Introduction

The economic crisis that is going on in Argentina right now is quite frankly scary to look at. The company is experiencing hyperinflation and the combination of that together with severe droughts is causing the agriculturally dependent economy to spiral out of control.

Investing into assets there right now seems too risky and I think investors who are interested and still do it will get burnt badly.

Having proper risk management is important and investing in a bank like Banco Macro S.A. (NYSE:BMA) seems like the least favorable way right now to grow capital. Deposits may have risen for the company, but the value of the currency has deteriorated and hurt its state on the world market. BMA trades at a significant discount to the sector and for good reason in my opinion. I find the risks too large and will be rating BMA a sell right now, unfortunately.

Company Structure

BMA is a significant financial institution, extending an array of banking solutions to both individual and corporate clients within Argentina. Diversifying its offerings, the bank provides an array of retail and corporate banking products and services tailored to meet the diverse financial needs of its customer base. With a market cap of nearly $3.5 billion, it’s one of the largest institutions in the country. But this hasn’t enabled them to be any better of an option in the country from an investment point of view, unfortunately.

The bank’s retail banking segment offers a comprehensive list of services, focusing on the needs of individual customers. This includes a range of savings and checking account options, providing the foundation for managing day-to-day financial transactions. Additionally, BMA offers time deposits, allowing customers to invest their funds while earning interest. The availability of credit and debit cards further empowers individuals with convenient payment options that enhance their financial flexibility.

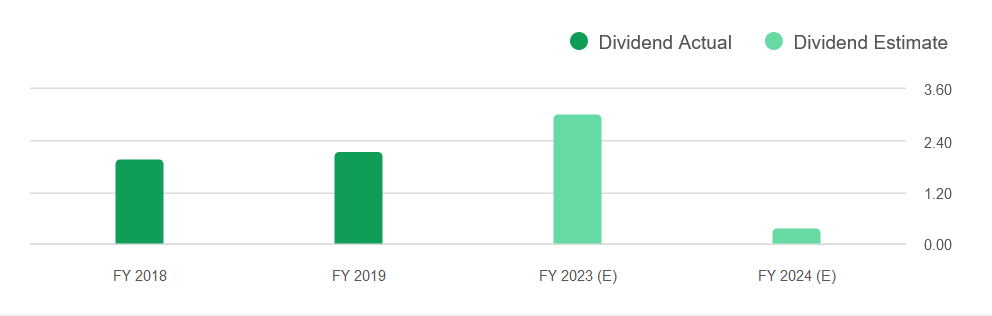

Dividend Estimates (Seeking Alpha)

Looking at the dividend for the company it seems likely that it will fall off quickly in a couple of years from where it is today, yielding over 9%. Investors are worried that the crippling inflation in the country is making it difficult to properly grow as a bank. The cost of everything is rising and people have less capital to save that is hurting the deposit potential for the business and in turn, leads to a lower valuation for the business.

Earnings Transcript

I think it’s worth getting some insight into the management’s views on the performance so far and what the coming quarters might entail. The head of IR Nicolas Torres said the following in the most recent earnings call the company had.

-

“Wherein interest income, interest from loans increased 12% or ARS13.1 billion quarter-on-quarter due to a 760 basis points increase in the average lending rate, while the average volume of private sector loans decreased 3%. On a yearly basis, income from interest from loans was 34% or ARS30 billion higher”.

Argentina is finally raising the interest rates in the country even further and the currency has fallen as a result of the primary vote recently happening that highlighted the positive results for Javier Milei who wants to rather dollarize the economy. This had a very negative result on the peso as it fell to all-time lows against the dollar. I think this will be persistent and speaks volumes of the current climate in the country. For BMA I think they are in a tricky situation as the deposits they may receive are lost in value against foreign currencies and that puts them in a difficult position to get outside investments and exchanges. The environment is uncertain and will lead to the company trading at a lower multiple for a long time most likely.

Risk Associated

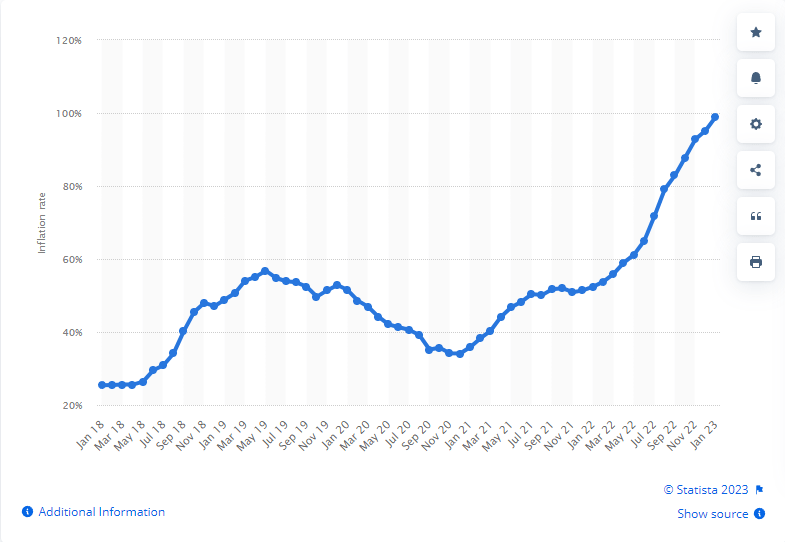

The trajectory of inflation in Argentina over the past decade is remarkable and concerning, as it surged from a modest 2% rate in 2012 to a staggering 61% by the close of 2022. This remarkable shift paints a vivid picture of the economic challenges that have beset the nation. The situation has been further exacerbated by projections indicating an even more alarming inflation rate of 113% for the current year, with expectations pointing towards a potentially astonishing 180% by the conclusion of 2024.

Inflation Rate Argentina (tradingeconomics)

Compounding the challenges Argentina is grappling with, the nation’s primary exports, largely rooted in agriculture, are now being threatened by a devastating mega-drought. This dire situation has reached such proportions that even the World Meteorological Organization, headquartered in Switzerland, has issued a sobering prediction. The organization anticipates a substantial 28% decline in the country’s agricultural exports for the year 2023, a stark contrast to the figures recorded in 2022. These unfortunate events are only making it more difficult for the country to be able to get out of the slump it’s currently in. Investing into that market seems incredibly risky right now and banks are far from the way to go about it. I think that loans that the banks are going to go down in value a lot as inflation is not likely to come down anytime soon. The result of inflation seems to have inflated the results for companies like BMA which had a 265% increase in net income on just a quarterly basis. Investors should stay away from investing in Argentina until there are clear and effective measures put in place that will help ease the situation.

Investor Takeaway

The risk profile for BMA right now is in my opinion too high to make an investment case for the company. As inflation runs rampant in the country there is a high risk of delinquencies and that will devalue the loan portfolio for the company and lead to it trading even lower I think. Staying away from investing in Argentina right now seems sensible and as a result, I am rating it a sell.

Read the full article here