This article is part of a series that provides an ongoing analysis of the changes made to Ole Andreas Halvorsen’s 13F stock portfolio on a quarterly basis. It is based on Viking Global’s regulatory 13F Form filed on 8/14/2023. Please visit our Tracking Ole Andreas Halvorsen’s Viking Global Portfolio series to get an idea of his investment philosophy and our previous update for the fund’s moves during Q1 2023.

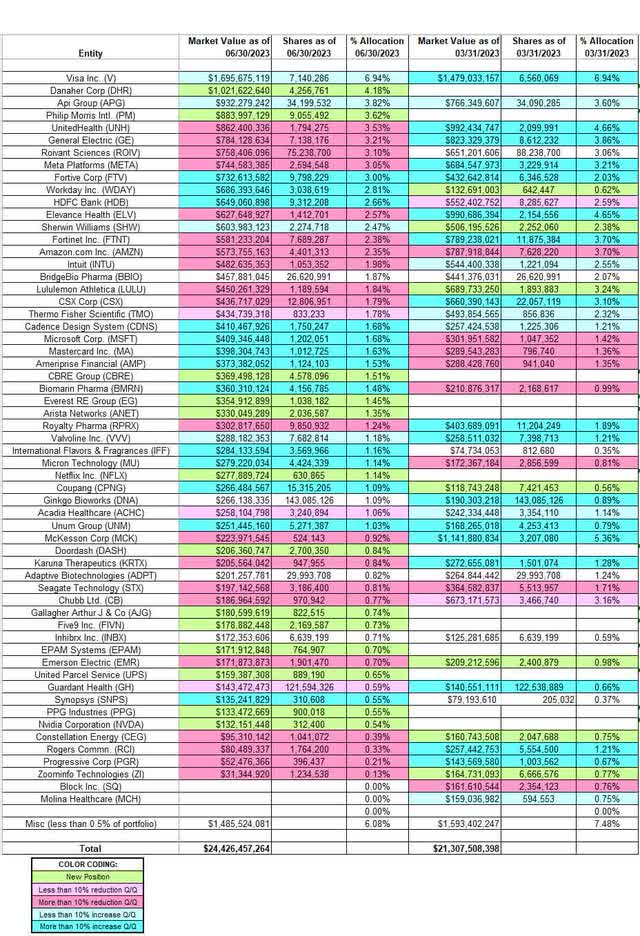

This quarter, Halvorsen’s 13F stock portfolio value increased from $21.31B to $24.43B. The number of holdings increased from 49 to 86. The largest five individual stock positions are Visa, Danaher Corp, Api Group, Philip Morris International, and UnitedHealth. They add up to ~22% of the portfolio.

Ole Andreas Halvorsen is one of the most successful “tiger cubs” (protégés of Julian Robertson & his legendary Tiger Fund). To know more about “tiger cubs”, check out the book Julian Robertson: A Tiger in the Land of Bulls and Bears.

New Stakes:

Danaher (DHR) and Philip Morris International (PM): DHR is a 4.18% of the portfolio position established this quarter at prices between ~$225 and ~$256 and the stock currently trades at ~$248. The 3.62% PM stake was purchased at prices between ~$90 and ~$102 and it is now at $94.45.

CBRE Group (CBRE), Everest Group (EG), Arista Networks (ANET), Netflix (NFLX), DoorDash (DASH), Arthur J. Gallagher & Co. (AJG), Five9 (FIVN), EPAM Systems (EPAM), United Parcel Service (UPS), PPG Industries (PPG), and Nvidia (NVDA): These small (less than ~1% of the portfolio each) stakes were established during the quarter.

Stake Disposals:

Block Inc. (SQ) and Molina Healthcare (MOH): These two small (less than ~1% of the portfolio each) stakes were disposed during the quarter.

Stake Increases:

Visa Inc. (V): Visa is currently the largest 13F position at ~7% of the portfolio. It was primarily built in Q4 2020 at prices between ~$181 and ~$219. There was a ~45% reduction over the next two quarters at prices between ~$193 and ~$237. H2 2021 saw a stake doubling at prices between ~$190 and ~$251 while in the next quarter there was one-third selling at prices between ~$191 and ~$235. Q3 2022 saw another stake doubling at prices between ~$178 and ~$217. That was followed by a one-third increase in the last three quarters at prices between ~$178 and ~$240. The stock currently trades at ~$247.

APi Group (APG): Viking Global was an early investor in J2 Acquisition, a SPAC which acquired APi Group in October 2019. APi Group started trading at $10.40 and now goes for $26.92. There was a marginal increase over the last two quarters.

Note: Viking Global has a ~17% ownership stake in the business.

Fortive Corp. (FTV): The ~3% FTV stake was increased by ~55% this quarter at prices between ~$63 and ~$75. The stock currently trades at $76.47.

Workday Inc. (WDAY): WDAY is a 2.81% of the portfolio position built during the last two quarters at prices between ~$160 and ~$227. The stock is now at ~$248.

HDFC Bank (HDB): HDB is a 2.66% of the portfolio position built over the three quarters through Q2 2022 at prices between ~$51 and ~$78 and the stock is now at $65.56. The last several quarters saw only minor adjustments. This quarter saw a ~12% increase.

Sherwin-Williams (SHW): The 2.47% SHW stake was established last quarter at prices between ~$209 and ~$249 and it is now at ~$269. There was a marginal increase this quarter.

BioMarin Pharmaceutical (BMRN): The 1.48% BMRN stake was built during the three quarters through Q2 2022 at prices between ~$74 and ~$92. The last quarter saw a ~60% selling at prices between ~$88 and ~$117 while this quarter saw a stake doubling at prices between ~$87 and ~$100. The stock currently trades at ~$92.

Ameriprise Financial (AMP), Cadence Design Systems (CDNS), Coupang (CPNG), International Flavors & Fragrances (IFF), Micron Technology (MU), Microsoft Corporation (MSFT), Mastercard (MA), Synopsys (SNPS), Unum Therapeutics (UNUM), and Valvoline (VVV): These small (less than ~2% of the portfolio each) positions were increased during the quarter.

Note: Regulatory filings since the quarter ended show them owning 8.34M shares (~6% of business) of Valvoline. This is compared to ~7.7M shares in the 13F report.

Stake Decreases:

UnitedHealth (UNH): The 3.53% UNH stake was built in the last three quarters at prices between ~$460 and ~$555. The stock currently trades at ~$480. This quarter saw a ~15% trimming.

General Electric (GE): The 3.21% of the portfolio GE stake was purchased over the five quarters through Q4 2021 at prices between ~$44 and ~$115. There was a ~50% selling over the next two quarters at prices between ~$64 and ~$103. Q3 2022 saw a similar increase at prices between ~$61 and ~$81 while the next quarter saw a ~40% selling at prices between ~$48 and ~$69. The stock is now at ~$115. There was a ~17% trimming this quarter.

Roivant Sciences (ROIV): ROIV came to market last September through a SPAC merger with Montes Archimedes. The stock currently goes for $11.22. Viking Global’s ~3% of the portfolio stake goes back to a private investment made in July 2016. There was a ~14% trimming this quarter.

Note: Viking Global controls ~10% of Roivant Sciences.

Meta Platforms (META) previously Facebook: META is a ~3% of the portfolio position established over the two quarters through Q1 2021 at prices between ~$246 and ~$295. The next two quarters saw a ~27% selling at prices between ~$295 and ~$382. There was another one-third selling in Q1 2022 at prices between ~$187 and ~$339. The next two quarters saw the stake rebuilt at prices between ~$134 and ~$234 while in Q4 2022 there was a ~55% reduction at prices between ~$89 and ~$140. The last quarter saw a ~35% increase at prices between ~$125 and ~$212 while this quarter saw a ~20% reduction at prices between ~$208 and ~$289. The stock is now at ~$302.

Elevance Health (ELV): The 2.57% ELV stake was built during Q2 2022 at prices between ~$444 and ~$530. There was a ~60% stake increase in the next quarter at prices between ~$446 and ~$507. Q4 2022 saw a ~20% reduction at prices while last quarter there was a similar increase. This quarter saw another one-third selling at prices between ~$436 and ~$496. The stock is now at ~$445.

Fortinet Inc. (FTNT): The 2.38% FTNT stake was established during Q4 2022 at prices between ~$46 and ~$57 and it is now at $63.50. The last quarter saw a two-thirds increase at prices between ~$48 and ~$67 while this quarter saw a ~35% reduction at prices between ~$60 and ~$76.

Amazon.com Inc. (AMZN): AMZN is now a 2.35% of the portfolio position. It was established in Q2 2015 at prices between ~$19 and ~$22 and increased by roughly one-third the following quarter at prices between ~$22 and ~$27. The position has wavered. Recent activity follows: H2 2022 saw a ~55% stake increase at prices between ~$82 and ~$145. The last two quarters saw a two-thirds selling at prices between ~$83 and ~$130. The stock currently trades at ~$141.

ACADIA Pharmaceuticals (ACAD), Chubb Ltd. (CB), CSX Corp. (CSX), Constellation Energy (CEG), Emerson Electric (EMR), Intuit (INTU), Karuna Therapeutics (KRTX), Lululemon Athletica (LULU), McKesson Corp. (MCK), Royalty Pharma (RPRX), Seagate Technology (STX), Thermo Fisher Scientific (TMO), and ZoomInfo Technologies (ZI): These small (less than ~2% of the portfolio each) stakes were reduced this quarter.

Kept Steady:

BridgeBio Pharma (BBIO): BBIO is a 1.87% stake. It had an IPO in Q1 2019. Viking Global’s position goes back to earlier funding rounds prior to the IPO. The stock started trading at ~$27 per share and currently goes for $28.55.

Note: Regulatory filings since the quarter ended show them owning ~25.12M shares (~15.7% of business) of BBIO. This is compared to 26.62M shares in the 13F report.

Ginkgo Bioworks (DNA): Shares of Ginkgo Bioworks started trading last September after the close of their De-SPAC transaction with Soaring Eagle Acquisition. Viking Global started investing in Gingko Bioworks in 2015 when the business raised ~$45M in a Series B funding round. The valuation at the time was ~$200M. The position was sold down by ~85% in Q1 2022 at prices between ~$2.80 and ~$8.70. Q2 2022 saw further selling. The position was rebuilt next quarter at prices between ~$2.40 and ~$3.75. Q4 2022 saw a ~40% selling at prices between $1.58 and $3.52. There was a ~125% stake increase last quarter at prices between $1.20 and $2.20. The stock now trades at $2.07.

Adaptive Biotechnologies (ADPT): ADPT position is now at 0.82% of the portfolio. It came about as a result of Adaptive’s IPO in June 2019. Viking Global was a majority investor in Adaptive. Shares started trading at ~$48 and currently go for $6.67. Q1 2020 saw a ~13% trimming at ~$25 per share. There was another ~10% trimming in Q4 2020 at ~$50 average price.

Note: Viking Global still controls ~21% of Adaptive Biotechnologies.

Inhibrx (INBX): The very small 0.71% of the portfolio INBX stake was kept steady this quarter.

Note 1: Regulatory filings since the quarter ended show them owning ~7.2M shares. This is compared to ~6.6M shares in the 13F report. The increase happened at $19.35 per share.

Note 2: Viking Global has significant ownership stakes in the following businesses: 4D Molecular (FDMT), Amylyx Pharmaceuticals (AMLX), Edgewise Therapeutics (EWTX), NewAmsterdam Pharma (NAMS), PepGen (PEPG), Pharvaris N.V. (PHVS), Rallybio Corp. (RLYB), Trevi Therapeutics (TRVI), and Verastem (VSTM).

The spreadsheet below highlights changes to Halvorsen’s 13F stock holdings in Q2 2023:

Ole Andreas Halvorsen – Viking Global’s Q2 2023 13F Report Q/Q Comparison (John Vincent (author))

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here