The Invesco CurrencyShares Japanese Yen Trust (NYSEARCA:FXY) offers investors a way of taking advantage of the Japanese yen’s extreme undervaluation and the reversal in monetary policy trends in Japan and the US. The FXY holds Japanese yen in a deposit account held by JPMorgan Chase (JPM) and charges a 0.4% expense fee. As overnight interest rates in Japan have been negative over the past 7 years, the FXY has actually lost 0.5% annually relative to the USDJPY exchange rate. I last called for a reversal in the yen and the FXY in April and since then the ETF has lost a further 10% as US real yields have risen further. However, since then the Bank of Japan has taken steps to tighten monetary policy while the US tightening cycle appears to have ended.

Yen Extremely Undervalued Thanks To BOJ Reflation Attempts

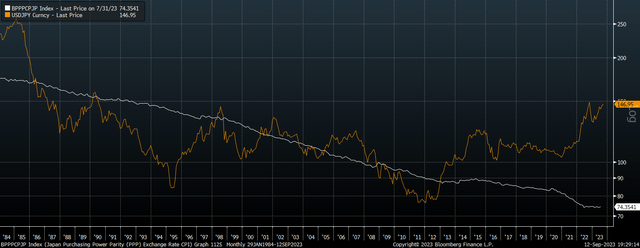

The Japanese yen has been the single worst performing major currency since policymakers opted to ‘reflate’ the Japanese economy in 2012, losing almost 50% of its value against the dollar over this period. Only the Turkish lira has suffered more over this period. The yen was not particularly overvalued in 2012, and since then its inflation rate has averaged 2% lower than the US. This means that the yen has lost over 60% of its value in real terms versus the US dollar. This can be seen in the chart below which shows the USDJPY exchange rate against its fair value as measured by the general price differential between the two countries.

USDJPY Vs Fair Value Based On Price Levels (Bloomberg)

The 60% decline in the real value of the yen relative to the dollar over this period has been almost entirely the result of punitively low interest rates in Japan relative to the US. While it is real yields not nominal yields that drive currency moves, even with lower rates of expected inflation, bond yields have been so depressed that real yields have moved significantly in the dollar’s favor.

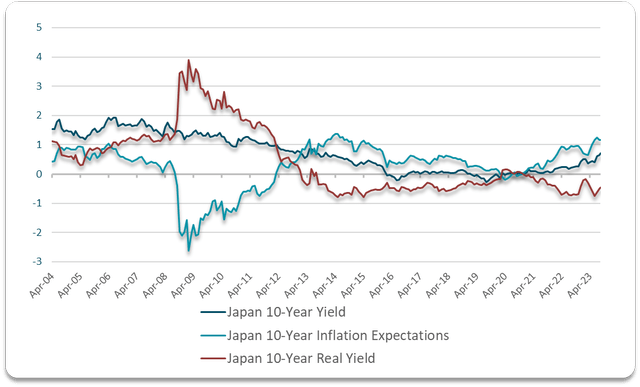

The following chart shows the evolution of 10-year inflation-linked bond yields broken down into nominal yields and expected inflation. At the yen’s peak in early 2012, 10-year yields were around 1% but lingering expectations of deflation following the Global Financial Crisis meant real yields were around 1.5%. The Bank of Japan’s decision to ease monetary policy in 2012 saw bond yields fall and inflation expectations rise, driving a significant decline in real yields.

Bloomberg, Author’s calculations

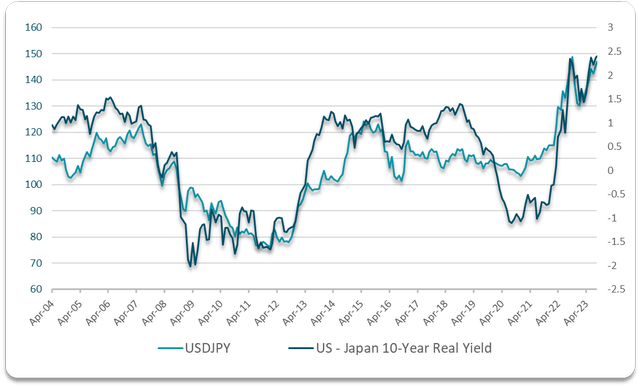

This contrasts greatly with the path of US real bond yields, which are now at multi-years highs. This divergence in monetary policy between the BOJ and the Fed has been the key driver of the yen’s weakness as shown in the chart below.

Bloomberg, Author’s calculations

Monetary Policy Divergence Likely To Reverse

There are now several signs that this monetary policy divergence is set to reverse course. The BOJ is gradually allowing long term bond yields to rise, and while 10 year yields are just 0.7%, this is a decade high and the trend is for further flexibility. While Japan’s huge primary fiscal deficit remains large, its interest payments on this debt amount to just 1.5%, compared to 3.6% for the US. Meanwhile, with the BOJ already owning the majority of the public debt stock, its debt held by the public is only around 30% of GDP. The same metric for the US is around 70%.

With private debt also much lower in Japan, the BOJ will be able to allow yields to rise further, which in turn should help keep inflation expectations in check. 10-year breakeven inflation expectations remain at just 1.2%, in part thanks to the disinflationary impact of Japan’s huge external surplus, and so we should expect real yields to head back into positive territory over the coming months.

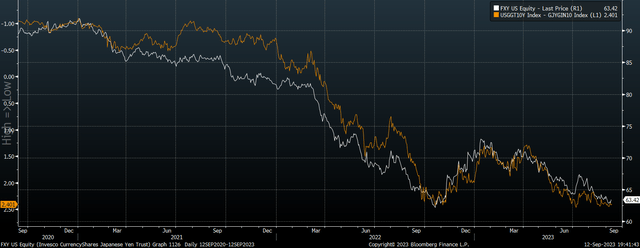

In contrast, 10-year US real yields are highly likely to move lower as spiraling debt servicing costs will necessitate lower interest rates. As a large net external debtor, high real yields also threaten to undermine the US’s already poor fiscal position as I explained in ‘The U.S. Dollar Privilege Likely Ending – Diversify Now‘. I would not be surprised to see the real 10-year bond differential move back in Japan’s favor over the coming years. Based on the correlation with the FXY, this should be expected to take the ETF to around $80 from its current level of $63.

FXY Vs Spread of US over Japan 10-Year Real Yields, Inverted (Bloomberg)

Read the full article here