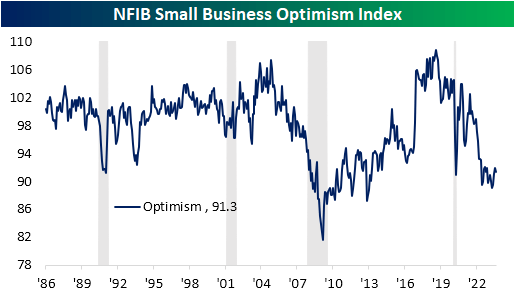

Early this morning, the NFIB published their latest read on small business sentiment. The headline index fell to 91.3, 0.2 points lower than expectations.

Sentiment continues to sit near some of the lowest levels of the past decade, albeit off of the worst post-pandemic period when it had reached a low of 89.0 this past spring.

With the decline in the headline index, it is just shy of the bottom decile of its historical range reinforcing the point that small businesses are historically pessimistic.

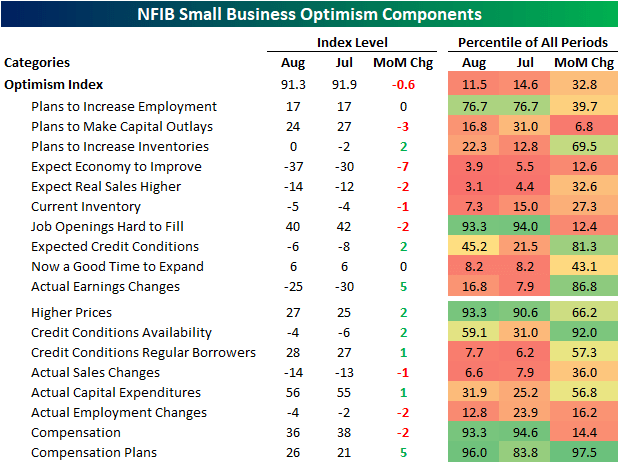

Breadth in this month’s report was fairly mixed with five inputs to the composite falling month over month, three rising, and two going unchanged. As for the other indices, five rose and the remaining three fell.

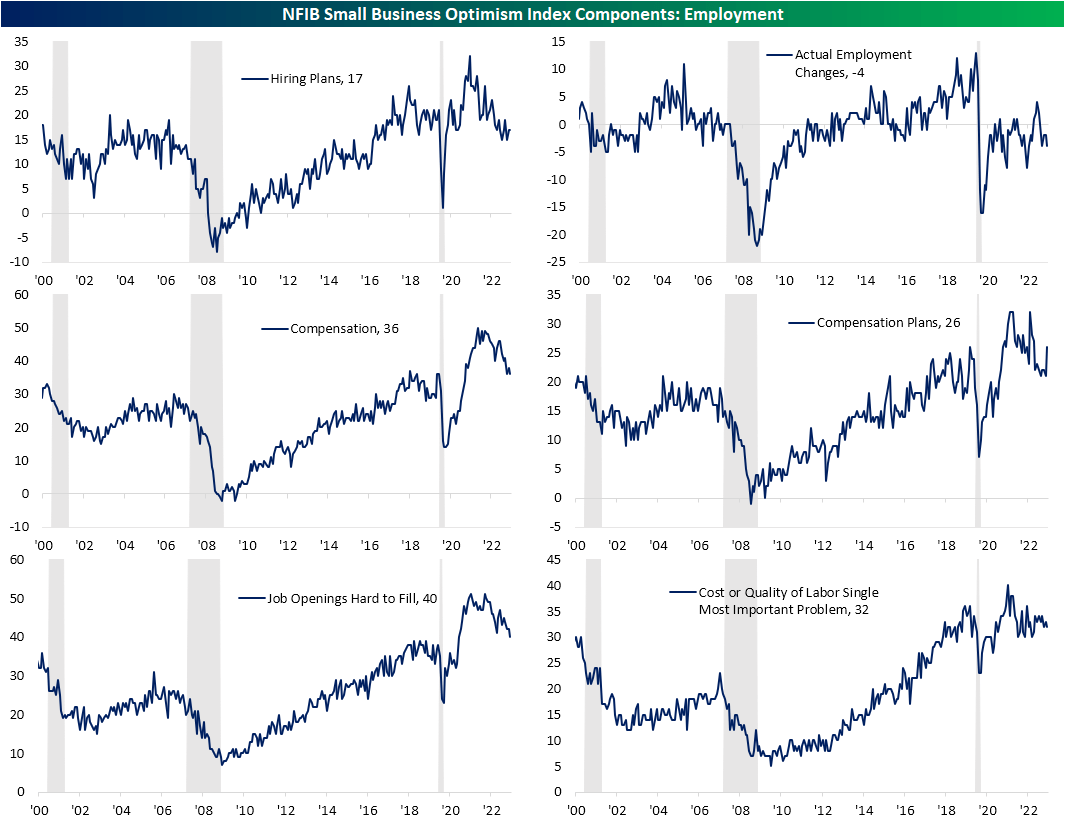

Employment metrics are some of the areas that have remained somewhat elevated versus history. For example, while many categories are in their bottom deciles of historical readings, job openings hard to fill, compensation, and compensation plans all rank in the 93rd percentile or better.

Even plans to increase employment have held up in the top quartile of its historical range. Although current readings would indicate a healthy labor market, conditions have not necessarily improved.

As shown below, most of these categories have been trending lower for some time meaning small business labor markets have cooled. However, compensation plans spiked by 5 points in August which is tied for the fifth-largest month over month jump on record.

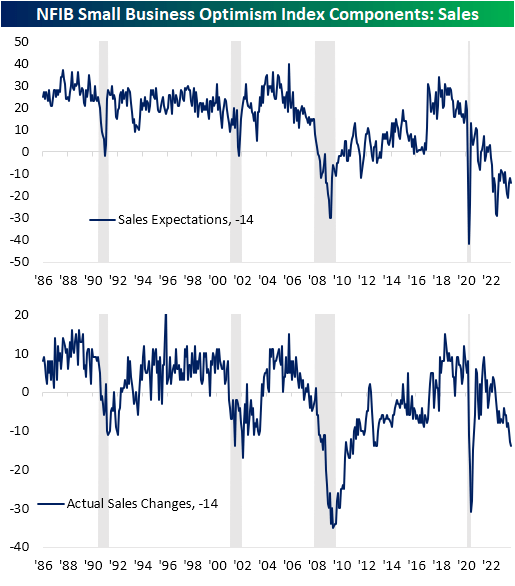

Expectations for changes to sales remain in negative territory meaning that on net more small businesses expect their sales to fall than rise. In August, that reading worsened, and at -14, the index is in the bottom 3% of all readings on record.

As with the headline number, although that is a disappointing result, it is off of recent lows. Conversely, actual sales changes are hitting more new lows with the weakest readings since the spring of 2020 and late 2012 before that.

The share of respondents reporting now as a good time to expand their business is another category where readings are at the low end of their historical range without any improvement or further deterioration in August.

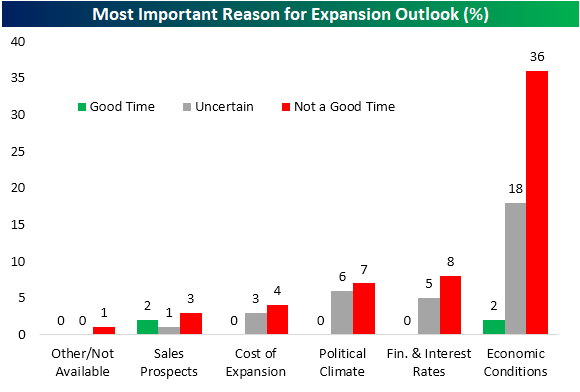

The NFIB provides a breakdown into the reasons responding firms report their expansion outlook. As shown below, the vast majority report poor economic conditions as the reason which checks out when compared to a very low reading on expectations for the economy to improve.

Behind economic conditions, interest rates are the next most quoted reason. That lends to some evidence that the Fed’s rate hikes are working as intended.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here