Proximus (OTCPK:BGAOF) has been an exceptionally poor performer these last years. But we see some hope for Proximus as markets are unlikely to be focused on the IPO market as a key drive of its value and the biggest source of its failures these last years. While we will stay on the sidelines because the fibre rollout puts undue pressure on their valuation and performance, we do think for more aggressive investors, the IPO market angle and the unlocking of value from Telesign is pretty likely to be underappreciated as a trading factor by markets. Proximus is interesting at these depressed levels, but they have substantial issues including debt pressure to worry about.

Q2 Breakdown

The fibre rollout is so important for looking at Proximus. It has made minimal progress now at 25% from 23% last quarter. There is around a 2.6 billion EUR outstanding CAPEX bill that will need to be paid by Proximus to complete the rollout.

For the general telco business, performance has been all right. Telcos are passing on some inflation and revenues are creeping upward, but EBITDA is flat on the issue of workforce inflation primarily.

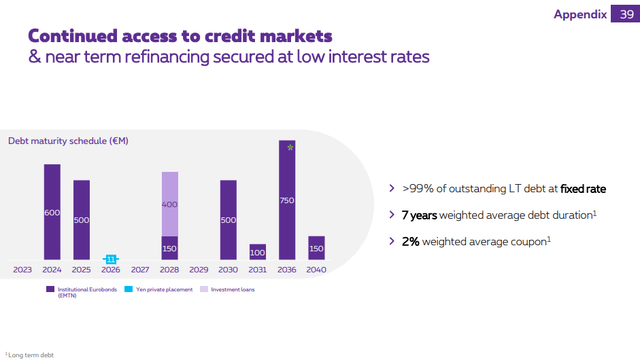

However, while they have a 7-year average duration on their debt, the maturity profile is not great considering that they are currently at a 2% rate which is going to go up substantially on refinancing. So there will be substantial net income compression from the financial side of the business. This is a real problem.

Maturity Profile (Q2 2023 Pres)

The debt profile requires pretty imminent refinancing on around 33% of their net debt in 2024 and 2025. We think that they will be financing at much higher rates than 2%, probably around 5-6%, considering their massive CAPEX burden and inflation pressure. Interest costs will have possibly doubled or more by 2025.

It is essentially certain that the dividend will disappear for a long time after that, since new debt covenants are likely going to target a dividend that is currently not financed by cash flows and is steadily growing the debt.

However, at least Telesign is performing well, which was supposed to be their IPO. Bookings are up in mid-double digits, and it is a tech market. There has been renewed IPO activity in tech, which is promising for Proximus to be able to monetize that stake. We estimate that Telesign could be worth approximately 10% of the company’s EV (including outstanding likely CAPEX) and could be a major trading factor for Proximus investors, since it has been a downside factor in the past few years.

Bottom Line

The problem is that monetizing Telesign in a value-accretive way is only a possibility. It is a certainty that, over the next couple of years, there will be mounting interest pressure. Also, they intend to pay a dividend still, and markets are likely hanging on to that. The dividend is not sustainable, and will likely be a point of contention as they refinance, since their FCFs are tanked by this ongoing CAPEX burden that will last years longer. There are trading factors to the downside too, and the business is quite badly positioned over anything longer than a medium-term time horizon. However, the IPO matter is important, and over the next 6 months could create some dynamism in a price that is close to record lows.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Read the full article here