Introduction

It’s time to talk about Enbridge Inc. (NYSE:ENB). On August 4, I wrote an article titled Enbridge’s 7% Yield: It Doesn’t Get Much Better Than This.

Now, the company yields 7.8%, as it has fallen more than 5% since early August. This was triggered by the acquisition of Dominion Energy’s (D) natural gas assets, which makes Enbridge the largest natural gas distributor in North America – in addition to being the largest pipeline operator.

After many discussions with readers who own ENB shares and diving into the company’s numbers and comments, I’ve come to the conclusion that Enbridge has become my favorite midstream/utility hybrid.

After this deal, the company now combines the best of two worlds, offering investors top-tier diversification and a very juicy yield. If I were an income-focused investor (for now, I prefer dividend growth), I would buy ENB and replace some of my current utility holdings.

In this article, I’ll give you the details and explain why I like the new Enbridge so much!

The New And Improved Enbridge

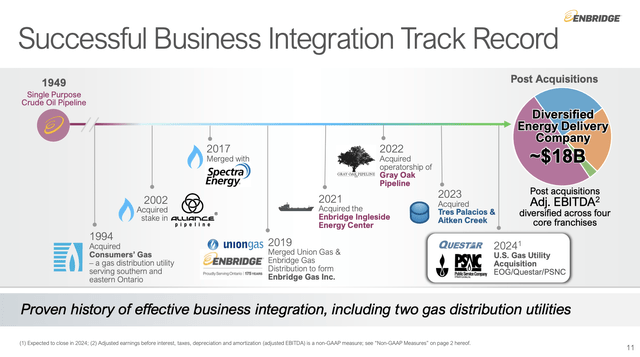

Enbridge has a history of diversifying its business. Back in 2016, it announced the acquisition of Spectra Energy, a $28 billion deal that had the purpose of diversifying its business in a period of subdued energy prices.

Wall Street Journal

In addition to diversifying its business, Enbridge had another achievement.

The merger back then enabled the combined company to derive 96% of its cash flow from take-or-pay contracts with shippers, guaranteeing revenue even in the face of declining energy prices.

Enbridge Inc.

Currently, energy prices are higher, and ENB still benefits from these contracts.

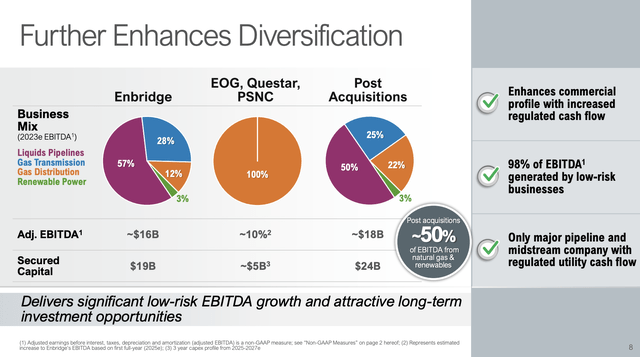

In my August article, I wrote that 98% of the company’s anticipated 2023 EBITDA is anchored by regulated assets or long-term take-or-pay contracts.

Within this, approximately 51% falls under the category of take-or-pay plus, indicating that these assets are backed by extended agreements featuring inflation protection and cost-sharing provisions.

Now, Enbridge is adding a new acquisition to its track record.

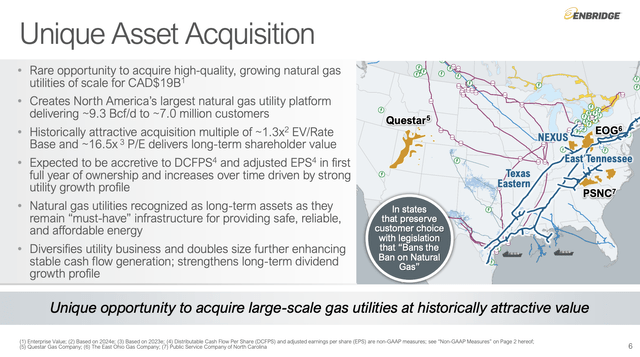

The company bought three utility companies from Dominion Energy in favorable areas.

The three utilities being acquired by Enbridge serve customers in Ohio, Utah, Wyoming, and North Carolina, regions where utility bill revenues are expected to outpace the national average growth rate.

This is a CAD 19 billion deal, which includes roughly CAD 6 billion of net debt. The company is using at least CAD 4 billion in equity to fund the deal. While this is dilutive for shareholders, it is protective of the balance sheet. But more on that later.

Enbridge Inc.

According to the company, the CAD 19 billion transaction is historically attractive, with an acquisition multiple of approximately 1.3x the estimated 2024 rate base and approximately 16.5x earnings based on 2023 estimates.

This valuation is compared favorably to recent U.S. utility transactions.

Furthermore, the deal is expected to be immediately accretive to DCF per share and earnings per share, with earnings increasing over time due to the strong utility growth profile of the assets.

Adding to that, just like the Spectra deal, this acquisition significantly shifts Enbridge’s business mix, with approximately 50% of EBITDA post-acquisition attributable to natural gas and renewables.

Enbridge Inc.

This diversification is seen as a positive development, aligning with the company’s view that all forms of energy will be necessary for a reliable energy transition. The acquisition also increases the proportion of EBITDA underpinned by regulated cash flows, further reducing business risk.

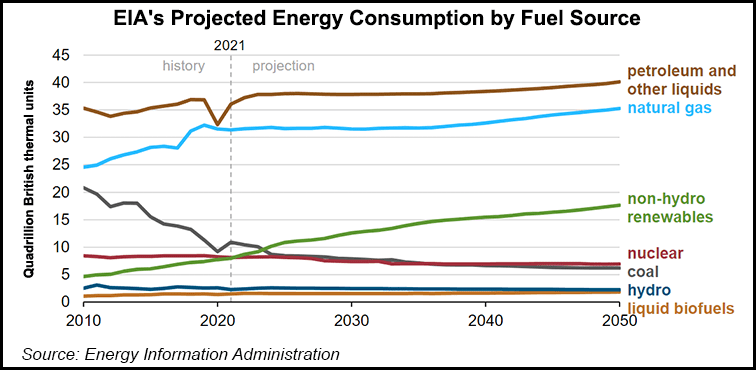

While some critics say that natural gas is a dying industry, the opposite is true. Natural gas is a bridge technology, which is expected to see rising demand for at least three more decades, which is how far the Energy Information Administration’s outlook goes.

Energy Information Administration

Essentially, Enbridge’s utility business is set to double in size, with the acquisition creating a top-tier natural gas utility franchise in North America.

The assets are expected to align well with Enbridge’s existing utility operations, with a strong focus on safety, sustainability, and community engagement.

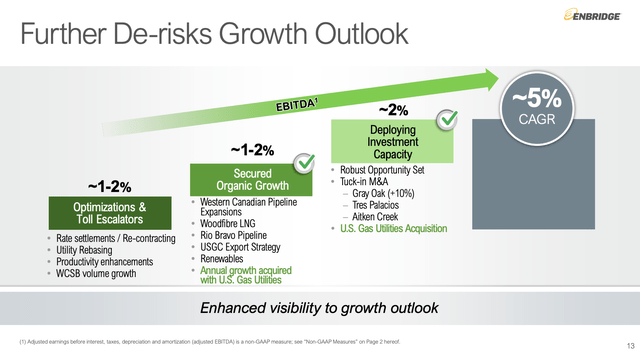

Having said that, the company’s outlook remains unchanged. It sees long-term EBITDA growth of 5% per year, consisting of almost equal parts of organic growth, pricing power (inflation-protected escalators), and external growth.

External growth includes the new gas utilities deal.

Enbridge Inc.

While the growth in 2024 will be offset by aspects of the financing plan executed throughout that year, 2025 is anticipated to see significant EBITDA contribution that may exceed the top end of the 3-year range.

The deal is also expected to be accretive and generate growth in DCF per share and earnings per share, enabling Enbridge to reaffirm its per-share guidance.

Enbridge also remains committed to growing its dividend, aiming to align it with medium-term cash flow growth while maintaining a payout range of 60% to 70% of distributable cash flow.

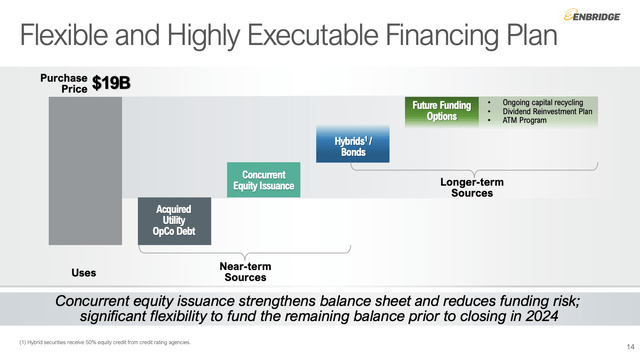

To fund this deal, the company is using both equity and debt. Debt is already included in the CAD 19 billion deal, as it is the enterprise value of the deal.

Enbridge Inc.

In addition to equity funding, the company has longer-term financing requirements.

These sources include projected EBITDA growth, increased balance sheet capacity generating incremental hybrid capacity, consideration of term debt, capital recycling, a reinstated dividend reinvestment plan, and, if needed, an ATM program.

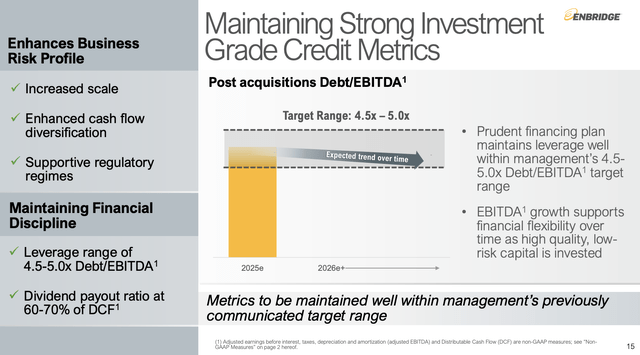

According to the company, funding the acquisition with substantial upfront equity is a strategic choice that ensures the company maintains strong investment-grade credit metrics.

Enbridge has engaged in a formal review with its rating agencies, who (according to the company) recognize the credit-enhancing nature of the low business risk associated with the acquired utility assets.

The company’s key message to rating agencies and stakeholders is a commitment to managing the balance sheet within prudent financial guardrails, including a leverage target of 4.5 to 5x debt-to-EBITDA while maintaining a dividend payout ratio of 60% to 70% of distributable cash flow, which will protect its 8% dividend yield.

Enbridge Inc.

EBITDA growth from the acquired assets and the rest of the growth portfolio will provide financial flexibility to reduce leverage over time.

ENB has a BBB+ credit rating, which is one step below the A- range. It’s one of the best balance sheets in the industry.

The company is expected to get formal approval and close the deal in 2024.

Dividend & Valuation

ENB yields 7.8%. This is higher than any major high-quality utility company and in line with some of the best midstream companies.

This yield is protected by the company’s commitment to maintain a 60% to 70% DCF payout ratio and roughly 8.5% 2023E free cash flow yield. This yield includes investments in maintenance and growth. By 2025, that number is expected to grow to almost 10%.

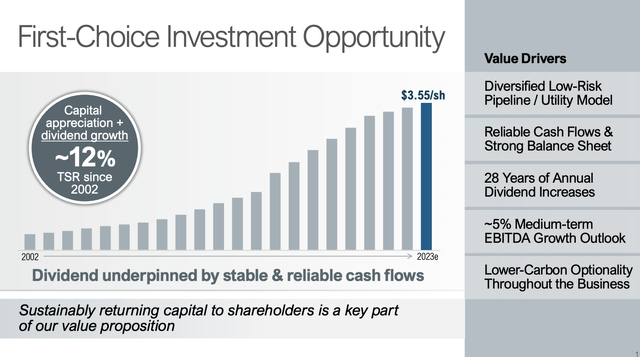

The 5-year dividend CAGR is 5.1%. On November 30, 2022, the company hiked by 3.2%. I expect dividend growth to remain in the low-single-digit range until it has lowered post-acquisition debt.

The company has hiked its dividend for 28 consecutive years, making it a Canadian dividend aristocrat.

Enbridge Inc.

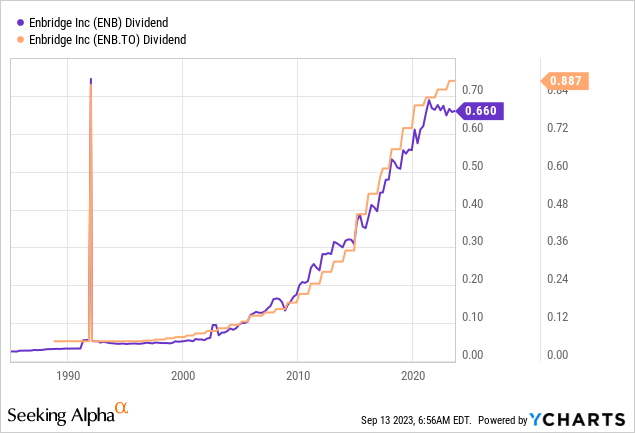

However, non-Canadian investors need to be aware that CAD/USD (or whatever currency you use) fluctuations impact the dividend you receive.

This is what the long-term chart of dividends from Toronto and NY-listed ENB shares looks like:

Having said that, due to the company’s diversification, I believe it offers the best of two worlds: midstream operations and low-risk utility income in areas with above-average growth. Its diversification and low-risk income profile make it a great long-term play with a safe 8% yield.

I believe Enbridge is one of the best high-yield plays money can buy in its areas, making it a great tool for income-focused investors and investors looking for diversification without wanting to buy too many single stocks.

The company is trading at just 12x forward earnings. Its consensus price target is $42.70 (in New York). That’s 25% above the current price.

I agree with that assessment and believe that ENB has room to rise to $45-$50 in the next two to three years.

So, if I weren’t focused on dividend growth, I would make ENB a big part of my portfolio. It’s starting to turn into a mini-ETF thanks to its diversification.

I also really like the dividend yield and believe that ENB has a very bright future.

Takeaway

With its recent acquisition of Dominion Energy’s natural gas assets, ENB has become the largest natural gas distributor in North America, solidifying its position as a leading pipeline operator.

ENB’s history of diversifying its business and its focus on take-or-pay contracts provide a strong foundation for stable cash flows. The new utility acquisition further enhances its growth prospects, doubling its utility business size and positioning it as a first-choice natural gas utility franchise in North America.

The company’s strategic moves ensure that it can weather fluctuations in the energy market while its commitment to maintaining a 60% to 70% payout ratio and strong free cash flow protect its impressive 7.8% yield.

ENB’s 28-year history of dividend growth and its focus on safety, sustainability, and community engagement make it an attractive long-term play. Trading at just 12x forward earnings, with a consensus price target significantly above its current price, there’s ample room for growth.

If you’re an income-focused investor or looking for diversification in your portfolio, ENB is a compelling choice. With its combination of high yield, solid fundamentals, and growth potential, ENB is shaping up to be a mini-ETF that offers a bright future for investors.

Read the full article here