Thesis

MAG Silver (NYSE:MAG) is a Mexico-based emerging silver (and gold) producer that has recently released the results for Q2 2023. An investment case in MAG is primarily centered around its 44% stake in the Juanicipio project in Mexico (recently upgraded from ‘developer’ to ‘producer’ status), besides promising exploration prospects at its other North American projects (Deer Trail in Utah, and Larder in Ontario).

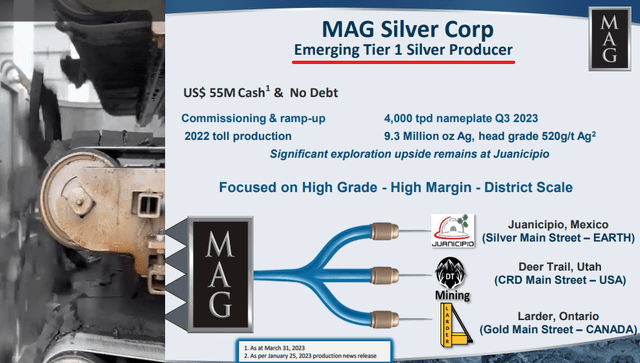

Investment Highlights – Source: MAG Presentation

As highlighted above, MAG considers itself an ‘Emerging Tier 1 Silver Producer’. I agree that MAG is an emerging silver producer but disagree that it’s operating in a Tier-1 jurisdiction regarding its flagship asset, Juanicipio. With Mexican mining risks (more on this later), the country may only be termed a Tier-2 jurisdiction at best. This article considers an investment case in MAG based on the near-to-medium-term growth potential of the Juanicipio mine. Even though MAG owns only 44% of Juanicipio (Fresnillo Plc, the project operator, owns the remaining 56%), the stock is highly leveraged to silver price volatility. That’s because MAG’s only producing asset is the silver-dominated Juanicipio mine (in Mexico). This ‘one-metal, one-country’ strategy could prove risky in the long run unless MAG pursues product diversification to expand its gold footprint. I say so, especially since the gold-silver ratio has witnessed a persistent uptrend (cumulative) during the past decade. Fortunately, MAG’s other two projects come to the rescue to de-risk its assets portfolio through appropriate geographical/product diversification (long-term growth prospects). Nonetheless, the Juanicipio mine has recently ramped up to full-scale production and is all set to deliver promising growth over the near-to-medium term.

This article will discuss all the above aspects in detail.

The Tier-1 Myth: Mexico is Risky

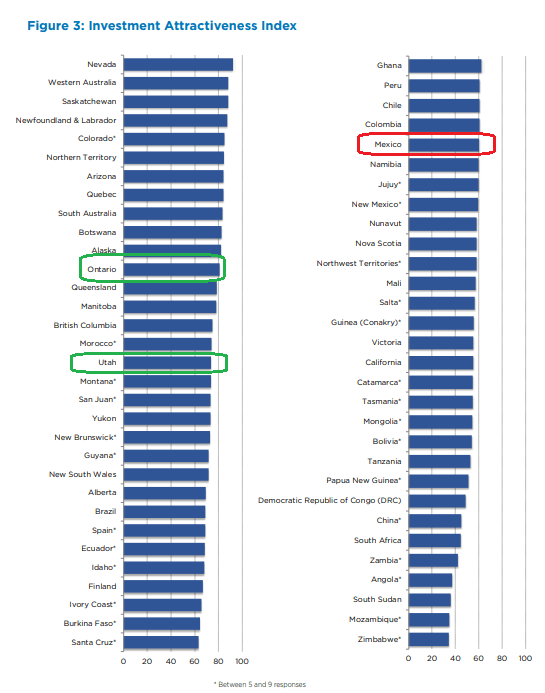

Every year, the Fraser Institute publishes an “Annual Survey of Mining Companies,” usually during the first half of a calendar year. This report analyzes mining countries/jurisdictions on multiple metrics such as regulatory inconsistencies, legal system, uncertainty concerning environmental regulations, taxation regime, uncertainty concerning disputed land claims/protected areas, quality of infrastructure, political stability, labor regulations (including employment agreements and labor militancy/work disruptions), security issues, etc. The data input is taken from the executives, consultants, etc., working in the mining sector of different countries/jurisdictions. The IAI (Investment Attractiveness Index) is a helpful indicator of the jurisdictional risk underlying any mining company’s operations. As a rule of thumb, the lower the score, the higher the jurisdictional risk, and vice versa.

Based on the Annual Survey of Mining Companies, 2022 (published in May 2023), the Mexico-based Juanicipio mine is more prone to jurisdictional risk than MAG’s other two properties. Mexico had a 2022 IAI score of 60.16 points (2021: 66.46 points) and ranked 37th out of 62 jurisdictions covered in the report (40th percentile). In other words, 60% of the jurisdictions covered in the report had a higher IAI score than Mexico. On the flip side, Utah (where the Deer Trail project is situated) had a 2022 IAI score of 73.79 points (2021: 80.22 points) and ranked 17th out of 62 jurisdictions, whereas Ontario (where the Larder project is situated) had a 2022 IAI score of 80.75 points (2021: 79.59 points), and ranked 12th out of 62 jurisdictions.

Source: Fraser Institute’s Annual Survey of Mining Companies, 2022

For 2023, I expect that the following two catalysts will further deteriorate Mexico’s IAI score, thereby adding to the country’s jurisdictional risk profile:

1) Amendments to the Mexican Mining Law: In May 2023, the Mexican government notified certain amendments to the Federal Mining Law, with implications related to the process of granting mining permits/transfer of permits, shortening the life of mining concessions, granting future water permits, mine reclamation process, requirement to distribute at least 7% of profits from mining operations to local indigenous communities, and mining waste management.

While MAG is thoroughly reviewing the potential implications of these amendments, I believe their impact on Juanicipio’s future exploration activities will be unfavorable, to say the least. I say so because Juanicipio’s existing resource estimate is based on the exploration results of only 5% of the property. The point is, while there is massive exploration potential at MAG’s 44%-owned Juanicipio property, the growth prospects linked with future exploration may be impacted by potential disputes with indigenous communities regarding future mining concessions on the unexplored area of the Juanicipio property. In my view, they could lead to unwanted legal disputes with stakeholders in the government or the local indigenous communities.

2) Political Uncertainty: The amendments to the Mexican mining law were proposed by President Lopez Obrador, whose policies are believed to hurt the Mexican mining sector. However, the Mexican general elections are scheduled to be held in 2024. The presidential candidate from the opposition coalition is Xochitl Galvez. It remains to be seen whether President Obrador’s party will form the next government and, if so, whether the Mexican mining sector will continue to be haunted by the next government’s policies. However, Galvez is a known proponent of reactivating the Mining Fund, which seeks to distribute money collected from mining companies directly to the communities affected by their mining operations. I believe this is a favorable alternative to the existing practice where the Mexican government mints money from mining companies in the name of social benefits and spends it at its discretion (~85% is allocated to the Ministry of Public Education, 10% to government projects, and 5% to the Ministry of Economy).

In my view, by ensuring a more transparent distribution of funds to the local communities affected by mining operations (‘Ejidos’ or local indigenous communities), the administration could create a win-win situation for mining companies and these communities. The local communities can benefit from a more significant share of the funds collected from the mining sector. In contrast, the mining companies may benefit from more significant and productive community engagement, which may help obtain mining permits/concessions. Nonetheless, it’s uncertain how the Mexican mining policies may shape up next year after the change of government.

As discussed above, Mexico is becoming a high-risk mining jurisdiction, and I’m afraid I have to disagree with MAG’s claim that it’s a Tier-1 silver producer.

Q2 Results – Review and Expectations

Let’s review the highlights from MAG’s Q2 2023 results and discuss my expectations:

1) Concentrate and Metal Production: The Juanicipio mine commenced concentrate production in Q1 2023 and produced 222,023 tons of mineralized material for processing at the Juanicipio, Fresnillo, and Saucito processing plants. Ore production increased to 377,718 tons in Q2 as the 4,000 tpd Juanicipio plant ramped up to ~85% of nameplate capacity (from ~60% in Q1). During Q2, Juanicipio produced 4,877,460 ounces of silver, 9,537 ounces of gold, 3,066 tons of lead, and 4,582 tons of zinc.

I expect further improvement in QoQ mineralized ore as MAG expects the Juanicipio plant to achieve nameplate capacity in Q3. Moreover, higher processing volumes, milling rates, and feed grade will help increase Juanicipio’s metal production in the future. These catalysts will enable Juanicipio to sustain (or possibly improve from) the current metal production levels going forward.

2) Silver Head Grades: The average silver head grade increased from 363 g/t in Q1 to 498 g/t in Q2. I believe that these grades are impressive in themselves compared with peer silver mines. For instance, H1 2023 silver grades for the mining operations of Fresnillo Plc (OTCPK:FNLPF), the operator of the Juanicipio mine, were as follows:

- 177 g/t for the Fresnillo mine,

- 197 g/t for the Saucito mine,

- 192 g/t for the Saucito Pyrites Plant,

- 144 g/t for the Cienega mine,

- 152 g/t for the San Julian (Veins) and

- 156 g/t for the San Julian (Disseminated Ore Body).

In contrast, Juanicipio mine’s H1 average silver grades were ~448 g/t.

In my view, these significantly higher grades indicate that Juanicipio will continue outperforming Fresnillo’s mining assets in cost performance (in the future). I expect Juanicipio’s grades to improve further during H2 2023 because H1 grades were based mainly on the processing of low-grade commissioning materials/stockpiles. As the Juanicipio plant is ramped up to full-scale production, higher-grade ore produced at the mine will enhance the operating margins per AgEq (silver-equivalent) ounce.

3) Revenues: MAG announced that the Juanicipio mine has reached full commercial production effective June 01, 2023. The ramp-up in the plant’s design capacity led to stronger QoQ revenue generation (from $51.48 MM in Q1 to ~$134 MM in Q2).

I expect Q3 revenues to be stronger than Q2 due to the expected ramp-up of the Juanicipio plant to nameplate capacity and improved silver prices during Q3 on a QoQ basis (check the silver price chart below).

Silver Price Chart – Source: Finviz

4) Strong operating cash flows: Since all major construction activities related to the Juanicipio processing facility have been completed, I expect the mine development CAPEX to decline during H2. Notably, Juanicipio’s total CAPEX spent during Q2 amounted to $20.04 MM (including $11.58 MM in development CAPEX and $6.54 MM in sustaining CAPEX).

In my view, Juanicipio’s strong operating cash flows attributable to higher ore processing volumes, milling rates, and improving metal prices (on an average basis, QoQ), combined with declining development CAPEX, will enable the mine to become FCF-positive in H2 2023.

5) Cost considerations: During Q2, production and transportation costs amounted to $54.57 MM. Going forward, I expect an improvement in proportionate transportation costs because once the Juanicipio mill reaches nameplate capacity, a dominant portion of the mine’s mineralized material will be sent for processing at the nearby Juanicipio mill rather than the current practice of shipping the excess mineralized material to the Saucito and Fresnillo processing plants, subject to availability.

Nonetheless, the following catalysts will likely impact Juanicipio’s cost performance unfavorably:

- Cost inflation continues to be affected by factors such as the Russia-Ukraine conflict, disruptions in the supply chain, and rising interest rates (which increase the cost of production of materials/supplies produced and consumed locally).

- Revaluation of the Mexican Peso against the USD – The peso gained ~13% against the USD during the past two years. This generally impacts the direct costs paid for in the Peso and reported in the USD and will continue to be a problem until the USD delivers a persistent bullish trajectory against the Peso.

MX Peso v/s USD – Source: XE

Exploration Activities: De-risking Business

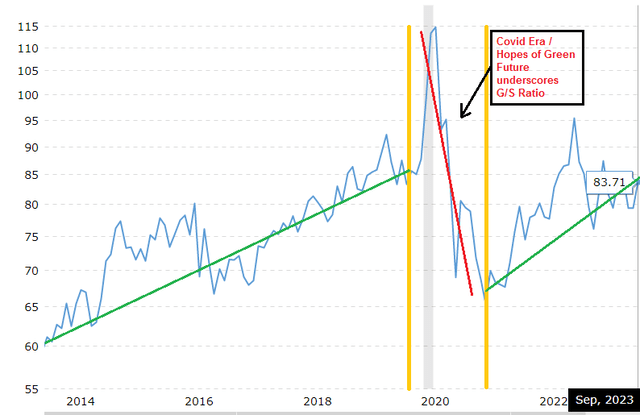

The preceding discussion highlights that MAG’s Juanicipio mine is firing on all cylinders and can deliver suitable near-term growth. However, given the Mexican risk factor, product and geographical diversification will help de-risk MAG’s business. Since the ratio has witnessed an overall uptrend during the past ten years (currently at 83 points), I think it makes sense for MAG to reduce dependency on a primarily silver asset (Juanicipio) and add suitable gold exposure through exploration projects.

10Y Gold/Silver Ratio – Source: Macrotrends

Fortunately, MAG has two PM mining projects outside of Mexico, with extensive exploration going on at both projects. Let’s discuss MAG’s exploration activities at all three mining properties in detail:

1) Juanicipio: Based on the results of the exploration of only 5% of the claim area, Juanicipio has a global (including Indicated and Inferred) resource of 267 Moz silver, 1.429 Moz gold, 1.256 Blb lead, 2.293 Blb zinc, and 109 Mlb copper (on a 100% basis). Using a long-term gold-silver ratio of 80 points, Juanicipio’s gold resource can only add up to ~114 Moz AgEq, confirming that Juanicipio is a silver-dominated mine.

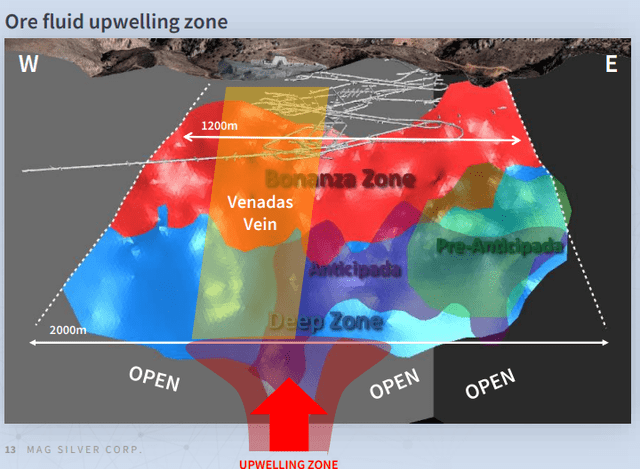

At the Juanicipio mine, Fresnillo is operating three infill drilling rigs on the surface and three infill drilling rigs underground, targeting to expand/upgrade the Valdecanas Vein System (including the Anticipada, Pre-Anticipada, and Venadas Vein structures) at depth.

Valdecanas Vein System – Source: MAG Presentation

So far, 9,924 meters have been drilled from the surface, YTD, of which 5,814 meters (or 59%) were drilled during Q2 2023. Likewise, 10,455 meters have been drilled underground YTD, of which 5,926 meters (or 57%) were drilled during Q2 2023.

These numbers indicate that drilling activities are ramping up at Juanicipio on a QoQ basis. I expect further improvement in drilling rates during H2, as a significant reduction in development CAPEX will free up cash flows and also enable the management to focus on drilling activities to identify mining targets for the near-to-medium term.

Update on the Los Tajos target: The Juanicipio JV began drilling four holes on the Los Tajos target, which is located approximately 6 kilometers from the Valdecanas Vein system. Other small-scale operators have previously mined the Los Tajos structure, and the vein structure is highly parallel to the high-grade Venadas Vein family that cuts the Valdecanas Vein. The Juanicipio JV conducted drilling with a highly portable rig, and the drilling activity was concluded in 2022. However, permitting restrictions led to poor drilling geometrics as the portable equipment failed to reach optimal target depths. Nevertheless, all four drill holes cut narrow quartz veinlets with assay signatures characteristic of high-level intercepts.

Once surface access rights and drill permits are received, it is planned to conduct follow-up drilling using more powerful equipment at locations with better target geometrics.

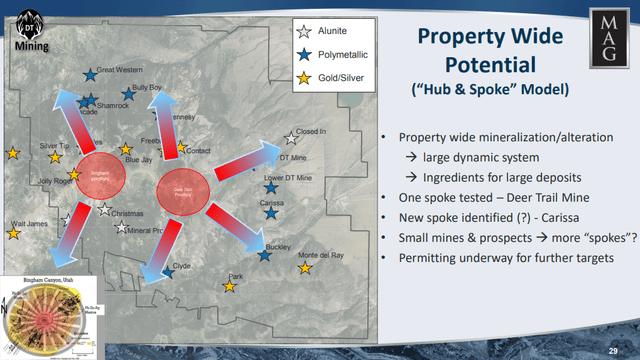

2) Deer Trail, Utah: As part of the 12,157-meter Phase II drill program at the DT (Deer Trail) property, MAG reported the best drilling results at holes DT 22-09 and DT 22-10 within the Carissa Zone. These drill holes demonstrated the most widespread mineralization and the strongest alteration yet drilled on the DT property. For reference, DT 22-09 intercepted ~274 meters of distinctive mineralized sulfide lacing with an average grade of 12 g/t silver, 0.2% copper, 0.1% lead, and 0.2% zinc. Interestingly, individual sulfide bands within the lacing zone have attractive grading ranging between 59-266 g/t silver, 0.2-5.5% copper, 0.1-1.5% lead, 0.1-5.2% zinc, and traces of gold with grades approximating 1.5 g/t. The lacing zone is preceded by hundreds of meters of progressively zoned Argentiferous (silver-bearing) Manganese-Oxide Mineralization (or AMOM), marble, and skarn deposits. Likewise, the DT 22-10 drill hole demonstrated alteration similar to DT 22-09 over 115.6 meters before intercepting sulfide lacing mineralization. Overall, the results of the Phase-II drill program continue to reinforce MAG’s CRD (Carbonate Replacement Deposit) exploration model and support Phase III drilling (commenced May 2023).

Phase III drill program follows a hub-and-spoke model to test the mineralization of porphyry “hubs” underlying Mt. Brigham and DT Mountain. Drilling at the first hole is in progress, targeting the Alunite Ridge on the south slope of Mt. Brigham (DT Mountain will host the next drilling target). In essence, future drilling under the Phase III drill program is expected to offset the Carissa Zone discovery holes and test new targets identified through geophysical/soil surveys.

Phase III Drilling at DT – Source: MAG Presentation

3) Larder, Ontario: The Larder property is located on a 7.5-kilometer stretch along the CLB (Cadillac-Larder Break) and hosts three distinctive gold zones. MAG applies a district-scale exploration model using modern technology to identify high-grade, large-volume gold mineralization typical to the Abitibi region. MAG’s 2023/24 exploration program at the Larder property will focus on re-evaluating all existing drills, targeted re-logging of selected holes, and assessing additional geophysics, sampling, and mapping results. These initiatives aim to enable MAG to chalk out a systematic property-wide exploration program for the Larder property. Note that the Larder property has historically lacked systematic exploration.

During H2 2023, MAG expects to complete a 17,000-meter drill program at the property, which is anticipated to pave the way for a comprehensive property-wide multi-rig exploration program in 2024. While the Larder project is in the early exploration stages, it helps MAG expand its gold footprint in a Tier-1 jurisdiction. Recall that Ontario’s 2022 IAI score of 80.75 points significantly outshines Mexico’s 2022 IAI score of 60.16. Moreover, the CLB represents a high-grade gold trend with grades in excess of 10 g/t gold. Even though the Larder project is a very ‘long’ call, it provides MAG with the opportunity to diversify its business to mitigate the risks associated with its existing “One Metal, One Country” strategy.

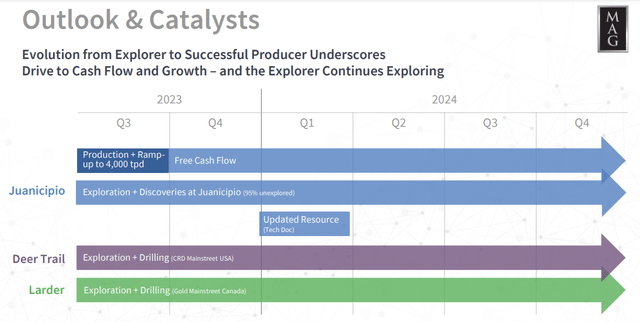

2023-24 Exploration Outlook- Source: MAG Presentation

Investor Takeaway

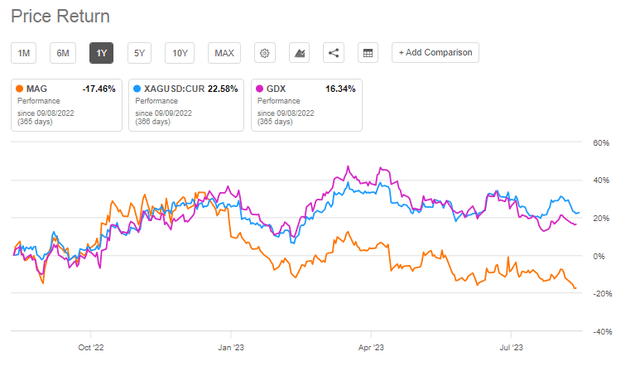

At the time of writing, MAG last traded at $10.64, at the lower end of its 52-week range (between $10.26-$17.02). The stock’s 1-year price returns significantly lag behind those of its benchmark ETF namely VanEck Gold Miners ETF (GDX) (spread of 34%), as well as spot silver (XAGUSD:CUR) (spread of 40%).

1Y Price Returns – Source: Seeking Alpha

MAG’s substandard price performance can be attributed to its current “one metal, one country” strategy, which is explained by the Mexican risk factor (political uncertainty and changes to the mining laws), and the fact that MAG’s only producing asset is the silver-dominated Juanicipio mine in Mexico. Since Fresnillo (one of the world’s largest silver miners and Mexico’s largest gold producer) is operating the Juanicipio mine, we can expect a margin of safety against the Mexican risk factor since FNLPF’s management enjoys good working relations with the Mexican authorities. Interestingly, the Juanicipio mine is among the best-performing assets in Fresnillo’s portfolio.

With the expected ramp-up of the Juanicipio processing plant to full nameplate capacity (4,000 tpd) in Q3 2023, I believe the mine can deliver greater volumes (on a QoQ basis) of high-grade, high-margin, and low-cost metal production to improve further its bottom-line profitability (related to its 44% share in Juanicipio’s earnings). Notably, Q2 2023 EPS (at $0.19) saw a remarkable YoY improvement (Q2 2022 EPS = $0.08). Although MAG runs extensive exploration programs at its two other projects (including the Larder gold project), I believe the following factors will impact MAG’s price trajectory over the near-to-medium term:

- Any bullish (and sustainable) momentum in silver prices will support the stock’s near-term momentum as MAG is largely a silver play;

- Positive QoQ operational results from Juanicipio will support the stock’s near-term momentum, augmented by a favorable ‘resource update’ on Juanicipio expected to be issued in Q1 2024;

- Results of the 2023/24 exploration programs at the Deer Trail and Larder properties will highlight the mining potential of these regions and may prove to be a near-to-medium-term growth catalyst.

- Meanwhile, the Mexican risk factor and any (significant) downtrend in silver prices will continue to haunt the share price in the near-to-medium term. On that note, we should look for MAG’s assessment of the implications of the amended Mexican mining law on Juanicipio’s operations and the conclusion of the 2024 Mexican elections to have more information about the mining priorities of the next government.

That said, I believe the stock is a ‘hold’ at present.

Read the full article here