Thesis

MP Materials (NYSE:MP) is a distinct company operating in a niche market. It is among the few rare earth element [REE] miners with operational mine in the Western Hemisphere. MP plans to become a fully integrated company covering upstream, midstream, and downstream operations. The company has solid financials to support its expansion plans. In short, MP is a geopolitical bet on REE market fragmentation.

Rare earth elements 101

REE, along with uranium, are truly geopolitical instruments to assert power. A few countries and state-owned enterprises dominate its production. The dominant players are China in REE and Russia in uranium. Those commodities are trump cards in the hands of their ruling elites. However, these pronounced imbalances present an excellent opportunity for asymmetric investments.

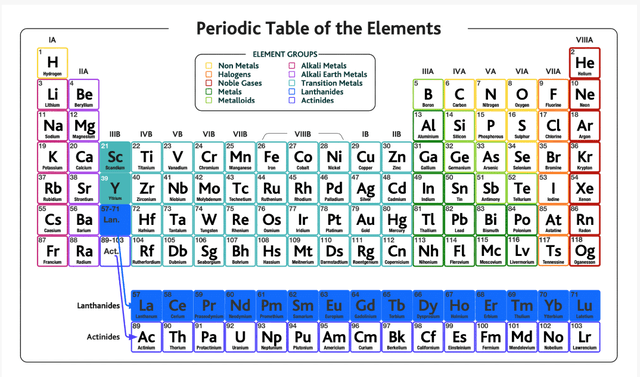

The group of elements on the row labeled “lanthanides” on the periodic table of details, marked in blue, are rare earth elements. However, due to their similar chemical characteristics, yttrium (Y) and scandium (Sc) are also considered REEs.

E Tech resources

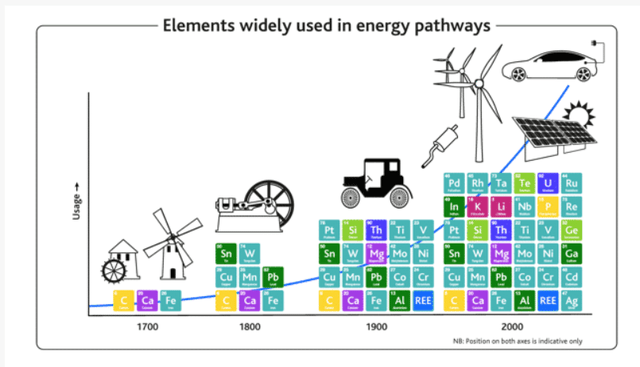

These elements are collectively known as “rare earth” since they were initially discovered in uncommon minerals and were difficult to extract. They are not particularly rare findings in the Earth’s crust. Many high-tech applications rely on rare earth elements, such as electronics, renewable energy technologies (including wind turbines and electric vehicle batteries), catalysts, and more. This is because of their unique characteristics. They are also used to produce powerful permanent magnets, which are crucial for many modern technologies. The image below shows the significant purposes of REE:

E Tech resources

Due to the importance of rare earth elements in various industries, their supply has strategic significance. For example, the magnets in some of America’s commercial and military equipment and Virginia-class attack submarines are made from REE.

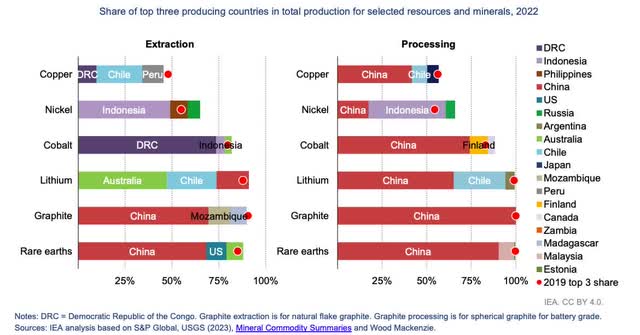

The world depends heavily on China for various materials, including REE.

International Energy Agency

China dominates in extraction and processing. The quote from an insightful article published in Politico summarizes it:

China could easily decide to restrict access to rare earths again, with disastrous consequences. Today, China accounts for 63 percent of the world’s rare earth mining, 85 percent of rare earth processing, and 92 percent of rare earth magnet production. Rare earth alloys and magnets that China controls are critical components in missiles, firearms, radars, and stealth aircraft.

Company Overview

MP Materials Corp. is one of the few producers of rare earth materials in the Western Hemisphere.

The company owns and operates the Mountain Pass Rare mien and North America’s sole facility for mining and processing rare earths. MP Materials is transitioning from producing and selling rare earth concentrate, which they ship to China for refining, to producing and selling separated rare earth commodities globally.

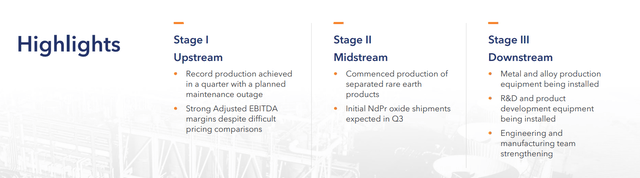

This strategic shift places MP Materials in a pivotal position in the supply chain for essential components for cutting-edge technologies. This is in addition to their partnerships and expansion plans. The image below from the last company’s presentation shows the stages:

MP Materials company presentation

Stage 1:

MP Materials’ operations center is the Mountain Pass Mine and Processing Facility—the concentrate production at this facility is marketed to Chinese refiners. About 15% of the rare earths produced globally are produced by the Mountain Pass mine, which started operating again in 2012 after years of idleness.

MP Materials’ Stage 1 operations sell concentrate products to Shenghe Resource Holding for further distribution to other downstream refiners in China. Except for MP Materials’ refining capabilities (which are currently undergoing renovation as part of the Stage 2 project) and one other plant in Malaysia, there are few downstream rare earth refining factories of scale outside of China. This reality is the main driving force behind MP Materials’ goal to reintroduce this vital industrial capability to the United States.

Stage 2:

Stage I provided a solid foundation with concentrate production, while Stage II was about refining. By converting to supplying rare earth elements, particularly the highly sought-after NdPr oxide, the company is positioned to capture a larger market share and demand higher prices. By focusing on NdPr oxide, MP Materials is effectively chasing these expanding industries, possibly ensuring continuous demand.

The partnerships with Sumitomo Corporation of America demonstrate MP Materials’ growth potential. These partnerships provide broad revenue streams and a solid business plan to withstand market fluctuations. In essence, Stage II will highlight MP Materials’ transformation into a market leader for rare earths on a global scale.

Additionally, the business has started construction on a brand-new manufacturing plant in Fort Worth, Texas, where the Mountain Pass minerals will be transformed into metals, alloys, and magnets.

Stage 3:

With the collaboration between MP Materials and General Motors (GM), a significant turning point in the transition toward electrification has been attained. Thanks to a long-term supply agreement, the Ultium Platform from GM will have a dependable domestic source of crucial rare earth materials. This will begin a new age of American independence in the electric vehicle supply chain.

Shareholders

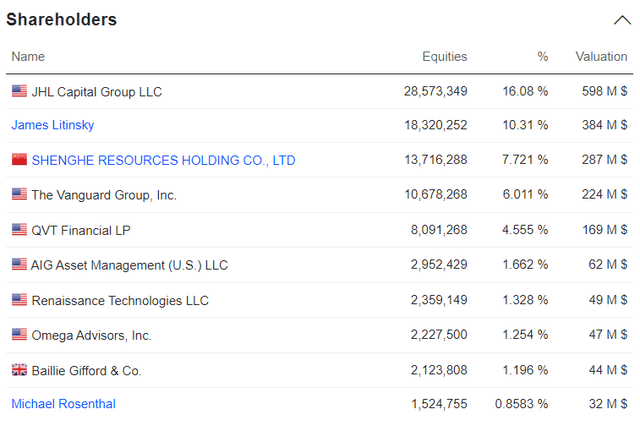

The company`s shareholders are worth special mentioning. The image below from Market Screener shows who are the major shareholders in MP:

Market Screener

James Litinsky is MP`s CEO, owning 10.3 % of the company shares. Besides that, he is the CEO and founder of JHL Capital Group, the largest shareholder. JHL is an alternative investment firm. More interesting is the third largest investor: Shenghe Resources. As stated by Senator Lisa Murkowski, Chinese enterprise among the shareholders represents risks considering the tensions between China and the US and the crucial importance of REE for the US defense industry.

Company Financials

The company balance sheet is impressive, considering the declining revenues and significant investments in expansion. The table below shows the liquidity and solvency metrics. The data is from the last company report:

|

EBITDA/Interest expense |

35.8 |

|

EBITDA-CAPEX/Interest expense |

-27.2 |

|

Quick Ratio |

16.1 |

|

Current Ratio |

15.1 |

|

Net debt/EBITDA |

(1.3) |

|

Net Debt/ EBITDA – CAPEX |

1.7 |

|

Long-term debt/Equity |

50.1 % |

|

Total debt/Equity |

50.2 % |

|

Total liabilities/Total assets |

40.4 % |

The liquidity ratios are among the highest in the mining industry. The CAPEX was a significant drag, as seen in EBITDA-based ratios. However, investments in PPE (plant, property, equipment) will bear fruit in the long term.

MP Q2 performance

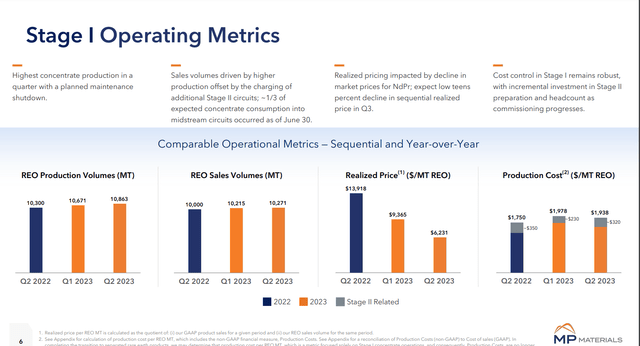

The last months were thought for commodity producers, including MP. The image below shows the Q2 results:

MP Materials presentation

The company highlighted record Stage 1 production for the quarter despite a planned maintenance downtime. However, the declining commodities prices adversely affected the company`s revenues. I want to point out the growth in production and sales volumes. As a commodity producer, MP does not have pricing power, and increasing output and sales are the only two variables they can control. They are the only source for the company’s long-term growth, apart from the spot price. However, the latter is out of control for the miners.

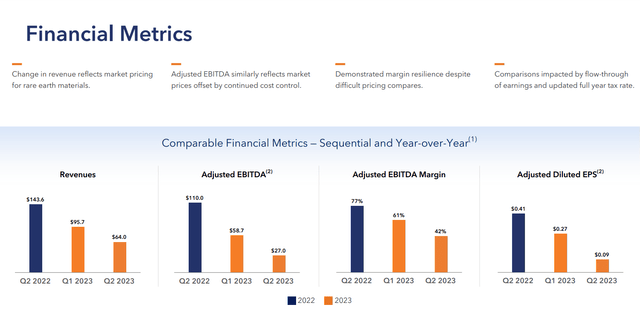

The chart below shows the financial metrics from the last quarter report:

MP Materials Q2 presentation

With growing demand and tightening supply due to the strategic importance of REE, I expect their prices to rebound in the following months. As long as MP keeps its production costs stable, its profit margins will grow, thus improving the company`s bottom line. On top of that, the progress to Stage 2 and Stage 3 developments will add diversified revenue streams.

MP Materials profitability

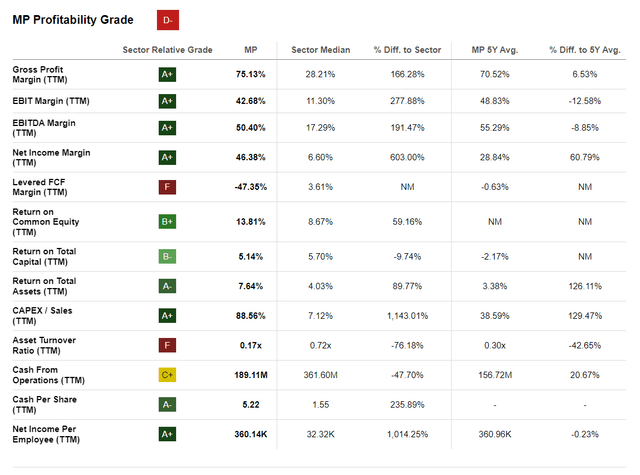

The chart below compares. MP`s profitability metrics with the industry and its five-year average:

Seeking Alpha

Despite lousy performance from the last quarters, MP maintains higher-than-average profitability metrics. What I like is the Capex to sales ratio. It is a long-term indicator of the company’s future revenue. MP CAPEX/Sales exceeds ten times the industry average and the company`s five-year average.

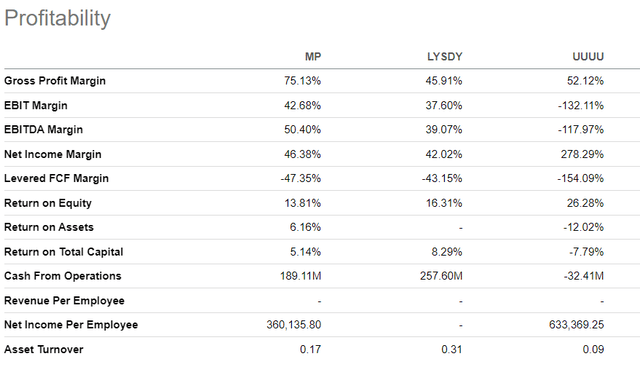

Going deeper in detail in the image below, I weigh MP`s metrics with Energy Fuels (UUUU) and Lynas Rear Earths. The former is a fully integrated producer of uranium and vanadium in the USA, while the latter is Australia’s largest REE miner.

Seeking Alpha

As seen, MP has the highest profit margins. In the long run, the margins and free cash flow matter the most. Expecting growing tensions between China and the West and Malaysia’s intentions to ban REE exports, their prices will soar significantly.

Valuation

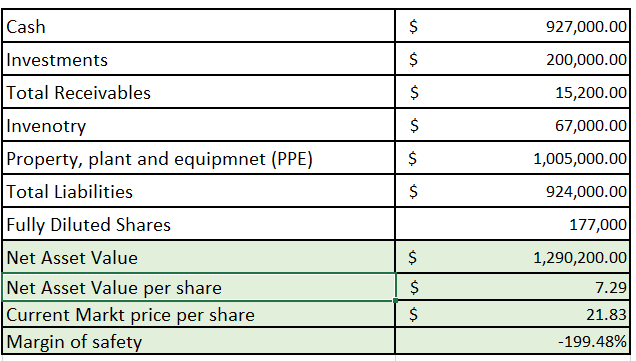

MP Materials does not have pricing power, and its business is capital-intensive, focusing on tangible assets. These features make the use of cash flow-based valuation methods dangerously misleading. On the other hand, the company has yet to generate free cash flows for now, and using the DCF methodology will obtain misleading outcomes.

I calculate NAV as follows:

NAV = NetPPE + cash + short term investments + inventories + total receivables – total liabilities

The table below shows the results. All data is taken from MP’s last report. The numbers are in thousands of USD.

MP Materials Q4 financial statement and author`s database

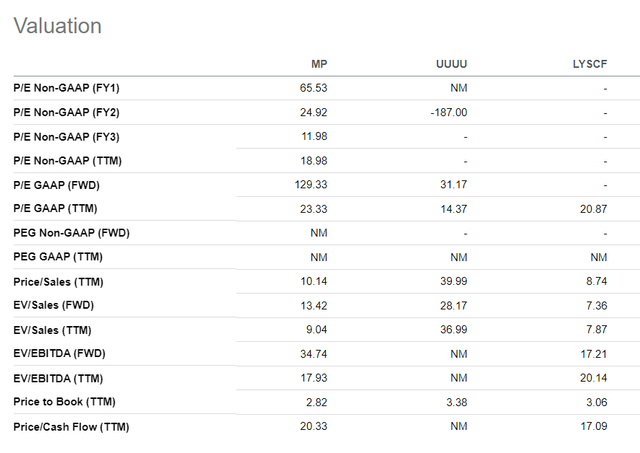

Valuing MP against its peers is challenging because they are almost nonexistent. I used earlier UUUU and LYCFT for measuring profitability. To estimate MP`s relative standing, I use those companies again.

Seeking Alpha

The juxtaposition is imperfect due to the unique positioning of every enterprise. However, comparing MP to polymetal miners such as BHP or Rio Tinto is less misleading. Using EV/Sales and Price/Cashflow, MP is in the middle.

Risk

MP Materials is a geopolitical wager betting on exacerbating REE supply issues. As an upstream company, MP carries all risks inherent to miners.

- Metallurgical risk

- Geological risk

- Economic risk

- Financing risk

The company has profound expertise in operating the Mountain Pass mine. That said, the geological and metallurgical risks are minimal. MP has an incredible balance sheet for a mining company, mitigating the financial risk. The company has extra liquidity to serve as a buffer and provide funds for the company`s expansion. Economic growth, interest rates, and inflation represent the economic risk. China, as a source of demand, has a significant role too. The political risk is the major contributor to unknowns in MP`s operations. It has twofold implications.

The role of REE in the US defense sector is crucial, and dependence on Chinese enterprises for refining REE concentrates carries notable risks. Shenghen ownership is deeply disputable and has been raised as a danger to national security.

Conclusion

MP Materials is a curious company comparable to Centrus Energy (LEU). Both are pivotal for the US defense industry and national security while depending on China and Russia for raw materials and processing. MP is positioned uniquely to become the sole fully integrated producer in the Western Hemisphere. The company has the financial resources to achieve its goals. Its balance sheet has enough liquidity to keep MP out of trouble while expanding its business.

The price compared to NAV is high, but I use PPE book value. The company`s PPE is complicated to evaluate due to its distinct nature. There are not many REE operations outside China and Malaysia with public records. Hence, we can estimate PPE value using a sales comparison approach.

Despite the higher stock price and last quarter’s poor financial performance, I give MP a buy rating due to its positioning to become the leader in the REE industry. Buying MP stock is a long-term investment with at least 24 24-month horizon. Any price declines are welcome to add to the position.

Read the full article here