Investment Thesis

Floor & Decor Holdings, Inc.’s (NYSE:FND) stock price has increased ~35% since my bullish article last year, outperforming S&P 500 (SPY). Looking forward, the company’s same-store sales are expected to see a decline in the near term due to the slowdown in remodeling market as high inflation and interest rates impact consumer budgets. The company’s margin outlook is also muted in the near term. While gross margin is expected to improve, SG&A deleverage from declining comparable store sales should offset it to a good extent. Management is executing well, trying to gain market share through focus on PRO and commercial customers and opening new stores. However, I would like to move to the sidelines given the near-term headwinds, and wait for the remodeling market to bottom. So, I am changing my rating to neutral.

Revenue Analysis and Outlook

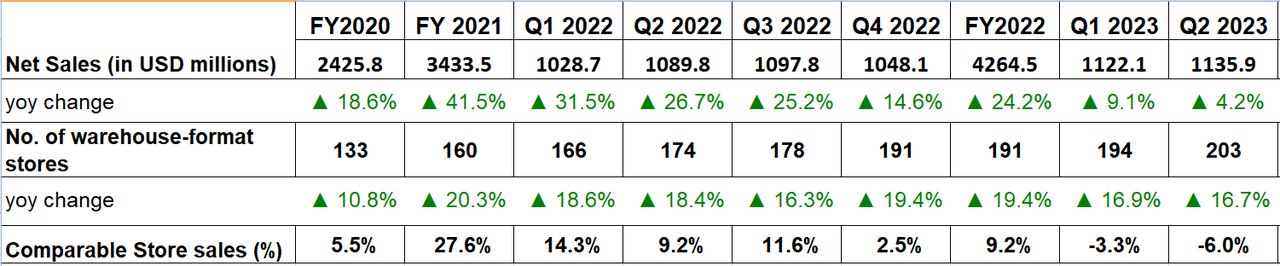

After seeing good growth post-pandemic, FND’s comparable store sales are getting impacted from slowing remodeling market in recent quarters. In the second quarter of 2023, the company’s sales increased 4.2% Y/Y to $1.13 billion, but the growth was entirely driven by new store opening, partially offset by 6% Y/Y decline in comparable store sales. The decline in comparable store sales was driven by a 7.1% Y/Y decrease in comparable customer transactions due to declines in existing home sales, higher borrowing costs, and high inflation which is impacting consumer budgets. The decline in transactions more than offset a 1.1% Y/Y increase in comparable average tickets from retail price increases and benefits from a slight improvement in revenue mix from PRO customers as well as design initiatives.

FND’s Revenue Growth and Key Metrics (Company data, GS Analytics Research)

Looking forward, the company’s revenue outlook is mixed with near-term headwinds from the current challenging macroeconomic environment and longer-term opportunity of market share gains.

I closely cover many home builders, building product companies, and home improvement retailers, and one clear trend that has emerged from their commentary of late is that while the new construction market has turned out to be much better than initially feared at the beginning of this year, remodeling business is faring worse. The strength in the new construction business can be attributed to a significant underbuilt of new homes post the great housing recession of 2008, a phenomenon which I have explained in a previous article. This has resulted in a quick recovery in this market due to tight supply and we have seen July housing starts turning positive Y/Y. This is helping the companies exposed to the new construction end-market.

However, the same cannot be said for the remodeling market. On the one hand, existing home sales have continued their downward trajectory, while, on the other, high interest rates and an inflationary environment have impacted consumer budgets. As a result, this market is seeing fewer projects by homeowners and the scope of these projects has also been reduced. With Floor and Decor exposed primarily to the remodeling market, the company is witnessing this headwind.

Below is an excerpt from the company’s President Trevor S. Lang talking about the situation on the company’s last earnings call,

Overall, homeowners and pros are engaging in fewer projects and undertaking smaller-scale flooring projects and are very intentional in their purchase decisions. For example, they are choosing a single bathroom project rather than a bathroom in kitchen project or a full room project rather than a 5-room project. Additionally, the cost of financing projects has risen due to the increase in interest rates, fewer subsidized financing programs and tighter lending standards. Collectively, we believe these factors are contributing to us selling less square footage when compared with last year.”

I expect this challenging situation to continue in the remodeling market in the near term and there is little scope for this market turning unless the inflation is brought under control and the U.S. Federal Reserve starts cutting rates.

If we look at management commentary at the time of their earning release in August, they commented that quarter-to-date comparable store sales in Q3 were down 8.4% which was worse than 6% Y/Y decline in sales in Q2 2023. So, sales trends are getting worse and are likely to disappoint investors again when the company releases its Q3 results.

However, despite this challenging situation, management is executing well and controlling what it can control. The retailer is maintaining its price gap versus peers, which is a key competitive advantage for FND and has helped it gain share in the past. The company is also introducing new assortment and SKUs. Further, as explained in my previous article, the company is focused on PRO sales growth, expansion in the commercial market, and new store opening to drive growth, and it is making good progress on each of these fronts. The company is gaining good traction in its Pro Premier Rewards (PPR) loyalty program, and in the last quarter, over 80% of its Pro sales came from PPR members while PPR points redeemed increased by 73% Y/Y. On the commercial flooring side, the company’s total sales increased 40.5% Y/Y with the regional account managers (RAM) sales increasing 39% Y/Y. The company has also acquired Sales Master Flooring Solutions, a NY-focused commercial flooring distributor in June which should help the company expand its presence in the large and fragmented New York City market.

The company also continues to open stores in new as well as existing markets and plans to open 11 new warehouse-format stores in Q3. The company’s long-term store count target remains at 500 stores, which is more than double the current levels, providing a long pathway for growth. These initiatives should help the company gain market share in the long run and outperform the broader category growth.

Overall, the company’s outlook is mixed with muted sales in the near term but good medium to long-term prospects once the inflationary environment and interest rate cycle reverses.

Margin Analysis and Outlook

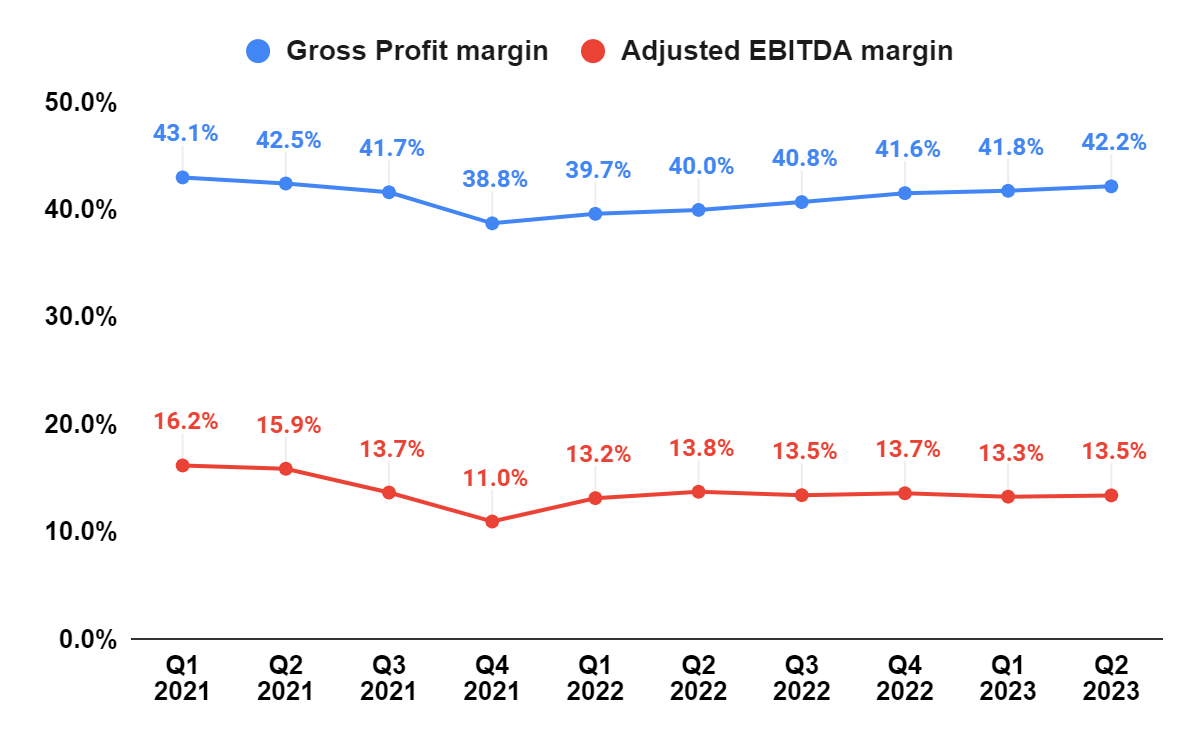

In Q2 2023, the company saw a 220 bps Y/Y improvement in gross margin to 42.2%, driven by retail price increases taken to offset higher Y/Y supply chain and product costs. Selling and store operating expenses as a percentage of net sales increased 290 bps Y/Y to 27.4%, primarily due to higher occupancy costs for new stores, wage increases, higher credit card transaction processing fees, and fixed costs deleverage as a result of lower comparable store sales. The higher operating expenses outweighed the improvement in the gross margin which resulted in a 30 bps Y/Y decrease in adjusted EBITDA margin to 13.5%.

FND’s Gross margin and Adjusted Operating margin (Company data, GS Analytics Research)

Looking forward, I expect the company’s gross margin to continue benefiting from the carry-forward impact of price increases implemented in the past quarters coupled with opportunistic price increases moving forward as well. Further, the supply chain and product cost inflation are also expected to sequentially ease, which should help gross margin. However, on the operating margin side, I expect continued SG&A deleverage as volumes continue to be under pressure. So, on the operating margin front, I am expecting a flattish trend. Overall, margin outlook is also mixed with gross margin improving and SG&A deleverage offsetting it to a good extent.

Valuation and Conclusion

FND is currently trading at a 38.93x FY23 consensus EPS of $2.42, which is a slight discount versus the company’s 5-year average forward P/E of 41.91x. However, after ~35% run-up since my bullish rating last year, FND’s valuations are not extremely cheap as was the case at the time of my previous article. I am not too keen to give it a buy rating at these levels given the near-term revenue headwinds and the associated impact of same-store-sales deleverage on margins. I prefer waiting for remodeling industry to bottom before becoming more positive on the stock. Hence, I am moving to a neutral rating.

Read the full article here