Introduction

Established in 2006 in Denmark, Ascendis Pharma (ASND) is committed to pioneering therapies for unmet medical needs, including products like Skytrofa for growth hormone deficiency. The company focuses on conditions such as pediatric and adult GHD, Turner syndrome, hypoparathyroidism, and achondroplasia. Ascendis aims to be a global biopharma leader through its TransCon technology, which is central to its Vision 3×3 roadmap for sustainable growth until 2025. The roadmap includes plans for regulatory approval of key endocrinology products, pipeline expansion, and a global commercial presence.

In my previous analysis, I labeled Ascendis a “Hold” due to its mix of opportunities and challenges. Its strong revenue growth, led by Skytrofa and a promising product pipeline, indicated upward momentum. However, concerns included substantial debt, reliance on Skytrofa, and uncertainties over FDA approval of TransCon PTH. I advised investors to watch for future FDA interactions and European decisions on TransCon PTH.

Recent Developments: In Q3, Ascendis secured $150M upfront for a 9.15% royalty on U.S. SKYTROFA revenue, starting in 2025, capped at 1.925x multiple.

The following article analyzes Ascendis Pharma’s Q2 2023 financials and growth prospects. It maintains a “Hold” recommendation due to mixed financial performance and regulatory uncertainties.

Q2 Earnings Report

Looking at Ascendis’ most recent earnings report, Q2 2023 revenue jumped to $50.7M, largely fueled by Skytrofa sales at $38.4M. R&D costs rose to $112.4M, mainly for oncology programs and clinical trials. SG&A expenses climbed to $75.2M, primarily due to marketing and organizational growth. Net finance income decreased to $28.2M from $66M in Q2 2022. The company reported a net loss of $129.9M and had $461M in cash and equivalents, a drop from $795.2M at the end of 2022.

Cash Runway & Liquidity

Turning to Ascendis’ balance sheet, the company had $571.6M in cash and cash equivalents ($421.6M original + $150M recent addition), $39.5M in marketable securities, amounting to total liquid assets of $611.1M. Their six-month net cash used in operating activities stood at $321.2M, giving an estimated monthly cash burn rate of approximately $53.5M. The cash runway, calculated as total liquid assets divided by monthly cash burn, is now around 11.4 months. It should be cautioned that these values and estimates are based on past data and may not be indicative of future performance.

Ascendis has a significant amount of debt, with long-term borrowings listed at $512.6M. While the presence of debt may put pressure on the firm’s liquidity, their total liquid assets could cover the monthly cash burn for a short to medium term. Given the existing debt load, the company may find it challenging to secure additional financing at favorable rates without first showing a substantial improvement in its cash flow or reduction in cash burn. These are my personal observations, and other analysts might interpret the data differently.

Disclaimer: All financial values above originally reported in Euro have been converted to U.S. Dollars at a conversion rate of 1 Euro equals 1.07 U.S. Dollars for the purpose of this article.

Capital Structure, Growth, & Momentum

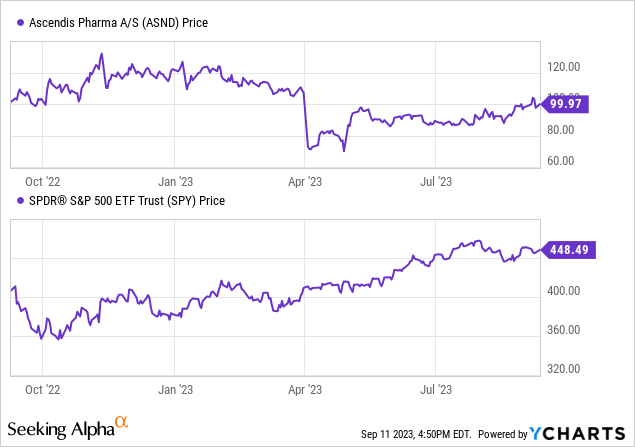

According to Seeking Alpha data, Ascendis Pharma has a moderate capital structure with an enterprise value of $5.57B, considering its cash and debt positions relative to its market cap. The company is clearly beyond the pre-revenue stage, with sales projections rising from $225.1M in 2023 to $658.44M in 2025, indicating significant growth. The stock shows mixed momentum, underperforming the S&P 500 over the medium term but recently showing a slight positive tilt.

Overall, Ascendis offers a blend of growth and risk, warranting continued scrutiny in line with upcoming FDA and EU decisions.

Ascendis Pharma: Navigating the Turbulence in Q2 2023

Expanding on my initial evaluation, Ascendis Pharma’s Q2 2023 results offer layered takeaways. Skytrofa’s rising revenues make it an emergent force in the U.S. pediatric GHD market, a sector with a high growth ceiling but also rife with competition. The less than 10% market share suggests room for significant expansion, potentially driving higher revenues in future quarters. However, Ascendis’ revenue adjustments-due to both rebates and a weakening dollar – sound cautionary notes about revenue predictability, underscoring my previous advice about diversification.

The TransCon PTH trajectory, particularly the positive Type A FDA meeting, could be a game-changer. Regulatory approval could open up a new revenue stream in adult hypoparathyroidism, alleviating previous uncertainties and fulfilling the promise of Ascendis’ technology in more complex disorders, as I had earlier mentioned.

Progress in other pipeline projects like TransCon CNP and IL-2 β/γ signifies Ascendis’ strategic move toward risk mitigation. By advancing multiple assets, they could lower their operational risks, aligning with my earlier counsel to reduce Skytrofa-dependency for revenue.

My Analysis & Recommendation

In the coming weeks and months, investors should pay close attention to Ascendis Pharma’s cash runway. Despite a recent $150M boost, the company continues to skate on thin ice, particularly given its high monthly burn rate of around $53.5M. The issue of ongoing net losses, marked by a $129.9M hit in Q2 2023, amplifies concerns over liquidity. The company’s sizable debt at $512.6M makes securing additional financing at favorable terms more challenging, barring substantial improvements in cash flow.

However, there are mitigating factors. Ascendis is not a one-trick pony. The upward trajectory in Skytrofa revenues and the company’s progress on the TransCon PTH suggest more than one pathway to revenue generation. If TransCon PTH gains FDA approval, it could significantly diversify the revenue stream, offering a much-needed cushion against the inherent volatility of relying solely on Skytrofa.

Furthermore, investors should consider the company’s ambitious Vision 3×3 roadmap, which outlines a strategy for sustainable growth through 2025. If Ascendis successfully navigates the regulatory hurdles and continues its planned pipeline expansion, it may achieve longer-term stability, thereby mitigating current concerns about its cash runway and debt load.

Despite some concerns, I maintain my “Hold” recommendation on Ascendis Pharma. While the risks around cash runway and ongoing losses are non-trivial, they are balanced by Skytrofa’s market potential and the promise of TransCon PTH. Investors already in the stock may find it worthwhile to stay the course while closely watching upcoming FDA and EU decisions. New investors should exercise caution, recognizing that Ascendis is a high-risk, high-reward play.

Read the full article here