On the face of it, Ingredion (NYSE:INGR) looks cheap, but slowing economic growth could take a toll on the company’s revenue and profitability growth. Thus far, the price increases enacted over the past year have helped the company improve margins in the face of declining volumes. Pricing power may not hold up if volume deteriorates further. The company hopes its customers will return to pre-pandemic purchasing behavior after inventory de-stocking efforts over the past year. But, that assumption may not hold in a slowing economy. The slowing growth and its effect on profits may be the reason behind the underperformance of the consumer staples sector and Ingredion over the past month. The stock has gone sideways since my last hold rating in January, justifying my rating. I continue to rate it a hold.

Volumes continue to decline.

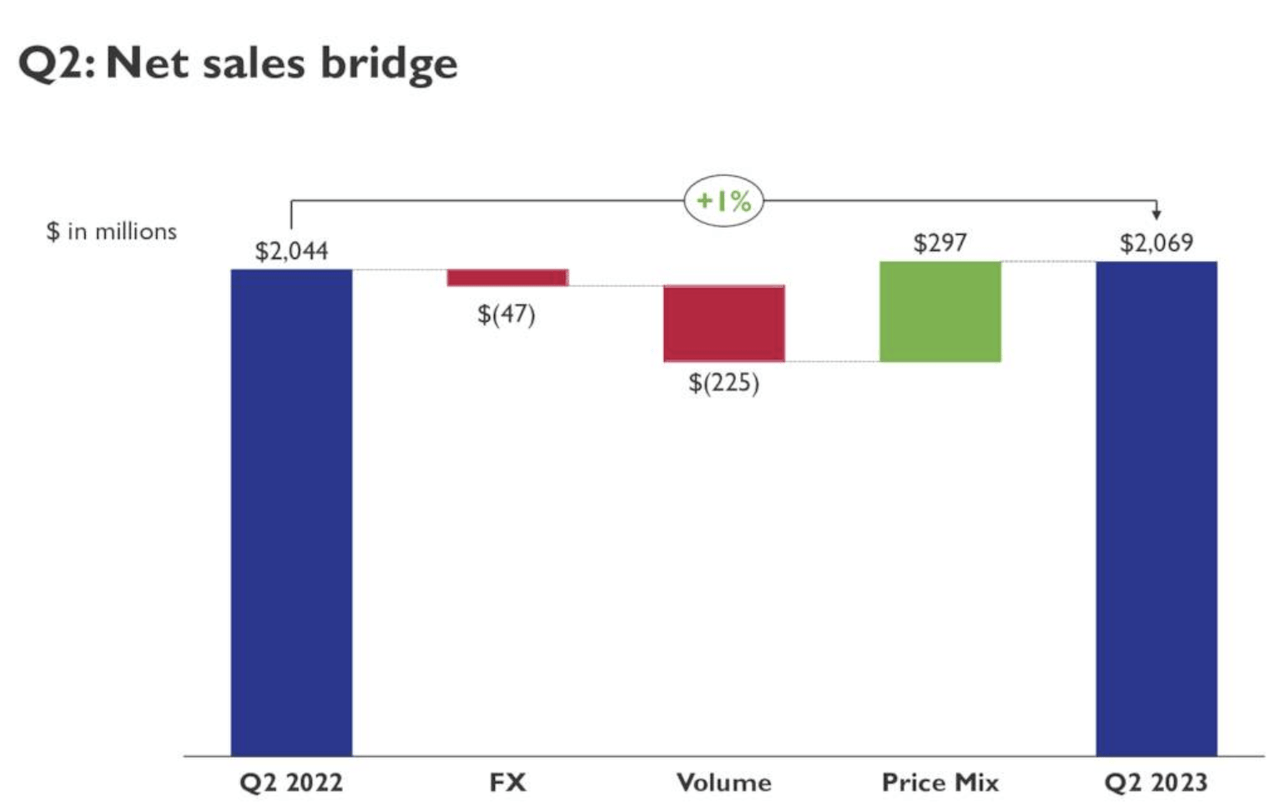

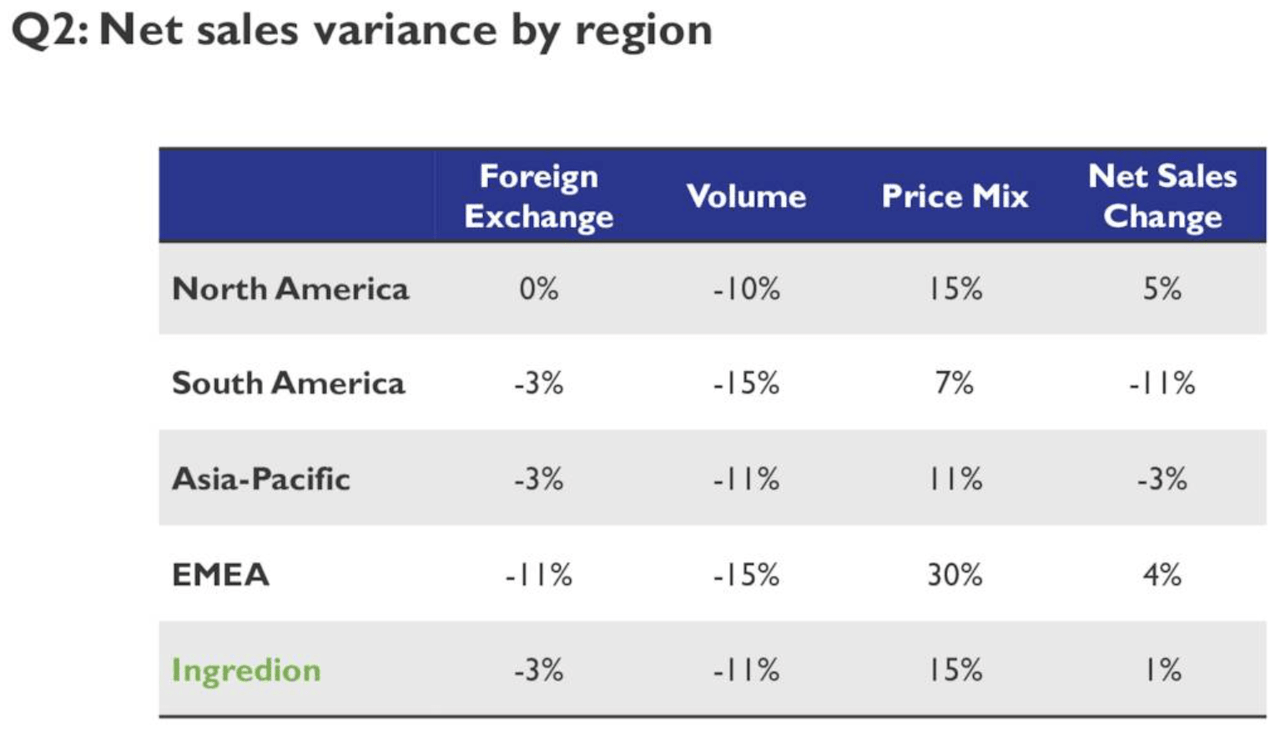

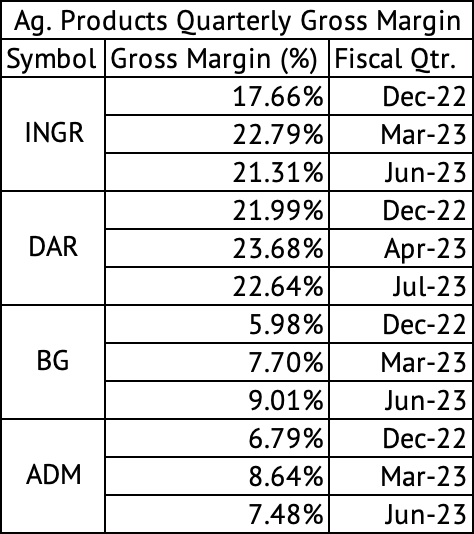

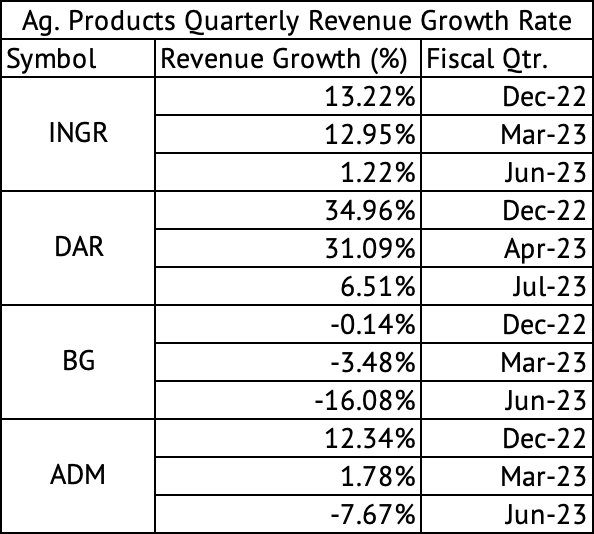

Sales volumes have been dropping at a double-digit pace. While pricing stayed strong and contributed positively to revenue growth, a drop in volume took away most of the gains from price and mix (Exhibit 1). Every region saw volumes drop by double-digits (Exhibit 2), with EMEA and South America seeing the most significant drop in the volume of 15%. The price increases most companies enacted over the past year have been sticky thus far. These price increases have enabled many companies in the Consumer Staples sector to increase gross margins despite declining volumes and sales (Exhibit 3). Agricultural product industry companies have all seen their y/y revenue drop or growth rate decelerate considerably over the past three quarters (Exhibit 4). Companies can only hold on to their pricing power for so long before the need to sustain volumes leads to lower pricing and margins.

Exhibit 1:

Ingredion: Y/Y Quarterly Change in Revenue Due to FX, Volume, and Price (Ingredion Investor Presentation)

Exhibit 2:

Ingredion Change in Volume and Price By Geography (Ingredion Investor Presentation)

Exhibit 3:

Consumer Staples Ag. Products Quarterly Gross Margin (Seeking Alpha, Author Compilation)

Exhibit 4:

Ingredion Quarterly Revenue Growth Rate (Seeking Alpha, Author Compilation)

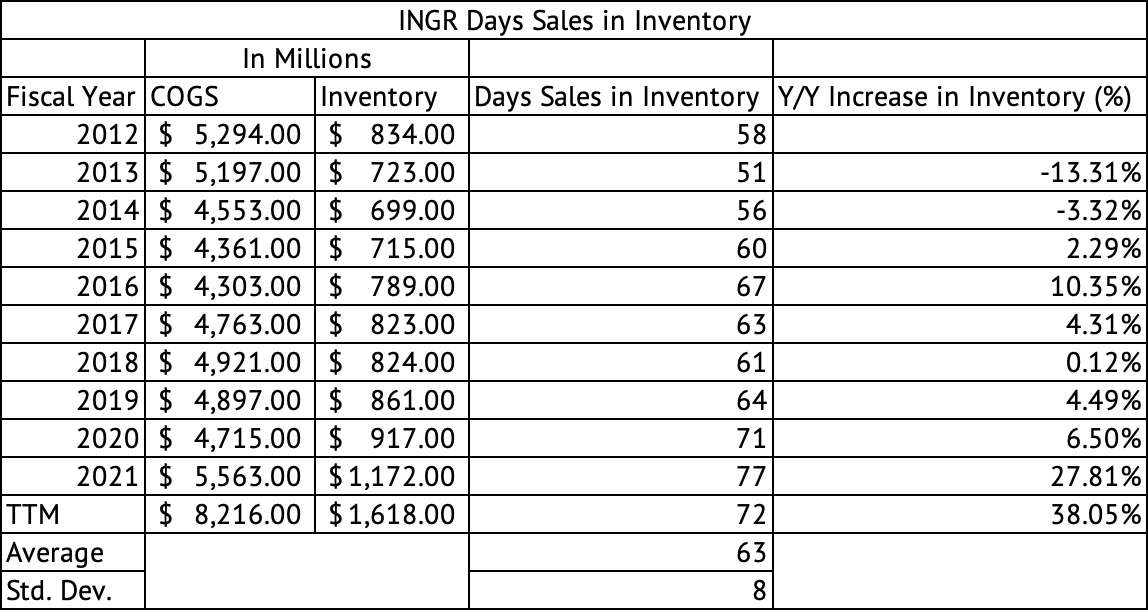

The company mentioned that inventory levels were normalizing and companies were again moving to “just-in-time” inventory rather than “just-in-case.” The company carried 72 days of inventory based on trailing twelve-month data compared to the company average of 63 days (Exhibit 5).

Exhibit 5:

Ingredion Inventory (Seeking Alpha, Author Compilation)

Europe’s GDP growth continued to slow, with the region expected to grow by 0.9% in 2023 compared to its 3.5% growth in 2022. The European Central Bank expects growth to rebound in 2024, but the expectation is for a low 1.5% GDP growth rate. The Conference Board forecasts a 0.5% GDP growth rate for the U.S. in 2024. These low growth rates would feel like a recession for most U.S. and European workforces. Europe may also face structural challenges in its Economy, which may prevent it from growing at a 3% clip anytime in the next few years. The Economist recently pointed out that Germany may be the sick man of Europe, needing a stiff dose of reform, pointing to structural economic issues.

The stock’s fading momentum

If investors think these margins and profits are sustainable, the consumer staples stock would not be underperforming the markets over the past month. Given that the global economy continues to slow, one would think investors would take refuge in the low-volatility consumer staples sector. Instead, the Vanguard Consumer Staples Index Fund ETF (VDC) has dropped 3.5% over the past month compared to a 1.3% median drop in all ETFs and a 0.7% drop in the Vanguard S&P 500 Index ETF (VOO). Packaged foods companies like Kraft Heinz (KHC), General Mills (GIS), and Campbell Soup (CPB) are trading near 52-week lows. Incidentally, I have recently added to my positions in these dividend stocks as a long-term investor. This could be a long-awaited buying opportunity in quality consumer staples stocks.

Given the poor economic growth prospects, it may be reasonable for investors to assume that growth could decelerate further for Ingredion. The stock has returned 17% over the past year while dropping 6% over the past three months, indicating declining momentum. The stock has dramatically underperformed the S&P 500 Index over the past decade, returning 102% compared to the 225% return for the index. Nearly 44% of the total return in the stock was due to dividends. This statistic is why investors may have to wait for a much higher yield than the stock’s current 3.1% yield.

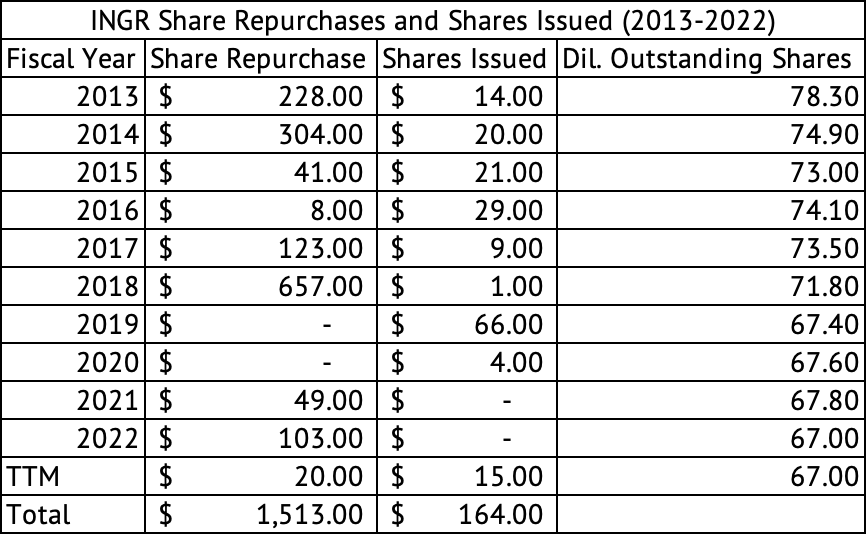

Consumer staples stocks must be acquired at an attractive valuation and much higher yield for the investment to pay off since a sizable portion of the total return will be from dividends. But, one unfortunate thing about Ingredion, which could be a red flag, is the high payout ratio. The trailing twelve-month payout ratio was 152%, which is not a good sign. The company spends about $190 million on dividends annually. Over the past decade, the company has spent $1.5 billion on share repurchases (Exhibit 6). It has reduced the share count from 78.3 million to 67 million, a reduction of 11.3 million at an average price of $133. With the business slowing down substantially, investors should expect to see smaller repurchases in the future.

Exhibit 6:

Ingredion Stock Repurchase (Seeking Alpha, Author Compilation)

The company’s quarterly free cash flow margins have high variability due to variability in its underlying business and the capex spending required to sustain its operations. The company’s quarterly free cash flow margins have averaged 3.5% since March 2020, with a standard deviation of 7.2%, showcasing the low predictability of its quarterly margins. The company has averaged a free cash flow margin of 6.4% since 2012, with a standard deviation of 2.1%. The company has spent, on average, 4.1% of its quarterly revenue on capital expenditures since September 2020. However, its capital expenditure has been below its average in the March and June 2023 quarters, likely looking to bolster its cash flows by reducing its capital expenditures.

Ingredion is fully valued

The company looks fully valued and is trading in line with its peers, although the company trades at a slight discount to its five-year average as measured by forward P/E and EV/EBITDA multiple. The stock is trading at a PE of 11.1x compared to its five-year average of 12.9x. Peers such as Darling Ingredients (DAR), Bunge (BG), and Archer-Daniels-Midland (ADM) are trading at 10.5x, 8.2x, and 10.9x forward P/E ratios (Exhibit). The company trades at an EV/EBITDA multiple of 7.4x compared to its five-year average of 8.1x. Darling Ingredients has the potential to grow much faster than Ingredion, given its investments in producing renewable diesel in collaboration with Valero, yet it trades at a lower valuation.

Ingredion looks slightly undervalued compared to its average over the past five years. But, the stock trades in line with its peers based on the P/E and EV/EBITDA ratios. The company’s pricing power may not last, and declining volumes could lead to lower profits. At best, the stock looks fully valued. Investors may have to wait a while longer before buying Ingredion.

Read the full article here