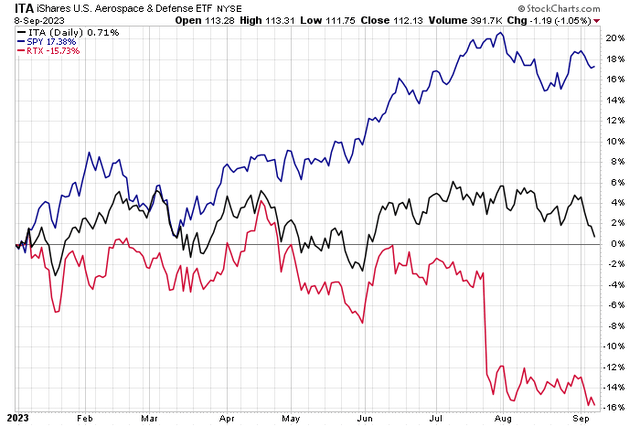

One of the hottest industry areas coming into this year was Aerospace & Defense. The iShares U.S. Aerospace & Defense ETF (ITA) was a 2022 relative winner, but it has been a major opportunity cost this year. ITA is about unchanged compared to the S&P 500’s total YTD return of 17%. One of the fund’s biggest components, RTX Corporation (NYSE:RTX), was negative on the year coming into its Q2 earnings report. The large cap then plunged despite a top and bottom-line beat, guidance increase, and details on a share repurchase program.

I have a hold rating on RTX stock. The valuation appears fair but technical risks are many and the threat of further sellside downgrades post headline risk in the near term.

Defense Stocks With Few Bullets In 2023

Stockcharts.com

According to Seeking Alpha, RTX Corporation, an aerospace and defense company, provides systems and services for the commercial, military, and government customers worldwide. It operates through four segments: Collins Aerospace, Pratt & Whitney, Raytheon Intelligence & Space, and Raytheon Missiles & Defense.

The Virginia-based $121 billion market cap Aerospace & Defense industry company within the Industrials sector trades at a near-market 22.1 trailing 12-month GAAP price-to-earnings ratio and pays an above-market 2.8% dividend yield. Ahead of earnings next month, the stock has a low implied volatility percentage of 17% and a modest short interest of 0.8%.

Back in July, RTX reported a solid Q2 report. EPS summed to $1.29, topping analysts’ expectations of just $1.18 while revenue growth climbed 12% year-on-year to $18.3 billion, a $0.6 billion beat. With a backlog totaling $185 billion, the management team raised its full-year 2023 sales and earnings outlooks. The firm now sees 2023 EPS of $5 (midpoint) but reduced free cash flow. Bullish, though, is that RTX confirmed a sizable $3.0 billion stock buyback program. That all seems generally sanguine, right?

Well, the firm faces challenges with Pratt & Whitney, including concerning inspections regarding a rare powder metal condition affecting its GTF engines. As a result, free cash flow may suffer, and earnings will likely be hit before long. The troubles also hinder inventory that must now be diverted to address the GTF issues, which may also lead to a cash drain over the coming years. In light of all that, the stock cratered post-earnings, and after a brief recovery rally, the shares are once again testing the low $80s.

Key risks include a downturn in the global aviation cycle and reduced government investment in aerospace assets. A broader slowdown would undoubtedly hurt the business given that nearly half of RTX’s sales come from non-US markets. Still, if the company can weather the aforementioned controversy well and maintain or increase its margins, then the stock could outperform.

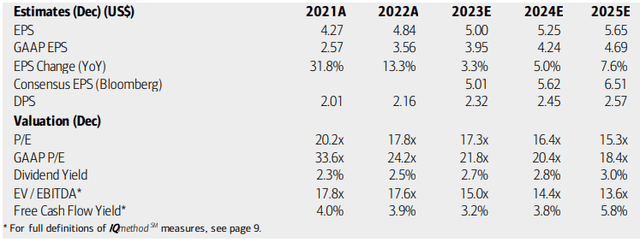

On valuation, analysts at BofA see earnings rising at a low but accelerating pace through the next two years. The Bloomberg consensus forecast is much more upbeat compared to BofA’s outlook, though. Dividends, meanwhile, are seen as rising commensurate with EPS advances over the coming quarters. With a mid-teens operating P/E, the stock trades at a slight discount to the broader market’s earnings multiple while its EV/EBITDA ratio is near that of the S&P 500. For an established blue-chip company, it does not generate a large amount of free cash flow – FCF per share over the last 12 months has summed to just $1.52.

RTX: Earnings, Valuation, Dividend Yield, Free Cash Flow Forecasts

BofA Global Research

If we apply a 13 multiple on $5.50 of normalized next-12-month EPS and assume a P/E of 14, then the stock should trade near $82.50. I assert that both macro conditions (higher interest rates) and firm-specific issues warrant a P/E under its 5-year average. A mid-teens multiple is also where some of its peers trade. Even at current levels, the valuation picture is not overly constructive, and I question the consensus earnings growth expectations in light of recent developments highlighted earlier.

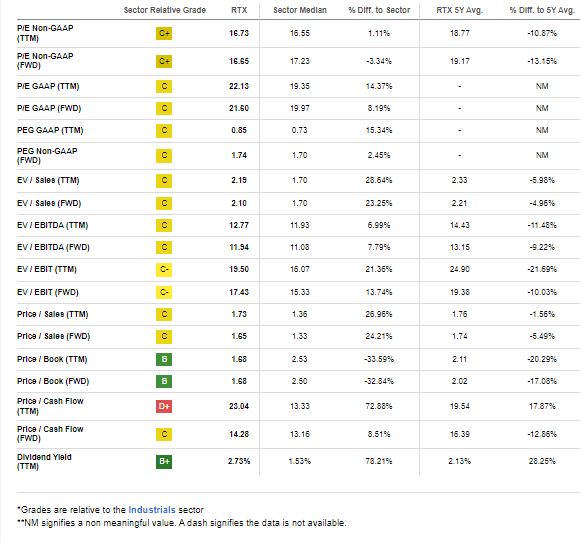

RTX: Soft Valuation Metrics, Growth Risks, Too

Seeking Alpha

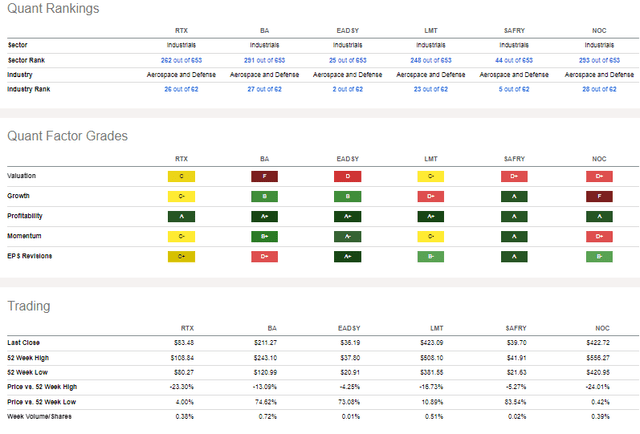

Compared to its peers, RTX has a mixed valuation situation (with downside risks in my view) while its growth trajectory is less impressive. While RTX is highly profitable today, its stock price momentum and EPS revision history as far less bullish compared to others in the space.

Competitor Analysis

Seeking Alpha

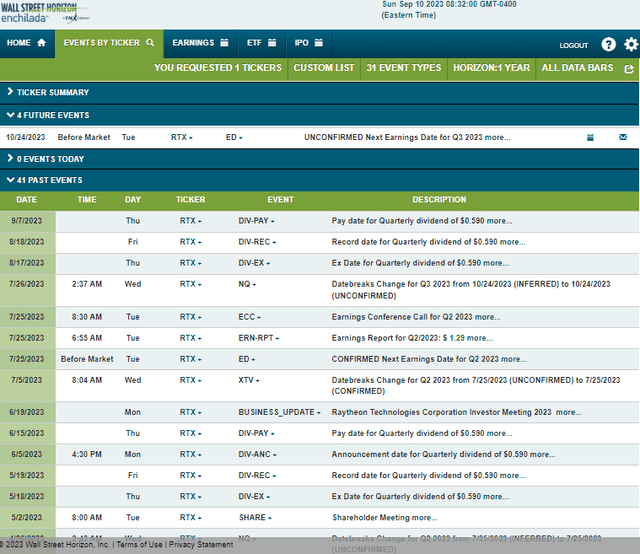

Looking ahead, corporate event data provided by Wall Street Horizon shows an unconfirmed Q3 2023 earnings date of Tuesday, October 24 BMO. No other volatility catalysts are seen on the calendar.

Corporate Event Calendar

Wall Street Horizon

The Technical Take

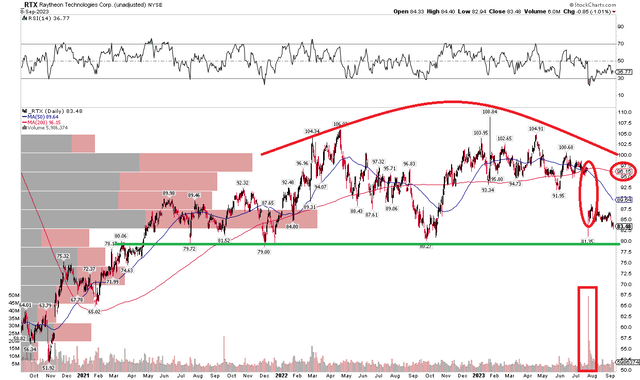

RTX has been a significant underperforming stock so far this year. Notice in the chart below that shares plunged around its July earnings event, and the bulls were unable to even partially fill that gap. Now, the stock is barely above key support levels in the $79 to $81 zone. It retreated right to that area at the post-earnings intraday nadir, and here we are again probing the low $80s.

A bearish breakdown under $79 would call for a downside measured move price objective to the mid-$50s. That would seem to be an aberration, but it would be where RTX sold for just three years ago. With a 200-day moving average that is now downward sloping, the bears are clearly gaining a foothold on this blue-chip name. A possible telltale sign is that extreme volume took place on the massive July drop – so losing the mid-$80s could be particularly problematic as rally attempts toward $90 (let alone the gap-fill level near $96) may face significant selling pressure from overhead supply.

Overall, given the emerging topping pattern, we cannot rule out a breakdown through support.

RTX: Bearish Topping Pattern, Watch $79 For Support

Stockcharts.com

The Bottom Line

I have a hold on RTX. The valuation appears fine, but technical momentum is poor as the stock hovers above key support. Also, the looming threat of negative headlines care of downward EPS revisions and stock downgrades is a key risk.

Read the full article here