Mettler-Toledo International (NYSE:MTD) is a prominent manufacturer of laboratory balances, liquid pipetting solutions, and automated laboratory reactors, serving both the healthcare and industrial sectors. Many of Mettler-Toledo’s products hold dominant positions in the market, contributing to an operating margin exceeding 28%. It is undoubtedly an outstanding business franchise with strong long-term potential. However, it’s important to note that the impending economic challenges in China may have a significant short-term impact on their growth.

Chinese Business Deterioration

In FY22, Mettler-Toledo’s China operations accounted for 21.5% of the group’s total revenue, contributing significantly to the company’s overall growth in recent years. Notably, the constant currency growth rate in China was an impressive 25% in FY21 and 14% in FY22.

However, a shift occurred starting from Q2 FY23. China’s operation revenue grew by only 3% year-over-year on a constant currency basis, and the year-to-date business performance in China showed a modest 6% increase.

MTD Quarterly Results

The management at Mettler-Toledo has attributed the weakness in their China operations to a sharp deterioration in economic growth and reduced government stimulus. I believe that several factors have contributed to the challenges faced by their China operations:

Weak Pharma and Biopharma Customer Spending: During the pandemic, Chinese local governments allocated substantial funds for the purchase of Covid test kits. According to estimates from Nomura Holdings, regular Covid testing accounted for 1.8% of China’s GDP. Consequently, local governments now have limited budgets for the post-pandemic healthcare system. This budget constraint has led to reduced spending in the pharma and biopharma sectors, resulting in decreased demand for Mettler-Toledo’s products, particularly laboratory balances and liquid pipetting products.

Healthcare Industry Anti-Corruption Measures: In June 2023, China launched an unprecedented crackdown on corruption within the healthcare industry. News reports indicate that over 180 hospital leaders have come under investigation this year alone. This anti-corruption campaign has caused significant disruptions in many hospitals, which, in my opinion, could have a substantial impact on laboratory spending.

In summary, I do not anticipate a near-term turnaround in Mettler-Toledo’s China operations, and the ongoing growth deceleration is likely to remain a significant headwind for the company.

Solid Growth Track Record

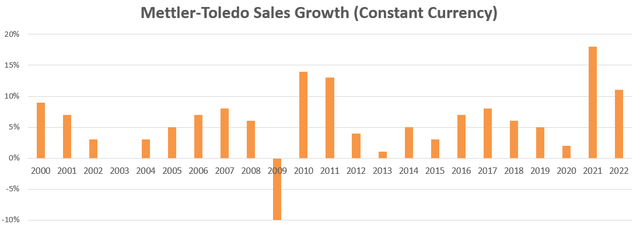

I believe that Mettler-Toledo’s products have established themselves as the gold standard in many laboratories and pharmaceutical research and development centers where precision weighing machines are essential. Over the period from FY12 to FY22, the company achieved an impressive average revenue growth rate of 6% in constant currency, a noteworthy accomplishment in my opinion.

MTD 10Ks

Mettler-Toledo’s primary competitor is Sartorius (OTCPK:SARTF), a European-based company. Sartorius has a more Europe-centric focus, while Mettler-Toledo operates on a more international scale, with 37% of its revenue coming from the U.S., 20% from Europe, and 21% from China. Based on my research, the competitive landscape in this industry has remained relatively stable over the past decade.

Pricing Power

Thanks to its market-leading position in niche markets, Mettler-Toledo wields significant pricing power. In Q2 FY23, price increases contributed a substantial 6% year-over-year growth, and their guidance anticipates an overall 5% price increase for FY23.

While laboratory balances and liquid pipetting products may not represent large-ticket purchases for most laboratories, their precision and mission-critical nature in research make them indispensable. I contend that this is the primary reason behind Mettler-Toledo’s remarkable pricing power over its customers. Furthermore, I anticipate that Mettler-Toledo will continue to benefit from pricing growth in the coming years.

High Margin Business

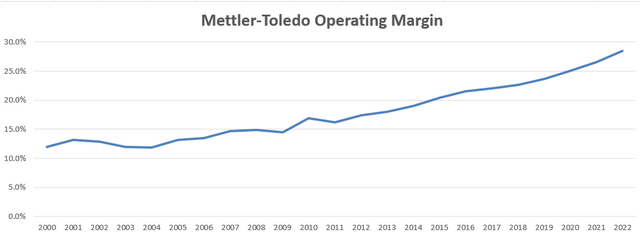

Mettler-Toledo has achieved consistent margin expansion over the past two decades, with their operating margin reaching an impressive 28.5% in FY22.

MTD 10Ks

I think the margin expansion is driven by the following factors:

Pricing Increase: As discussed earlier, Mettler-Toledo’s ability to raise prices provides them with a means to enhance their gross margin gradually. For instance, in FY03, their gross margin stood at only 47.4%, but by FY22, it had significantly improved to 58.9%, demonstrating the company’s adeptness at leveraging pricing power.

Operating Leverage: Mettler-Toledo has demonstrated effective cost management practices, with a focus on cost control initiatives as part of their corporate strategy. They are particularly attentive to sales and marketing programs, closely tracking marketing budgets and execution. These cost control efforts enable them to harness operating leverage, facilitating margin expansion.

New Products: Mettler-Toledo boasts a robust pipeline of innovative products. These new offerings often command higher prices and margins. Additionally, a diverse range of product lines can enhance the efficiency of their sales force and, consequently, improve operating margins. According to their management team, Mettler-Toledo has been expanding its product lines into the mid-range segment over the past two years and has plans to introduce high-end solutions to their existing customer base.

Recent Financial Result and Outlook

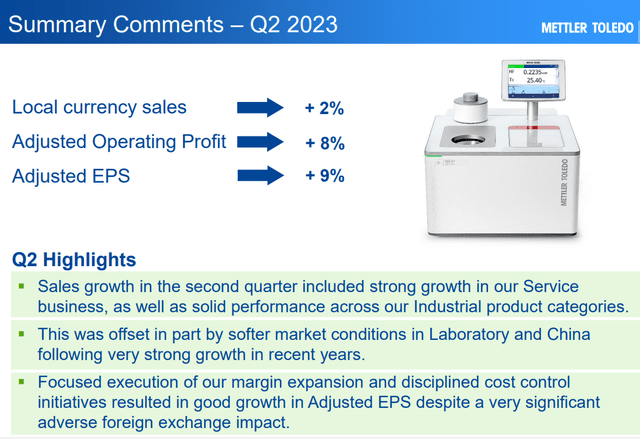

The most significant takeaway from Q2 FY23 is the weakness in their China operations, which has led to a reduction in their full-year guidance due to the challenging outlook in China.

MTD Q2 FY23 Presentation

For the full year 2023, they anticipate a constant currency revenue growth of 0% to 1%, a significant decrease from their previous guidance of 5% growth. They are guiding for an adjusted EPS in the range of $40.30 to $41.20, which represents a growth rate of approximately 2% to 4%, or approximately 5% to 7% when excluding the impact of unfavorable foreign currency exchange rates. This overall guidance is notably weak and disappointing. The primary reason behind this revision is the ongoing deterioration in China, and I believe that the challenges in China may persist for several quarters.

Key Risks

Significant China Exposure: As previously discussed, China constitutes 21.5% of their total revenue and an even larger share, 35%, of their total operating profits. Any slowdown in their China operations could have a substantial financial impact on the company. Additionally, there is a potential risk from geopolitical tensions between the U.S. and China, which could further affect Mettler-Toledo’s operations in China.

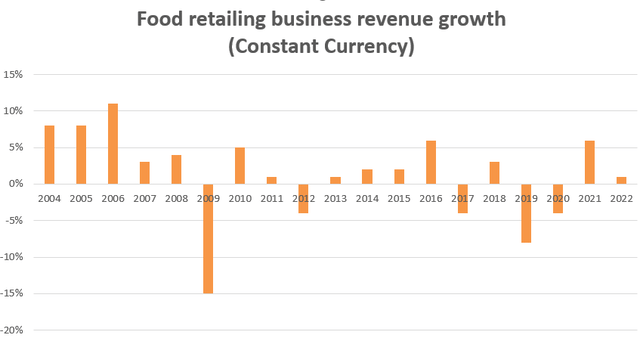

Food Retailing Segment: The food retailing business accounts for less than 5% of their total revenue. This segment has experienced sluggish growth over the past few years.

MTD 10Ks

I believe the food retailing business operates in a highly competitive market, and I do not anticipate it making a significant contribution to the company’s growth. Given its limited revenue percentage, I have relatively minor concerns about this aspect.

Valuation

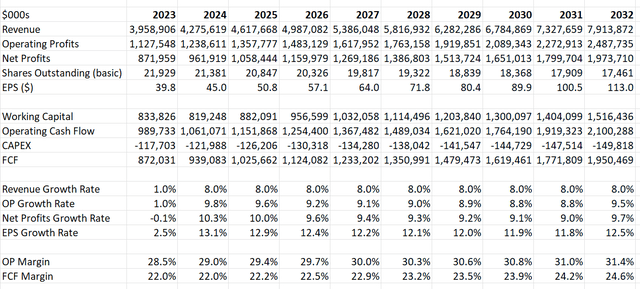

In the DCF model, I have assumed zero percent organic growth in FY23, followed by a seven percent growth rate in the subsequent years. Additionally, I’ve factored in a one percent acquisition growth rate into the model. Over the past five years, Mettler-Toledo has repurchased over $4 billion of its own shares, leading to a consistent reduction in the number of shares outstanding year over year. Specifically, basic shares outstanding decreased by 2.8% in FY20, 3.2% in FY21, and 2.8% in FY22. I anticipate that they will continue to allocate cash generated from operations to repurchase their own stock. With a robust balance sheet, the company’s gross debt leverage was only 1.6x in FY22.

MTD DCF Model- Author’s Calculation

I have projected that their operating margin will expand to 31.4% by FY32, with the free cash margin improving to 24.6% by the same year. The model utilizes a 4% terminal growth rate, a 10% weighted average cost of capital, and a 19% tax rate. When discounting all the free cash flows, the DCF model suggests a fair value for the stock price of $923 per share.

To Recap

I view Mettler-Toledo as a high-quality business franchise with strong margins and market-leading positions. However, the company’s significant exposure to China is presenting substantial near-term challenges, and I believe their stock price is currently overvalued. Therefore, I recommend a ‘Sell’ rating.

Read the full article here