A ship is safe in harbor, but that’s not what ships are for.“― John A. Shedd

Today, we take a deeper look at small biotech concern that feels like a very high risk/high reward play at current trading levels. An analysis follows below.

Seeking Alpha

Company Overview

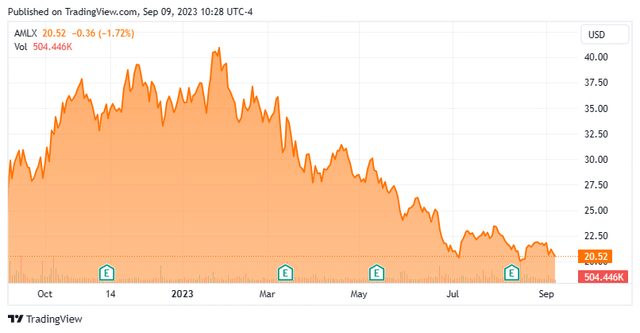

Amylyx Pharmaceuticals, Inc. (NASDAQ:AMLX) is a Cambridge, Massachusetts based commercial-stage biotechnology concern focused on the development of therapies that treat neurodegenerative diseases. It has one FDA-approved product for the treatment of amyotrophic lateral sclerosis (ALS) disease that is marketed as Relyvrio in the U.S. and as Albrioza (with conditions) in Canada. Amylyx was founded in 2013 by two Brown University undergraduate students and went public in January 2022, raising net proceeds of $196.9 million at $19 per share. The stock trades just under $21.00 per share, translating to an approximate market cap of just under $1.4 billion.

August Company Presentation

ALS

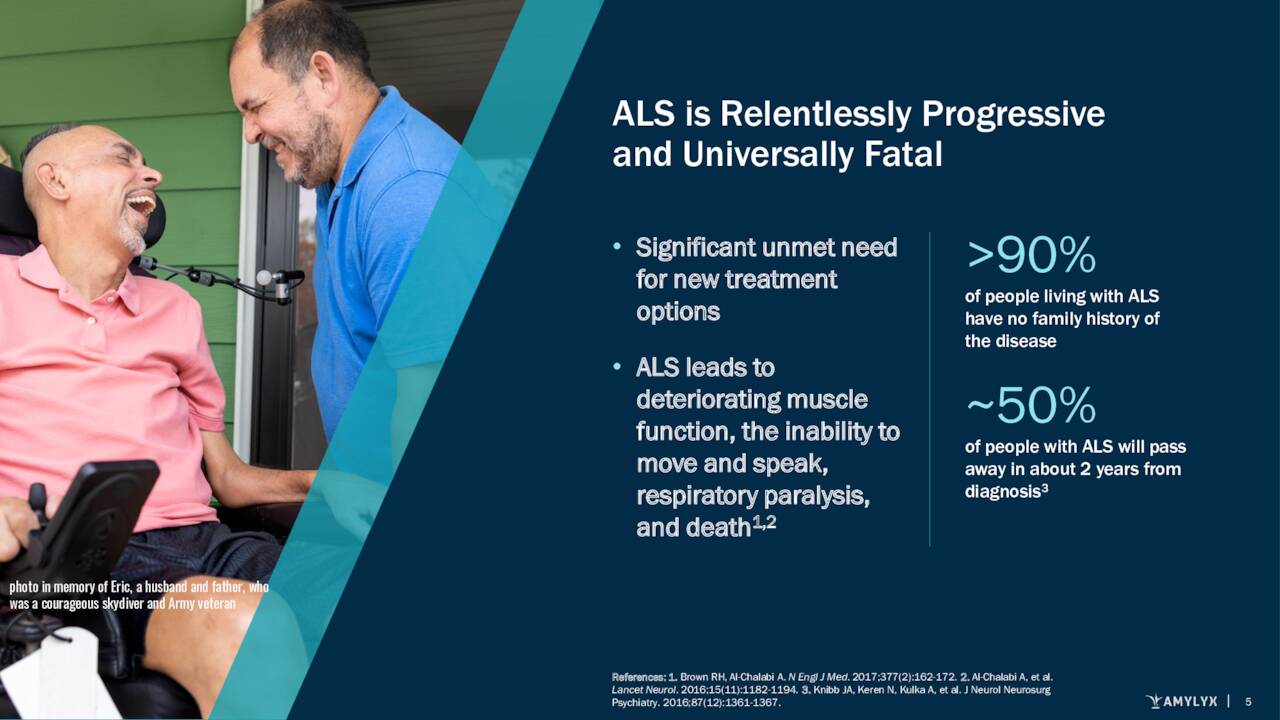

Relyvrio (formerly AMX0035) is the company’s only commercial or clinical therapy. It was approved in September 2022 by the FDA (June 2022 by Health Canada) for the treatment of ALS. Many are familiar with the disease made famous by the great New York Yankee baseball player Lou Gehrig, who contracted the malady in 1938 and died from it in 1941. It is an adult-onset, progressive, and fatal neurodegenerative disorder characterized by loss of voluntary muscle movement, which is triggered by the deterioration of motor neurons in the spinal cord and brain.

August Company Presentation

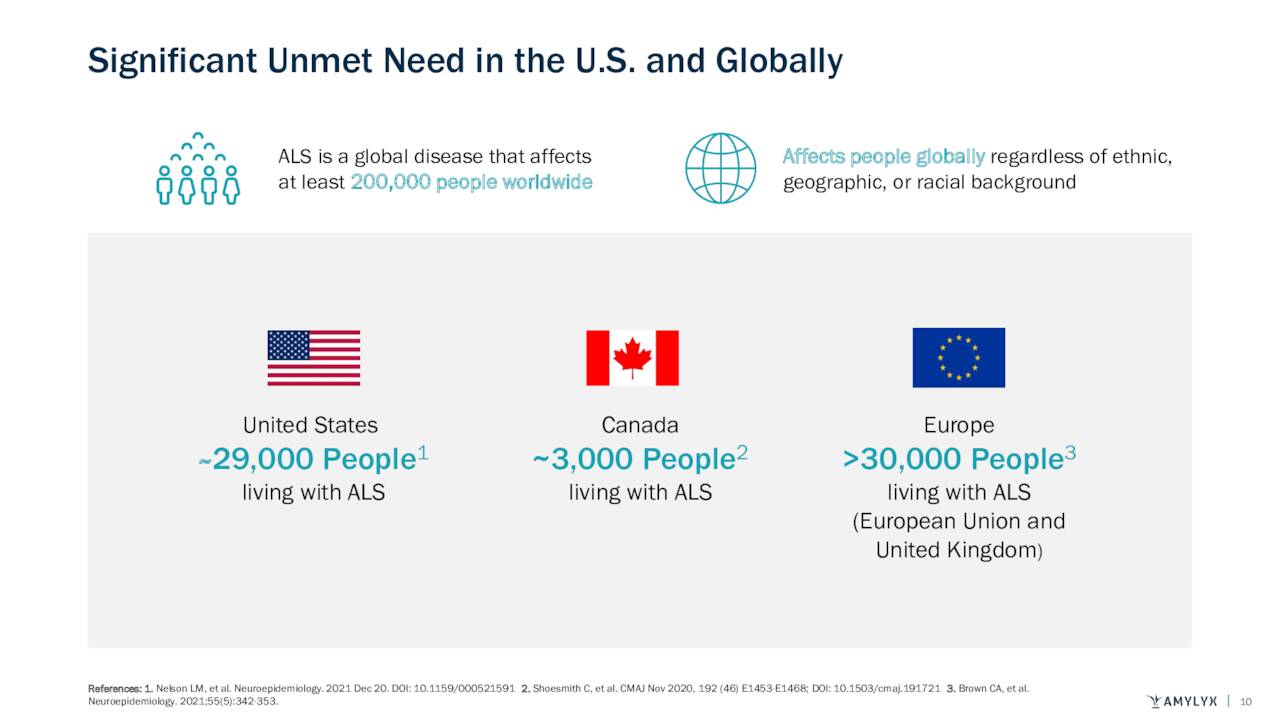

This dreadful, rapidly progressing disease is always fatal with a median survival of less than three years from symptom onset. It currently afflicts ~29,000 in the U.S., ~3,000 in Canada, and ~30,000 in the EU. More than 90% of patients have no family history of ALS.

August Company Presentation

Unlike most eukaryotic (nucleus containing) cells in mammals, neurons do not undergo cell death (apoptosis) and regeneration as part of a normal function. However, neuron cell death can be triggered by at least two factors: endoplasmic reticulum (ER) stress and mitochondrial dysfunction. The ER is responsible for (amongst other functions) biosynthesis and assembly of membrane and secretory proteins. When triggered by unwanted stimuli, the ER may incorrectly fold proteins, which, under normal conditions, are retained and ultimately degraded through a process known as unfolded protein response (UPR) – essentially autophagy. However, prolonged periods of UPR can induce ER-stress associated programmed cell death. As for the mitochondrion, when it detects sufficient cell damage, it signals for the initiation of a cell death cascade, in which Bcl-2-associated X protein (BAX) plays an important role.

AMX0035 (Relyvrio)

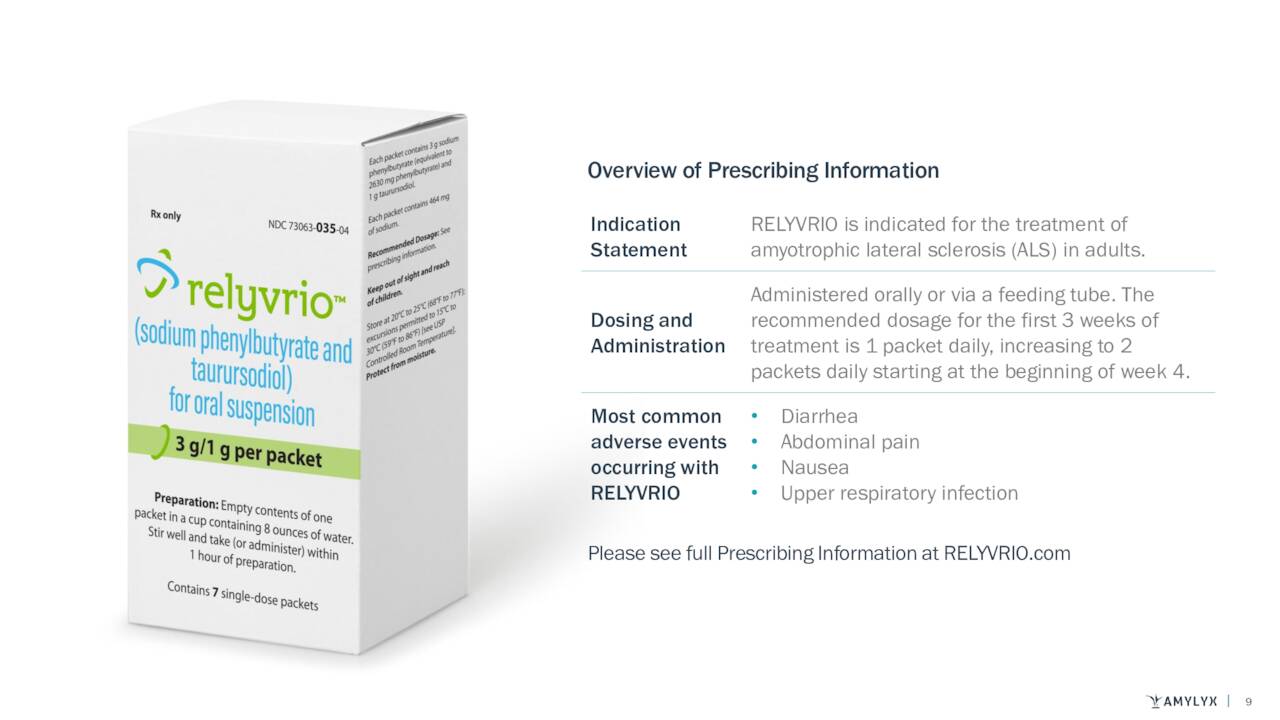

To prevent ER and mitochondrial dysfunction, Amylyx has developed Relyvrio, an oral combination of nitrogen scavenger sodium phenylbutyrate and cytoprotective bile acid taurursodiol that act as a dual UPR-BAX apoptosis inhibitor. In a Phase 2 study (CENTAUR), 137 patients were randomized 2:1 to receive (then) AMX0035 or placebo with primary efficacy endpoint the difference in the rate of decline in the revised ALS functional rating scale (ALSFRS-R) total score at week 24. ALSFRS-R is a 48-point gauge that measures 12 different motor functions (e.g., speech and walking) on a 0-4 point scale with 4 being ideal. CENTAUR scarcely achieved its primary endpoint with patients on AMX0035 (n=87) attaining a 2.32 higher average score than placebo (n=48) (p=0.03). Secondary endpoint of upper limb strength also barely achieved statistical significance (p=0.042), while lower limb strength (p=0.34) and lung function (p=0.076) did not. In a post-hoc evaluation, patients originally randomized to AMX0035 experienced a median overall survival (OS) of 23.5 months versus 18.7 months for those originally randomized to placebo (p=0.045) as of a March 1, 2021st cutoff date.

Company Website

After failing to receive a go ahead from an FDA advisory committee in March 2022 (6-4 vote against citing issues with trial data), Amylyx – likely due to some heavy lobbying by the ALS community – was surprisingly able to get the committee to reconvene in September 2022 and evaluate new OS analysis from the company, ultimately prevailing with a positive 7-2 vote. Formal FDA approval was obtained later that month. That said, it was not exactly a ringing endorsement with the agency stating that it had a “a degree of residual uncertainty about the evidence of effectiveness,” but ultimately approved it based on ALS’s “substantial unmet need“. More specifically, before the approval of Relyvrio, the only two FDA-green lighted ALS therapies were anti-glutamatergic agent riluzole (1995) and free-radical scavenger edaravone (2017), which were (and still are) typically prescribed in combination. However, they have demonstrated minimal functional and survival benefits, providing the opportunity for Amylyx.

This approval was obtained while it was enrolling 664 patients in a Phase 3 trial (PHOENIX), the primary endpoint of which is the same ALSFRS-R total score, except at week 48. Enrollment completed in February 2023 with a readout anticipated in mid-2024 and OS data sometime in 2025. The patient population will be more advanced than CENTAUR with a symptom onset threshold of less than 24 months versus less than 18 months in the Phase 2 study.

It was later revealed that Amylyx agreed to pull Relyvrio from the market if it did not achieve “success” in PHOENIX. Since success is somewhat of a nebulous term – not necessarily defined by achieving its primary endpoint – management has hedged its commitment by stratifying its PHOENIX analysis to include a CENTAUR-like subgroup.

This Phase 3 study was also the ‘condition’ of the conditional approval obtained from Health Canada in June 2022. Furthermore, a positive outcome from PHOENIX will likely be needed for EMA approval, after an advisory committee gave a negative opinion on AMX0035 in June 2023. Amylyx is expected to take the same route (applying for a formal reexamination) as it did with the FDA, contending that its Phase 2 data is robust enough for approval.

Beyond ALS, management sees AMX0035’s mechanism of action as potentially effective against other neurodegenerative disorders. As such, it is currently pursuing the following indications in the clinic: progressive supranuclear palsy with a patient population similar to ALS (a pivotal trial ‘ORION’ is expected to initiate in 2H23); Wolfram Syndrome (proof-of-biology study ongoing with results anticipated in 2024); and Alzheimer’s Disease (Phase 2 study completed – next steps unknown).

While these developments were transpiring at Amylyx, Biogen (BIIB) received accelerated (but not full approval) for antisense oligonucleotide therapy Qalsody (tofersen) in ALS patients who have a mutation in the superoxide dismutase 1 gene in April 2023, after it was able to reduce levels of neurofilament protein, a biomarker of nerve cell degeneration believed to be tied to disease progression in a Phase 3 trial. That said, Qalsody did not achieve statistical significance versus placebo on the ALFSFRS-R scale. Its confirmatory Phase 3 study (ATLAS) is not expected to complete until 2026.

1Q23 Financials

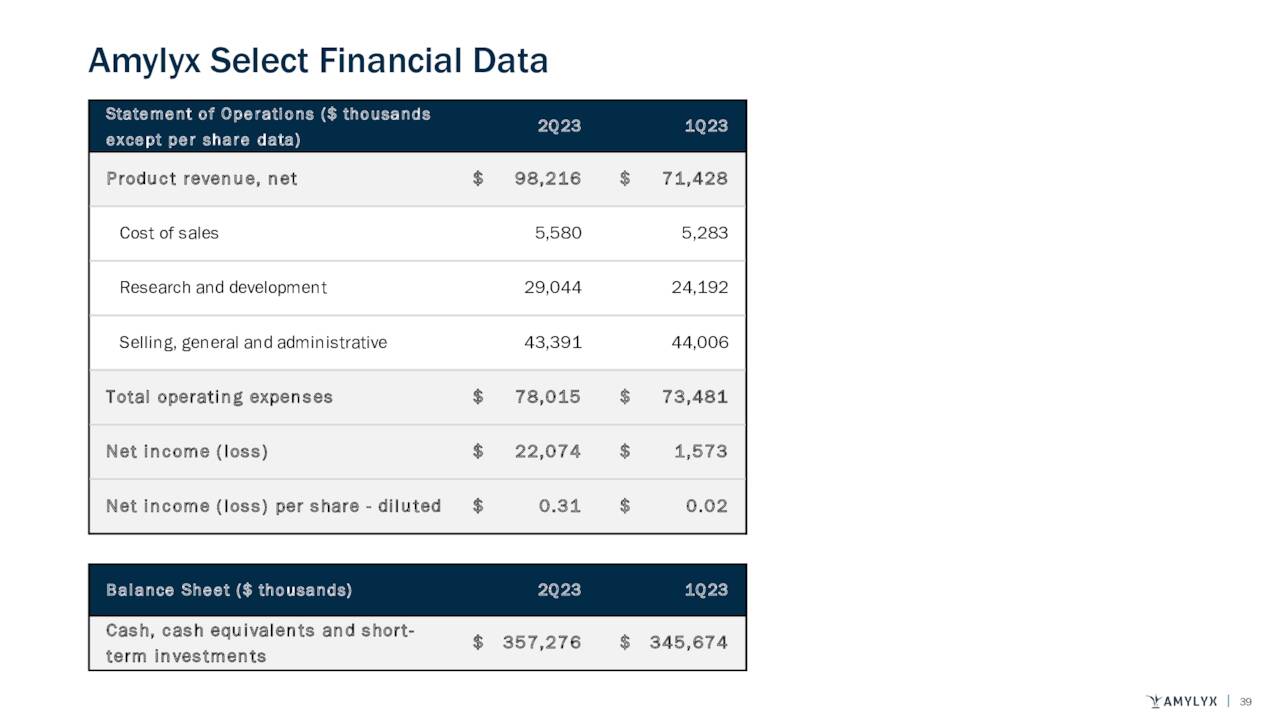

Despite its debatable efficacy, the ALS community has long desired any remedy that would prolong progressive symptom onset and life expectancy. With an FDA-approved treatment and an annual price tag of $158,000, sales have been relatively brisk, with the company posting revenue of $71.4 million in 1Q23 versus $21.5 million in 4Q22, its first quarter on the U.S. market. This top line progress combined with a gross profit margin of 93% was enough to put Amylyx into the black, registering GAAP earnings of $0.02 a share in 1Q23.

2Q23 Financials:

On August 11th, the company posted second quarter numbers. Amylyx posted a profit of 31 cents a share, where the Street was expecting a slight loss. The Amylyx Pharmaceuticals delivered $22.1 million worth of net income for the quarter. Revenues came in at $98.2 million for the quarter. This was $6 million north of expectations and represented an impressive increase from the $71.4 million of sales booked in the first quarter of this year.

August Company Presentation

Balance Sheet & Analyst Commentary:

Furthermore, the company’s balance sheet is in pristine condition, reflecting cash and short-term investments of $357.3 million and no debt as of June 30th, 2023, which was up $11.6 million from the end of the first quarter.

Over the past five weeks, four analyst firms including Bank of America and Goldman Sachs have reiterated Buy ratings on the stock. Price targets proffered ranged from $45 to $50 a share. On average, they expect the company to earn $1.26 a share (GAAP) on sales of $415 million in FY23, followed by $2.95 a share (GAAP) on sales of $639 million in FY24.

Verdict

The skepticism regarding AMX0035’s efficacy has merit, which may or may not be cleared up when PHOENIX reads out in mid-2024. The Phase 3 study will have (in theory) a higher hurdle with the evaluation occurring at week 48 (versus week 24 in CENTAUR) in a more progressed patient population. Given the FDA’s concerns (despite approval), the pledge by management to pull the therapy if PHOENIX is not a success, and the challenges prognosticating its outcome, Amylyx’s stock trades at a significant discount to the four-to-five times peak sales bestowed on other high-margin therapies. Factoring in its current cash position, three times FY24E sales would equate to an approximate $25.00 value on shares of AMLX – giving no effect to its other non-ALS indications.

As for potential competition, which would have the largest impact on sales next to an outlier result from PHOENIX, Biogen’s tenuously approved therapy is not as effective, and its indication is narrower in scope. Also, Prilenia Therapeutics’ pridopidine failed to achieve statistically significant separation from placebo on the ALSFRS-R scale in a Phase 2 trial read out in February 2023.

However, Seelos Therapeutics (SEEL) has an autophagy enhancer (trehalose) that is undergoing evaluation in a 160-patient Phase 2b/3 study with the same primary endpoint as CENTAUR: change in ALSFRS-R at week 24. In earlier in-vivo studies it demonstrated accelerated clearance of (misfolded) protein aggregates. That trial should read out by YE23 and is worth keeping an eye on as its results will be measured against AMX0035’s.

It should also be noted that a hospital in Italy is sponsoring a 337-patient Phase 3 study that is investigating taurursodiol monotherapy in the treatment of ALS. There is a risk that results could be interpreted negatively if it fails or if it succeeds better than AMX0035. That study should complete at YE23.

That said, short of a clear demonstration of superiority by trehalose or a total flop from PHOENIX, AMX0035 has a pathway to blockbuster status. Owing to the rapid deterioration of ALS patients, they are not afforded the luxury of waiting around for data from Seelos’ trial. Even if trehalose’s results are slightly superior to AMX0035, Amylyx’s first-mover status will result in a ~25% share of the total addressable market in the U.S. and Canada by 2026, which translates into sales of ~$1 billion, assuming discounts, free meds for the uncovered, and no European sales. Short of the CENTAUR stratification of PHOENIX being a complete bust – remember OS stats won’t be available until sometime in 2025 – one can rest assured that management will do everything in its power to not pull Relyvrio from the market.

As such, the best way to play Amylyx’s future is via a very small ‘watch item‘ position for aggressive investors or through a straddle for those that want to play AMLX via options given the shares could move in either direction in a significant way.

So, we shall let the reader answer this question for himself: who is the happier man, he who has braved the storm of life and lived or he who has stayed securely on shore and merely existed?“― Hunter S. Thompson

Read the full article here