Investment Thesis

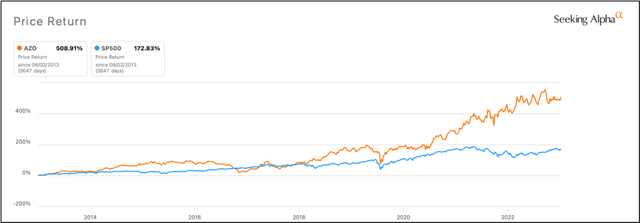

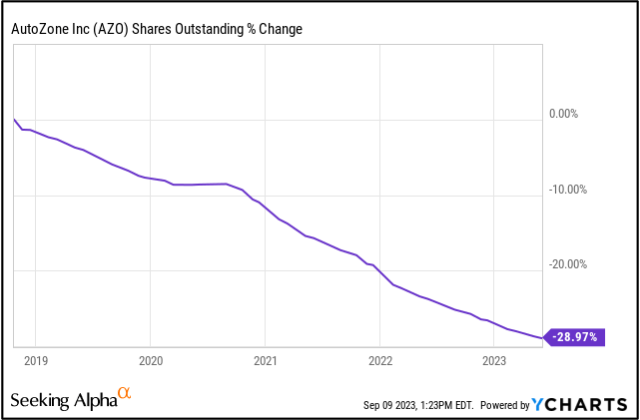

When I first added AutoZone (NYSE:AZO) to my watchlist and started to look into the company, I assumed it would have a massive following on Seeking Alpha, given they have crushed the S&P 500 over the past ten years, but that wasn’t the case. AZO’s leading position in the DIY market has allowed it to deliver consistent margin and earnings performance. Such performance has allowed the company to aggressively buy back its stock over the past five years, decreasing shares outstanding by more than 25%. I believe there is still room for growth, driven by new store openings and same-store sales. Additionally, the company is riding some nice tailwinds, such as an increase in car usage and vehicle age. I arrived at a price target of $2,761 by August 31, 2024.

YCharts

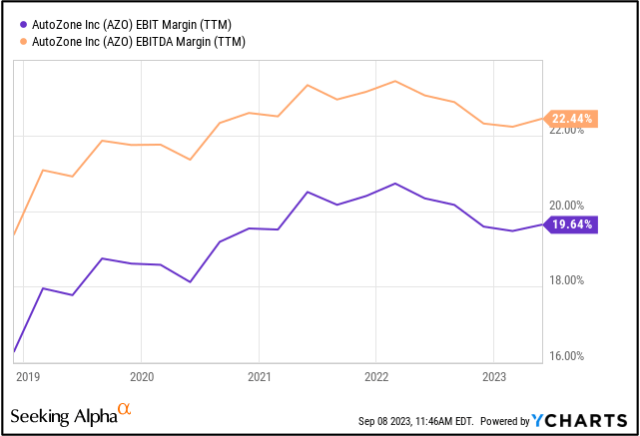

Thanks to the company’s leading position in the distribution of automotive parts and accessories, AZO experienced serious top and bottom-line growth, compounding revenue, and adjusted EPS at ~10% CAGR and ~25% over the past four years. The story here is not that growth is a thing of the past. I believe AZO still has room to grow domestically and expand in countries such as Mexico and Brazil. The company is forecast to have 7,772 stores by the end of the 2026 fiscal year (up from 6943 in 2022). Now, will the company be able to open new stores at such a pace? I believe so given their stellar cost advantage, which has helped them generate strong cash flow, and management’s effectiveness at deploying capital, which has averaged a ~26% ROIC over the past five years. The company’s profit margin is well above the sector median, and that is mainly due to cost control. AZO’s operating expense margin has gone from 37% in 2018 to 32% in 2022.

YCharts

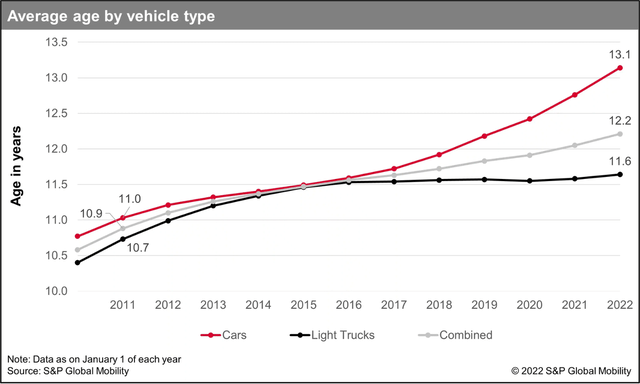

In the future, I expect growth to come in two forms. The first one is new store openings and taking share from small regional players given the fragmented market. The second is from same-store sales driven by increased car usage and a rise in vehicle age. The older the vehicle and the more you use it, the higher the chance that something might need replacing. Additionally, according to Statista, the size of the U.S. automotive aftermarket is expected to increase from $326 billion in 2021 to $400 billion in 2025.

Capital IQ

Now let us address the elephant in the room: the company’s buyback programs. AZO is no stranger to share repurchases, having spent more than $14 billion on buybacks since 2016, but the company has recently started aggressively repurchasing stock. Of that $14 billion, half was from the last two years. Plus, in the past three quarters, the company has spent $2.6 billion on buybacks. AZO is forecast to allocate $16.8 billion towards share repurchases from 2023 to 2027. This might raise the question: if the company is willing to spend this much on buybacks, will they slow store openings? My answer is no because AZO is not the same as it was five years ago. The company has come a long way due to its large scale, which provides it with a cost advantage and thus enables strong cash generation (FCF is up by 63% from 2018 to 2022 despite the buybacks and store openings).

Created by the author

Company Overview

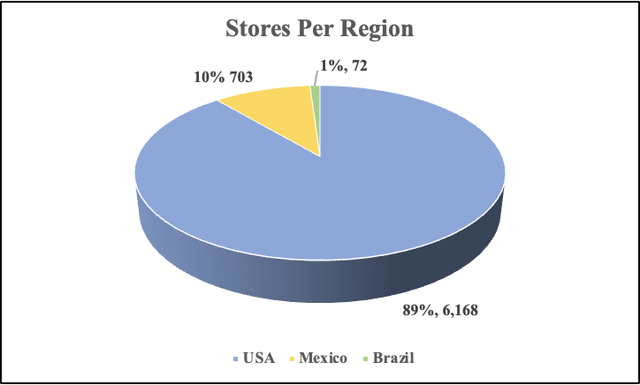

AutoZone is a leading U.S. specialty retailer and distributor of automotive replacement parts and accessories, focusing primarily on do-it-yourself (DIY) consumers. The company operates in the U.S., Mexico, and Brazil. AZO derives revenue by selling automotive parts, equipment, and other accessories online. A big reason why I believe AZO has been able to dominate the industry for so long is that its stores are generally located in high-visibility locations, which makes them the No. 1 stop for automotive parts. As of August 27, 2022, AZO had 6,168 stores in the U.S., 703 in Mexico, and 72 in Brazil.

Created by the author

Earnings Preview

Before I get into the valuation, I want to spend some time on the company’s upcoming earnings. AZO is set to report Q4 and full-year earnings on September 19, 2023. For Q4, revenue is expected to be $5.64 billion and non-GAAP EPS of $45.27, and for full-year expectations, revenue is estimated to be $17.4 billion, EPS of $132.47, and the number of stores to be 7,145. The company has been very consistent in crushing estimates, having not missed on earnings since Q1 21. I will post a comment on this article once earnings come out to keep you updated.

Valuation

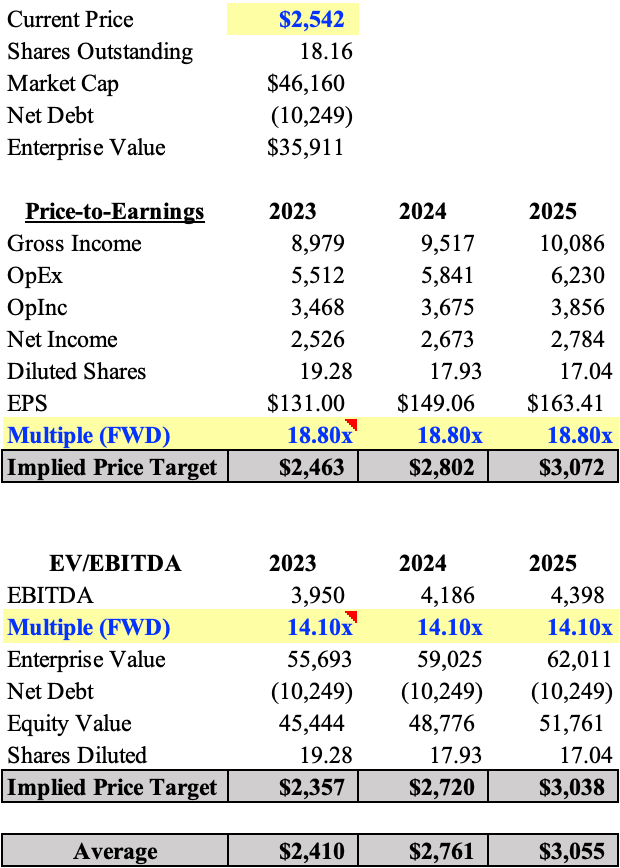

AZO is currently trading at an FWD P/E ratio of 19.31x and an EV/EBITDA ratio of 14.33x. On a trailing free cash flow basis, the stock yields over 4.2% relative to its enterprise value. I valued AZO using both P/E and EV/EBITDA multiples.

Starting off with a price-to-earnings valuation. I estimated revenue growth of 6% annually in the next three years, driven by new store openings and same-store sales growth. I assume gross margin will increase by 100 basis points annually and OpEx will stay stable at 32% of revenue. As for shares, I project they will decrease by 6.33% annually over the same period due to aggressive buybacks. I used a multiple of 18.80x, which is in line with the TTM multiple and has a 2.7% discount relative to the FWD multiple of 19.31x (data from seeking alpha).

As for EV/EBITDA, I used an EBITDA figure of $4,168 and a 14.10x multiple, which is a 1.6% discount to the FWD multiple of 14.33x. Taking the average of both methods, I arrived at an implied price target of $2,761 per share by the end of fiscal year 2024. The company’s fiscal year ends on August 29.

Created by the author

Risk/Mitigates

When it comes to risks, there is a short-term headwind, which I think can decrease the demand for AZO’s products. Oil prices have been on the rise recently, and will they remain that way? I don’t know. But let’s assume they do, given the OPEC cuts. As prices rise, customers tend to spend more on gas, which leaves very little money to be spent on automotive parts.

Another risk is a lockdown or a recession. In a lockdown, as miles driven decrease due to people only using their vehicles for one stop (grocery shopping), so will the chance of automotive parts breaking and needing to be replaced. Recessionary environments hurt most businesses, and AZO isn’t immune. A rise in inflation could force customers to spend money on necessities rather than buy automotive parts.

Final Thought

The main takeaway is that AZO has been a great compounder over the past few years. Despite the recent earnings performance, I believe there is still room for growth, driven by new store openings and same-store sales. Management has effectively deployed capital, averaging an ROIC of 26% and decreasing shares outstanding by 26% over the past five years. I believe the company’s cost advantage should allow for strong cash flow generation to support expansion. Using both P/E and EV/EBITDA valuations, I arrive at an implied price target of $2,756 by August 29th, 2024.

Read the full article here