The home construction sector is notorious for its “boom and bust” cycle. During rising home prices, high demand, and low existing home inventories, residential construction companies often see their EPS soar by multiplies. Of course, as investors clamor over solid earnings growth, their valuations usually rise according to their EPS. Increases in valuations are most dramatic when investors fail to remember the cycle risks inherent to the industry. As the construction cycle inevitably normalizes and price competition returns, most construction firms will see most or all of their income evaporate, occasionally leaving equity investors with significant losses.

Today’s situation is somewhat unique due to the vast impact of the Fed’s QE (and now QT) program on mortgage rates. As discussed in “Orchid Island Capital: 21% Dividend Yield May Be Cut As Net Interest Income Crumbles,” mortgage rates have gone from extreme lows to extreme highs in an extremely short period. This situation is unprecedented, so effectively, no companies in the mortgage and construction industries are apt to handle it easily. Further, because this significant change has occurred over such a short period, few investors may be appropriately pricing for its impacts on property sector profits.

The impact on mortgage companies is primarily priced in because those firms are subject to mark-to-market accounting. However, the effect on construction stocks does not appear to be accounted for because most in the industry still have significant trailing twelve-month profits. Of course, those profits are based on construction contracts, which were generally created before the mortgage rate boom. The residential property market has a very long lag because demand and supply trends are pretty “sticky” (due to the need for long-term planning for home buyers and builders). Thus, changes in market conditions will not usually manifest in the bottom line for some time.

In my view, the data finally shows an evident trend indicating product contraction across the homebuilding sector. Considering the popular iShares U.S. Home Construction ETF (BATS:ITB) is trading near an all-time high, I do not believe this issue is accounted for in the valuations of those companies. Therefore, there may be a solid short opportunity in ITB and many of its constituents today.

2023 Construction Market Slowdown

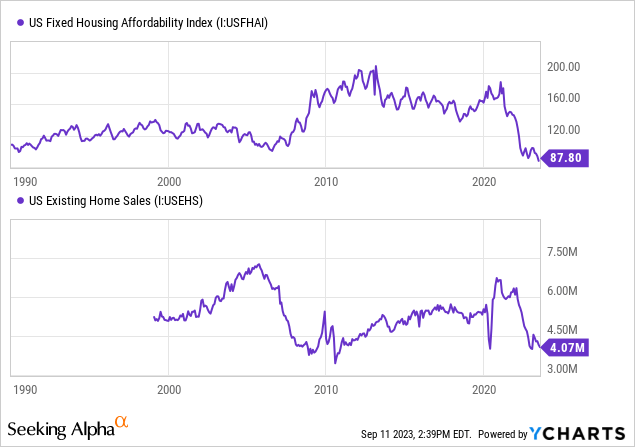

Undoubtedly, the past five years have been one of the best for home builders. Construction activity was relatively low for around a decade after 2008. Home buying activity has also been somewhat low because many more people are priced out of the market or are too debt-encumbered. While that remains an issue, the ultra-low mortgage rates from 2020-2021 created a surge in new buying activity as homes were, very briefly, extremely affordable. Of course, by now, they’re at record-low affordability due to higher rates and home prices. See below:

Home affordability is currently resting around an all-time low. Home sales are also meager, indicating that home demand is likely sharply declining. Indeed, very few new buyers are entering the market, with far more property sales occurring between cash buyers, mostly retirees (or near-retirees) looking to downsize. This segment is holding property prices up and keeping inventories from rising too fast, but it will not last as the market continues to rebalance.

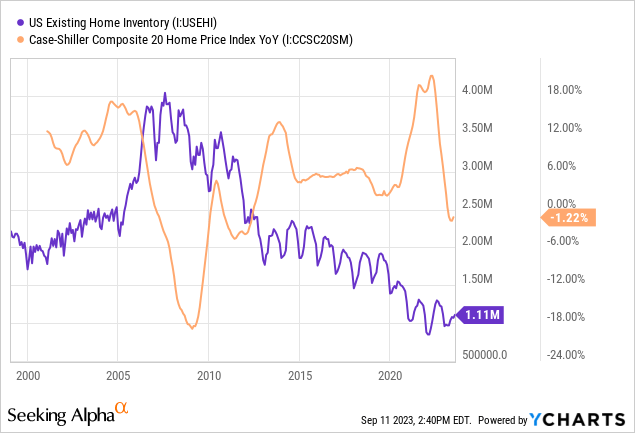

Home inventories are still relatively low despite the declines in home demand. Home prices are generally peaking or falling, but not at the pace anticipated by demand trends. See below:

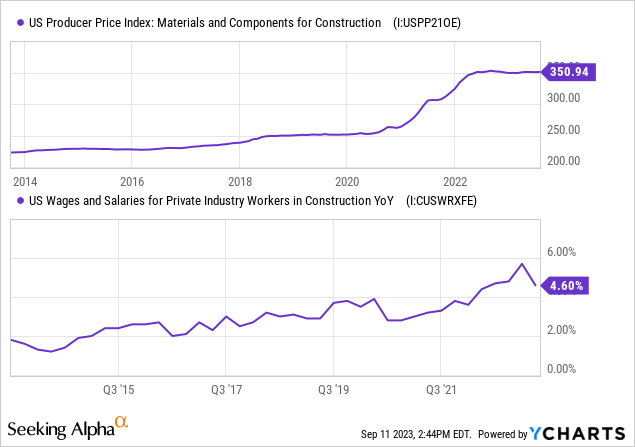

Put simply, the home market is in the odd situation of “low demand, low supply.” For now, this only implies slight declines in home prices. However, that should be enough to upset profits in the construction sector due to the true impact of rising labor, materials, financing, and other costs. This year, the shortage of labor and materials in construction has slowed, but it persists, as indicated by pricing and wage data:

Higher interest rates also significantly increase builder financing costs. Of course, not all companies in ITB are developers. Roughly a third of the fund is in related segments such as building products, home improvement retail, construction chemicals, and construction trading companies. That said, the non-developers may be more significantly impacted as building activity slows because they benefited from materials shortages created during the excess building activity that culminated around ~2021. This is discussed in greater depth in “Builders FirstSource: Short Opportunity As Homebuilder Momentum Fades.”

Overall, I expect homebuilders and related companies to see expenses increase. The direct inflationary pressures should slow, partially offset by increased financing cost pressures. Of course, if energy commodities rise again, as I strongly suspect, then cost pressures would mount in all needs, such as they had in 2020. Unlike then, home prices are not likely to rise in most of the country, and I expect will fall at a faster pace over the next year.

We should also remember that the market is turning over without a recessionary rise in unemployment. Over recent months, much of the developed world has dipped into or near a recession, and the data suggests that the odds of a U.S. recession are higher than in 2008 and 2000. The recent years’ tumult may upset the validity of these historical models. Still, a recessionary increase in unemployment would almost certainly make this situation more dramatic as home inventories could likely soar as defaults rise.

Expected Impact on ITB Constituent’s Profits

ITB currently trades at a weighted average “P/E” of ~9.5X. While that may not seem too high for stocks in general, it is much higher than is typical for the sector. During cyclical downturns, most construction stocks will lose nearly all their income. 2008 was an extreme example, but during that period, most saw EPS go from extreme highs in 2006 to having such significant losses that they were insolvent by 2009. Today’s situation differs, but home valuations (compared to income) and mortgage rates are higher, so most core components remain the same.

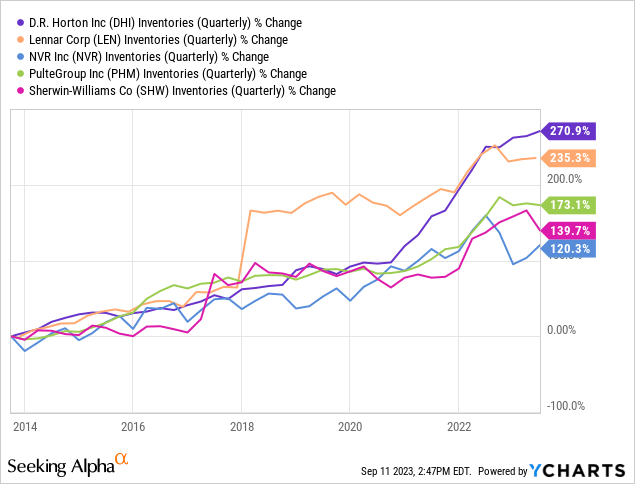

Homebuilders are generally not as stretched as they were then; however, they’re far more extended today than they have been since then. This is seen clearly in the inventory levels of the largest companies in ITB:

These companies are betting very heavily that their record profit levels will continue. Most are not slowing down activity too significantly despite the massive decline in home sales activity. Of course, it is possible that “cash buyer” demand remains strong enough to move this inventory as it’s completed. However, as is typical for the industry, they’re most likely deploying maximal capital at the least opportune time (during the market peak). This is understandable because builders usually reinvest most of their profits into new projects (instead of dividends), and profits have been stellar in recent years. However, it creates a high-risk scenario wherein most, or more than all, of that income will be lost amid a slowdown in prices (and/or a rise in costs).

The Bottom Line

Over the coming quarters, as the current wave of summer sales ends, I expect that the remaining “cash buyer” demand will fade. A rise in unemployment seems likely with a recession, but it is certainly not guaranteed as such, we can have a “base case” view that ITB’s constituents will face an idiosyncratic slowdown (not coinciding with recessionary unemployment) and a possible outlook given a recessionary scenario.

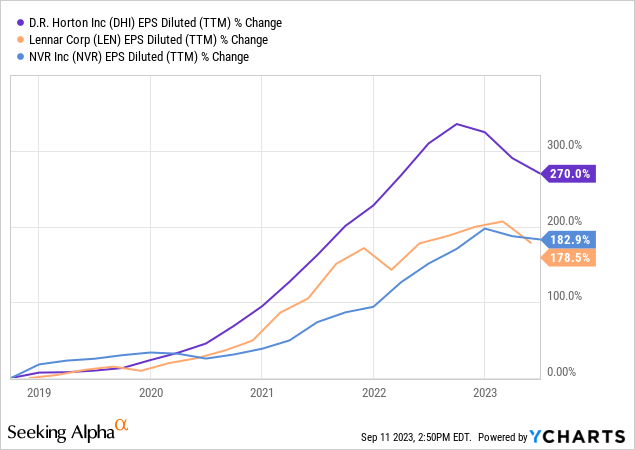

In the “stagnancy” scenario, I still expect ITB’s constituents to face a decline in EPS and some stagnation for years, likely bringing its valuation to a more reasonable level. Operating margins in the sector are around ~18% for most of the more prominent builders in the fund today. So, a slight decline in prices or activity (revenue indicators) could easily cause most operating income to rise in those builders that use debt leverage. Increased interest rates will also lower the amount of operating income, which translates to net income through a near doubling in interest costs. Thus, without a recession, I expect ITB to decline to ~$40-$50, as EPS falls by ~50%, the same level just three years ago. As you can see below, the negative trend in the EPS among the most significant three stocks in ITB is quite clear:

With a recession, the potential downside in ITB is challenging to quantify because it will depend on the depth and length of a recession. However, based on property market conditions, an increase in unemployment could be very problematic as that would likely lower the amount of non-cash buyers even more. Without significant demand drivers, prices would almost certainly decline significantly until affordability normalized. Nationally, based on mortgage rates today, home prices would likely need to fall by around one-third for affordability to return to normal. Of course, this scenario would likely cause losses for most companies in ITB. I believe the record decline and rebound in mortgage rates indicate that construction profits may peak and collapse as the market adjusts to financing conditions.

Regardless of the scenario, I am bearish on ITB. Considering its downside potential is quite significant while its upside seems very limited, the ETF appears to be a solid short opportunity. Its short borrowing cost is just ~1-2%, also low due to its low dividend yield. Further, put options on it are surprisingly cheap because it has not been too volatile recently; thus, those may be a great way to take a levered bet against it with defined risk.

Of course, ITB has potential to continue to rise in value. Sufficient investor exuberance can push any stock higher, even if its fundamentals weaken. Further, low home inventories may continue to support property prices for longer than I expected. Though not likely to me, investors should keep in mind the potential for builders to continue to perform well. A return to QE or rate cuts could also fuel upside for builders. However, I believe that is also unlikely considering that scenario already played out in 2020-2021, unintentionally creating the affordability and inflation issues today.

Read the full article here