Introduction

When looking for stocks that provide passive income for your retirement, you are looking for some safer investments that help you sleep at night. VICI Properties (NYSE:VICI) is a stock that has been adored by many dividend investors. As such, VICI might be considered as a boring stock, but that’s exactly what you want in your retirement portfolio. A stock that pays you every quarter while having some capital appreciation along the way.

Currently, the stock gives a 5.32% dividend yield, and we believe VICI is an interesting buy with this yield on cost (of course without the fundamentals significantly changing).

Today we will take a look at this beautiful casino REIT and we will discuss how you can increase this yield even further.

Dividend Compounder Which Pays Quarterly

While VICI is by no means a dividend aristocrat like Realty Income (O), the company has a lot of potential and has shown to be a well-managed casino REIT, while people gamble their money away at the casino, you are able to compound your hard-earned money in VICI.

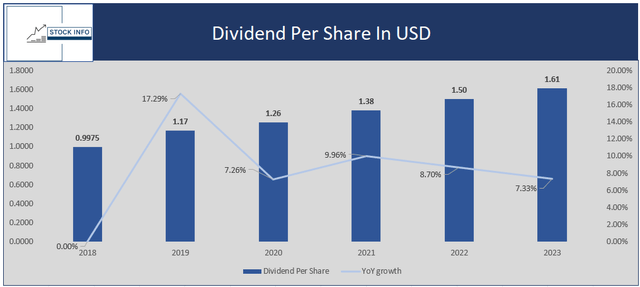

VICI has only been paying out a dividend since 2018. As such, we could say that this is a relatively young REIT in an exciting industry. Below you can see the dividend and its yearly increase since it started paying a dividend in 2018. As can be seen, the dividend has steadily increased over the last 5 years, and we made an estimation that the Q4 payout will also be $0.415 per share, equal to the Q3 payment. In total, this would give a $1.61 dividend per share for 2023.

Stock Info

As can be seen in the chart above, the company has increased its dividend at a steady pace. This results in a dividend CAGR since inception of 8.31%, which is very impressive.

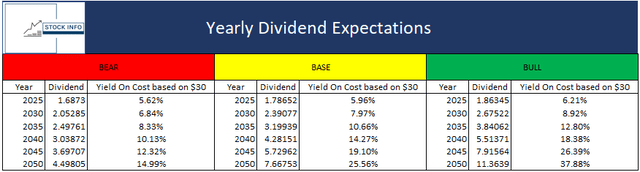

Let’s take a look at some of the dividend projections through 2025. We will do this by taking a look at a bear case, a base case, and a bull case. All these numbers are projected using the starting yearly dividend of $1.5, which equals the total dividend received in 2022. In addition, we start from a share price of $30 for simplicity.

In the chart below, you can find the expectations for each 5-year period starting from 2025.

Bear Case: For the bear case we used a 4% annual dividend increase, which is below the $1.73 per share consensus for 2025. In addition, this is below the long-term inflation expectation from the bond market, as the 10-year Treasury Rate is currently at 4.26%. Currently, this would give a 5.62% yield on cost in 2025 and almost a 15% yield on cost in 2050.

Base Case: For the base case we decided to use a 6% annual dividend increase. While this is still below the forward growth consensus of 7.14%, we want to be sure we are on the safer side with these investments, as it obviously is based on guesses and thus warrants a margin of safety. This would give a 5.96% yield on cost in 2025 and over 25M yield on cost in 2050.

Bull Case: For the bull case we picked a 7.5% dividend increase, which is above the consensus rate of 2025, but below the current 8.31% CAGR since inception. This would give a 6.21% yield on cost in 2025 and a close to 38% yield on cost in 2050.

Stock Info

This doesn’t sound too bad for the long-term income-seeking investor, I would say. This isn’t even taking into account the potential of capital appreciation and dividend reinvestments. For reference, the stock has appreciated close to 72.50% since going public in late 2017. If you were lucky enough to pick the March 2020 bottom in VICI you would have made a 216.65% return already, excluding dividends.

This means the stock has risen around 9.59% per year on average excluding dividends. Pretty solid right? In contrast to Realty Income (O), which we did a similar piece on a while ago, VICI stock is probably able to continue growing at a similar pace for a bit longer, making this an interesting investment opportunity for income-seeking investors.

In addition to collecting your dividends each quarter, we will discuss how you can get paid even more for holding your shares of VICI Properties in the next part of this article.

Compounding On Steroids

While I’m not typically a dividend investor myself due to unfavorable tax policies regarding dividends in my home country, I’m a big fan of generating capital while holding shares. This will be no surprise to my regular readers; in this part we will be discussing covered calls, though this isn’t the only strategy to generate extra income. In addition to the covered call, we will be discussing the cash-secured put as well. Held together, these two strategies are called a short strangle.

In general, a short strangle is a strategy that is used if one wants to capitalize from a stock trading in a specific range over a specific period of time. In this case, we will be using this strategy so that you, the income-seeking investor, generate even more income while holding your shares.

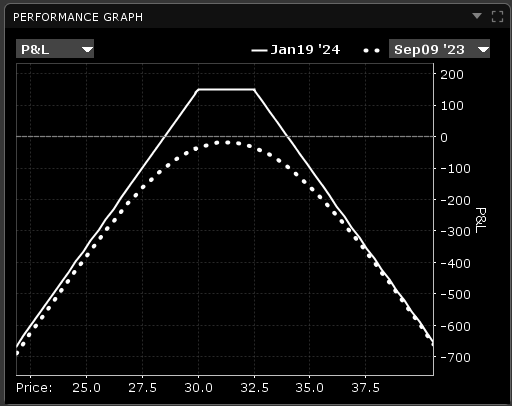

Let’s say you don’t mind buying 100 shares of VICI at $30 per share on January 19th of ’24. At the moment of writing, this cash-secured put gives you $.97 or $97 in total as each option contract in the US market has an underlying of 100 shares. This represents a 8.60% return on a yearly basis at the moment of writing. Keep in mind that a cash-secured put requires that you put up $3000 in collateral, to buy the shares in case you get assigned.

In addition to the cash secured put, we also write a covered call. Let’s say we don’t mind letting go of 100 VICI shares at $32.5 per share, which is the upper side of the current trading range. If we take the same expiration date (January 19 th 2024) this would give us around $0.71 or $71, representing a 6.29% return on a yearly basis.

In total, this would mean we would have collected an additional $168 on top of the dividends we collected along the way. Keep in mind this is based on a 100 share example. If you want to use this strategy with 1000 shares, you would just sell 10 contracts of each resulting in a premium collected of $1680.

Given you can do this options strategy almost 3 times a year in this case, this would generate an additional $5 in income per share each year. In total to the expected $1.61 dividend for this year, this would give a total of $6.61 per share or a yield of 21.19%.

Obviously you can tweak this strategy as you see fit. For example, if you feel like the share price of VICI is getting a bit high, you can decide to sell more covered calls. If you feel like VICI shares are getting too cheap you can decide to sell more cash secured puts.

Furthermore, you don’t have to hold these contracts till expiration, and you can take one side off as you see fit. It is important that you manage this to make sure you roll the contracts in time if you don’t feel like letting go of 100 shares or if you don’t want to buy an additional 100 shares due to a change in the fundamentals. In addition, I wouldn’t advise doing this on your full position, especially not the put side due to the risk of a black swan event, for example the covid-19 crash.

Below you can see a graph of the P&L curve of this option strategy at the date of opening the position. The solid white lines shows the P&L of this strategy at expiration date ( January 1th 2024). You can see that the breakeven bounds of this trade would be around $29.51 and $32.87 respectively, if held until expiration.

Stock Info with IBKR

You can also take this strategy off way earlier if you don’t feel like holding till expiration or for other reasons. For example, you could set a take profit at around 25 or 50% and then just repeat the strategy with adjusted strikes at a further expiration date.

Great Execution + Straightforward Business

VICI, alongside with the rest of the REITs has been underperforming in 2023 and for good reasons.

While VICI has robust fundamentals the elevated interest rates alongside macroeconomic headwinds have been dreadful for the REITs. The company is currently down 11% since the end of January and in the short-term the stock price might deteriorate further.

Nonetheless, VICI continues to execute. The company is seeing strong earnings growth and I believe a multiple expansion towards 18x P/FFO could occur.

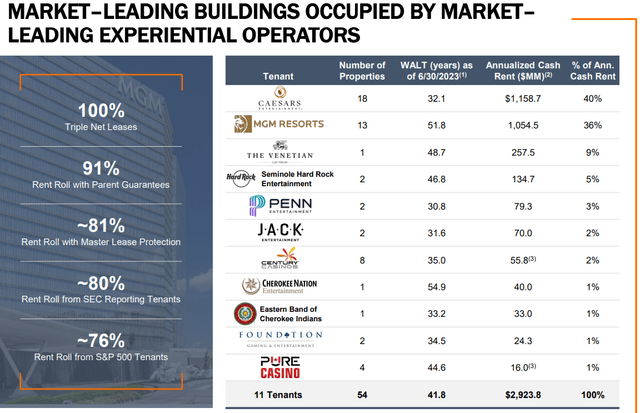

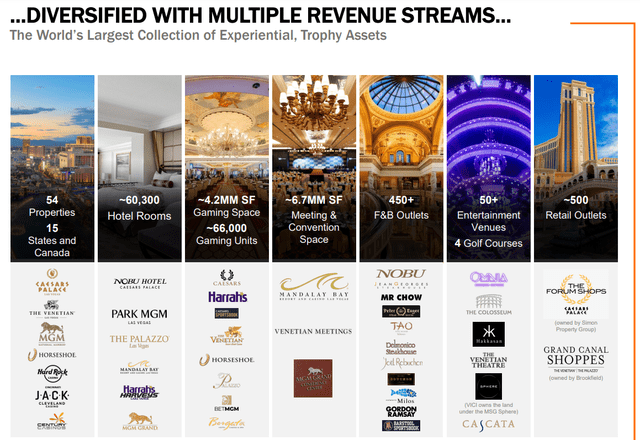

The company has a growing portfolio in both Canada and the United States, currently counting over 54 leading gaming facilities, such as Caesars Palace (CZR) in Las Vegas and over 450 restaurants, bars, clubs, and sportsbooks on over 124M square feet.

VICI is a qualitative owner of entertainment and experiential properties, including casinos and even 4 golf courses. Most impressively, the company boasts a 100% occupancy rate, which is simply incredible in times of macroeconomic hardship.

VICI Investor Page

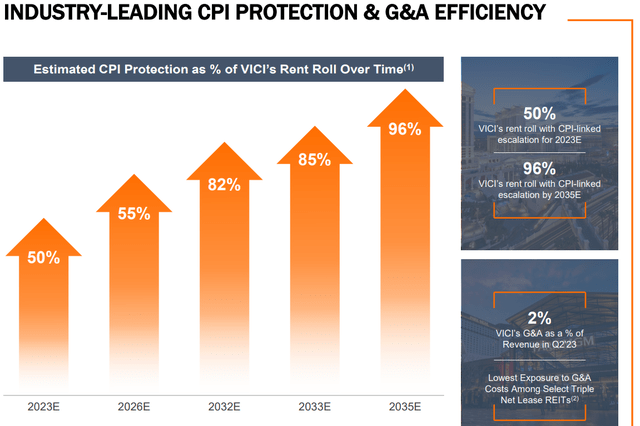

In addition, VICI focuses on long-term leases, with the average lease term being 41.8 years, and with a 100% occupancy rate, that’s very impressive. Furthermore, the company’s management has proven to be a great capital allocator. In addition, VICI mostly works with leases that are linked to CPI-escalators over the long term, which differentiates itself from other REITs.

VICI Investor Presentation

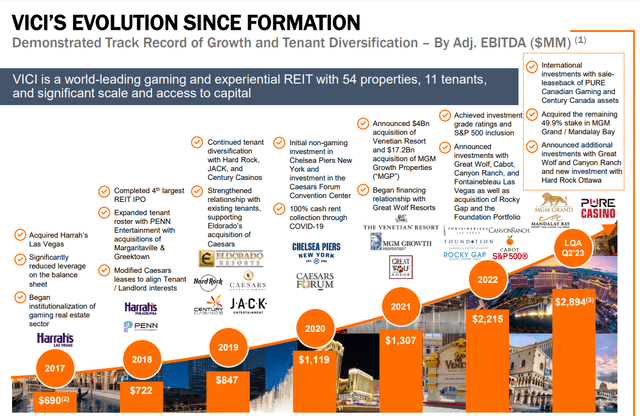

In the slide below from the recent investor presentation that was released on the 7th, you can see VICI’s track record of growth.

VICI Investor Presentation

While VICI isn’t as diversified as a lot of other REITs, such as O or Agree (ADC), VICI has the high-quality properties to make up for that; two tenants are responsible for over 75% occupancy of VICI’s portfolio. This is due to the fact that Caesars and MGM are 40% and 36% respectively of the company’s ABR. Nonetheless, this provides some unnecessary risk and we believe that as the company matures and continues to expand they will diversify further. Due to the high quality of both of these properties, we don’t see an issue with this in the short-term.

Again, I would like to emphasize that the company’s assets are more than likely one of the best out there. For example, Caesars is one of the most iconic and well-known casinos in the world. The chart below shows some of the key numbers and tenants.

VICI Investor Presentation

The company has mentioned that it intends to continue its impressive growth trajectory by diversifying into other experiential sectors. The execution of the management team is really remarkable. Since its IPO in 2017, the company has managed to become one of the top REITs in the United States and got added to the S&P 500 (SPY). There are very few companies that have been able to accomplish this in such a short time frame, especially in such a tough industry as real estate.

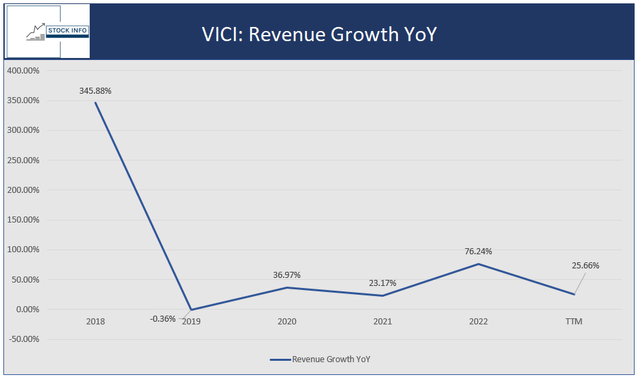

Strong Revenue Growth and Investment Grade Balance Sheet

As mentioned earlier, VICI has a strong growth trajectory, and has shown that they are able to continuing growing. The company has grown its revenues from $201.4M in 2017 to $3.34B over a trailing-twelve month period. The chart below shows this revenue growth on a year-on-year basis. This gives a 3 and 5Y revenue CAGR of 39.72% and 30.16% respectively.

Stock Info

VICI is focused on high-quality investments in the gaming and experiential sector. The company is a leader in this sector and while it may not be as large or have such a long history as many other REITs, the company definitely makes up for this in quality and execution.

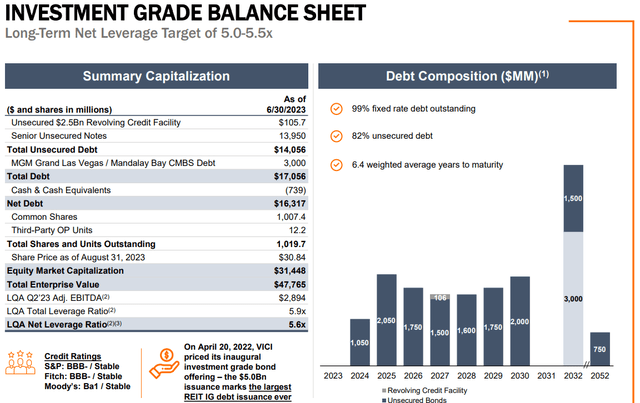

VICI is focused on triple-net leases, which are meant to preserve consistent cash flows. In addition, VICI is committed to maintaining its high investment-grade debt ratings, as can be seen in the chart below.

VICI Investor Presentation

Risks

While the macro headwinds and elevated rates might remain an issue for a while longer, we believe VICI has shown its ability to execute during these rough circumstances and we believe that it will continue to do so in the future.

Furthermore, if the economy takes a turn for the worst, VICI is still positioned well due to these long-term agreements that must be fulfilled. As such, we believe as long as the management continues to execute and further diversifies with quality assets the company should be able to continue its strong growth trajectory.

VICI Investor Presentation

Technical Analysis

You might be thinking, “I don’t care about TA, because I plan on holding this stock for years”. That’s definitely a valid point and for the long-term holders, fundamentals are more important. Nonetheless, even you can benefit from some quick technical analysis. TA gives you the ability to identify possible key levels, which can help you with deciding when to add some more shares or when to sell some shares.

In addition, technical analysis can also be very helpful for the option strategy, which helps generate extra income. TA can be a very useful tool to help you decide when you might want to sell some puts or calls.

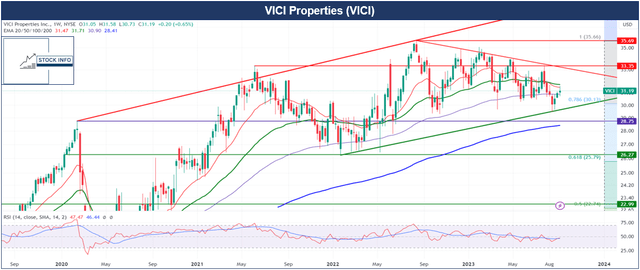

Let’s take a quick look at the chart. As you can see, VICI is moving between the down-trending red trendline and the up-trending green trendline. This pattern is what we call a symmetrical triangle, the green support line has proven to be a solid support a month ago and is currently the main price point to be looking out for. This level also corresponds with the $30 zone, which provides an interesting entry point.

On the other hand, we’ve got the purple resistance line, which last week coincided with a strong horizontal resistance level (red line). As you can see, this was a strong resistance level and VICI Properties stock was unable to break above this level.

Stock Info with Tradingview

Conclusion

In conclusion, VICI Properties stands out as a perfect income investment for retirement. It provides a reliable source of passive income for investors due to its increasing quarterly dividends. Additionally, the company’s focus on long-term leases of its high-quality assets and its 100% occupancy rate with an average lease time of 41.8 years ensures consistent cash flow even in challenging market conditions.

We believe the short strangle strategy provides an enticing way to generate additional income through covered calls and cash-secured puts, further enhancing the overall yield. VICI’s execution and commitment to maintaining a strong investment grade bolsters its position as a solid income generator.

Technical analysis indicates potential buying opportunities around the $30 support level, making it an appealing prospect for investors seeking income and capital appreciation.

In summary, VICI emerges as an attractive choice for retirement portfolios, offering stability, income, and still strong growth prospects, making it an excellent income investment for the long term. As such, we currently rate VICI as a buy.

Read the full article here