What happened With Amazon and the FTC?

It was widely reported last week by reputable news organizations that the FTC will soon file a massive antitrust lawsuit against Amazon (NASDAQ:AMZN), with one of the remedies being the breakup of the conglomerate.

Reportedly, the case will challenge Amazon’s fulfillment programs and practices relating to third-party sellers.

This isn’t the first action taken by the FTC against Amazon under current FTC chairperson Lina Khan (pictured above), but it will likely be the most wide-ranging. A previous lawsuit was filed in June 2023, accusing Amazon of deceptive practices in enrolling customers in Prime during checkout and making the cancellation process difficult. The suit is still in the early stages.

The action is also not shocking to anyone paying attention to the FTC. The organization is aggressive, ask Microsoft (MSFT) and Activision (ATVI), and Amazon is in the crosshairs.

Khan wrote a piece published in the Yale Law Journal in 2017, positing that Amazon’s “structure and conduct pose anticompetitive concerns – yet it has escaped antitrust scrutiny.”

It is reported that the FTC and Amazon met recently in what is described as a last-ditch meeting, where Amazon did not offer concessions. This is likely because Amazon knows that nothing offered at this stage will be accepted short of breaking up the company. The FTC is determined to do battle.

What are the likely outcomes for investors?

This article is for investors, not political punditry. Big Tech was a target of the FTC under Trump and Biden, although Lina Kahn is more aggressive than Joseph Simons, her predecessor. I am not judging Big Tech’s practices, either. Amazon is a company in which I own stock; if the investment thesis changes, I’ll sell and move on.

I want to know what other stockholders do: How will this affect our investment?

It’s funny, I covered this scenario two years ago, which you can read here. Congress sought updates to antitrust laws to make them more applicable to Big Tech, but they were unable to enact meaningful legislation. Both parties wanted to punish Big Tech, but for different reasons, so (surprise, surprise) nothing happened except for the typical grandstanding.

This is important. The antitrust laws were created in 1890 and updated in 1914, but not much since. The original laws targeted Standard Oil and have been ineffective against tech companies recently. Meta (META) (then Facebook) had lawsuits against it dismissed in 2021. The FTC quickly refiled them, and the battle continues. But this illustrates how long these cases take and the shaky legal ground on which the FTC stands.

Scenario #1: Amazon Prevails

Amazon has undoubtedly been prepping for this day for a long time and won’t go quietly. Recent lawsuits against Microsoft, Meta, Alphabet (GOOG)(GOOGL), and Apple (AAPL) haven’t been transformative.

The potential lawsuit and appeals will probably take several years and test the political will of the FTC. It would also be a “win” for Amazon to escape with just a fine or settlement. This was the case for Apple in 2014. The FTC challenged certain app store practices, and Apple gave out refunds of $32.5 million.

If Amazon wins the case, it will keep chugging along with revenue streams of Amazon Web Services (AWS), Prime subscriptions, third-party seller services, advertising, and first-party sales.

Scenario #2: A Draw

As the case draws out and even gets into the appeals process, the two sides could settle for a change in practices. This happened in the landmark case against Microsoft in the late 1990s and early 2000s.

What this looks like is difficult to say. It could prevent Amazon from featuring its own products and change other practices in favor of third-party sellers, affect the company’s ability to expand its third-party logistics, change how it solicits Prime signups, and make it easier for customers to cancel services.

An agreement like this is the most likely scenario.

Amazon would still be a terrific investment with these changes, and we are years away from this type of settlement if history is a guide.

Scenario #3: A Massive Breakup

A landmark FTC victory could see the biggest breakup of a conglomerate since the AT&T (T) Bell system was split into eight “baby bells” 41 years ago.

What this would look like is anyone’s guess. Because of the reported focus of the FTC, Amazon Prime, Advertising, and third-party services would be severed in some way. This scenario would negatively affect shareholders since the company would give up serious competitive advantages. A forced breakup is not likely, but it is possible.

This is the scenario that should concern investors the most. It will create uncertainty and damage the stock price.

AWS could also be split off in the process, although AWS does not appear to be a target of the FTC. AWS has significant competition from Microsoft Azure and Google Cloud. It is a dominant platform, but not a monopoly. This could be a silver lining for shareholders who would love to own AWS as a standalone business. AWS is highly profitable and benefits from massive secular growth.

A breakup would send massive shockwaves through Big Tech and have far-reaching consequences.

Is Amazon stock a buy?

The key here is that each scenario is several years away. There are already lawsuits ongoing involving the FTC and several tech companies, but the stocks continue to trade based on results.

Amazon’s recent earnings show why it is a target; its business model is dominant.

Q2 Sales increased 11% year over year (YOY) to $134 billion, despite a slowing economy and AWS headwinds. Operating income, net income, and cash flow all improved YOY.

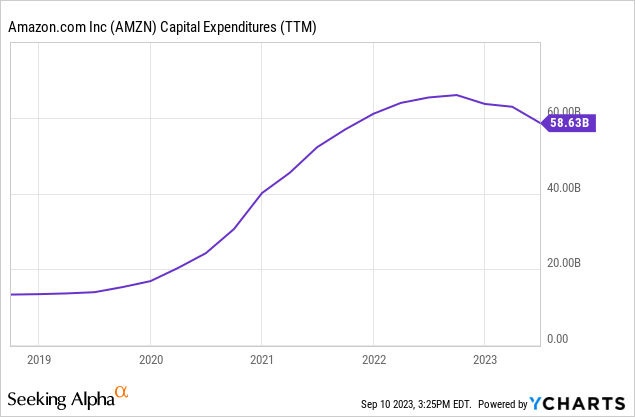

2021 and 2022 were transformative years. The incredible growth of AWS caused Amazon to pour billions into capital expenditures ((CapEx)) to keep up with demand, as shown below.

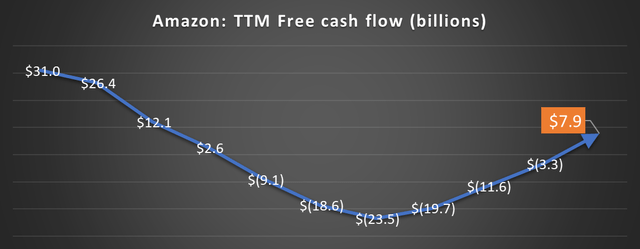

$164 billion was spent in 2020-2022. Free cash flow collapsed when this was coupled with billions in added costs due to increased labor and inflation.

CapEx and costs are normalizing, and the trailing twelve months (TTM) free cash flow turned positive in Q2 continuing its steady improvement, as depicted below.

Amazon stock (Data source: Amazon. Chart by author.)

The big concern right now is AWS. Growth slowed to 12% last quarter after years of 30%+ increases. The company told us this was coming, but it is still shocking to some. Much of the pricing for AWS is like a utility – you pay for what you use.

Amazon is actively working with customers to lower their data usage bills this year, since many budgets were cut due to fears of a recession in 2023. This is a drag on Amazon’s results in the near term but solidifies relations with these customers for the long haul.

I expect AWS growth to accelerate in 2024 for two reasons. First, the artificial intelligence (AI) wave is just starting. Is it hype or transformative at this stage? It’s both. AI means data; data means demand for AWS, and Amazon’s capital investments mean it is ready.

Just like during the internet bubble, companies can’t afford to get “Amazon’ed” like Borders or “Netflix’ed” like Blockbuster. So you can bet next year’s budgets across industries will include plenty of cash dedicated to AI. Data usage will almost certainly increase.

Second, the recession has yet to materialize. I am still wary of the economy, namely the economic health of consumers, and we aren’t out of the woods. But many business budgets, including those for data, will snap back as the economy is proving resilient.

The outcome of a potential FTC lawsuit against Amazon is years away, and anyone’s guess at this point. In the meantime, the company is thriving after the challenges of 2021 and 2022, and the stock remains an excellent investment.

Read the full article here