Selling a covered call on a stock that you own, otherwise known as a “buy-write”, is a well-known way of reducing the risk of your long stock trade, as well as minorly increasing the yield by receiving the option premium in addition to the dividend. This of course must come at some cost, as a covered call caps the upside potential of the stock at the strike price. This is what makes this an income strategy as opposed to a growth strategy. It maximizes the returns when the stock trades within a certain range, slightly minimizes losses if the stock falls below this range, but completely eliminates any additional gains when the stock rises above this range. The goal is always to provide a more consistent return to your portfolio. The added bonus of this strategy that is often overlooked is its ability to increase (and potentially double) your dividend yield, which I will specifically focus on in this article. I believe this is often not considered much because this effect is very minor with trades that are OTM or not very deep ITM which are traded the most frequently. However, when done very deep ITM it can be maximized to potentially double your dividend yield.

The strike price that you choose for your call determines the overall risk and return profile of your trade. As you go deeper in-the-money (ITM), your risk should decrease, but your profit potential will also decrease. The same trend holds for out-of-the-money (OTM) trades, but in reverse: the higher OTM you go, the higher your risk, but the higher your profit potential. Before I go any further, I want to clarify what I mean when I talk about risk and profit potential in regard to a covered call strategy.

In terms of risk, I am talking about two different things at the same time, as both follow the same trend in regard to strike price selection (both increase as the strike price increases, and decrease when it decreases). The first portion of risk simply regards the total position size, and therefore the maximum loss you can take from the trade. By selling deep ITM, you naturally will receive more premium than you would at a higher strike, reducing your overall cost-basis of the trade. Technically this isn’t associated with risk, however, many people can often find it difficult to safely trade covered calls with smaller account sizes due to the requirement of purchasing 100 shares of stock. With smaller position sizes, you should have an easier time diversifying your portfolio if you are trading a smaller account.

The more important portion of risk has to do with volatility, and in this case, the volatility on the downside. I am not talking about the volatility of the stock, but rather the volatility of the trade as a whole (100 shares of long stock and 1 short call). When you sell a covered call ITM, you assume that at the time of expiration, as long as the stock is still ITM, you will be assigned and sell your 100 shares at the strike price. This means taking a loss of some amount, however, the premium you received should always be more than your loss on the stock, making it a net positive trade. The difference between your loss on the stock and the premium received is called the extrinsic value of the option, which for our purposes is our profit (before adding any dividends). As long as the stock remains above the strike price, we will make this extrinsic value profit, no matter how high or how low the stock goes. We will only ever make less than this amount, or potentially lose, if the stock drops below the strike, resulting in not being assigned. The deeper ITM the option is, the more the stock will have to fall before a loss is taken, reducing the downside volatility and risk even further.

Finally, in terms of risk, you may have heard about ‘assignment risk’. This is the ‘risk’ of being assigned to your call position, resulting in the forced selling of all of your 100 shares of stock at the strike price. This only should ever happen when ITM and usually only before an ex-dividend day or on expiration, however, the call owner technically has the right to exercise their option at any time. For our purposes, I do not consider this a risk, as being assigned is usually our goal and results in the highest profit potential of the trade. This can change depending on when this happens, which I will examine below for each trade, considering assignment before each dividend, and also at expiration. Early assignment could be a ‘risk’ if it results in lower profit or annualized return, but often it can also result in the highest annualized returns. My advice here is to simply make sure you are comfortable being assigned both early and at expiration before placing any trades. The only other ‘risk’ here is that you will lose the stock, however, this is usually the goal with these trades, and results in the maximum possible return.

In regards to ‘profit potential’, I am referring to the maximum potential return of the trade. The key here being potential. Without any covered calls, a simple long-stock trade has unlimited profit potential, as the stock has no limit on how high it could possibly go. By writing a covered call, you automatically cap this potential maximum gain. To actually achieve this maximum potential return on a buy-write, the stock has to be ITM at expiration. So for OTM trades, that means we will need the stock to increase in value if we want to achieve our maximum return. For ITM trades, we simply need the stock to stay ITM to achieve the maximum return. While it may sound great that ITM trades are already at their maximum gain, their problem is that their maximum return is generally much lower, as we cannot benefit at all from any increase in stock price. For an OTM call on the other hand, we have built-in room for growth and will continue to earn more as the stock price increases. That is until it reaches the strike price, where the returns eventually are maxed out. This is because you are required to sell your shares of stock at the strike price if assigned, which will likely happen if you are ITM. Even with ITM trades which are already at their maximum gain, the profit potential will decrease as the strike price chosen decreases. This is because at lower strike prices, the extrinsic values offered are generally much lower, and increase as the strike price increases. Don’t worry if you are still confused about the relationship between the strike price and risk/profit potential as I provide example calculations below.

Your decision of strike price should depend entirely on the following four key points: your desired risk/return profile, your understanding/opinion of the underlying stock, the premiums being offered at each strike, and the expiration date chosen. In this article, I will examine two of my past trades at the different extremes of moneyness, with my (COP) trade only slightly ITM and my (LNC) trade extremely deep ITM. For both trades I will explain my logic for placing them according to the above four points.

COP – 4.5% ITM

This trade is only slightly ITM and has a very short duration. Expectedly, this is also the highest risk, highest reward trade we will look at. The idea of this trade is some form of a ‘dividend capture’, even though we assume the stock price will drop by the dividend amount on the ex-dividend date. It works because if we are assigned at expiration, we will have received the dividend, but also bought and sold the stock for a minor net gain (technically we will be taking a loss on the stock, as we will buy it at the current price and then sell at a lower strike, but the premium we receive should cover at least this difference and more resulting in a net positive trade before receiving the dividend). This of course assumes that the stock price does not fall below the strike price and that the premium received is enough to cover this difference. And since a dividend is being paid, we must consider that the stock price will drop by at least the amount of the dividend. So for a trade like this to work, it must be ITM by some amount greater that the dividend payment at a minimum.

We also need to consider the fact that as an ITM trade that is close to expiration, there is a high possibility of early assignment before the ex-dividend date. Therefore we must also make sure this trade works in our favor if assigned early, assuming we only receive the premium and not the dividend.

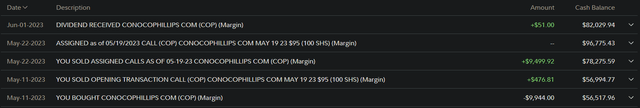

As you can see from the transactions below, on May 11, 2023, I bought 100 shares of COP for $99.44 and sold 1 May 19, 2023 call with a strike of $95 for $4.77/share in premium. COP also pays the $0.51 dividend with an ex-dividend date of May 15. Because we receive the premium, our investment size goes down from $9944 to $9467. Assuming the stock price stays above the strike price by the time of expiration, we will be assigned and sell the stock for the strike price of $95. This is a net loss of $4.44/share since we bought it at $99.44 however, we also received the premium of $4.77/share. Therefore, before the dividend, our net profit is ($4.77 – $4.44) x 100 shares = $33, and if we receive the $0.51 dividend, our profit increases to $84. We can divide each of these by the investment size of $9467 to get ROIs of 0.34% and 0.89% respectively. Of course, these are very small ROIs, with the key being the short trade duration. To annualize these returns, we can use the compound annual growth rate formula (CAGR).

CAGR = ((end value / start value) ^ (1 / years)) – 1.

The start value for each is the initial investment amount of $9467, and the end value is the start value plus the profit, so $9500 without the dividend, and $9551 with the dividend. For trade duration I always use market days as opposed to calendars days, excluding weekends and holidays, and assuming 252 market days/year. If early assigned, the trade duration would be only 2 days (May 13th and 14th were weekends), so 2 / 252 = 0.008 years. And if the trade goes to expiration, the length would be 7 days or 0.028 years. Plugging each of these into the equation results in CAGRs of 54.5% without the dividend and 37.1% with the dividend. This then looks like a great trade in terms of annualized returns, however, you still need to remember that you can only achieve that annualized return if the trade was reproducible, which in this case it is not, unless you can find other stocks paying dividends and offering similar premiums. Therefore, you really should only make these kinds of trades if you are okay with the 1-time small gain or have the ability to find similar trades on other stocks to make it reproducible, and are okay with the extra work it takes to consistently place such short-term trades.

Finally, you must always accept the level of risk associated with these trades. The nice thing about ITM covered calls, is that the stock price will have to drop by at least the value of the premium received (in this case $4.77) before you start losing money. So for this trade to fail, COP would have to drop 4.8% from $99.44 to $94.67 in 7 days, which to me seems somewhat unlikely, but certainly not impossible, as we already know that it should drop by an average of $0.51 (the dividend payment) on the ex-dividend date.

I am not here to discuss the fundamentals or my personal opinions of any of these stocks, but rather explain the framework and logic of placing these different trades. These trades always depend on your own understanding and opinions of the underlying stock. If you think the stock very likely will increase, you may be better off trading OTM, or even avoiding selling a call altogether. If you are very uncertain of where it will go, it may be smarter to go deeper ITM, so that the stock must fall further before you start to take a loss. It is also important to note that short-term trades like these generally are more risky, at least if they are repeated frequently. That is because, just like how the ROI of the profits increase when annualized, any losses will also be magnified with annualization.

In the end as you can see below, I was not early assigned, and therefore received the dividend (later paid on June 1), and was finally assigned at expiration on May 19th (completed May 22), as the stock price remained above the strike of $95. Resulting in a total profit of $84 on a $9467 investment earned over 7 days for an annualized return of 37.1%.

COP trade details (Fidelity account transactions)

In summary, here are how the four key points play into this trade decision:

- Desired risk/return profile: Med-high risk, high return.

- Opinion of stock (not my opinion, just an example): Generally long, with low volatility in the short term so that the price should likely remain above the strike prior to expiration, resulting in being assigned at the ex-dividend or at expiration.

- Premium: Sufficient to still receive a high CAGR (54.5%) if assigned before the first dividend is received.

- Expiration date: Short-term nature of this trade means both profits and losses are magnified when compounded. If desired to repeat regularly at a similar length, you will need to find other stocks with upcoming dividends after this trade adding additional work researching and placing trades. Finally, transaction costs may be more significant than they would be with lengthier trades.

LNC – 51% ITM

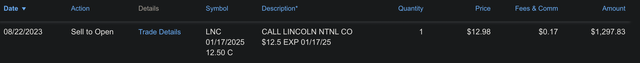

In contrast to the COP trade, this is an extremely deep ITM trade, and over a much longer time horizon. As a result it can be generally be considered a lower risk, lower return trade. At the time of the trade I had already owned 100 shares of LNC from a previous buy-write that had expired, so I will be using the price of LNC at the time of the trade for return calculations which was $25.34. This is my general rule of thumb for trading: to always be looking forward and not looking at where prices were in the past. Therefore, I always look at new trade as starting from zero rather than considering how much I am already up or down. So for this trade we ‘buy’ 100 shares of LNC at $25.35 and sell a January 17, 2025 covered call with a $12.5 strike receiving $12.98 in premium. Following the calculations used above for COP, we now know that LNC must drop by the value of the premium received before we start taking any losses. For this trade, that means LNC can drop $12.98, or lose 51% of its current value before we lose any money. This may sound too good to be true, but as always there are tradeoffs. Here our main tradeoff generally means lower possible returns. And while that is true for this trade, we are still likely to make a minimum of 8.58% annualized, as long as the stock remains above the strike between now and the first dividend of $0.45 on Oct 6, 2023. This is assuming we get called before the dividend and only receive the premium. Here is the calculation assuming early assignment on Oct 6:

Profit = sell price – buy price + premium = 12.5 – 25.35 + 12.98 = $0.13.

Start value = 25.35 – 12.98 = $12.37.

End value = start value + profit = 12.37 + 0.13 = $12.5.

Trade length = 32 market days / 252 market days/year = 0.127 years.

CAGR = (( 12.5 / 12.37 ) ^ (1 / 1.43)) – 1 = 8.58%.

This is the worst-case scenario in terms of when we could get assigned (of course the true worst-case scenario of the trade is if the stock loses all of its value). This means if we do not get assigned at the first dividend date, but rather at a further dividend date or expiration, we will make even more. This is because we will start to receive the dividend payments on top of the premium, but even better, we will effectively be doubling the yield of the dividend, because our initial investment amount is $12.37/share as a result of receiving the premium as opposed to $25.35/share if just buying the stock. We don’t know for sure the dividend dates until they are announced, so I am going to assume they are each 63 market days apart (252 days / 4 quarters) and each pay the same $0.45 per dividend. Here are the CAGRs for being assigned at each of the ex-dividend dates and finally at expiration:

0 dividends received; assigned at 32 days: 8.58% CAGR.

1 dividend received; assigned at 95 days: 12.92% CAGR.

2 dividends received; assigned at 158 days: 13.61% CAGR.

3 dividends received; assigned at 221 days: 13.75% CAGR.

4 dividends received; assigned at 284 days: 13.73% CAGR.

5 dividends received; assigned at 347 days: 13.63% CAGR.

6 dividends received; assigned at 360 days (expiration date): 15.51% CAGR.

As you can see, the CAGR of the trade is significantly greater when we receive at least one dividend payment because we are now receiving the full dividend amount but with only half the initial investment amount. An not only that, but the stock can continue to fall all the way down to the strike and we will continue to make the same return, so long as it doesn’t fall below. One more benefit to this kind of trade is that it cuts in half the necessary investment amount making it more ideal for smaller accounts that would normally have issues with purchasing 100 shares of stock for trading buy-writes.

The risks here are the same as always, which is that you can still lose nearly 100% of your initial investment (except for the net premium received and any received dividends), if the stock were to drop all the way to 0. While structuring trades this way may decrease risk, it is absolutely not a replacement for properly researching the stocks you invest in. The only other downside to this type of trade is that it is always going to cap your maximum return on the upside. In this case, I was more than happy to do so for the sake of risk minimization considering that target return is somewhere around 10% annualized, with the most important factor being consistently achieving this return.

LNC trade details (Charles Schwab account transactions)

Here are the four key points for the LNC trade:

- Desired risk/return profile: low risk, low return (about 10% desired).

- Opinion of stock (not my opinion, just an example): Generally long, with medium volatility in the long-term, assuming the price should remain well above the strike resulting in being assigned at any of the many ex-dividends prior to expiration.

- Premium: Sufficient to still receive a decent CAGR (8.58%) if assigned before the first dividend is received. Even though this falls below the desired 10%, it is very likely to stay above the strike before this first date, making it an acceptable return to me. Somewhat comparable to a cash investment in a money-market fund, although with higher risk, and therefore a higher return.

- Expiration date: This is a long-term trade, with the expiration in Jan of 2025. This does provide more opportunity for the price to drop which should be noted. Compared to the first trade, this is a much easier trade to make for an investor as it will not require the continuous work of searching for and placing new trades. This also minimizes the effect of transaction costs, as they are only paid once in a period of over a year.

Conclusion

In conclusion, ITM buy-writes can be a great tool for income-focused investors seeking to earn a more predictable return that can be withdrawn or reinvested. It can have the effect of increasing yield through reducing the principle investment, and adding the premium received, and significantly reduce downside risk by lowing the loss threshold. All of this comes at the cost of sacrificing potential gains on the upside. If you are ok with shooting for more modest returns, and simply want to be able to achieve your goals on a more consistent basis, this may be an appropriate strategy for you. As always, you need to properly asses your risk tolerances, investment goals, properly research any companies you invest in, and make sure you completely understand the risks associated with this kind of investment strategy.

Read the full article here