With challenges in the aerospace supply chain, I have been looking whether there are any supply chain specialist companies that are interesting for investment. After some searching, I ended up finding GXO Logistics. In this report, I will be discussing what GXO Logistics does, a very brief discussion of its most recent results, the growth drivers, the risks, and the valuation of GXO Logistics.

What Is GXO Logistics?

GXO Logistics, Inc. was spun off from XPO (XPO) in August 2021 and provides contract logistics services. The Company provides its customers with warehousing and distribution, order fulfillment, e-commerce and reverse logistics, and other supply chain services to deliver technology-enabled, customized solutions. It offers platforms for outsourced e-commerce logistics, including the e-fulfillment platform in Europe. The Company has three reporting units: Americas and Asia-Pacific; United Kingdom, and Ireland and Continental Europe.

The Company operates approximately 979 facilities worldwide totaling 197 million square feet of space, primarily on behalf of large corporations, that have outsourced their warehousing, distribution and other related activities to the Company. The Company serves a range of customers across a range of industries, such as e-commerce, omnichannel retail, technology and consumer electronics, food and beverage, industrial and manufacturing, and consumer packaged goods, among others.

GXO: A Boeing Recognized Aerospace Logistics Solution Provider

GXO has various end markets, the one I initially was interested in was the aerospace supply chain. While not the biggest opportunity for GXO, it is the aerospace supply chain where disruptions most clearly demonstrated the need for efficient supply chain solutions to dampen the effect of staff shortages. Currently, Boeing and Airbus cannot build airplanes fast enough to meet demand. Just having an efficient supply chain management and logistics is not going to solve that issue, but having an efficient supply chain is a requisite as is continuously optimizing that supply chain, especially with higher commercial airplane build rates planned for the future.

GXO is seemingly good at what it does. In 2022, it received the Supplier of the Year for Support & Services Award from Boeing:

GXO supports Boeing’s Spares Distribution Center, located in SeaTac, Wash.; GXO’s Boeing Aggregated Standards Network (BASN) operation supports all Boeing Commercial Airplanes programs at assembly sites and tier 1 suppliers globally; and GXO supports Boeing’s “Stores” distribution facilities throughout the U.S.

Somewhat ironically, GXO last year signed a 40-year lease for a 500,000 square feet facility that was once Boeing’s property but was sold to Bosa Development as the aerospace giant was looking to bring its footprint more in line with its operational needs and to cut costs and raise liquidity. The 40-year lease does provide some evidence that the company sees significant upside in the industrial and manufacturing end-market for decades to come.

GXO Logistics: Revenues Fly Inorganically

In the second quarter of 2023, GXO Logistics saw its revenue grow by 11% to $2.4 billion or 3.4% growth on organic basic. Its operating income grew from $59 million to $99 million, signaling 67% growth. Adjusted EBITDA, which might be the better metric to consider, grew 8% to $190 million but pointed at slightly lower margins.

Normalized earnings per share were $0.70, beating analyst estimates by $0.09, while beating by $13.8 million on revenue.

Plenty Of Growth Drivers For GXO Logistics

GXO Logistics

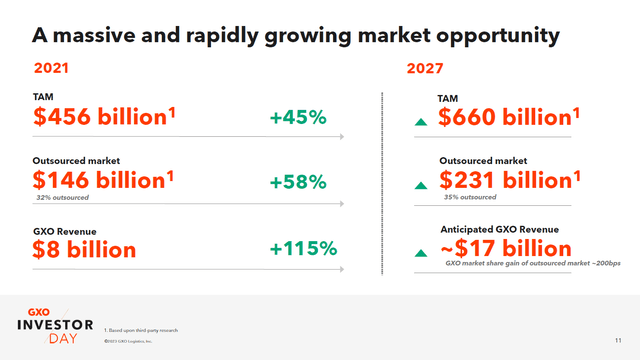

In January 2023, GXO laid out its targets. What firmly supports the growth is the growing demand in the end markets, indicated by 45% growth in the end markets and outsourcing playing a bigger role with 58% growth. GXO is ambitious expecting revenue growth of 115% supported by a combination of addressable market growth, outsource market share growth and aiming for market share to grow from 5.5% against the outsourced market to nearly 7.5% in 2027. So, the company aims to capture a bigger piece of a bigger pie.

The revenue goal that GXO has can be seen as ambitious, as the targeted revenue growth indicates a revenue growth rate of around 13.5%. The company sees around 8 to 12 percent in organic growth, meaning that mergers and acquisitions might and likely are needed to hit the targets unless the company has guided conservatively. However, with a 6 to 8 percent targeted growth rate for 2023 and 12.5% realized in the year prior, getting to 13.5% can prove to be challenging.

GXO sees its organic growth supported by economic demand, which is just increased demand from the end market consumers, and that already captures around 2 to 4 percent of the organic growth.

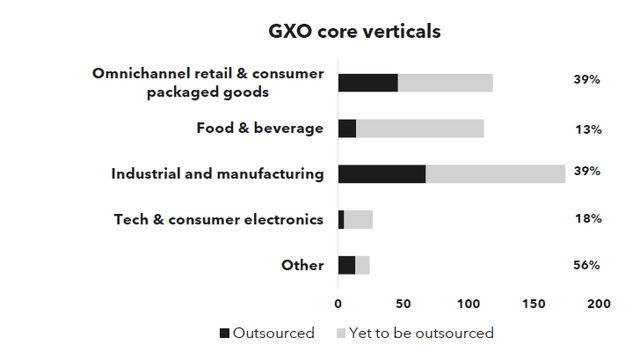

GXO Logistics

Besides the addressable market growth, there is also the multiplier of growth in outsourcing. The diagram above is somewhat confusing due to the x-axis. It is not a dollar value, but the growth rate of the outsourced market. Outsourcing is one of the main tailwinds and in some way the demand for outsourcing is understandable, supply chains are more globally oriented than ever, and they are more complex. To cut costs and book efficiency gains, companies in the end markets are now increasingly outsourcing to logistics and supply chain specialists such as GXO. This trend provides around 2% of the organic targeted growth. While e-commerce will drive a lot of growth in the years ahead, it can be seen that the Industrial and manufacturing end market has the highest relative outsourcing growth, and that should not come as a surprise. Just taking Boeing as an example, we are seeing more needs of global spare parts coverage and flexibility and punctuality for operators.

E-commerce is still where a lot of value can be generated. As part of the omnichannel retail segment, it is the highest revenue-generating segment and another 1% in annual growth is expected by GXO. E-commerce penetration will grow from around 20% today to around 30% by 2027 and that also requires supply chains to grow and more importantly be optimized which can be done by increasing automatization, while the reverse logistic chains or chain of items returned can be made more cost efficient to drive profitable solutions.

The third growth driver is reshoring and nearshoring. The pandemic clearly showed that even when you have an optimized logistics and supply chain, it is worth little if there are no manufactured goods to be transported or logistics are disrupted. The geopolitical tensions in some parts of the world amplified the need for reshoring and nearshoring. In China, electronics and other consumer goods are examples and in the case of Russia aerospace, titanium processing is an example. By reshoring and nearshoring the need for a supply chain at a new location arises while the logistics and supply chain at the previous site does not necessarily disappear, which means that reshoring and nearshoring requires establishing a new logistics and supply chain.

The growth of demand in all-end markets also drives the need for automation to efficiently scale logistics and supply chains, 7.7% guided.

The Risks For GXO Logistics’ Business

So, there are plenty of growth drivers for GXO and its peers. The most prominent risks I see for the sector as a whole are economic cooldowns that could reduce consumer spending. That is something that affects all companies, but hits transportation and logistics stocks harder when it does happen.

In some way, GXO Logistics has some shielding against those risks. On EBITDA margin level, the company has 45% of its revenues from cost-plus contracts, meaning that the company has a secured revenue. Its margins can either be shielded via a mark-up, which adds a percentage to the costs or fixed fee where the margins vary slightly based on the volumes. Lower volumes would amortize the fixed fee over a smaller number of units, while higher volumes would amortize the fixed fee over a higher number of units.

Around 55% of the contracts are hybrid in the sense that there are fixed and variable components against the company can execute and charge customers. These type of contracts usually are higher margin with potential for expansion of margins by means of continued cost control, while inflation escalators provide some padding as well. With contracts usually lasting five years, I would say that GXO Logistics is in some way to the extent that is possible and reasonable shielded from macroeconomic fluctuations. Supply and logistics chains are not chains that you dissolve from one day to the other due to changes in the economic outlook, but it is also clear that GXO Logistics relies significantly on end-market growth and outsourcing growth.

The company relies on a mix of end-market growth, outsourcing penetration and market share growth. My only reservation specific to GXO is that its organic growth won’t bring the company in.

Is GXO Logistics Stock A Buy?

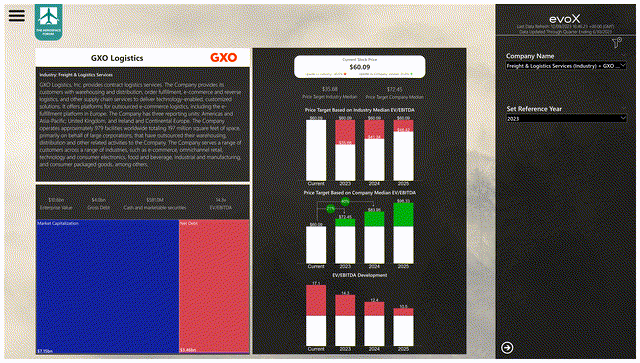

Stock price valuation for GXO using evoX Financial Analytics

Overall, I am liking the approach GXO Logistics has to create value for its customers and for itself and subsequently its shareholders coupled with end market growth. Compared to the industry, the company without doubt is overvalued. However, GXO Logistics is a company that aims to optimize its industry, and thus it deserves to be traded at a premium in my view. As a result, I am assigning a strong buy for GXO Logistics with 21% upside, putting the stock price target at roughly $72.50.

Conclusion: GXO Logistics Undervalued With Growth Ahead

I am liking the GXO Logistics mindset and its diverse end markets. While the company is diverse, it is subject to macroeconomic indicators and consumer sentiment, but in its space, the company is creating value for its stakeholders and is shielded by long-term contracts, diversification and margin preservation and expansion guarded in its contract types. The big question often is, whether the future value is already embedded in the stock price and with GXO Logistics that is not the case providing 21% upside for 2023 and around 65% by 2025.

Read the full article here