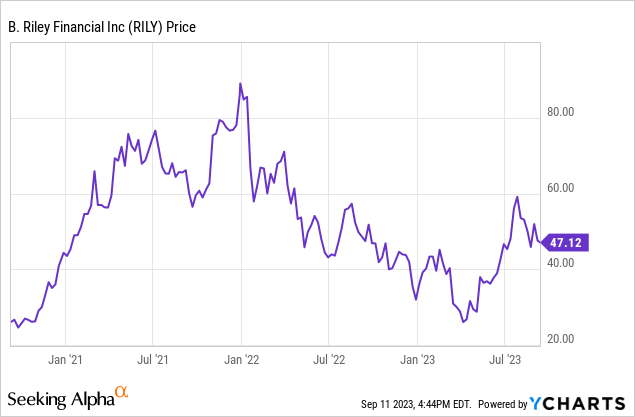

B. Riley Financial (NASDAQ:RILY) has had a turbulent 2023 with the commons staging a roughly 140% rally from 52-week lows set in April after falling from $87 per share in 2021 to around $25 per share. The reasons for the decline are broadly pegged to a comedown from the previous euphoria that defined the early 2021 stock market and a Fed funds rate that currently sits at a 22-year high of 5.25% to 5.50%. The income is the prize here and the company last declared a quarterly cash dividend of $1 per share, in line with its prior payout and for an 8.6% annualized forward dividend yield. This fat yield comes against a large near 17% short interest in the commons as bears bet on a near-term dividend cut from continued macro pressures. Indeed, the highly diversified financial services platform has seen revenues from its investment banking segment fall as its total quarterly interest expense jumped 80% over its year-ago comp.

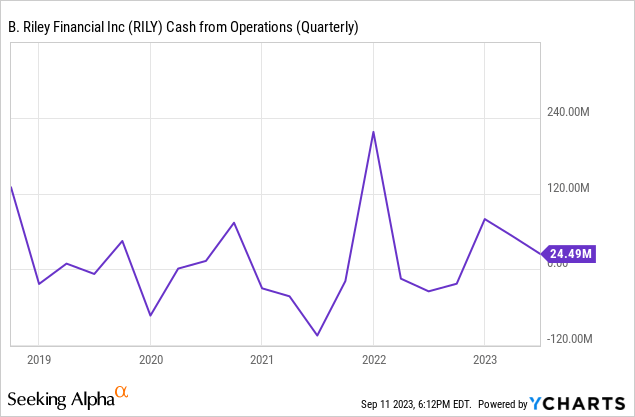

The company is now trading hands for a trailing 12-month price-to-sales multiple of 1.06x, around 20% lower than its 5-year average and less than half of its peer group median. However, intense diversification of its operating footprint has mitigated the risk posed by the slowdown of US capital market activity from IPOs to M&A with B. Riley reporting positive fiscal 2023 second quarter cash from operations and with cash and investments of $1.92 billion. This was comprised of $108 million in unrestricted cash and cash equivalents, $1.07 billion in net securities and other investments owned at fair value, and $684 million in loans receivable at fair value.

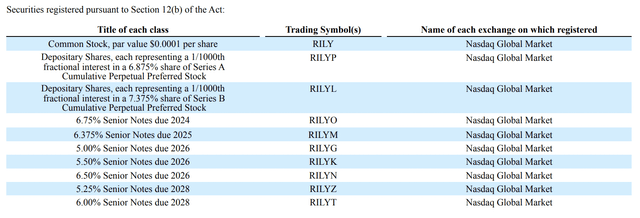

B. Riley Financial Fiscal 2023 Second Quarter Form 10-Q

Debt, Liquidity, And The Sustainability Of The Dividend

A dividend cut is a forced event and happens when a company’s current operational footprint is not able to sustainably support a prior payout level. B. Riley currently pays its common shareholders an average of $40 million in distributions per quarter with $80 million paid for the first half of 2023. This was set against cash flow from operations of $77.1 million for the same half-year, up from a cash burn of $50 million in the year-ago comp. Critically, total debt as of the end of the quarter was $2.33 billion, with this figure net of cash and investments coming in at $406 million. B. Riley has a range of publicly traded preferred stock and baby bonds, and I previously covered its Series B preferred shares (NASDAQ:RILYL) when it traded on a 17.7% discount to par that has since shrunk to 3.7%.

Firstly, bears would be right to point out that the company’s current operational cash flow does not cover the current quarterly dividend distribution. Further, that cash flow has dipped markedly from its 2021 highs has of course meant the company is inherently less well placed to protect its dividend, justifying the dip in valuation we’ve seen from its sales multiple. To be clear, each dollar in revenue has markedly less positive sentiment today than in 2021. However, that B. Riley has so far maintained its distribution through some of the worst capital markets conditions in decades is a vote on confidence in the staying power of the dividend on the back of its diversification strategy.

Revenue And Momentum

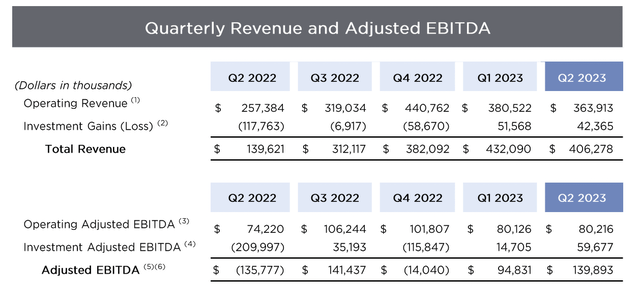

B. Riley Financial Fiscal 2023 Second Quarter Presentation

Fundamentally, with the Fed set to bring an end to its current era of monetary tightening, B. Riley is likely set to experience an ever-increasing level of client activity across capital markets, retail liquidation, consulting and appraisal. The company stated during its second-quarter earnings call that they closed more investment banking transactions post-period end in July than during all of the second quarter. The company recorded revenue of $406.28 million, an increase of 191% over its year-ago comp with operating revenues growing by 41% to $364 million. Adjusted EBITDA of $139.9 million grew from a loss of $135 million in the year-ago period. Net income for the second quarter came in at $44.4 million, around $1.55 per share.

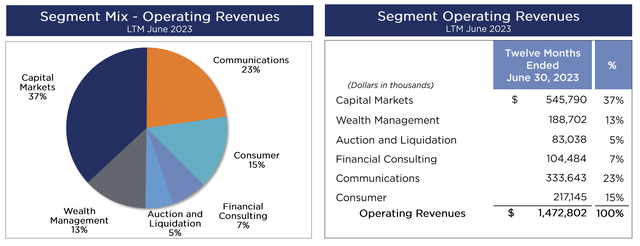

B. Riley Financial August Investor Overview Presentation

The pending recovery of capital markets, which accounted for 37% of trailing 12-month revenue represents latent upside inherent in the commons. This segment saw revenue for the second quarter fall by $13.2 million. The market is currently pricing in a 92% chance that the Fed will keep rates unchanged at their upcoming September 20 FOMC meeting as recession expectations get peeled back. According to Barclays, the US is likely on the cusp of a soft landing, an outcome that would further add legs to the current quarterly distributions set to be bolstered by a pickup of the capital markets. I think a dividend cut would be unlikely against this backdrop.

Read the full article here