Over the past few years, I have shifted from being strongly bullish in mid-2021 to strongly bearish at the peak in May this year. After the recent correction from this peak, I am no longer short the metal. While real bond yields suggest gold should be significantly weaker than it current is, I cannot justify a short position in the face of the inevitable decline in real bond yields that will have to come in order to allow the US Treasury to keep funding costs manageable. I therefore think any dips in the SPDR Gold Trust ETF (NYSEARCA:GLD) should be bought.

The GLD ETF

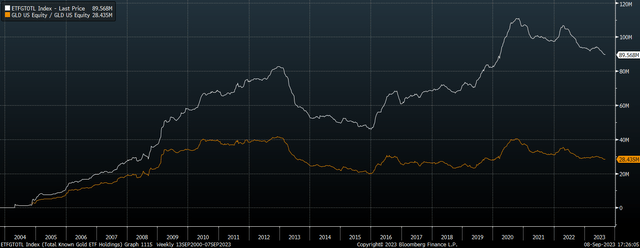

The GLD is the most popular gold ETF with USD55bn under management and an average daily turnover of USD1.3bn, and it tracks the price of gold almost exactly after expenses. It charges a relatively high expense ratio of 0.4% compared with the iShares Gold Trust ETF (NYSEARCA:IAU) which charges 0.25%, which may explain the decline in GLD ounces under management over recent years. However, this decline has occurred across the ETF space, with inflows reversing alongside the gold price.

GLD And Total ETF Market Ounces Of Gold Holdings (Bloomberg)

The GLD continues to exhibit a pattern of lower highs and having failed to hold gains above $190, which corresponds to a gold price of $2,000, a triple top pattern is in play. The next meaningful level of support comes in at around $170 but a drop to $150 is a growing risk.

GLD ETF and Spot Gold Price (Bloomberg)

Extreme Valuations Are A Major Headwind

As I have argued in several articles since the start of the year, the price of gold is completely at odds with real bond yields. The last time the iShares TIPS Bond ETF (TIP), which tracks the performance of inflation linked bonds, was at current levels, gold traded at around $1,000/oz. Even when we add in the impact of inflation over time, gold should still be trading around $1,500/oz based on the performance of TIP.

TIP ETF Vs Spot Gold And Inflation-Adjusted Gold Price (Bloomberg)

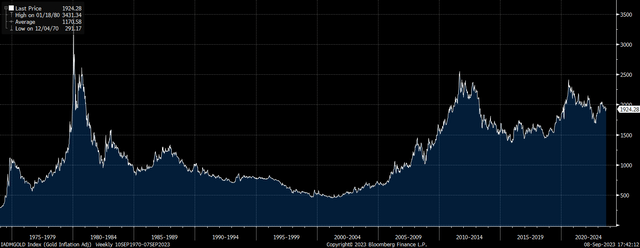

The TIP now yields 2.6% in real terms, meaning that gold would have to rise by 2.6% per year over the next 7 years in order for the metal to perform in line with inflation-linked bonds. This would put the real price of gold back at its 2021 high, significantly higher than its long-term average.

Inflation Adjusted Gold Price (Bloomberg)

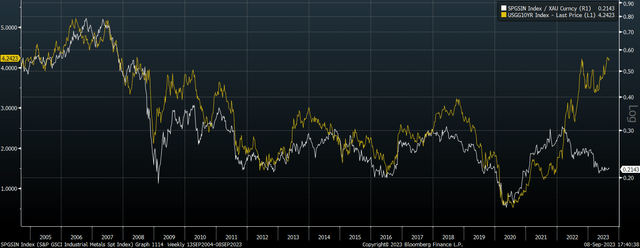

A similar conclusion can be drawn from the correlation between 10-year Treasury yields and the ratio of gold prices to industrial metals prices. On this basis, gold’s fair value is less than half of current levels.

10-Year UST Yields Versus Ratio Of Industrial Metals Over Gold Price (Bloomberg)

The US Fiscal Position Precludes A Short Position

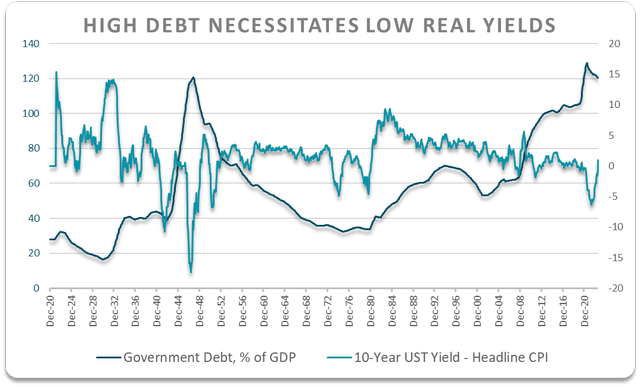

While the poor technical picture and gold’s extreme overvaluation relative to its historical drivers suggests a short position is warranted, the US fiscal position suggests the fundamental backdrop for gold prices is set to improve greatly over the coming years. As I argued recently in ‘The U.S. Dollar Privilege Likely Ending – Diversify Now‘, there is no feasible way for the US government to continue running primary fiscal deficits without the Fed driving real bond yields deeply negative.

US Government Debt, % of GDP Versus Real 10-Year Bond Yields (Bloomberg, Robert Shiller)

To pay for War spending in the 1940s, the 10-year bond yield was fixed at 2.5% even as inflation rose to as high as 20%. A repeat of such financial repression today would likely drive a collapse in demand for the US dollar as a store of wealth. While the gold price was fixed during this period of history, we should assume that the metal would be the main beneficiary of a plunge in real borrowing costs this time around, particularly as the US is not the only country with structural fiscal largesse that will necessitate lower real yields.

We have already seen how the price of gold responds when central banks are forced to drive down real bond yields into negative territory to prevent exponentially rising interest payments. The Bank of Japan’s yield curve control amid rising inflation expectations has seen real 10-year bond yields fall below zero, leading to a surge in gold prices in yen terms. The metal is up 86% since the brief deflationary episode trigger by the Covid crash.

Gold Priced In Japanese Yen (Bloomberg)

How I’m Playing It

The balance of risks still suggests there is more downside to come for gold prices. Rate markets are already pricing in aggressive rate cuts in 2024 and speculators remain net long the metal according to CTFC futures data. If rates remain on hold even slightly longer than consensus expectations, we could easily see gold fall to $1,800.

However, I am no longer short gold because I will be happy to buy if it falls significantly. Gold deserves a valuation premium to the fact that falling prices would be most likely driven by sustained high real bond yields, which would over time have to reflect strong real GDP growth, and result in high risk-free returns for investors. Anyone who is not fully invested, and in particular anyone who has regular salary income should absolutely welcome these things, even if they mean losses on their existing equity and bond portfolios.

While the gap between real bond yields and the implied fair value for gold remains wide, I much prefer to hold inflation-linked bonds relative to gold as a means of benefiting from any declines in real bond yields. If the Fed continues to hold rates at current levels for longer than expected, the TIP may well suffer but gold faces much greater downside risks. Furthermore, I own industrial metals miners via the iShares MSCI Global Metals & Mining Producers ETF (PICK) as I explained here. Industrial metal miners have a great track record of outperforming during periods of rising inflation expectations and are trading at undervalued levels. I also own silver, which is trading at deeply undervalued levels relative to gold and should still perform well in the event of a downward reversal in real bond yields.

Read the full article here