WBA’s Dividend Aristocrat Status Is No Longer A Viable Investment Thesis

We previously covered Walgreens Boots (NASDAQ:NASDAQ:WBA) in July 2023, discussing its mixed prospects thanks to the deteriorating stock performance and improving balance sheet. Its prospects appeared mixed as well, due to the lowered FY2023 guidance and underwhelming FY2024 commentary.

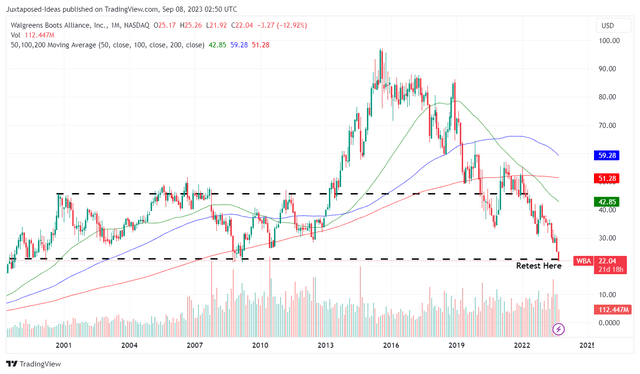

WBA 25Y Stock Price

Trading View

For now, WBA’s decline has been painful to observe, especially since it has plunged drastically by -36.78%/ -$13.17 since our first WBA coverage in February 2023, and by -20.25%/ -$5.75 since July 2023.

Even its dividend aristocrat status is not enough to make up for the stock decline thus far, based on the YTD payout of $1.44 per share.

Perhaps the pessimism embedded in WBA’s stock prices is attributed to its slower transition toward the primary healthcare space, an area that its direct competitor, CVS (CVS) has been dominating thanks to its integrated insurance offerings.

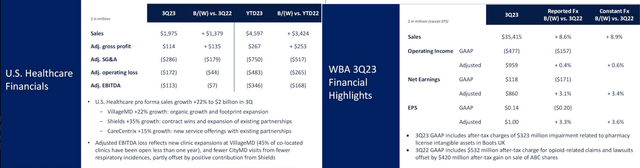

WBA’s FQ3’23 US Healthcare Performance

Seeking Alpha

However, it appears that WBA’s pivot has been too slow and too little, worsened by the underperformance witnessed in the US Healthcare segment in FQ3’23. Most of the newer co-located clinics remain unprofitable, further impacted by the lower respiratory incidents.

The optics do not favor the company as well, due to the impact of $44M settlement for the Theranos fraud claims, $323M impairment related to pharmacy license intangible assets in Boots UK, $5.4B after-tax charge for opioid-related claims, and lower COVID-19 contribution, partially offset by the $420M gain from the sale of ABC shares over the past few quarters.

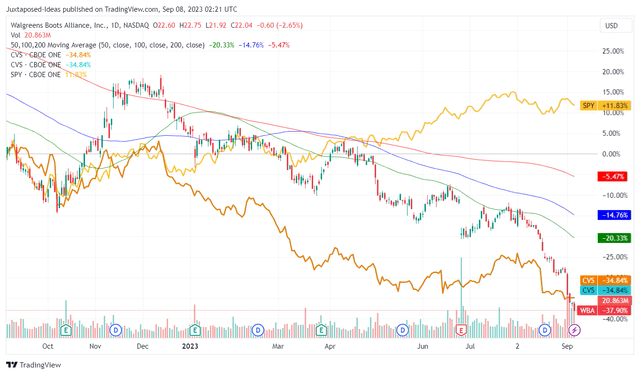

WBA & CVS 1Y Stock Performance

Trading View

While the opioid headwind do not affect only WBA, with CVS similarly set to pay nearly $5B over 10 years, it appears that Mr. Market is no longer convinced about its turnaround story.

In addition, with no moat, many other players have also encroached into the pharmacy, healthcare, and beauty retail space, including Target (TGT), Walmart (WMT), Costco (COST), Rite Aid (RAD), and even Amazon (AMZN).

These embedded pessimisms have directly contributed to WBA’s and CVS’ underwhelming stock performance over the past year, compared to the wider market and tech rally thus far.

WBA’s prospects are also significantly worsened by the sudden departures of its CFO, James Kehoe, in July 2023, and its CEO, Rosalind Brewer, in September 2023.

It remains to be seen what fresh ideas the new leadership may bring to the table, due to the lack of succession plan and the aggressive consolidations we have observed in the industry, potentially triggering further uncertainty in its forward execution.

While we have been optimistic about its reversal in our previous WBA article, everything is off the table for now, since the critical support levels of $22 may be breached in the near term.

Due to the sustained impairments and acquisitions, its balance sheet has also deteriorated to cash/ short term investments of $970M (-47.3% QoQ/ -78.2% YoY), with growing long-term debts to $8.84B (inline QoQ/ +13.6% from FQ1’23).

As a result of WBA’s slowing growth and impacted profitability, it is unsurprising that there are concerns about its dividend safety with an F rating for TTM Dividend Coverage Ratio.

It is also not overly bearish to project a further retracement to its previous H1’98 support levels of $18s, implying another -18% downside from current levels. Only time may tell.

So, Is WBA Stock A Buy, Sell, or Hold?

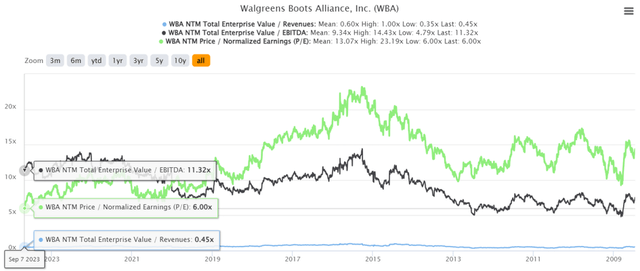

WBA 15Y EV/Revenue and P/E Valuations

S&P Capital IQ

Due to these pessimistic developments, it is unsurprising that WBA’s valuations have been depressed to NTM EV/ Revenues of 0.45x, NTM EV/ EBITDA of 11.32x, and NTM P/E of 6.00x.

This is compared to its 1Y mean of 0.51x/ 11.52x/ 7.75x and 3Y pre-pandemic mean of 0.61x/ 8.87x / 11.86x, respectively. The same pessimism is also observed compared to the Diversified Health/ Retail sector median EV/ EBITDA of 12.63x and P/E of 15.61x.

And it is for this reason, that there is a minimal margin of safety to our long-term price target of $25.50, based on its consensus FY2025 adj EPS estimate of $4.25 and its NTM P/E.

As a result of the potential capital losses, we prefer to adopt a wait and see attitude until bullish support materializes. Only then will we re-rate it as a Buy, thanks to its consistent dividend payouts and likely, expanded dividend yields.

For now, we prefer to cautiously rate the WBA stock as a Hold (Neutral) here. Do not chase the dividends.

Read the full article here