Investment Thesis

Evertec (NYSE:EVTC) is pursuing an ambitious M&A growth strategy, recently purchasing payments and fintech companies in Brazil, in order to diversify their geographic and product offerings. At the same time, EVTC has released positive financial results in recent quarters, and the market consensus is for the momentum to continue, as the management team recently raised their guidance. Whilst the stock is up ~16% YTD, the expansionary strategy and financial results could possibly lead to a further increase in the stock price, as EVTC is currently undervalued relative to local peers.

Company Summary

Evertec is a full-service transaction processing business, offering a broad range of payment services, merchant acquiring, and business process management services. The company’s key markets are in Puerto Rico, the Caribbean, and Latin America. According to the company’s recently quarterly results press release, EVTC processes over six billion transactions annually on behalf of a diversified customer base of financial institutions, merchants, corporations, and government agencies.

Whilst the company is headquartered in Puerto Rico, it has managed to diversify its financial geographic mix and revenues to become less dependent on its home market, as it now operates in 26 LatAm countries. In addition, whilst EVTC’s most important product line is in Payment Services, it has shown a good balance of revenue generation from the other ancillary divisions of Business Solutions and Merchant Acquiring. This strategy of successful geographic and business mix makes the company less susceptible to earnings volatility in the case that a specific market or product underperforms in a given period.

Financial Geographic Mix (Bloomberg) Financial Product Mix (Bloomberg)

EVTC’s strategy is to growth organically, as well as through M&A opportunities, which it has been successfully taking advantage of in recent periods to expand into new geographies and expand their product offerings. Most recently, EVTC announced the acquisition of Sinqia, a leading provider of software solutions for financial institutions in Brazil. This represents an exciting opportunity for EVTC to expand its activities into a large market and cross-sell their complementary products. This is on the back of another Brazilian acquisition at the start of the year, as EVTC purchased paySmart, a payment processing services firm. These are good examples of an exciting growth strategy that should expand the addressable market and revenues for EVTC, which in turn may stimulate the stock price to rise to higher levels in the coming periods.

In terms of market performance, EVTC has had a positive year so far, with the stock up ~16% YTD, generally tracking the S&P 500 Index. However, in the last couple of months we have seen a drop in EVTC’s price, which could possibly make the current price level an attractive entry point, given the positive growth plans and solid financial results discussed below.

Normalized Chart 2023 – EVTC, S&P 500 Index (Bloomberg)

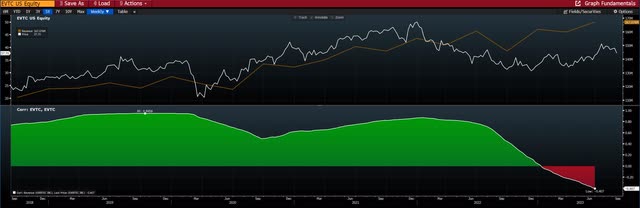

Comparing the stock price to its fundamental performance in terms of revenues, we can observe a strong correlation between the two data sets in the last ~4 years. However, we can observe a notable drop in the correlation this year, as the stock has failed to increase relative to the growing revenue numbers. Again, this could prove to be an interesting tactical opportunity to buy shares at good value, ahead of a possible mean correction of the revenues vs. stock price correlation.

Fundamental Graph – Revenues, Stock Price (Bloomberg)

Solid Financials & Bullish Consensus

Evertec released their Q2 23 results at the end of July, and there were plenty of positives. Revenues increased to $167.1 million, up ~5% from the previous quarter, whilst Net Income increased ~11% to $30.6 million. EPS also increased a similar percentage over the previous period, reaching $0.52.

Looking forward, the market consensus maintains a positive outlook and ongoing momentum seen in the results so far this year. For Q4 23, Revenues are forecasted to increase further to ~$171.8 million, and Net Income is predicted to rise significantly to $46 million.

Financial Analysis (Bloomberg)

As a result of these positive financial developments, EVTC management increased their guidance for the year. They increased the top end of the 2023 fiscal year Revenues to $658 million, compared to the previously estimates of $652 million, as well increasing their expected annual EPS by ~6%. In addition, the company announced an increase to their share repurchase program, up to an aggregate of $150 million in the next 18 months. This should be a bullish catalyst for the stock, as these buybacks can generate additional shareholder value.

Positive Analyst Recommendations

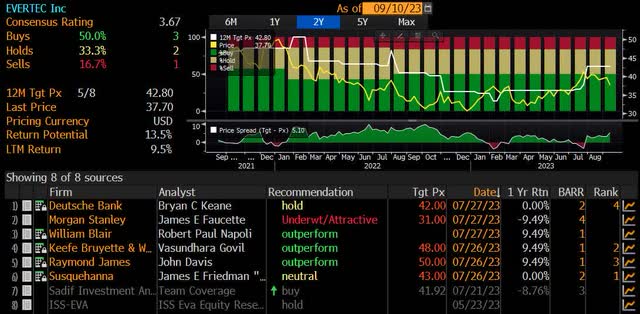

Analyst Recommendations (Bloomberg)

I look to affirm my thesis by analyzing the Bloomberg Analyst Recommendations in order to gauge the sentiment of the sell-side community. Whilst EVTC has relatively low coverage by analysts, there is a constructive consensus around the stock. 50% of surveyed equity research analysts have issued a “BUY” rating on the stock, whilst only one analyst has issued a “SELL” recommendation. In addition, the consensus 12 month target price is $42.80, which implies a possible 13.5% return potential based on the current price.

Valuation Relative To Peers

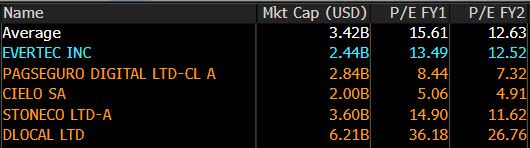

P/E Ratio – Local Peers (Bloomberg)

From a Relative Valuation perspective, EVTC is trading at a slight discount to its local sector peers, as illustrated above by the Price-Earnings Ratio for Fiscal Year 1 and 2. If we were to see a convergence between EVTC’s P/E Ratio and that of the average peer group, we could expect to see a positive uplift in the firm’s stock price, and I believe there are good arguments for EVTC to be trading at least in line with peers.

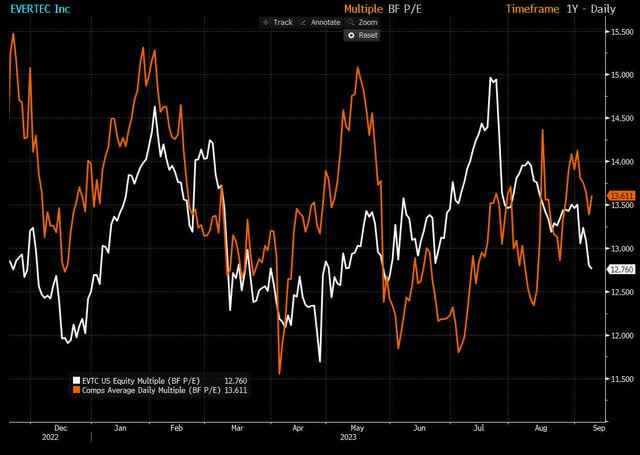

Firstly, the below chart illustrates the Bloomberg Blended Forward P/E Ratio, which uses a time weighted average of fiscal year 1 and fiscal year 2 forward estimates for EVTC and its comps average. We can see that in the last year, EVTC has managed to trade above or at-least in-line with its comps across several periods. However, in recent months EVTC’s P/E has fallen away from the comps. Nevertheless, given the tight correlation between the two, as well as the numerous periods in which EVTC’s P/E has actually been higher, I believe that we can be relatively confident that EVTC will narrow its discount over the long-term, especially given to positive financial fundamentals and acquisition headlines.

Blended Forward P/E Ratio – EVTC, Peers (Bloomberg)

Secondly, I believe that EVTC will trade closer to peers due to its recent push into new markets, notably their acquisitions to enter and build their presence in Brazil, representing the largest LatAm market. Digging into their Transaction Processing peer group, the firms that are trading at higher P/Es are StoneCo and Cielo. Both of these competitors operate exclusively in the Brazilian market. EVTC will now be able to tap this market, whilst bringing its products, services, and knowhow from their existing offering in Central America. At the same time, EVTC’s stock should benefit from better geographic and product diversification when compared to those peers.

The stock’s Bloomberg Adjusted EPS estimate for FY 2023 is $2.79, which I believe is a sound market estimate to use for a couple of reasons. On Bloomberg, the figure is derived from the underlying forecasts of 6 analysts, which arguably gives us a broad enough panel of opinions in order to derive a valid average from. In addition, across these analysts, there is a relatively tight dispersion of opinions, with the lowest EPS reading coming in at $2.78, whilst the highest contribution is $2.83. When the dispersion of forecasts is not as broad, it indicates that there is a relatively tight consensus from the analyst community, which could help to provide more conviction to the estimate value.

If we apply the EPS FY 2023 estimate, $2.79, to the comps average P/E Ratio for Fiscal Year 1 of 15.61x, we can calculate a target fair value price of ~$43 for EVTC. That target level would take us near to stock price levels last seen a couple of months ago, before the recent sell-off. I believe that correction was primarily driven by opportunistic profit-taking and was arguably a good selling opportunity, as the period return between Jan 23 – July 23 was approaching ~30%. Overall, the below P/E valuation approach represents a notable potential uplift of ~15% to the fair value, which is also relatively in-line with the analyst consensus 12 month return potential illustrated earlier.

P/E Valuation (Bloomberg)

Positive Shareholder Trends

I always look at the Top 10 Shareholder base and the recent quarterly reporting of their positions, in order to spot any significant buying or selling patterns that may shed light on the sentiment of major investors. In this case, we can see a positive outlook that affirms my bullish thesis.

In recent quarters, we can see large institutional shareholders increasing their positions in EVTC, such as BlackRock ( current owns ~15% of shares outstanding), State Street (~4%), and River Road Asset Management (~3%). This positive positioning by these key investors could imply that they potentially see EVTC as good value for the coming quarters and may have a bullish outlook on the stock, or else one could argue that the investors would either be maintaining or selling down their positions.

Top 10 Institutional Shareholders (Bloomberg)

Moving onto the Management Transactions, a similar positive pattern can be observed. Whilst there has been a higher frequency of smaller sell transactions throughout 2023 so far, there have also been significant purchase transactions that more than off-set. On an aggregated basis, there were ~115,000 share sold and ~226,000 shares bought, resulting in a net positive increase in management transactions of ~341,000. This generally indicates that the management team have skin in the game and implies that they might see the recent price levels as good value relative to the long-term fundamental prospects for EVTC, which further affirms the thesis.

Management Transactions 2023 (Bloomberg)

Bullish Options Positioning

A technical indicator in the options market that we can use to identify bullish or bearish sentiment signals is the Put/Call Ratio, which compares the current open interest for put options versus call options. A value below 1 indicates that there is a greater amount of open interest in call options versus puts. The current value of 0.10 for EVTC shows this greater demand for call options, indicating that there is strong positioning in the market to take advantage of upward moves in the stock through call options. Conversely, it also shows a lesser demand for put options, which are generally purchased if there are concerns on the stock being overbought or overvalued, as options traders would be looking to either protect or speculatively profit from an expected fall in the stock.

Risks

It is important to highlight a couple of key risks to the thesis. On a micro level, there is the execution risk that EVTC is not able to efficiently integrate the new businesses that it has recently purchased (and considering to purchase in the near future), as the management team continue to drive growth through M&A opportunities. This corporate expansion can lead to financial risks in terms of depleting the cash and financing reserves more than originally budgeted for, and can lead to operational risks of not fulfilling the synergies that were hoped for. These risk events would possibly lead to a deterioration in EVTC’s financial results and position, and ultimately weigh down on the stock price.

On a macro level, if the economic conditions in Central and Latin America were to worsen, there would be a negative impact on the demand for the payment services offered by EVTC, resulting in underperformance at the top line. As per the below Bloomberg Economic forecasts, the LatAm region does run the risk of a high and sustained level of inflation in upcoming years. Nevertheless, there is a large mix of fortunes within this region, and EVTC is currently pursuing the sensible strategy of targeting large and valuable nations within this bloc such as Brazil, in order to reduce the exposure to country-specific downturns.

Economic Forecasts- LatAm, Brazil (Bloomberg)

In Conclusion

EVTC is an interesting and ambitious company in the growing industry of fintech and payments, and is targeting geographic expansion in a region that is less saturated than Western and North American payments markets. The recent acquisitions of Sinqia and paySmart demonstrate the exciting potential prospects for the firm, and the financial results have trended up this year, which could possibly feed through to the stock’s price. At the same time, there are bullish signals from sell-side analysts and buy-side investor positioning, which help affirm my view that the company and stock are on an exciting path for growth in the coming periods.

Read the full article here