Molina Healthcare, Inc. (NYSE:MOH) signs three to five years contracts with federal and state governments, offering a lot of visibility about future net sales and FCF growth. I believe that further acquisitions like that of Brand New Day and Central Health Plan of California or new transactions could accelerate net revenue from Medicaid and Medicare programs, and also enhance FCF margin growth. I also think that we could see further organic growth driven by MAPD and D-SNP membership expansion as we saw in the most recent quarter. There are obvious risks from failed M&A, new health care reform proposals, or lack of new contracts. With that, MOH does appear a bit undervalued.

Molina Healthcare Has A Lot Of Experience In The Healthcare Industry, And Offers Many Different Healthcare Programs

Molina Healthcare, Inc. is a leader in the healthcare industry, providing managed services through Medicaid programs, Medicare, and state insurance marketplaces. Founded in 1980 to serve low-income families in Southern California, Molina has expanded its services significantly, and currently serves approximately 5.3 million members in 19 states in the United States. With a leading position on the FORTUNE 500 list, ranking 125th, Molina is dedicated to providing quality and accessible services to low-income communities, thereby promoting equitable health care.

Molina Healthcare, Inc.’s business model is based on providing managed care services through Medicaid programs. Although funded jointly by the federal and state governments, each state has the flexibility to structure its own Medicaid program in terms of eligibility, benefits, service delivery, and provider payments. Molina participates in various Medicaid programs, including Temporary Assistance for Needy Families, Medicaid for the Aged, Blind, or Disabled, Children’s Health Insurance Program, Medicaid Expansion, and Long-Term Services and Supports.

Market Forecasts Include Net Sales Growth And FCF Margin Growth In 2024 And 2025

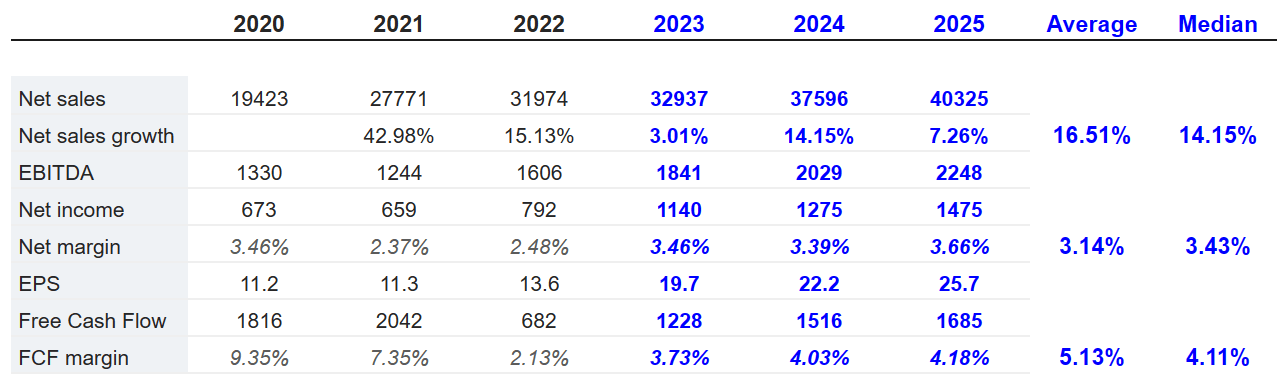

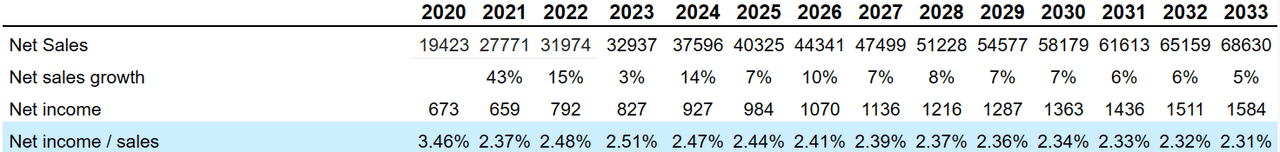

I believe that the expectations from other financial analysts are quite beneficial. Some figures are worth mentioning before I show my expectations. They include net sales growth, net margin growth, and free cash flow margin growth for the years 2024 and 2025. The average net sales growth would stand at close to 16%, with an average net margin close to 3% and an average free cash flow margin of about 5%.

Expectations from analysts include 2025 net sales close to $40325 million, net sales growth of 7.25%, 2025 EBITDA of $2248 million, 2025 net income worth $1475 million, and 2025 free cash flow worth $1.685 million. In addition, the 2025 FCF margin would stand at close to 4.18%.

Source: MarketScreener

Balance Sheet And Contractual Obligations

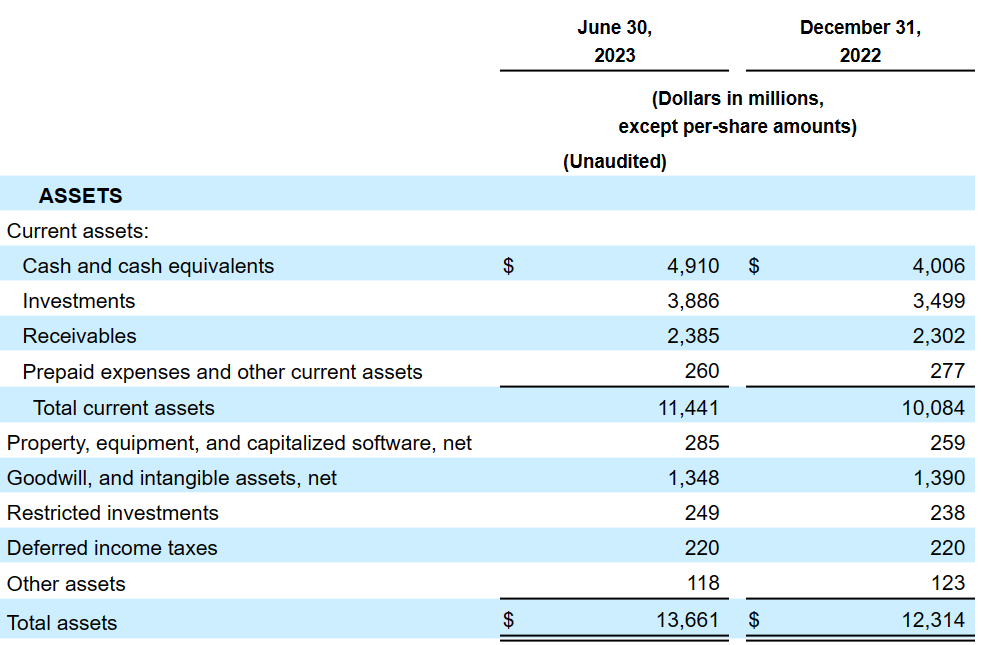

In the last quarterly report, we saw increases in cash, increases in investments, and an increase in the total amount of current assets. With regards to the total amount of assets, they increased driven by increases in property and equipment as well as restricted investments.

Cash and cash equivalents stood at $4.910 billion, with investments of about $3.886 billion and receivables worth $2.385 billion. Total current assets stood at $11.441 billion. Besides, long term assets included property, equipment, and capitalized software worth $285 million, goodwill and intangible assets of about $1.348 billion, and total assets close to $13.661 billion. The asset/liability ratio stands at more than 1x, so I think that it appears quite stable.

Source: 10-Q

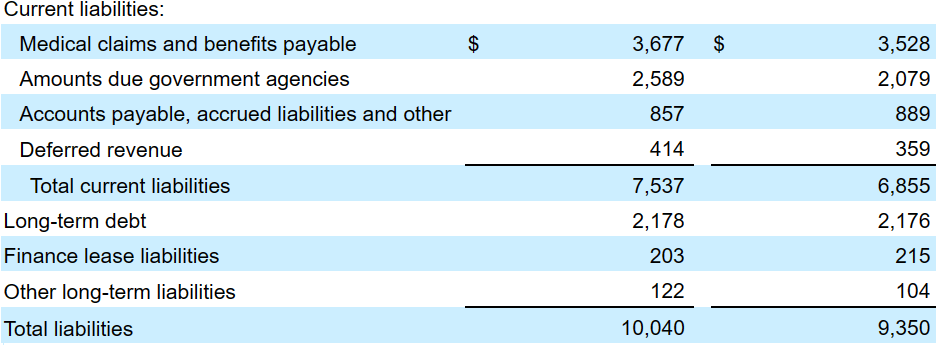

With regards to the list of liabilities, I don’t think investors would be really worried. The total amount of current liabilities increased driven by medical claims and benefits payables as well as amounts due to government agencies. More precisely, medical claims and benefits payable stood at $3.677 billion, with amounts due to government agencies of $2589 million, accounts payable, accrued liabilities, and other worth $857 million, deferred revenue of $414 million, total current liabilities of $7537 million, and long-term debt of $2178 million.

Source: 10-Q

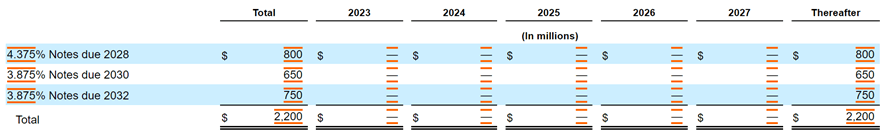

As of December 31, 2022, MOH reported long-term debt with notes due from 2028 and 2032 and interest rate ranging from 4.3% and 3.8%. The company seems to have plenty of time to pay the debt obligations, which most likely would be appreciated by the market.

Source: 10-k

I Assumed That More Government-sponsored Contracts Will Accelerate The Demand For The Stock

Molina Healthcare, Inc.’s long-term growth strategy is focused on its position as an exclusively government-sponsored business in the healthcare industry. Management signs three to five years contracts, which financial forecasters, I believe, would appreciate quite a bit. It means that investors have a lot of visibility about future payments. In my view, further new contracts with government-sponsored healthcare programs will most likely bring more attention from investors. As a result, the demand for the stock may increase.

As of June 30, 2023, we served approximately 5.2 million members eligible for government-sponsored healthcare programs, located across 19 states. Our state Medicaid contracts typically have terms of three to five years, contain renewal options exercisable by the state Medicaid agency, and allow either the state or the health plan to terminate the contract with or without cause. Source: 10-Q

New Acquisitions Like That Of Brand New Day and Central Health Plan of California May Improve FCF Margins, And Bring Economies Of Scale

MOH seeks to compete in synergistic, high-growth market segments with attractive and sustainable margins. Its strategic priorities include organic growth through acquisitions and increasing market share. With regards to inorganic growth, I believe that MOH has outstanding expertise in the M&A markets, which may help improve the outcome of recent acquisitions. I also assumed that we may see new acquisitions like that of Brand New Day and Central Health Plan of California in the coming years.

On June 30, 2023, we announced a definitive agreement to acquire 100% of the issued and outstanding capital stock of Brand New Day and Central Health Plan of California, each of which is a wholly owned subsidiary of Bright Health Company of California, Inc. The purchase price for the transaction is approximately $510 million, net of certain tax benefits, which we intend to fund with available funds including cash on hand. We currently expect the transaction to close by the first quarter of 2024. Source: 10-Q

Medicaid Premium Revenue May Also Increase Thanks To New Acquisitions

I would also expect net sales growth driven by closed acquisitions like that of AgeWell. In this regard, the recent increase in Medicaid premium revenue reported in the last quarter is worth noting. Besides, I believe that we can also expect further organic growth driven by MAPD and D-SNP membership expansion. Management made a remark about the beneficial impact of new MAPD and D-SNP membership in the last quarterly report. Under my DCF model, I assumed that organic growth will likely continue.

Medicaid premium revenue increased $184 million, or 3% in the second quarter of 2023, when compared with the second quarter of 2022. Medicaid premium revenue increased $553 million, or 5% in the six months ended June 30, 2023, when compared with the six months ended June 30, 2022. The increases were mainly due to organic membership growth and the impact from the AgeWell acquisition that closed in the fourth quarter of 2022. Source: 10-Q The increase was primarily due to the impact of MAPD and D-SNP membership expansion, including organic membership growth in existing states. Source: 10-Q

I Assume That The Stock Repurchase Program Will Enhance Stock Demand, And May Push The Price Up

Finally, I believe that the stock may also experience beneficial demand coming from the stock repurchase program enacted by MOH. In my view, as soon as other market participants study the purchase of stock run by MOH, they may buy shares too.

In November 2022, our board of directors authorized the purchase of up to $500 million of our common stock. This new program is funded with cash on hand and extends through December 31, 2023. Source: 10-Q

DCF Model

With the previous assumptions, I included net sales growth between 3% and 10% from 2023 to 2033. The ratio of net income/sales stands close to 2% and 3% for the next decade. More in detail, the 2033 net sales forecast stood at $68.629 billion with net income/sales close to 2.3%.

Source: My Expectations

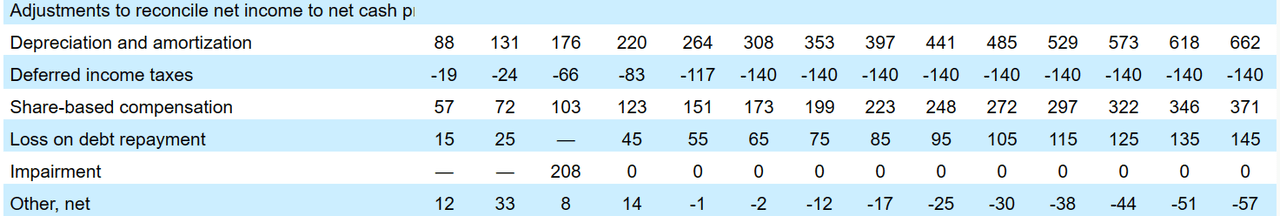

I also included adjustments to reconcile net income to net cash provided by operating activities such as 2033 depreciation and amortization of about $661 million, 2033 deferred income taxes of -$140 million, share-based compensation of $371 million, and losses on debt repayment close to $145 million.

Source: CFO Expectations

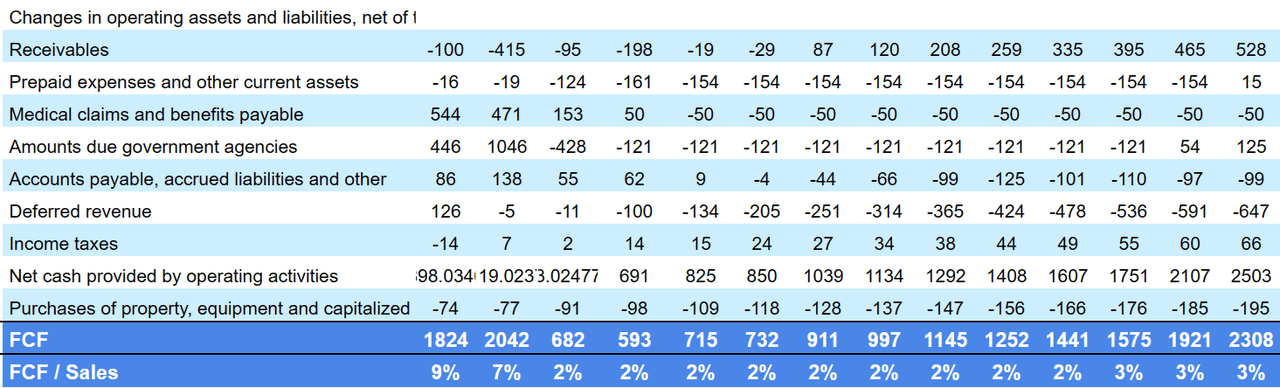

Changes in operating assets and liabilities included 2033 receivables worth $528 million, 2033 prepaid expenses and other current assets worth $15 million, and medical claims and benefits payable of about -$50 million. Besides, with changes in amounts due to government agencies of about $125 million, accounts payable and accrued liabilities close to -$99 million, and 2033 deferred revenue worth -$648 million, my results included net cash provided by operating activities of close to $2502 million, purchases of property, equipment, and capitalized software worth -$195 million, and 2033 FCF of $2.308 billion.

Source: CFO Expectations

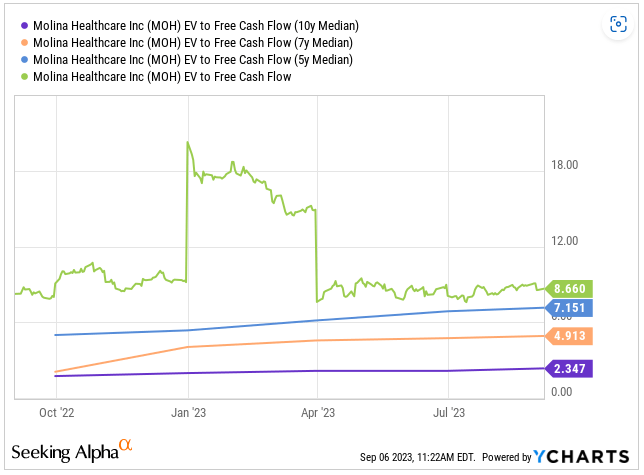

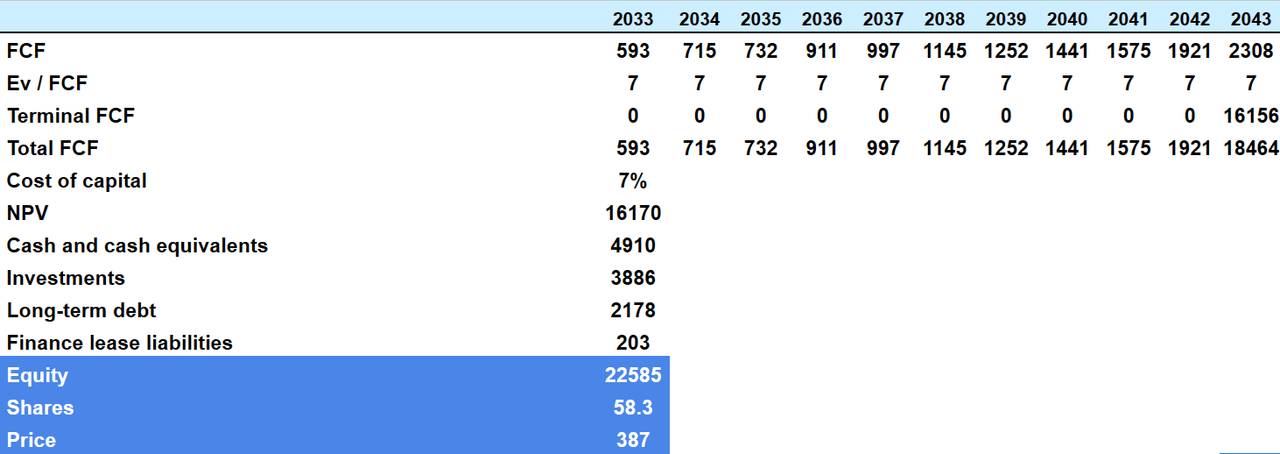

My DCF model included free cash flow growth, enterprise value/free cash flow multiple of 7x, and cost of capital of 7%, implying a net present value of around $16.1 billion. Note that my EV/FCF multiple is close to the historic EV/FCF. I tried to be as conservative as possible.

Source: YCharts

Adding cash and cash equivalents worth $4.910 billion and investments of $3.886 billion, and subtracting long-term debt of $2.178 billion and finance lease liabilities of $203 million, the implied equity would be $22.585 billion. Finally, the implied price would be $387.

Source: DCF Model

Risk And Competitors

MOH operates in an industry, in which profit margins are in the single digit, which means that small changes in the operating performance of subsidiaries may have a large impact on the stock valuation. With this in mind, we could expect certain stock volatility associated with minor business model changes or complications. Management provided a full explanation about this risk in the last annual report.

Although most of our health plans over the last several years have generally operated with profit margins higher than those of our direct competitors, nevertheless the profit margins in our industry are low (in the single digits) compared to the profit margins in most other industries. Given these low profit margins, small changes in operating performance or slight changes to our accounting estimates could have a disproportionate impact on our reported net income and adversely affect our business. Source: 10-k

In the next two years, we may also see some changes with respect to the 2023 CMS Medicare Final Rule, which may have a negative effect on the income statement of MOH. In this regard, it is worth noting that the company operates MMPs in Illinois, Michigan, Ohio, South Carolina, and Texas.

Pursuant to the 2023 CMS Medicare Final Rule, which will require MMP plans to end no later than December 2025, the five states that we operate MMPs were required to submit a transition plan to CMS by October 1, 2022, to convert their MMPs to integrated Dual Eligible Special Needs Plan. Source: 10-k

MOH may also suffer significantly if management encounters problems in some jurisdictions, or the government does not accept the bids for contracts. MOH makes a significant amount of dollars in New York, Ohio, Texas, and Washington. Any problem in these regions would most likely have detrimental effects on net sales and FCF generation.

Our Medicaid premium revenue constituted 80% of our consolidated premium revenue in the year ended December 31, 2022. Measured by Medicaid premium revenue by health plan, our top four health plans were in New York, Ohio, Texas, and Washington, with aggregate Medicaid premium revenue of $13.3 billion, or approximately 54% of total Medicaid premium revenue, in the year ended December 31, 2022. Source: 10-k

In my opinion, Molina Healthcare, Inc. faces significant competition in the healthcare industry. The reform proposals may affect the market for government-sponsored programs although licensing and contracting barriers in some states may make entry difficult. Competition occurs in government contracts, members, and providers, considering factors such as provider network, quality, medical management, member satisfaction, and punctuality in payments. Members look for strong networks and quality of services, while providers consider volume, payment methods, and administrative capacity. Molina excels at securing contracts, attracting members and providers, and providing quality services.

My Opinion

In my view, Molina Healthcare, Inc. has a strong business model and well-defined strategies for long-term growth in the healthcare industry. Its focus on providing managed services through the Medicaid and Medicare programs has allowed it to serve a broad member base in multiple states. Hence, I believe that the company is well diversified. Besides, in my opinion, we can expect Medicaid Premium revenue to increase thanks to new acquisitions and the closing of Brand New Day and Central Health Plan of California. I also think that we could expect organic growth driven by MAPD and D-SNP membership expansion as seen in the last quarter. There are risks associated with competition, failed M&A, new health care reform proposals, or the 2023 CMS Medicare Final Rule, however I believe that MOH appears undervalued.

Read the full article here