Investment Rundown

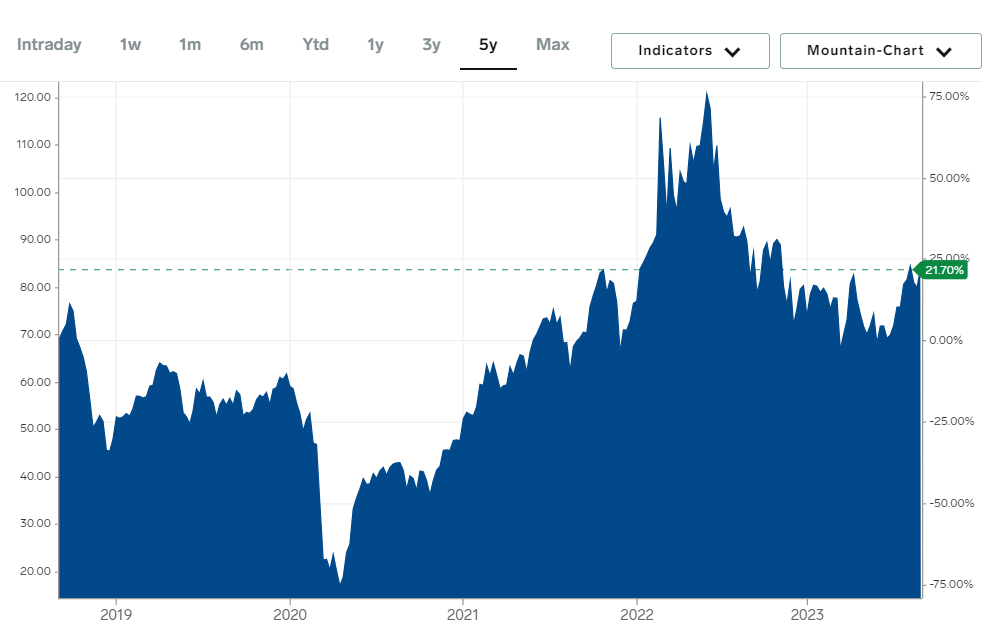

TXO Partners L.P. (NYSE:TXO) operates in the energy sector and more specifically in the oil and gas exploration and production industry. As it implies, TXO mainly focuses on acquiring and optimizing oil deposits and sites in the US and then leverages this into earnings and revenue growth. The last few years have been quite volatile in terms of oil prices and how companies have had their FCF develop. Many companies in 2023 so far have posted significant decreases in EPS from 2022 numbers as the price of crude oil hasn’t returned to those levels and natural gas remains somewhat subdued and suppressed in terms of price.

The company is in my opinion yet to prove itself and the last report showcased some of this as a fact as the EPS came in at a negative $0.08 for the second quarter of 2023. I remain bullish on the industry though and will be rating the company a hold for now as a result.

Company Segments

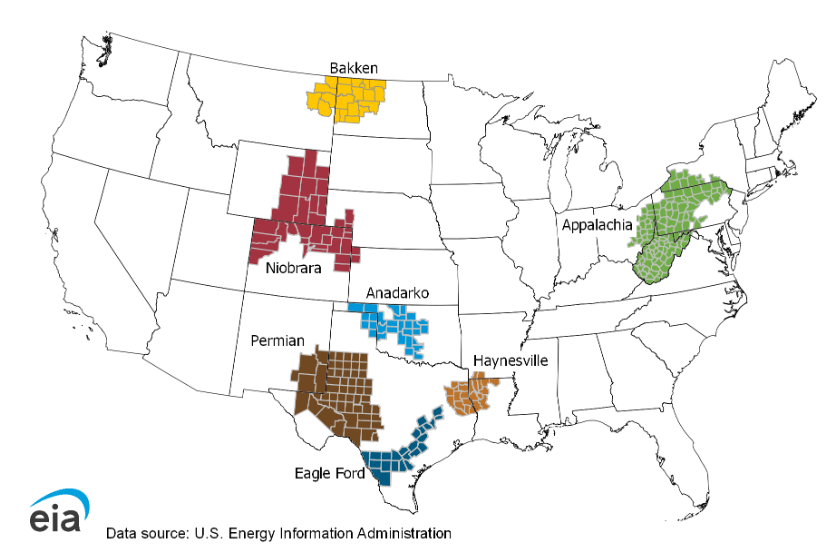

TXO Energy Partners, L.P., originally established under the name MorningStar Partners, L.P., is headquartered in Fort Worth, Texas. The company’s core mission has been to acquire, develop, and extract oil and gas resources, primarily from conventional formations situated in the prolific Permian Basin and the San Juan Basin regions of the United States.

With a strategic focus on these resource-rich areas, TXO Energy Partners, L.P. has actively engaged in exploration and production activities to harness valuable hydrocarbon reserves. By adhering to its commitment to responsible energy development, the company has contributed to the growth and sustainability of the domestic oil and gas industry.

US Basins (EIA)

Back in 2022, a market research report conducted by GlobalData indicated that the USA’s Permian Basin boasts a substantial production capacity, with an estimated 5 million barrels per day of crude oil and condensate production capacity. Additionally, the basin exhibits significant natural gas production potential, with a capacity of approximately 19.9 million cubic feet per day. This makes it the largest oil-producing basin in the US and the fact that TXO has some good exposure and involvement here is a key reason for the hold rating. I think that as they use their cash flows efficiently and focus on high-margin opportunities they can deliver a decent return over the years for shareholders. That will of course take some time to be fully realised and even with net margin profits of over 30%, I think that TXO could grow the capital expenditures further to a level more closely in line with what they have had before, along the lines of $227 as back in 2021. This would, in my opinion, come from an increase in the oil prices that would create more favorable market conditions that should lend themselves to yield TXO’s stronger earnings potential as well.

Earnings Highlights

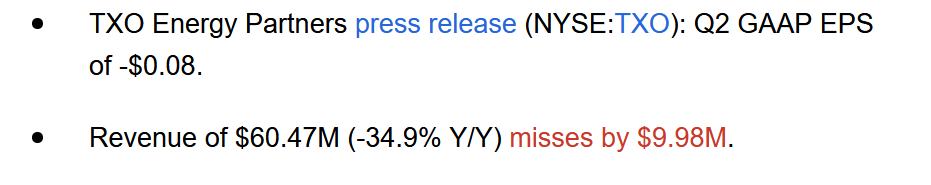

Not long ago we got the most recent results from the company and it seems they are struggling on both the top and bottom lines unfortunately. The revenues landed at $60 million for the quarter, a miss of nearly $10 million. Some of the reason for this seems to be a lack of beneficial pricing actions in the quarter in terms of oil and natural gas. The long-term remains very strong though for the industry I think. Oil and gas are two major energy sources that are necessary to supply our society’s needs, and switching over to renewables won’t be something that happens in the coming years or decades even as the sheer amount of work necessary to make that happen is quite frankly almost overwhelming. It’s worth mentioning though that TXO has had a very good last 12 month, as the revenues has grown by over 70%. This I think has been a leading factor for the share price running up the way it has. But despite that, I still find it important to get a good deal on the price, and with p/s over 16% above the rest of the sector, I don’t think that is the case right now. A hold is better suitable and potentially adding to a position could be done when then valuation corrects itself to something more in line with the rest of the broader sector.

Earnings Results (Seeking Alpha)

As for the bottom line, I think it was also disappointing as the GAAP EPS was negative. Still, the TTM net margins are at a strong 30% and I think this quarter may have been a slight headwind and the long-term remains largely positive. Nonetheless, I think it will be crucial in the coming quarters to see sequential growth in the earnings as otherwise, the valuation may have to be corrected downwards instead.

Risks

One of the foremost concerns for the company’s future as a publicly traded entity revolves around the unpredictable pricing dynamics in the oil and gas sector. The industry has experienced considerable volatility, initially triggered by the COVID-19 pandemic and compounded by the geopolitical tensions arising from the conflict in Ukraine. These external factors have introduced an element of uncertainty into the company’s revenue and profit projections.

Oil Prices (Business Insider)

Furthermore, the regulatory landscape surrounding oil and gas production in the United States has become increasingly intricate and subject to fluctuations driven by evolving political priorities. As policies and regulations about the energy sector continue to evolve, the company must remain vigilant and adaptable to navigate potential changes that could impact its operations and profitability.

Financials

On the balance sheet for TXO, the results are a little bit all over the palace, to be honest. The cash sits at $4.4 million currently and is down from nearly $22 million back in 2020. What is perhaps the biggest positive on the balance sheet right now has to be the debt position the company has managed to reduce heavily to just $21 million. That is in my opinion an amount that isn’t necessarily worth worrying about as much as the cash can cover nearly 25% of it instantly. If oil prices improve further I see a likely scenario occurring where TXO can pay most of this in a short time frame, 1 – 2 years possible. This would let them focus heavily on expanding operations and exploring and developing new sites.

Final Words

Investors that are eager to get exposure to the oil and gas industry should perhaps look elsewhere right now than TXO in my opinion. The company has had some decent improvement on the balance sheet but the last report seemed to showcase some difficulties on both the top and bottom lines. I want to see consistent EPS growth and margin retention before considering a higher rating than a hold for now.

Read the full article here