Note:

I have previously covered Diamond Offshore Drilling, Inc. (NYSE:DO), so investors should view this as an update to my earlier articles on the company.

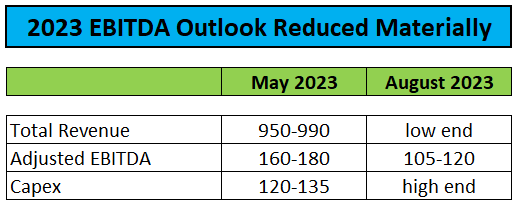

Last month, Diamond Offshore Drilling (“Diamond Offshore”) reported better-than-expected second quarter 2023 results but reduced full-year profitability expectations substantially due to host of minor issues expected to culminate in a big Q3 miss:

Company Presentation / Conference Call Transcript

While I was surprised by the magnitude of the projected miss on Adjusted EBITDA, 2024 should be a very different story with higher average day rates and fleet utilization in combination with substantially reduced special periodic survey requirements expected to favorably impact the company’s financial results.

Quite frankly, following the disappointing near-term outlook and based on management’s somewhat guarded commentary on the Q2 conference call, I wasn’t expecting the company to pursue a refinancing of its restrictive, post-bankruptcy debt facilities anytime soon, but on Tuesday, management actually proved me wrong (emphasis added by author):

Diamond Offshore (..) announced today that its wholly-owned subsidiaries, Diamond Foreign Asset Company and Diamond Finance, LLC (…), intend, subject to market conditions, to offer for sale to eligible purchasers in a private placement under Rule 144A and Regulation S of the Securities Act of 1933, as amended (…), $500 million in aggregate principal amount of Senior Secured Second Lien Notes due 2030.

The Company intends to use the net proceeds from the offering to fully repay and terminate its term loan credit facility, redeem in full its Senior Secured First Lien PIK Toggle Notes due 2027 and repay all of the borrowings outstanding under its senior secured revolving credit agreement. The Company intends to use any remaining net proceeds for general corporate purposes.

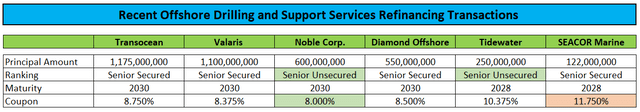

In fact, the offering was met with strong demand by market participants thus resulting in the aggregate principal amount being upsized to $550 million and a very reasonable 8.50% coupon, similar to other recent industry refinancing transactions:

Press Releases

Please note that Noble Corp. (NE) and Tidewater (TDW) even managed to place unsecured debt while SEACOR Marine (SMHI) had to abandon an intended secured bond offering earlier this year and just recently closed on a comprehensive refinancing transaction with EnTrust Global at less-than-stellar terms.

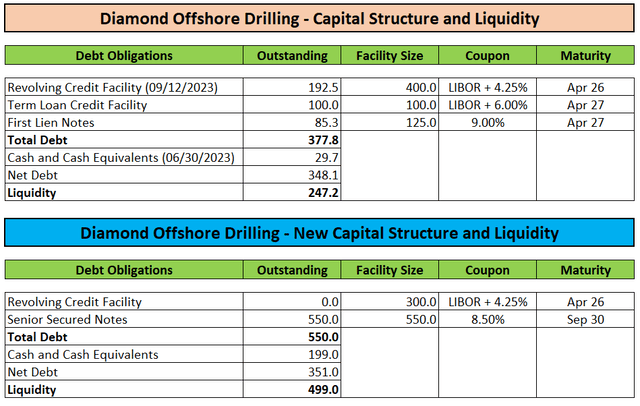

The successful refinancing benefits Diamond Offshore Drilling in multiple ways:

- lower coupon

- extended debt maturities from 2026/2027 to 2030

- simplified the company’s capital structure

- increased cash on hand to approximately $200 million

- more than doubled available liquidity to almost $500 million.

Regulatory Filings

However, with the existing revolving credit facility remaining in place (albeit being downsized from $400 million to $300 million), Diamond Offshore will likely remain precluded from returning capital to shareholders for the time being. However, I firmly expect the company to address this issue once the ongoing industry recovery will be better reflected in its financial results.

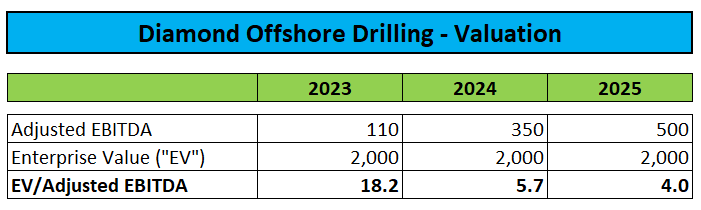

Based on my estimates, I would expect Diamond Offshore to generate Adjusted EBITDA of approximately $350 million next year and $500 million in 2025:

Author’s Estimates

Assigning a 2025 EV/EBITDA multiple of 6x would result in a $24 price target for the shares, and this scenario does not even account for anticipated lower net debt levels starting next year.

That said, very limited analyst coverage in combination with the largely unnoticed guide down on the Q2 conference call, is likely to result in Q3 results underperforming consensus expectations by a very wide margin in November, thus potentially triggering an initial selloff in the shares.

Given ongoing, strong industry conditions, I would consider this a great chance for investors to get exposure to Diamond Offshore Drilling, particularly with the overall financial condition of the company anticipated to improve substantially next year.

By 2025, Diamond Offshore should have worked through all of its remaining low-margin legacy contracts and priced options, thus allowing for the company’s full earnings potential to unfold.

Risks

Not surprisingly, offshore drilling stocks remain heavily correlated to oil prices so any sustained down move in the commodity would almost certainly result in Diamond Offshore Drilling’s shares taking a hit.

Bottom Line

Kudos to Diamond Offshore management for successfully closing on a comprehensive debt refinancing at favorable terms just weeks after lowering full-year profitability expectations substantially.

Going forward, the company will benefit from its vastly improved financial position, including almost $500 million in available liquidity.

Given ongoing, strong industry conditions, I would consider using any major weakness to initiate or add to existing positions.

Read the full article here