After generating significant cash returns for shareholders since going public in 2021, CION Investment (NYSE:CION) may find it difficult to continue increasing base dividends and providing supplementary dividends to its shareholders. CION, like other BDCs with floating rate portfolios, is vulnerable to potential Fed rate cuts in the coming years, and there are no clear plans for how the BDC will offset the negative impact of these cuts on investment income in my opinion. Increasing portfolio size and bringing in new interest income could be one of the key strategies for mitigating the effects of rate cuts. However, due to economic challenges, the company has so far pursued a cautious investment strategy. Therefore, in light of the growing uncertainty surrounding future growth prospects, I am changing my buy recommendation to a hold.

Dividend Coverage Ratio Likely to Fall

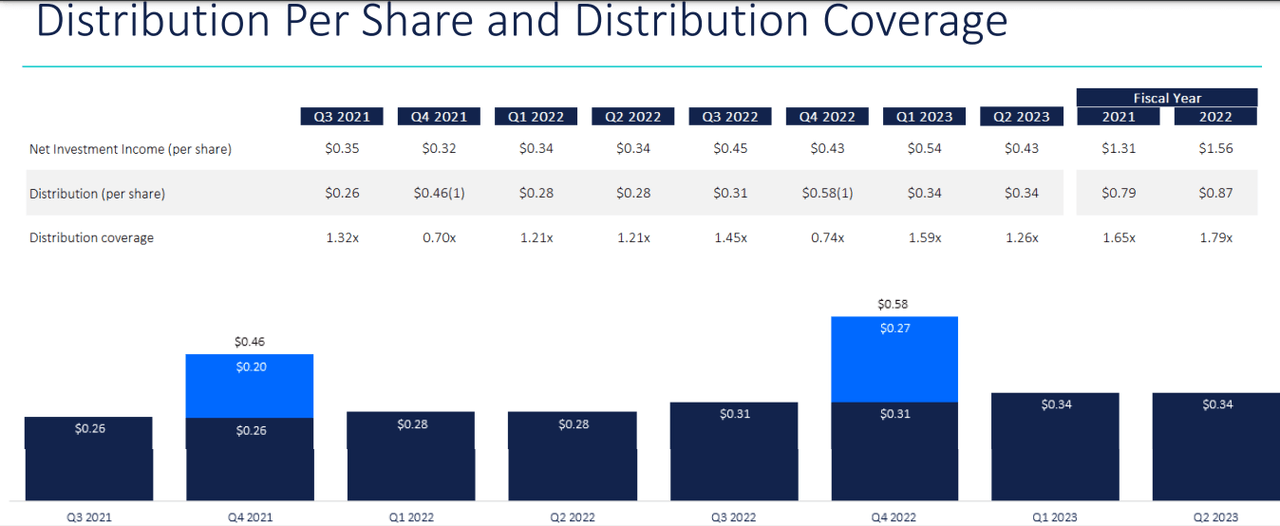

Dividend History (Q2 Presentation)

CION’s significant net investment income growth momentum led it to achieve a base dividend coverage ratio of 1.65x in 2021 and 1.79x in 2022. Consequently, the company raised its base dividends and paid healthy supplementary dividends to shareholders. So far in 2023, the company’s net investment income has outpaced base dividends, with the second-quarter dividend coverage ratio standing at 1.26x. However, the financial outlook and future fundamentals show that its dividend coverage ratio is likely to steadily decline quarter over quarter, leaving little room for dividend increases and supplemental dividends.

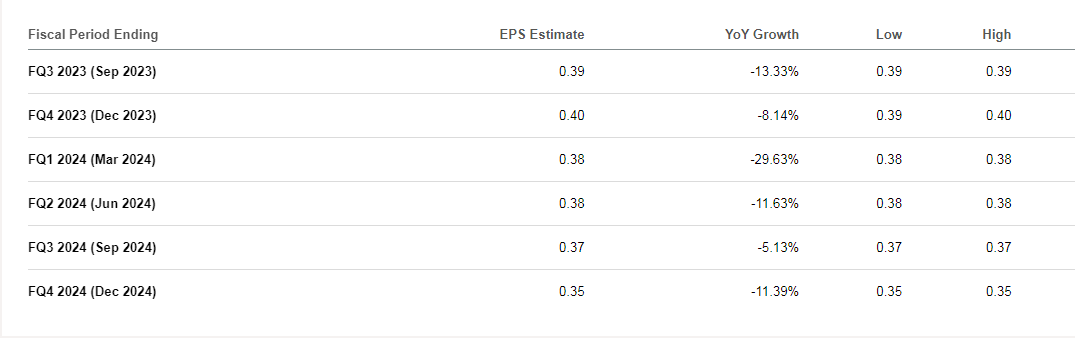

Earnings Forecast (Seeking Alpha)

Wall Street estimates show that the company’s third and fourth-quarter earnings per share are likely to decline by 13% and 8%, respectively, year over year. This means that the dividend coverage ratio is likely to fall to around 110x in the second half. The negative earnings growth trend is likely to intensify in 2024, when the Fed will begin rate cuts. As a 100 basis point increase in rates results in a $0.10 per share growth in CION’s net interest income, similar-size cuts could have the same effect on earnings in my view. In fiscal 2024, its quarterly earnings are expected to be around $0.35 per share, nearly equal to its current base dividend of $0.34 per share. With a 100% dividend coverage ratio, there may be no base dividend increases or supplementary dividends for shareholders. Furthermore, I think more rate cuts in 2025 are expected to increase the pressure on dividends and earnings.

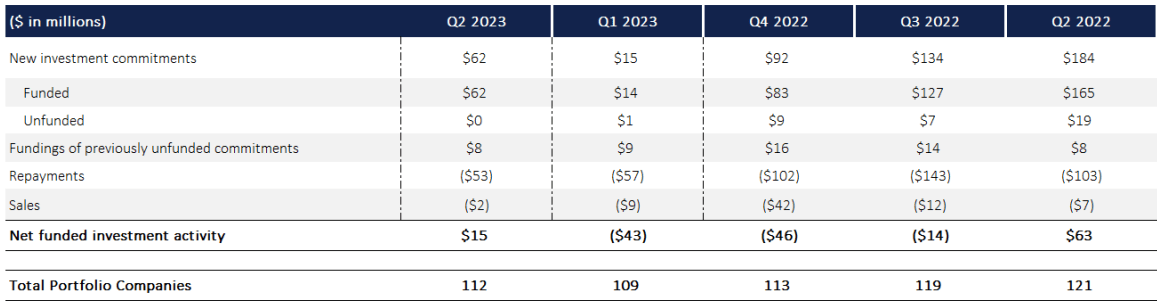

Investment Summary (Q2 Presentation)

The company’s cautious and selective investment approach in the past two quarters may be the right strategy considering the economic uncertainty. However, this strategy will not help it achieve sustainable growth in net interest income, especially since rate cuts are likely to affect its floating rate portfolio in the years ahead. In fact, the new interest income stream is important to soothe the impact of rate cuts. CION Investment has made only $77 million in new investment commitments in the first half of 2023, down significantly from around $300 million in the year-ago period. As a result of low new investments and higher non-accruals, its fair portfolio value fell to $1.68 billion in the June quarter from $1.79 billion in the year-ago period.

Non-Accruals and Liquidity

Non-accruals are an important element in gauging market conditions and underwriting policies. Putting investments on non-accrual status means that interest from those investments has been halted. In the case of CION Investment, the company had 3.47% of its portfolio investments at fair value on non-accruals in the first quarter of 2023, one of the highest percentages in the industry. During the second quarter, it placed one new investment on non-accruals. It also removed three investments from non-accruals due to successfully utilizing secured loan positions. Consequently, its non-accrual came in at 1.69% at the end of the second quarter, up compared to the industry average of 1.16%. On the positive side, 99% of its total current portfolio is now performing according to or above expectations. Overall, despite higher non-accruals in the past, the current credit condition of its portfolio appears satisfactory, with less than 1% of investments at high risk.

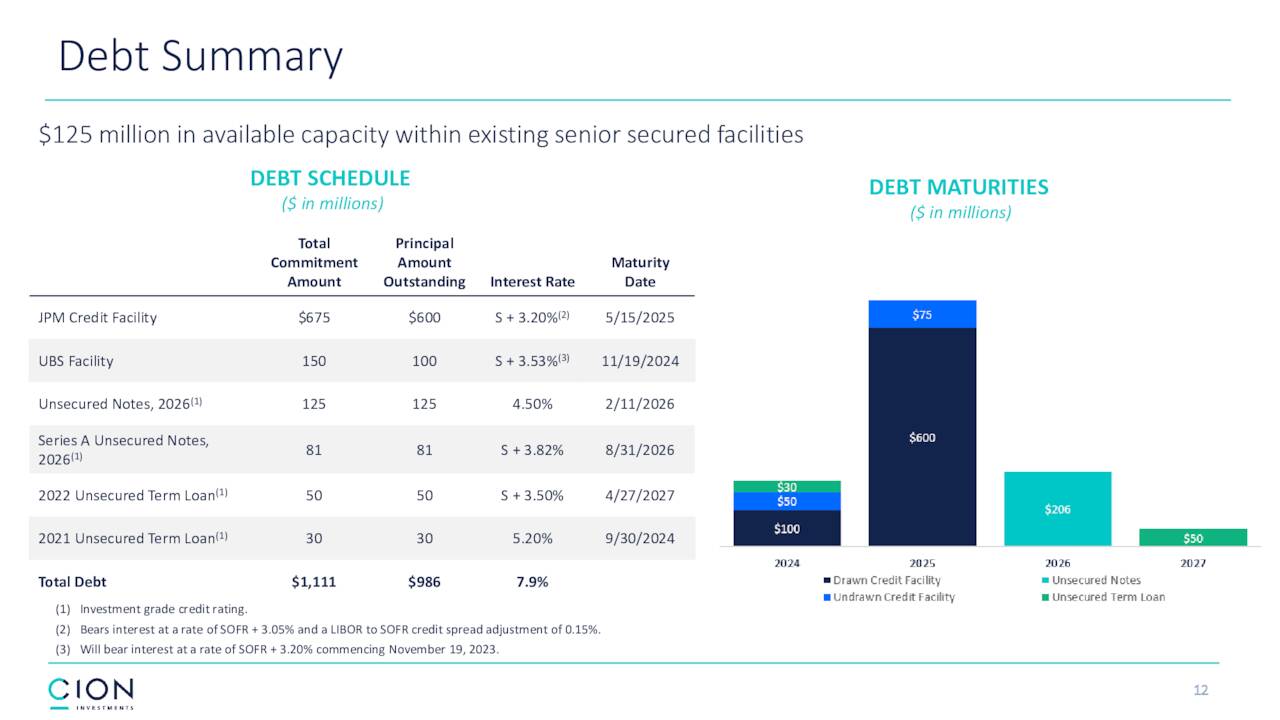

Debt Summary (Q2 Presentation)

I don’t see an immediate liquidity risk for CION Investment. It has more than $110 million in cash and short-term investments. It can also use the $125 million available under credit facilities. Moreover, in the short term, there are no debt liabilities. Its $150 million debt is payable in late 2024, and the $600 million drawn credit facility is likely to mature in 2025. Therefore, CION Investment’s financial flexibility to invest in new opportunities remains strong in the short term. However, debt maturities, which are likely to begin in late 2024, may put pressure on its liquidity position in the mid-term.

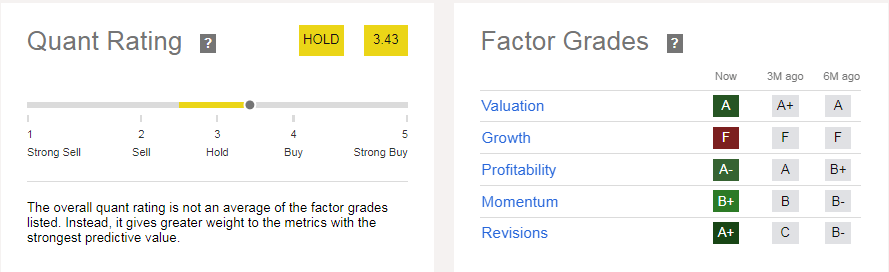

Quant Rating

CION Quant Rating (Seeking Alpha)

CION Investment received a hold rating based on SA quant analysis, which is in line with my recommendation. Furthermore, the quant analysis assigned a low grade to its growth factor due to the negative financial growth forecast. I do not want to go into detail about a growth factor because I have already discussed how much its future revenue and earnings are likely to decline and what factors would reverse the growth trends. Furthermore, I believe its profitability factor will also fall in the coming quarters due to the negative growth forecast and the potential decline in margins.

Where Do Industry Peers Stand?

CION Investment is not the only company with gloomy growth predictions. The entire BDC industry is vulnerable to a shift in future fundamentals and deteriorating financial performance. In my recent article on the VanEck BDC Income ETF (BIZD), I changed my rating from buy to hold. The majority of companies in the industry are likely to experience a high single to double-digit percentage decline in revenue and earnings in the following years because of Fed rate cuts and muted portfolio growth in my view. Although there is no risk to their base dividend in the near or medium term, supplementary dividends are at high risk beginning next year.

In Conclusion

CION Investment appears to be struggling to maintain higher cash returns for shareholders in the future. The negative earnings growth will gradually reduce its dividend coverage ratio in the coming quarters, and there may be no supplementary dividend in fiscal 2024. If the company fails to offset the impact of future rate cuts, I believe its base dividends will also be at risk in 2025. Overall, I believe it might not be a good time to buy due to challenging market conditions, a gloomy financial outlook, and slowing investments in new opportunities. Instead, investors may wait for the company to present an alternative plan for offsetting the impact of future potential rate cuts on earnings.

Read the full article here