Formula for success: rise early, work hard, strike oil. – J. Paul Getty.

Oil has been on a tear lately, sparking concerns of another bout of cost-push inflation. These concerns are valid, I’m just not sure how long the momentum can last. This is clearly a supply and inventory issue, but in the event I’m right about the risk of a credit event, everything takes a hit including Oil.

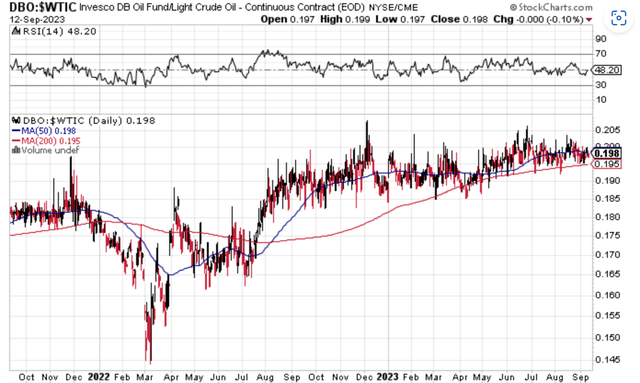

Investing in Oil directly itself is, of course, a challenge, but there are some funds that do a good job investing in futures to maintain some rough correlation to what’s quoted on the screen for Oil. The Invesco DB Oil Fund ETF (NYSEARCA:DBO) is a unique exchange-traded fund that attempts to do this. It seeks to provide investors with a cost-effective and convenient method of investing in Oil futures. The fund tracks changes in the level of the DBIQ Optimum Yield Crude Oil Index Excess Return, plus the interest income from the fund’s holdings of primarily U.S. Treasury securities and money market income, deducting the fund’s expenses. However, it’s important to underscore that investors cannot invest directly in this index, and that the index does NOT directly track spot Oil.

The Fund’s Holdings and Structure

The DBO primarily invests in liquid futures contracts traded on regulated exchanges. Its portfolio is not concentrated on near-term WTI futures contracts. Instead, its long portfolio in oil focuses on longer-term contracts, thereby minimizing the impact of roll yield risk.

When compared against WTI Crude itself, interestingly enough the fund has outperformed on a relative basis. This likely has to do with the shape of the term structure of contracts and how the fund allocates across different months.

StockCharts.com

When juxtaposed with similar funds in the market, such as the United States Oil Fund LP (USO), DBO seems to offer a more diversified and risk-mitigated exposure to the energy sector. While both USO and DBO invest in WTI futures contracts, USO’s portfolio is primarily concentrated on near-term contracts, making it more vulnerable to roll yield risk. On the other hand, DBO’s approach is marked by an optimization process that involves a cost-effectiveness calculation before its futures contracts roll over. This strategy has allowed DBO to exhibit comparatively more consistent performance as a means of being correlated to spot Oil.

A Word of Caution

Despite the seeming strength of the oil market, the possibility of a breakdown cannot be ruled out. While DBO offers a way to track oil futures, it is not immune to the impact of a credit event, which can hit the fund significantly. For all we know, it could be a source of a credit event should prices continue to rise against a collapsing Yen, causing a reversal of the carry trade on a Bank of Japan that would be forced to act to break inflation aggressively (a scenario I’ve brought up numerous times in my writings).

Regardless, while I understand the appeal of chasing Oil and using a fund like DBO to do so, macro developments could break momentum very sharply despite supply dynamics which unquestionably favor Oil from an intermediate to longer-term perspective.

Conclusion

As an investment vehicle, DBO offers a unique blend of potential benefits and risks. Investing in DBO requires a clear understanding of the fund’s structure and holdings, as well as the inherent volatility of the commodities market. You can’t directly invest in spot Oil itself, but this fund does a good job with the future sides to get you exposure as needed. Just don’t be overly convinced Oil will continue to skyrocket when tail risks are wagging everywhere.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Are you tired of being a passive investor and ready to take control of your financial future? Introducing The Lead-Lag Report, an award-winning research tool designed to give you a competitive edge.

The Lead-Lag Report is your daily source for identifying risk triggers, uncovering high yield ideas, and gaining valuable macro observations. Stay ahead of the game with crucial insights into leaders, laggards, and everything in between.

Go from risk-on to risk-off with ease and confidence. Subscribe to The Lead-Lag Report today.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Read the full article here