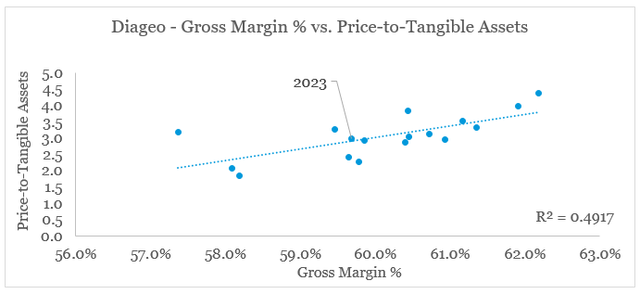

The reason why all that is much more important than the topline growth figure over the coming months is that over the long term gross margin is a key driver of Diageo’s Price-to-Tangible Assets multiple we saw above.

prepared by the author, using data from Annual Reports and Seeking Alpha

As we see in the graph above, based on its current gross margin, Diageo trades in line with expectations. Going forward, however, the company’s strong pricing power would allow the company to expand its margins, if commodity prices remain stable.

Sleep Well With The Dividend

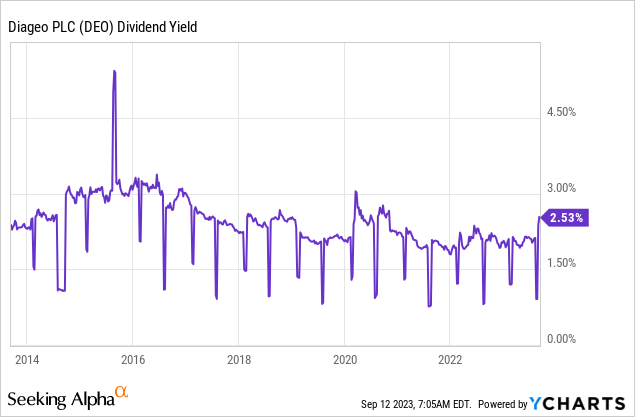

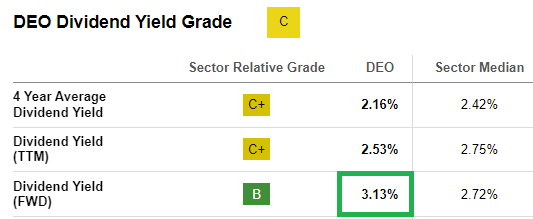

While the multiple repricing opportunity we saw above is unlikely to happen immediately, Diageo’s shareholders are also rewarded with one of the highest dividend yields since 2016.

On a forward basis, Diageo’s recent dividend increase results in a yield of more than 3%, which is also above the industry average.

Seeking Alpha

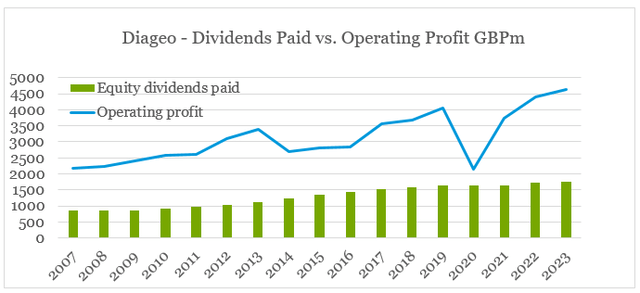

After keeping its annual dividend payments flat during 2020-21 period, Diageo is once again in a good position to keep increasing it at rates above the annual rate of inflation. As the gap between the dividends paid and Diageo’s operating profit grows, the management is likely to keep rewarding its shareholders with annual increases.

prepared by the author, using data from Annual Reports

The graph above is also a testament to the safety of Diageo’s dividend and yet another reason to sleep well at night.

Conclusion

In spite of all the short-term negativity around Diageo, the stock remains as a solid long-term buy in my view. The 10% drop since the beginning of the year while the business competitive positioning continues to improve, has strengthened my initial investment thesis even further. In addition to a potential multiple repricing opportunity, the stock offers both high and safe dividend.

Read the full article here